Still Uncovinced By Oneok Magellan Combo

It’s almost two months since Oneok (OKE) announced their proposed acquisition of Magellan Midstream Parners (MMP). Consummation of the transaction has never looked more promising than on the day of the press release.

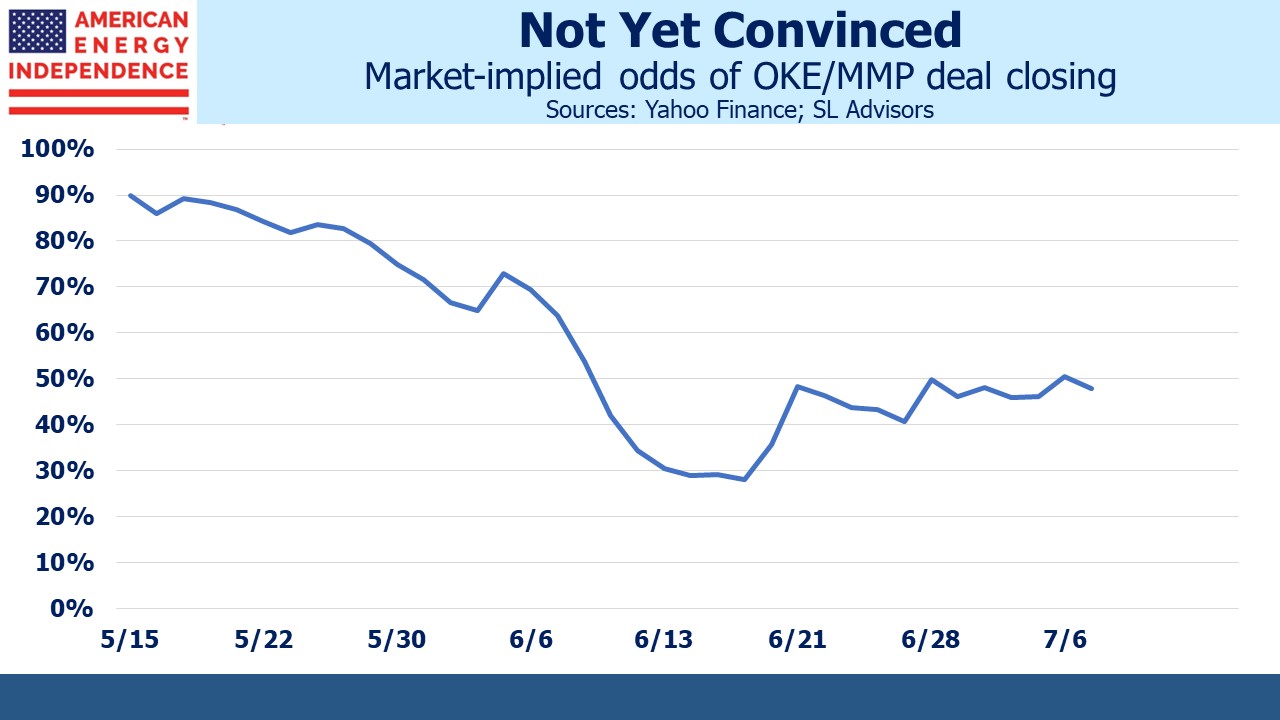

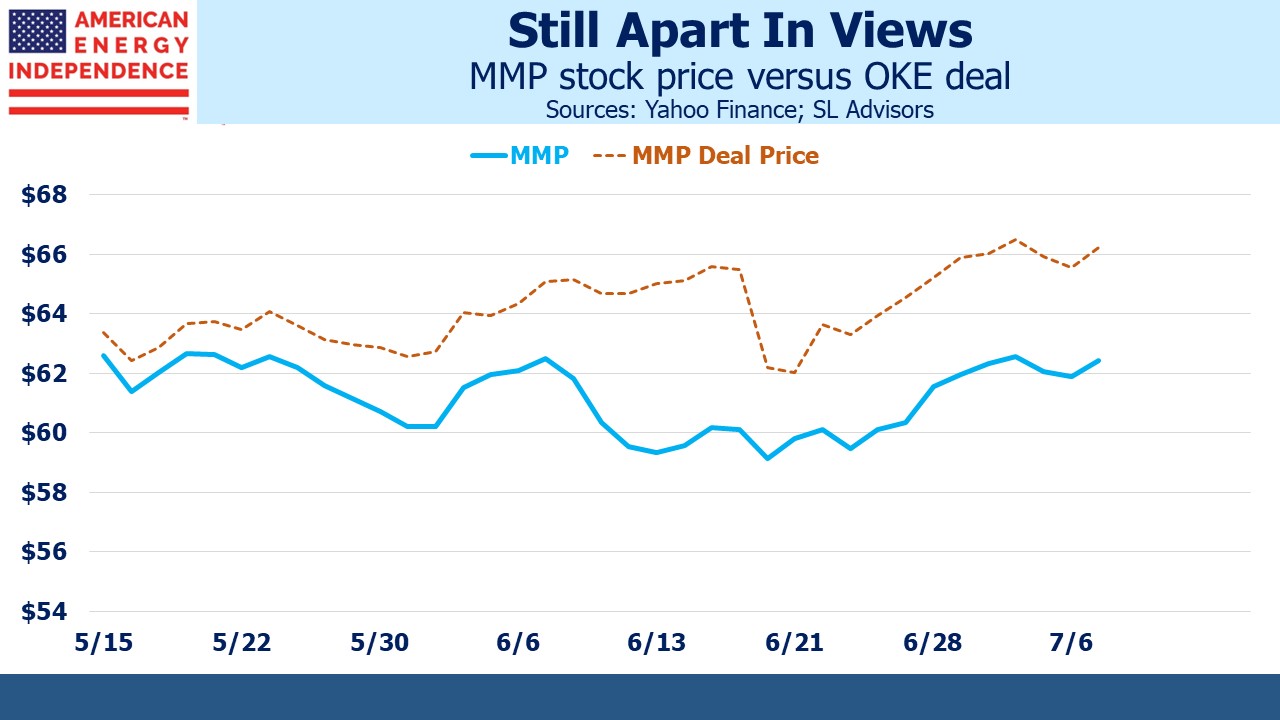

By mid-May, the market was ascribing less than 30% odds of shareholder approval, based on the gap between MMP and the combination of OKE stock and cash that is on offer. Energy Income Partners (EIP), a significant holder of MMP, issued a public letter outlining the reasons for their opposition. We had made similar arguments in prior blog posts (see Oneok Does A Deal Nobody Needs).

EIP’s letter so far marks the nadir of the market’s support for the deal. Neither company responded publicly to EIP’s criticisms although both have been active behind the scenes. At a couple of recent industry events they were making the case to interested investors, and the market-implied probability of the deal closing improved.

The tax bill facing MMP unitholders is the most offensive element of the transaction. The longer you’ve held MMP, the lower your cost basis and the greater your recapture of taxes deferred on distributions. MMP business model is designed to encourage investors who plan to stick around. In their May 4 press release disclosing 1Q earnings, MMP said they remain committed to, “…maximizing long-term investor value.”

Except this isn’t true.

The merger with OKE rewards the short-term investor whose recent purchase doesn’t create a tax obligation. This includes the MMP management team who are embarrassingly paltry investors in their own company. By MMP’s own calculations, the investors who have held their units the longest are facing the biggest tax bill. Like John Kerry (“I did vote for (it) before I voted against it”) MMP wants investors with a long-term outlook until they don’t. Their pursuit of a combination with OKE prioritizes value creation for short term investors because they’re the ones without the inconvenient tax deferral.

Sell-side analysts are not unbiased, objective observers. There’s not much in underwriting fees to be gained from upsetting potential capital markets clients. Therefore, the lukewarm comments from several firms can be interpreted as a negative view ameliorated by their business models. It’s a form of code. The deal odds slipped below 50% a month ago and still haven’t broken above in spite of the management charm offensive. The market’s unenthusiastic response means that if the deal does get approved there will be many former MMP investors ready to dump their newly received OKE stock, since they’ll have no taxable gains. OKE/MMP remains, just, more likely than not to be voted down. We’re happy to be raising awareness.

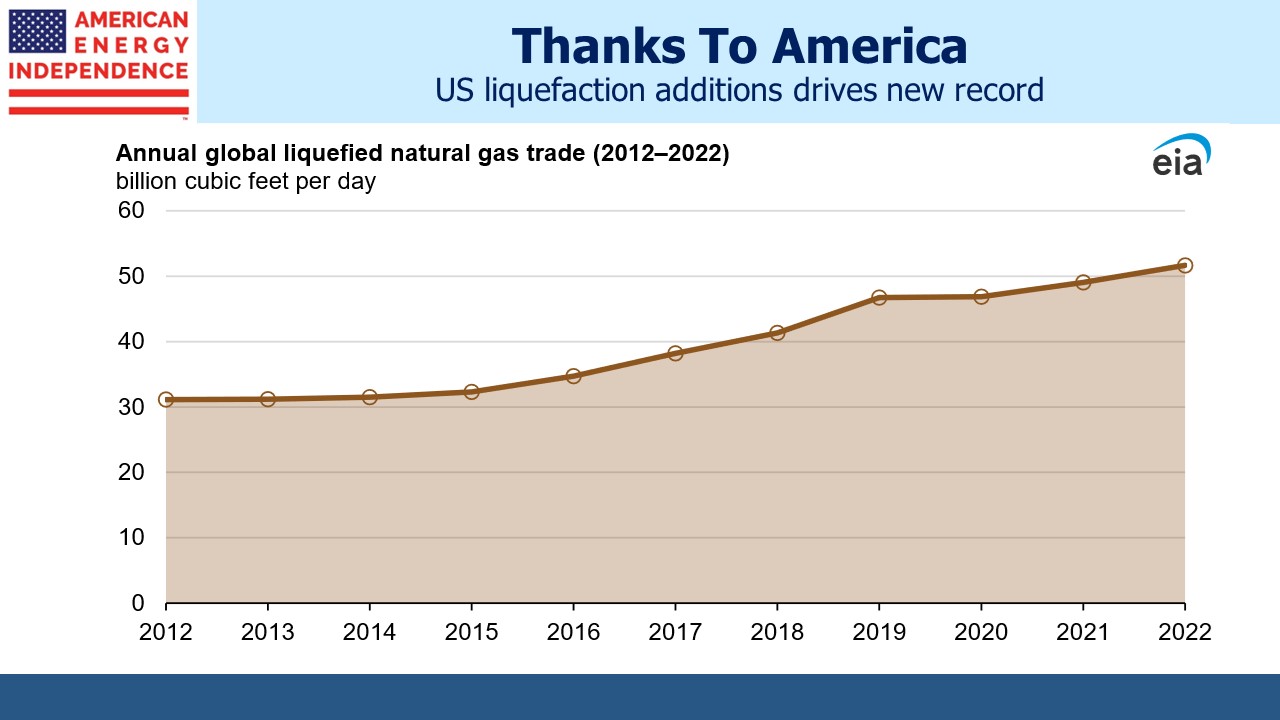

In other news, the US Energy Information Administration (EIA) reported that global trade in Liquefied Natural Gas (LNG) reached a new record last year of 51.7 Billion Cubic Feet per Day (BCF/D). Recent increases have been driven by liquefaction capacity additions in the US. Europe’s loss of Russian pipeline imports has also helped, since these have been partly replaced by imported LNG.

NextDecade (NEXT) is a company we’ve followed for some time. They recently confirmed they have bank financing in place to begin construction of their Rio Grande LNG export facility. Bechtel, who has the contract, just awarded an order to Baker Hughes to supply three main refrigerant compressors as part of the project. NextDecade hasn’t yet announced a Formal Investment Decision (FID) to proceed but have indicated this is imminent. We continue to think NEXT is attractively priced at current levels. Announcement of FID should be reflected in the current price although may still provide a modest boost. In any event we think the stock offers good upside potential.

Finally, within the details of Friday’s employment report was the news that black workers have accounted for 90% of the recent rise in unemployment. Monetary policy is hardly the tool with which to combat such a development. Past history shows that minority unemployment rises faster during a slowdown. However, Fed chair Jay Powell has in the past stated a desire for maximum employment that is “broad-based and inclusive” (see Criticism Of The Fed Goes Mainstream). Democrat lawmakers have another reason to criticize the conduct of monetary policy.

Market expectations have shifted in recent weeks towards the blue dots from the FOMC’s Projections. Just two months ago Fed funds futures were priced for a policy rate of 2.75% by the end of next year. Since then, hawkish comments from the FOMC and moderately firmer data have led traders to revise this to 4.25%. Usually the market is better than the Fed at forecasting monetary policy. This time around, they’ve caught some traders flat footed.

We have three funds that seek to profit from this environment: