The Best Odds Aren’t In Las Vegas

Following last week’s 6.2% inflation print, eurodollar futures fully priced in 0.75% of tightening by the end of next year. The approximate rate path envisages tapering by the summer, and rate hikes commencing around the same time. Beyond December ‘23 the curve is so flat that in effect the market expects the tightening cycle to be more or less completed, eighteen months after it began.

Ten year projected inflation edged up to 2.7% as derived from the treasury market. Although this is the highest it’s been, that figure doesn’t suggest the market believes inflation is out of control. With ten year treasuries still below 1.6%, it’s more accurate to say that the market expects the Fed to concede defeat on the transitory narrative and raise rates, even though the long term inflation outlook isn’t that far from the Fed’s 2% target.

The Fed may follow the market’s lead. The FOMC is notoriously poor at forecasting and for years projected a higher neutral rate than futures. Public comments suggest increasing discomfort among some FOMC members with persistently elevation inflation.

And yet, with their new policy regime targeting maximum employment with increased tolerance for a short term inflation overshoot, reversing the improvements achieved in the labor market will be a tough pill to swallow. The Warren/AOC wing of the Democrat party is likely to be a vocal critic of rising rates.

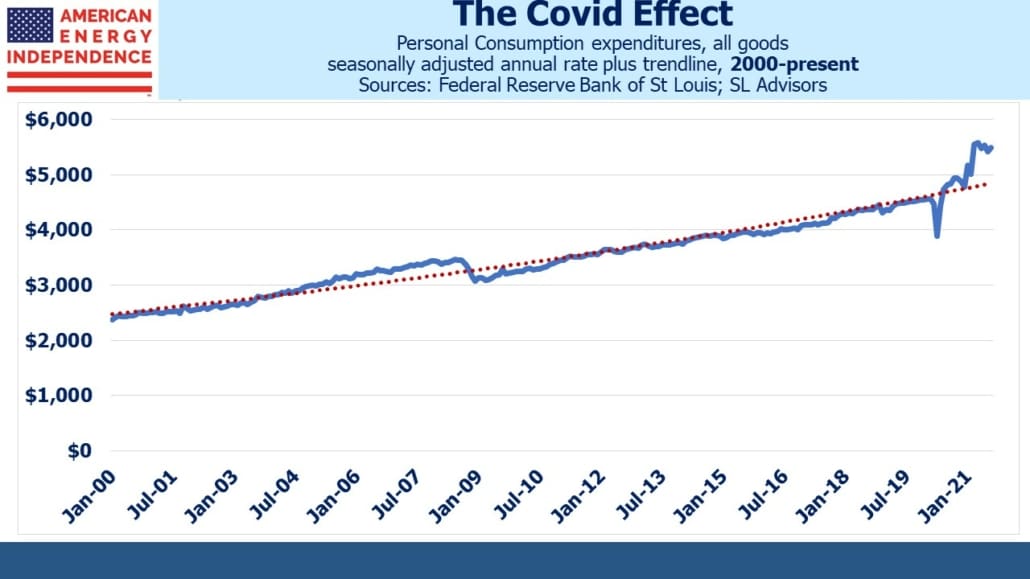

Hence the Administration’s growing focus on inflation. Although higher energy prices and supply constraints are two major symptoms, the real cause is surging demand boosted by the $1.9TN covid relief stimulus passed shortly after Biden’s inauguration. This is seen most clearly in the overshoot of personal consumption expenditures on all goods.

White House discussions with companies about logistics and pleas to OPEC to raise production overlook the fact that the US fiscal response to Covid was initially correct but became profligate once the welcome vaccine news was released a year ago. Both Congress and the Fed have overdone it.

Modern Monetary Theory (MMT) holds that because a government cannot go bankrupt in its own currency, deficits don’t matter. The constraint on unlimited fiscal largesse is found when Federal spending outruns the economy’s ability to provide goods and services without causing inflation. We have found that limit – and Congressional Democrats appear set on pushing even further unless Joe Manchin provides a brake.

MMT purists should by now be advocating fiscal restraint to offset the uber-stimulus, but they will not. So the White House sees a brief window to convince Americans they have inflation under control, before they fear the Fed will be compelled to act. The market forecast of three 2022 tightenings by next year may be right, but this is a very dovish FOMC. There isn’t much economic pressure for a Fed response, since bond yields remain low and stock prices close to all-time highs.

Some economists think the Fed should tighten. The market is conceding they will but not for long. The yield curve is at the extreme. It wouldn’t take much to cast doubt on the projected 0.75% of hikes next year.

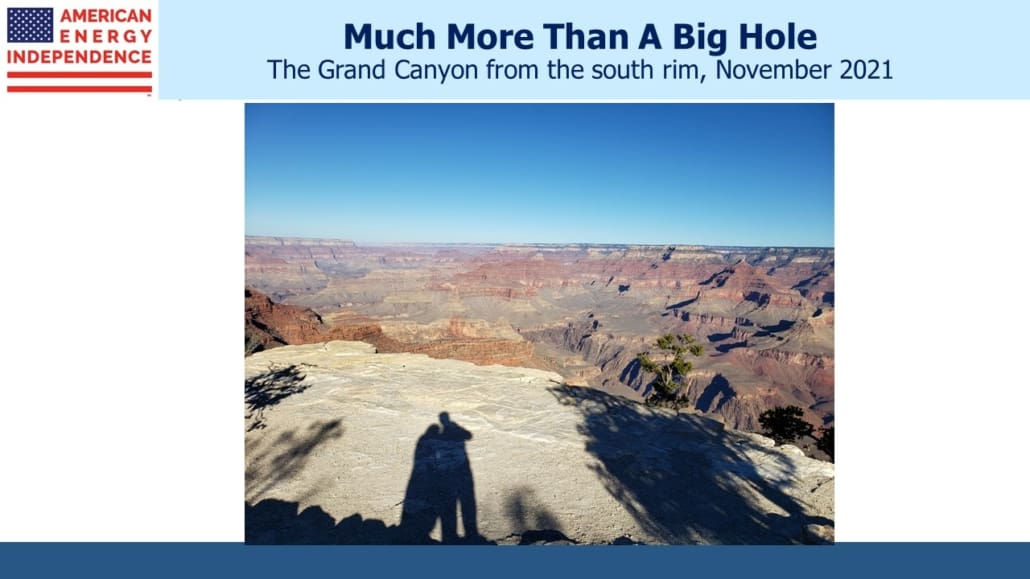

Many readers enjoy the travel photos from past trips, so see below from last week. The Grand Canyon needs no explanation – we hiked in both directions along the south rim trail and each view was more spectacular than the last. National parks have a mask mandate indoors that even extends to certain outdoor areas too. It was mildly irritating and widely ignored.

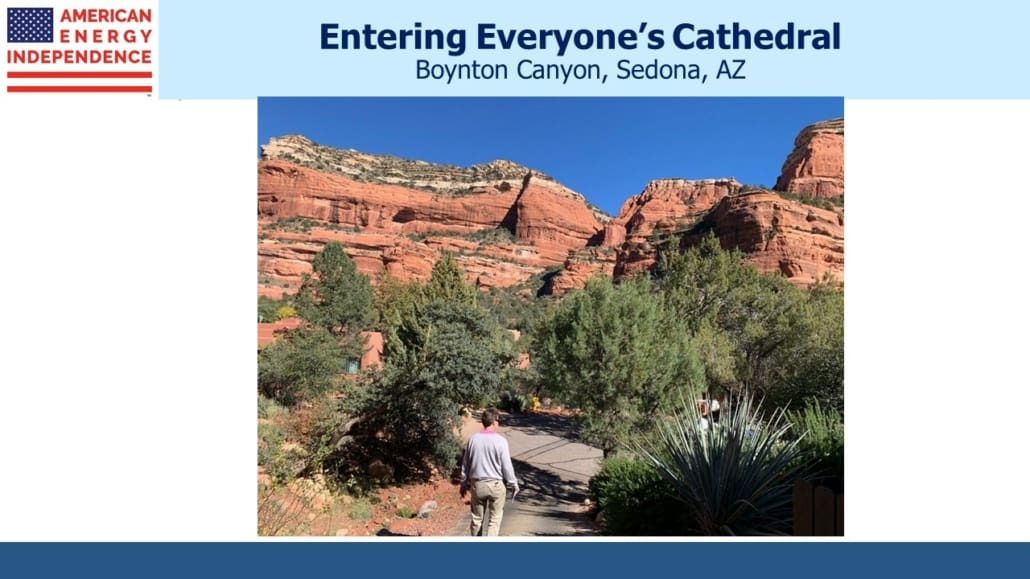

Several people recommended a visit to Sedona. Boynton Canyon with its sheer red rock walls attracts hikers, many of whom find the location spiritual and settle down to meditate. Someone we met referred to it as “Everyone’s Cathedral”.

We ended in Las Vegas, and what happened in Vegas will remain in Vegas. I am not a gambler – it’s hard enough finding attractive odds in financial markets. When I told one friend that losing $50 in a casino would ruin my day, he said I’d be unlikely to find a table offering such low stakes.

The pipeline sector and inflation trades offers far better odds.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.