The Best Odds Aren’t In Las Vegas

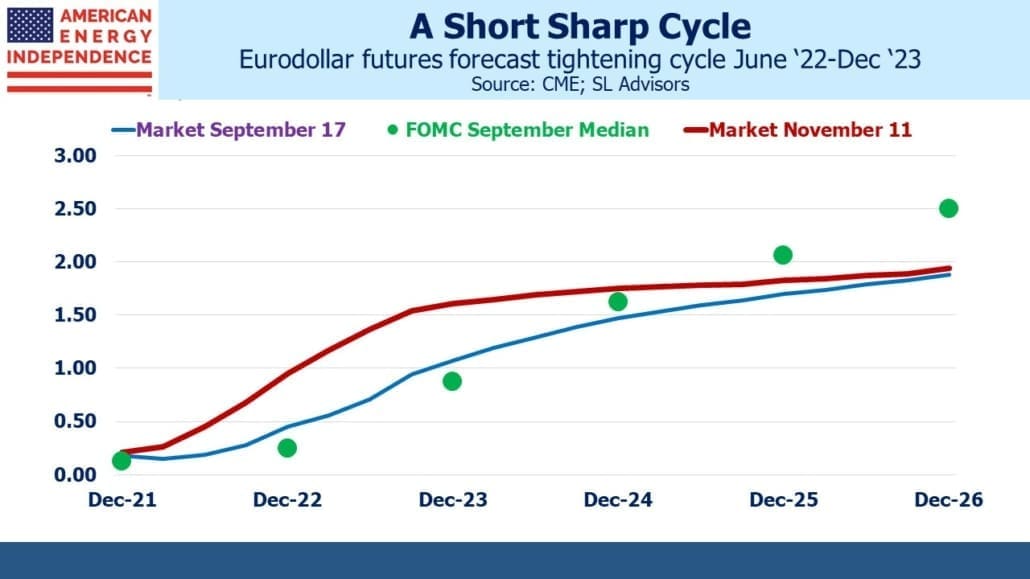

Following last week’s 6.2% inflation print, eurodollar futures fully priced in 0.75% of tightening by the end of next year. The approximate rate path envisages tapering by the summer, and rate hikes commencing around the same time. Beyond December ‘23 the curve is so flat that in effect the market expects the tightening cycle to be more or less completed, eighteen months after it began.

Ten year projected inflation edged up to 2.7% as derived from the treasury market. Although this is the highest it’s been, that figure doesn’t suggest the market believes inflation is out of control. With ten year treasuries still below 1.6%, it’s more accurate to say that the market expects the Fed to concede defeat on the transitory narrative and raise rates, even though the long term inflation outlook isn’t that far from the Fed’s 2% target.

The Fed may follow the market’s lead. The FOMC is notoriously poor at forecasting and for years projected a higher neutral rate than futures. Public comments suggest increasing discomfort among some FOMC members with persistently elevation inflation.

And yet, with their new policy regime targeting maximum employment with increased tolerance for a short term inflation overshoot, reversing the improvements achieved in the labor market will be a tough pill to swallow. The Warren/AOC wing of the Democrat party is likely to be a vocal critic of rising rates.

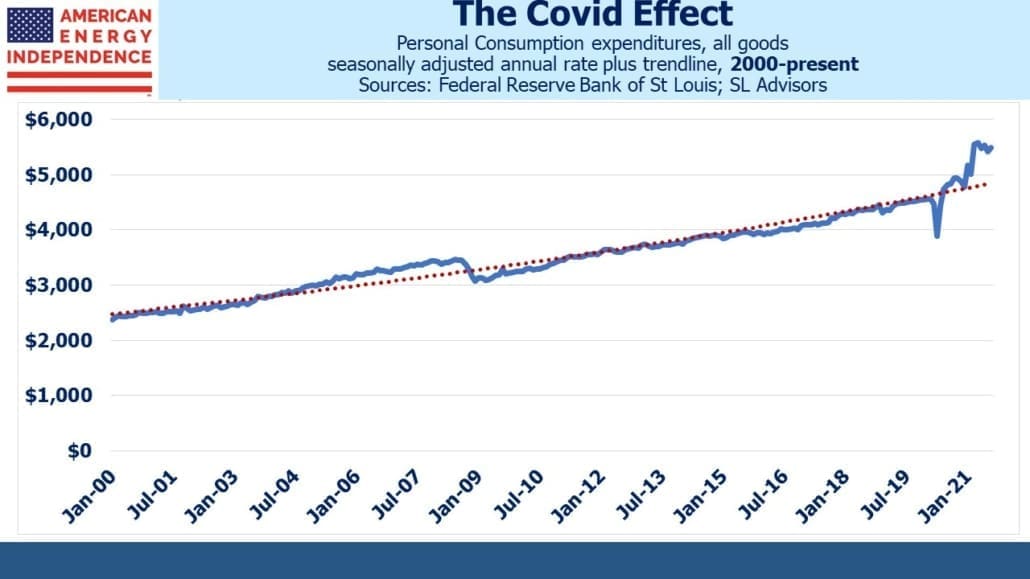

Hence the Administration’s growing focus on inflation. Although higher energy prices and supply constraints are two major symptoms, the real cause is surging demand boosted by the $1.9TN covid relief stimulus passed shortly after Biden’s inauguration. This is seen most clearly in the overshoot of personal consumption expenditures on all goods.

White House discussions with companies about logistics and pleas to OPEC to raise production overlook the fact that the US fiscal response to Covid was initially correct but became profligate once the welcome vaccine news was released a year ago. Both Congress and the Fed have overdone it.

Modern Monetary Theory (MMT) holds that because a government cannot go bankrupt in its own currency, deficits don’t matter. The constraint on unlimited fiscal largesse is found when Federal spending outruns the economy’s ability to provide goods and services without causing inflation. We have found that limit – and Congressional Democrats appear set on pushing even further unless Joe Manchin provides a brake.

MMT purists should by now be advocating fiscal restraint to offset the uber-stimulus, but they will not. So the White House sees a brief window to convince Americans they have inflation under control, before they fear the Fed will be compelled to act. The market forecast of three 2022 tightenings by next year may be right, but this is a very dovish FOMC. There isn’t much economic pressure for a Fed response, since bond yields remain low and stock prices close to all-time highs.

Some economists think the Fed should tighten. The market is conceding they will but not for long. The yield curve is at the extreme. It wouldn’t take much to cast doubt on the projected 0.75% of hikes next year.

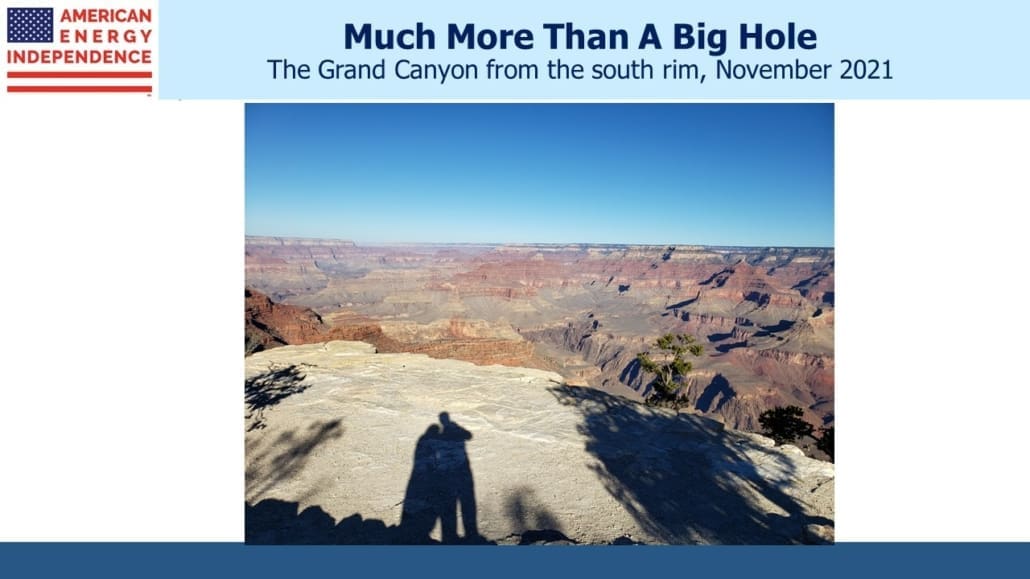

Many readers enjoy the travel photos from past trips, so see below from last week. The Grand Canyon needs no explanation – we hiked in both directions along the south rim trail and each view was more spectacular than the last. National parks have a mask mandate indoors that even extends to certain outdoor areas too. It was mildly irritating and widely ignored.

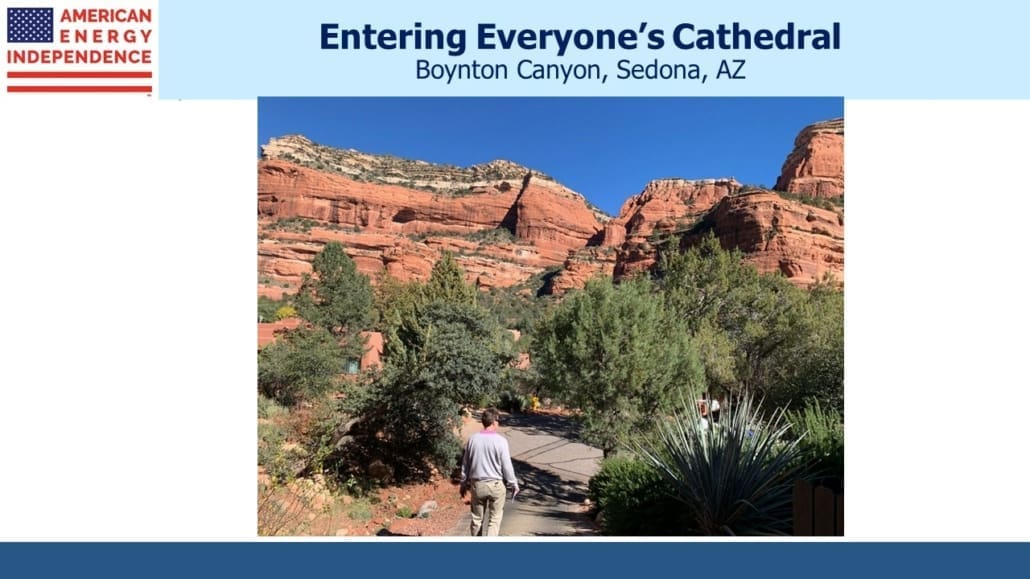

Several people recommended a visit to Sedona. Boynton Canyon with its sheer red rock walls attracts hikers, many of whom find the location spiritual and settle down to meditate. Someone we met referred to it as “Everyone’s Cathedral”.

We ended in Las Vegas, and what happened in Vegas will remain in Vegas. I am not a gambler – it’s hard enough finding attractive odds in financial markets. When I told one friend that losing $50 in a casino would ruin my day, he said I’d be unlikely to find a table offering such low stakes.

The pipeline sector and inflation trades offers far better odds.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!