The Consumer Is Ready To Spend

“Coiled, ready to go.” is how JPMorgan CEO Jamie Dimon described consumers last week. “Consumers have $2 trillion in more cash in their checking accounts than they had before Covid.” he added. Borrowers are in such good shape that JPMorgan reported a 4% drop in loans when they released their quarterly earnings. Stimulus cash is being directed towards debt repayment.

The inflationary result of a consumer spending boom and low interest rates is the biggest uncertainty confronting investors. There’s plenty to worry about. Federal debt:GDP is set to exceed the levels that followed World War II. The level of Covid stimulus is several multiples of the estimated loss in output. Larry Summers, who headed the National Economic Council under Obama and was Clinton’s Treasury Secretary, has called it “substantially excessive,” and in case his views weren’t clear added that fiscal policy is the “least responsible” in 40 years.

Rising inflation shouldn’t catch anyone by surprise – and sure enough March CPI jumped 0.6%, 2.6% year-on-year. Ex-food and energy it was only 1.6%. Will this be sustained, and at what point will the Fed feel compelled to react?

The base effect – a depressed March 2020 CPI because of the sharp economic contraction – means annual comparisons will look high for several months. This will not trouble the Fed. Prices for all kinds of commodities are rising – hot rolled steel has tripled in a year, and while this reflects a rebound from severely depressed prices, it’s also more than doubled compared with two years ago. Copper, lumber and carboard tell similar stories.

March Retail Sales jumped 9.8%, boosted by spending at bars and restaurants as restrictions are being eased.

Moreover, many small businesses report trouble hiring people, in part because the recent $1.9TN Covid relief plan continues $300 per week Federal unemployment benefit on top of whatever the state pays.

Although signs of pricing tightness are everywhere, a review of Fed chair Jay Powell’s comments on inflation show numerous reasons to ignore them. Year-on-year comparisons simply reflect a rebound from sharply depressed levels. Tight commodity prices are a function of supply challenges that are being erased as people return to work. Consumers’ spending power will boost demand for a few months before dissipating.

Moreover, the Fed will never react to housing inflation, because house prices don’t figure in CPI, or the Personal Consumption Expenditures (PCE) index, their preferred measure. Owners Equivalent Rent (OER), the survey of what homeowners think they could rent their house for, doesn’t track house prices and doesn’t reflect any actual transactions (see Why You Can’t Trust Reported Inflation Numbers). So it’s a meaningless index, and because of the weight OER occupies it artificially depresses CPI by 2% and the PCE index by 1%.

Finally, although the unemployment rate is 6%, it was 3.5% in February 2020 with no discernible impact on inflation. Given the Fed’s focus on ensuring maximum employment, they’re unlikely to raise rates before unemployment drops at least that far again, unless there are clear signs of wage pressure. Any tapering of bond buying is likely to await actual evidence of inflation. This is a subtle but important shift – the Fed isn’t going to act based on a forecast of inflation. They plan to be late.

Financial advisors have few tools with which to protect against rising inflation. Shorting bonds is inefficient because of the large amounts needed to create much protection, and few are licensed to use interest rate futures for clients. Stated inflation is also likely to lag the actual inflation experienced by most people, due to the flawed use of OER noted above.

Not surprisingly, since this is a blog focused on the energy sector, pipelines are one of the few sectors that offer meaningful protection. Dividends are stable, yielding 7%. Announced buybacks across the sector add up to a further 2% return. A drop in yields to 6% would add another 14% in appreciation, so a one year return of 20% or more (7+2+14) is plausible.

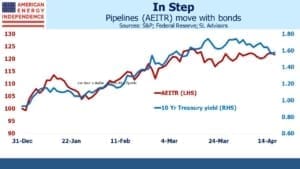

In addition, pipelines have tracked the ten year treasury yield reliably this year, with both rising together during 1Q21 and both moving sideways more recently. And if the Fed moves too slowly once inflation finally appears, the commodity sensitivity embedded in midstream energy infrastructure should provide additional upside.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!