Capturing More CO2

What if CO2 emissions could be captured before they entered the atmosphere? Sulfur dioxide is already removed from the emissions of coal-burning power plants. Why not CO2 from burning natural gas for power, steel or cement production? The endless hype over solar panels and windmills, overstating their competitiveness, downplaying their intermittency – none of this would be needed any more if we could just keep using the fuels we do without the harmful emissions.

It turns out the technology does exist to partially do this, via Carbon Capture and Utilization or Sequestration (CCUS). Although it’s not a solution for the transportation sector, it can be applied to power generation and some industries. As with most aspects of climate change, the problems are mostly economic and political rather than technological. If there was popular support for higher energy prices to combat climate change then CCUS would already be widely used. But as we noted in Energy Policy Meets Reality, polls show limited support for higher utility bills. Public concern is broad but shallow.

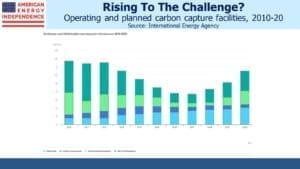

From 2010-17 CCUS investment fell since tax incentives weren’t high enough to support the cost. But CCUS is getting cheaper, and governments are creating greater incentives to curb CO2 emissions. Global development of new CCUS facilities began rising again following the 2016 Paris Agreement. Currently a record 21 facilities are operational worldwide, with another 44 at various stages of development.

Ten of the operating CCUS plants are in the U.S. Their main use is to provide CO2 for Enhanced Oil Recovery (EOR). This involves pumping CO2 into mature oil wells to increase pressure, boosting production. Because of this, CCUS hasn’t historically been linked with combating climate change, although EOR does at least keep the CO2 out of the atmosphere. But CO2 could simply be stored underground without being used, and this is where CCUS promises to be part of the climate solution.

Congress has promoted CCUS for years. In 2008 the Internal Revenue Code Section 45Q provided a $10 per ton tax credit for sequestered CO2 used for EOR and $20 for “geologic storage.” Under current law the tax credit will eventually reach $50 per ton for underground storage by 2026.

The 2020 U.S. Energy Act signed late last year directed R&D at CCUS and directed the Energy Secretary to identify, “… tools the Federal Government can use to advance deployment of carbon dioxide removal.”

A tax credit isn’t as effective as a tax – tax credits can encourage production unless carefully regulated, whereas a tax acts as a direct cost. But tax credits are more palatable in the U.S., where a carbon tax is a political non-starter. Other countries are increasingly imposing a carbon tax. Canada’s is currently $30 ($23.70) although set to rise to C$170 ($134.30) by 2030. 17 EU countries have a carbon tax — Ireland’s is the median at €25.60 ($30.46).

Exxon Mobil claims to be the market leader in carbon capture, taking credit for 40% of all the world’s captured CO2 since 1970 and 23% of the CO2 captured in 2019. However, their 9 million tons of annual “carbon capture capacity” barely registers against the world’s 36 Gigatons (1 gigaton = 1 billion tons) from human activity*. Current U.S. CCUS capacity is estimated at 25 million tons annually, around 0.5% of what we produce.

In December Congress extended the deadline for planned CCUS plants to qualify for 45Q tax credits by an additional two years. CCUS enjoys bipartisan support in Congress. Last month legislation was introduced (the SCALE Act) to increase financial incentives for CCUS and spur greater investment.

This is increasing activity around CCUS.

For example, last month Valero, Blackrock and Navigator Energy Services launched a JV to build a 1,200 mile CO2 pipeline in the Midwest that will move 5 million tons of CO2 annually into permanent underground storage. In addition to Exxon, other big energy companies such as Total, Aramco and Repsol are investing in CCUS capabilities.

Some pipeline companies are already in the CO2 business. Kinder Morgan (KMI) has provided CO2 for EOR for years, where fluctuating oil prices cause swings in demand. We and other investors have long criticized this business segment for its low returns (see Kinder Morgan: Great, But Stick to Pipelines), but increasing tax credits may offer salvation. Enbridge (ENB) and TC Energy (TRP) are considering CCUS investments. Canada’s carbon tax will support the economics.

The White House’s proposed $2TN spending on infrastructure promises to, “… establish ten pioneer facilities that demonstrate carbon capture retrofits for large steel, cement, and chemical production facilities…” and to expand the 45Q tax credit so that it’s, “… easier to use for hard-to-decarbonize industrial applications, direct air capture, and retrofits of existing power plants.”

CCUS today is small but growing. Cost has usually been the biggest barrier to widescale deployment. But a Democrat Administration looking for tangible results on climate change is likely to improve financial incentives for its further development. This creates another pragmatic alternative to erecting windmills everywhere and is good for the pipeline industry.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

*excludes land use

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!