The Dow’s Odd Construction

Last week’s ejection of Exxon Mobil (XOM) from the Dow Jones Industrial Average looks like another indication of the declining relevance of energy stocks. XOM had been in the Dow since 1928, and until 2013 was the most valuable publicly listed company. Its market cap peaked with oil prices in 2014 at $446BN, and is now around $171BN.

Pfizer (PFE) and Raytheon Technologies (RTX) were also dropped along with XOM, and these three were replaced by Salesforce (CRM), Amgen (AMGN) and Honeywell (HON).

Being dropped from an index is never good. For the much maligned energy sector, it’s tempting to regard this as the bell ringing at the market bottom – the sign that sentiment is so irretrievably poor that the only way from here is up. But the list of such past signals is already long.

The quirky construction of the Dow is the cause of these changes. The Dow may be “venerable”, and still the most widely followed index, but nobody would create anything quite like it today.

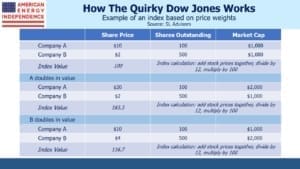

This is because it’s a price-weighted index, rather than market-cap weighted like most indices. This means that the price of a stock determines its importance in moving the Dow. Apple (AAPL) is the highest weighted stock in the Dow by virtue of its price. Because of its impending 4:1 split, its weighting is about to drop by around three quarters – for market cap weighted indices such as the S&P500, a stock split has no impact on the weights of the components.

If Berkshire A (BRK-A) was in the Dow, at $326K per share it would dominate the index.

Perhaps when Charles Dow and Edward Jones first published their eponymous average in 1896, calculating the average daily price of twelve stocks without a calculator was already enough work for two financial reporters. But their simple approach remains with us today.

The tables below illustrate the shortcomings. Perhaps the biggest is that a price-weighted index doesn’t reflect market cap weighted moves in its components. This makes it less representative. From next week moves in AAPL’s value will have much less impact on the index. An investor wishing to track the Dow Jones has to sell most of her AAPL’s shares, even though it’s still in the index. Tracking the Dow is more difficult and costly because it requires frequent rebalancing. That’s why there’s far more money invested in products linked to the S&P500, and they have much lower tracking error. Market-cap weighted indices by definition reflect the experience of all the money invested in their components, and are more easily tracked by portfolios invested in them.

One result is that although the recent rebalancing reflects the biases of the committee that oversees the Dow Jones, the smaller size of Dow Jones-linked funds limited the rebalancing trades by investors tracking the index.

Energy investors can console themselves that XOM’s ignominious ejection is due to AAPL’s meteoric rise and subsequent split. Several big companies have had a sporadic relationship with the Dow. General Electric (GE) has been spurned three times, most recently in 2018. Since then, GE has lost almost half its value. Given valuations, energy investors are likely to do much better.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!