Russia Boosts US Energy Sector

Maslow’s Hierarchy of Needs is a stylized pyramid with food and shelter at the base and self-actualization at the top. Maslow wasn’t around to contemplate where ESG (Environmental, Social and Governance) aspirations sit on his pyramid, but he would likely have placed them near the summit. The people and institutions most sensitive to ESG have already satisfied the other needs on the pyramid.

This is how the EU has come to rely on Russia for 40% of its natural gas while ambitiously pursuing the energy transition and, in Germany’s case, phasing out nuclear power. They perceived the world as post-geopolitical, making climate change a high priority since they identified few other big problems. The green movement’s hostility to reliable energy has stifled investment in new supply without much impacting demand. The consequent high prices have helped fund Russia’s invasion of Ukraine, and the EU’s impotence is most visible in the exclusion of energy from the west’s list of sanctions.

Europe’s energy policy has been a catastrophe.

The reason emerging countries continue to increase emissions is because their populations are lower on Maslow’s pyramid than rich world populations. If like John Kerry you’ve spent the last few decades flying on private jets, you’re afforded the luxury of preaching on climate change because you’ve ascended past all the other needs. The EU and Russia are at different levels on the pyramid, as the tanks rolling through Ukraine have shown. Russians don’t do virtue-signaling.

Geopolitical risk tends to be a right-tailed event for energy investors – a low probability positive outcome. Few sectors have that risk profile – left-tailed events (9-11 attack, 2008 Financial Crisis, Covid) cause all the trouble, and higher energy prices may yet be another financial shock. But it’s positive for the US energy sector.

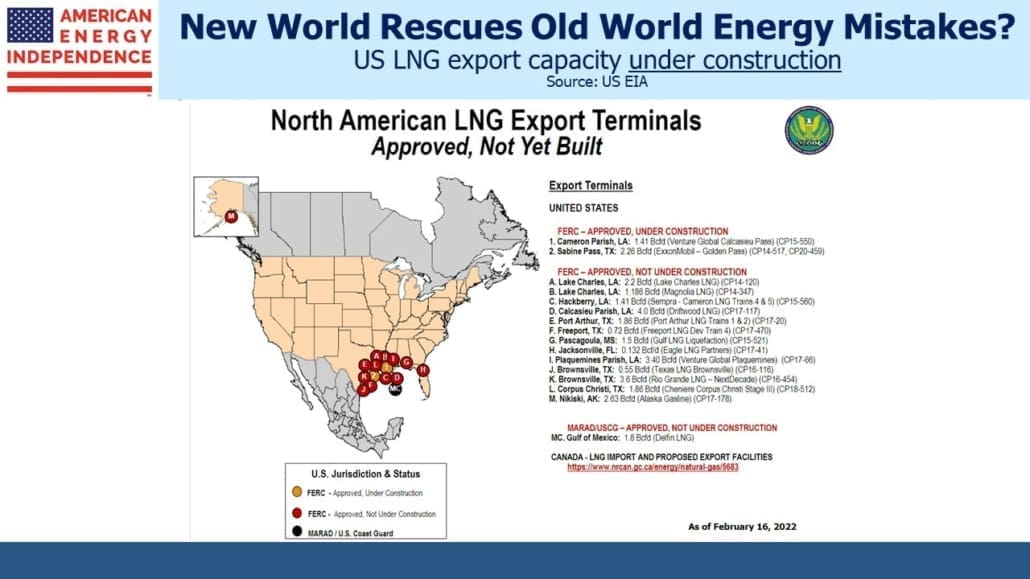

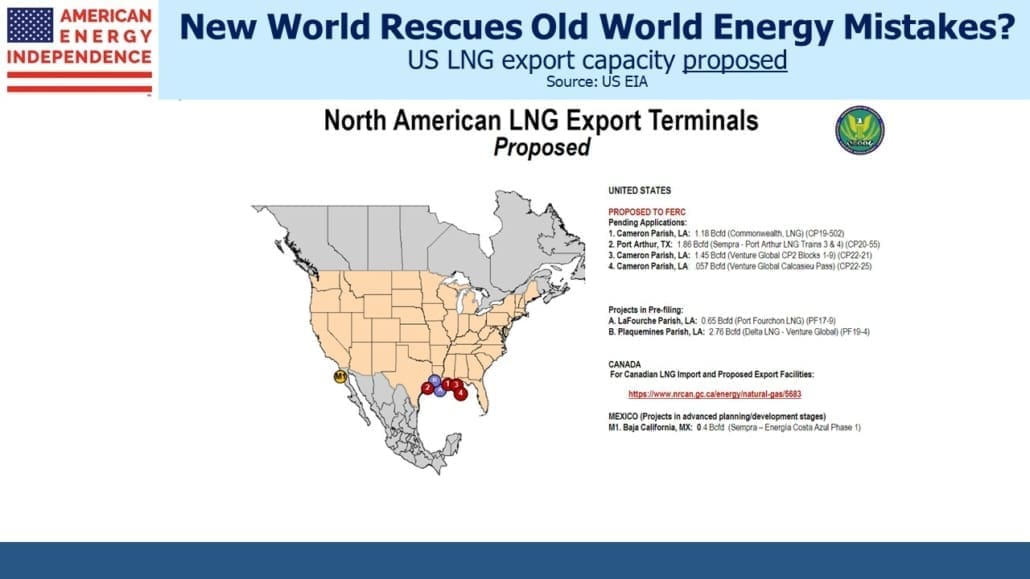

US shipments of Liquified Natural Gas (LNG) have been heading mostly for Europe in recent weeks as Russian pipeline deliveries were mysteriously lower than expected. Two months ago, this inconveniently coincided with less blustery weather that slashed output from windmills. Many of the buyers of US LNG are trading companies able to direct cargoes to the highest price. China is the world’s biggest buyer of LNG, with Asia representing 75% of global LNG trade. Europeans have had to compete on price to acquire needed supplies, at times driving European LNG prices to 10X the US. Cheniere, the leading LNG exporter in the US, raised 2022 EBITDA guidance by 20% and Distributable Cash Flow guidance by 35% when they reported 4Q earnings last week.

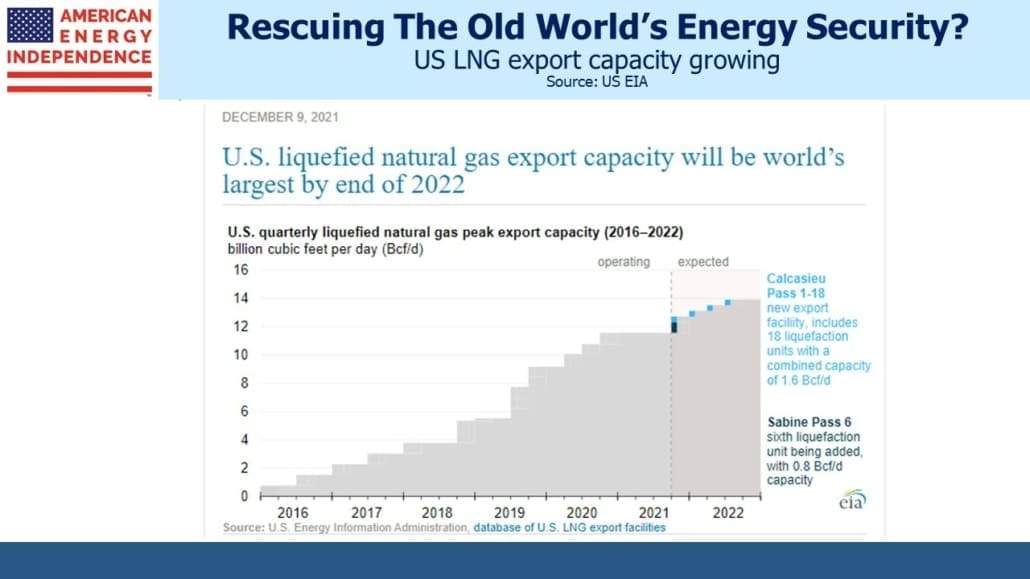

Williams Companies, which operates the Transco natural gas pipeline network, sees an additional 12 Billion Cubic Feet per Day (BCF/D) of LNG demand through 2030. That would almost double our existing exports – that they won’t grow even faster reflects the length of time LNG facilities take to build.

The Russian invasion of Ukraine is a near term positive. Europe’s response may make it a permanent one, if EU countries reassess their energy security. The US, including our pipeline companies, are well positioned to benefit from this. For example, in late 2020 French power company Engie halted LNG negotiations with NextDecade because of concerns over emissions. Today they might react differently.

Higher oil and gas prices will also feed through to inflation. Last year Wells Fargo estimated that around 60% of the pipeline sector’s EBITDA was linked to inflation escalators via tariffs that reprice based on PPI. Six months ago with PPI running at 5.5% they estimated a 3% boost to sector EBITDA for 2022. PPI is currently running at over 13%.

Persistently high inflation doesn’t necessarily mean the Fed will have to boost rates higher – this is a dovish FOMC and there are numerous avenues for them to identify temporary price surges soon to abate, as they did last year. But it does mean that inflation persistently above the Fed’s long term 2% target is even more assured (see Why You Shouldn’t Expect A Return To 2% Inflation). The market has begun looking ahead to another mistake, an overshoot of monetary tightening (see Policy Errors On Interest Rates And Energy). Investors should be concerned that reducing inflation below 3%+ is ultimately deemed too economically disruptive.

The PPI-linked tariffs on pipeline stocks have been a fixture for many years, and in the seductively unexciting days before the Shale Revolution were regarded as positive by income seeking investors. Over-leverage and MLP distribution cuts diverted attention from the PPI linkage, but it never went away and will attract increased attention later this year as earnings reports reflect price increases.

Midstream energy infrastructure is well situated to benefit from Europe’s mistakes on energy policy and elevated inflation. Maslow would not be surprised.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Very nice analysis of the situation.

Thank you