Russia Boosts Inflation

Had Jay Powell and the FOMC prudently begun reducing the economy’s degree of monetary support a year ago when the Covid vaccine was already being administered, they’d have more flexibility to manage the economy’s current challenges. From a 2% neutral rate and with the balance sheet shrinking, they’d be able to pivot towards easing or further tightening depending on circumstances. Because of that policy error they’re now having to get back to neutral during high economic uncertainty.

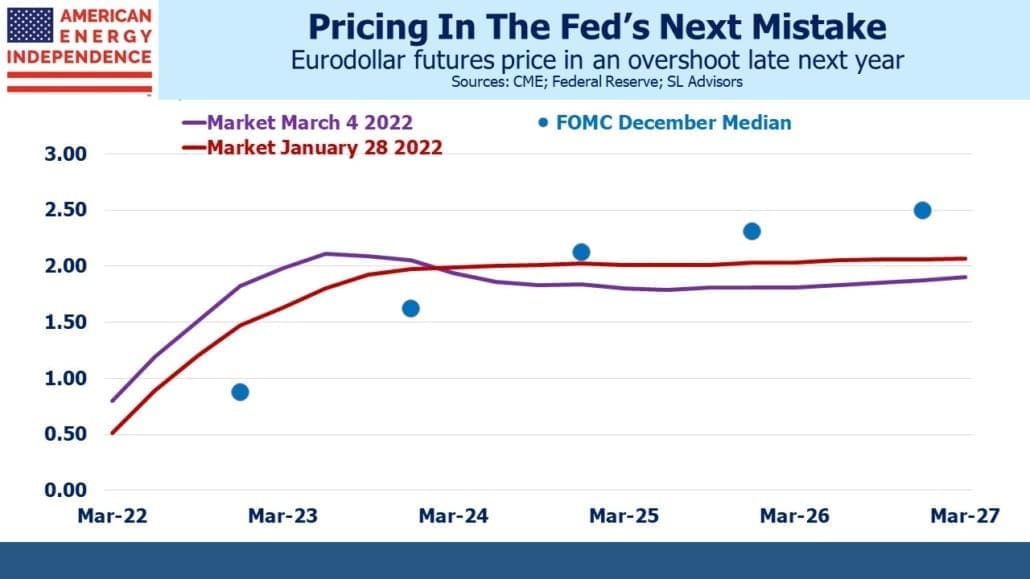

Hence eurodollar futures are anticipating a follow-up error to last year’s which is excessive tightening by the end of next year which then has to reverse in 2024, an election year. Some FOMC members must regret having followed such a reactive strategy.

The good news for the Fed in Friday’s payroll report was a small increase in the participation rate and flat earnings growth – although changes in the composition of the workforce make month-to-month comparisons difficult.

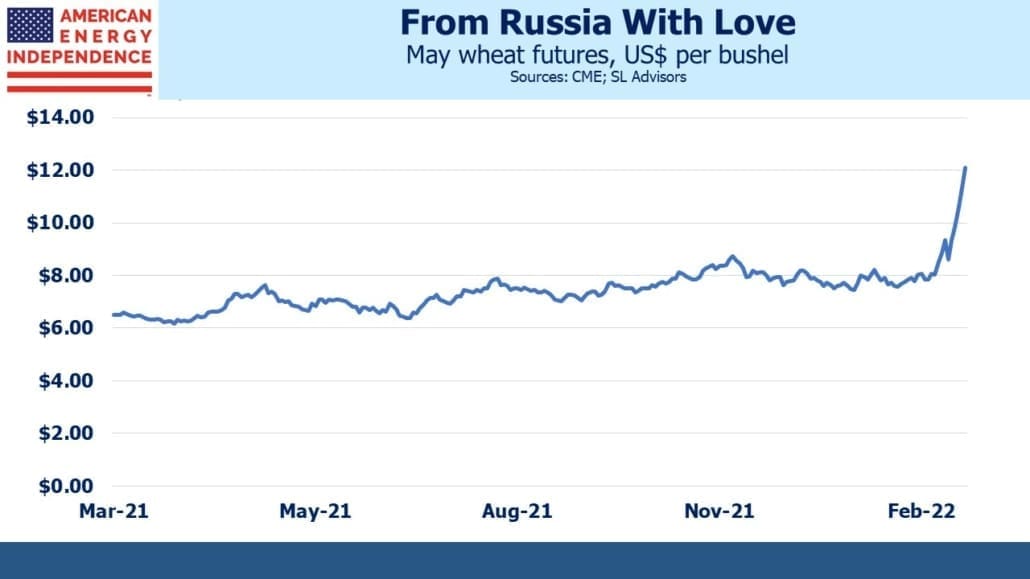

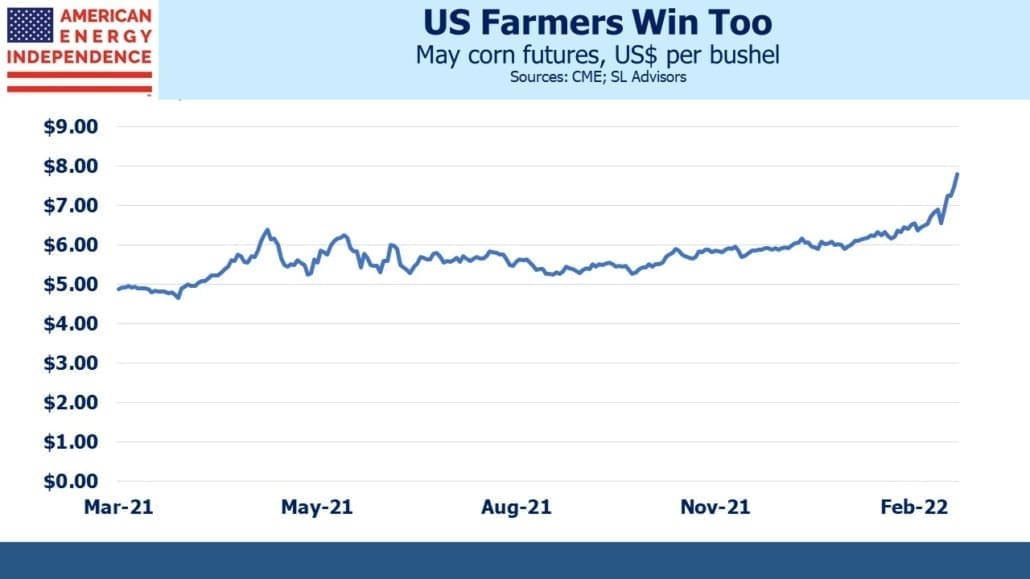

Higher energy prices will constrain growth in the months ahead, while also boosting inflation. Food prices are also likely to rise. Russia is almost 20% of gobal wheat exports, and Ukraine 10%. Fertilizer prices will probably also rise.

Inflation ex-food and energy won’t look as bad, although some of this will pass through via higher transportation costs. The Fed will want to control the inflation that’s caused by excess demand while looking beyond the transitory effects of supply constraints now exacerbated by Russia’s invasion.

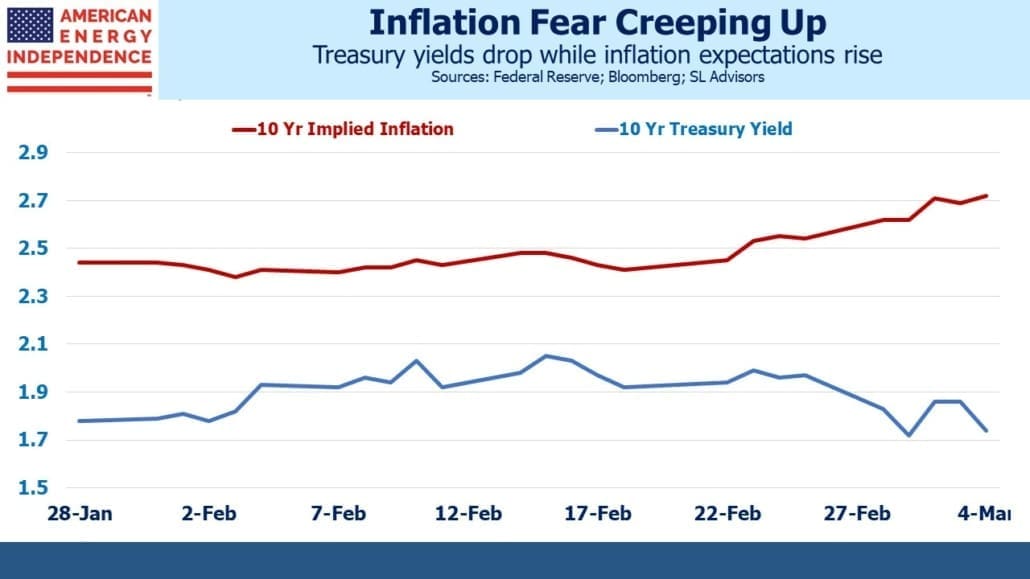

The futures market reflects some risk that the FOMC will fail to judge correctly. Ten year inflation expectations derived from the treasury market edged up 0.25% over the past month. Since higher energy and commodity prices will constrain growth while boosting prices, the Fed will likely have to tolerate higher inflation for longer than they would like. With the FOMC biased towards maximizing employment at the possible risk of higher inflation, signs of economic weakness ought to moderate their path to normalization of policy.

Financial markets are pricing for slower growth with higher inflation, what became known in the 1970s as “stagflation”. Fortunately, persistently negative real yields are softening the blow by allowing nominal rates to stay lower than they would otherwise be. Next time you run into the trustee of a public pension fund, thank them for unthinkingly financing America’s growing indebtedness for no real return.

On crude oil, the Administration’s anti-fossil fuel posture is translating into higher prices. White House press secretary Jen Psaki responded to a reporter that oil companies should increase production. Meanwhile, members of the Federal Energy Regulatory Commission (FERC) were justifying their recent decision to consider climate change when approving new natural gas pipelines. Senator Joe Manchin (D-W.Va) accused FERC of, “setting in motion a process that will serve to further shut down the infrastructure we desperately need as a country and further politicize energy development in our country.”

Chevron’s CEO Mike Wirth has called for “long-term commitments to support investment in America’s domestic oil industry.” Administration policy has been to dissuade domestic oil and gas production, a strategy that has been a disaster for US consumers. Energy executives understandably see little point in major capital commitments given the Federal government’s stance. It represents a collision between proponents of an overly rapid energy transition and energy security.

Russia is already having trouble finding buyers for its oil, with Shell reporting a transaction on Friday at a $28.50 discount to the Brent benchmark. JPMorgan estimates that 70% of Russian crude exports are struggling to find buyers. Political support is growing for banning US imports of Russian oil, a move the White House probably regards as a trap since it would quickly be followed by calls to support increased US production.

The Administration is unlikely to shift their energy policy before the mid-terms, which means US consumers shouldn’t expect much relief from high prices.

The outlook for US midstream energy infrastructure is unambiguously good. Large new pipeline projects are almost impossible to complete, so free cash flow continues to grow because spending on new projects remains a third of its 2018 level. And no matter how the conflict in Ukraine plays out Europe will be less reliant on Russia for its energy supplies.

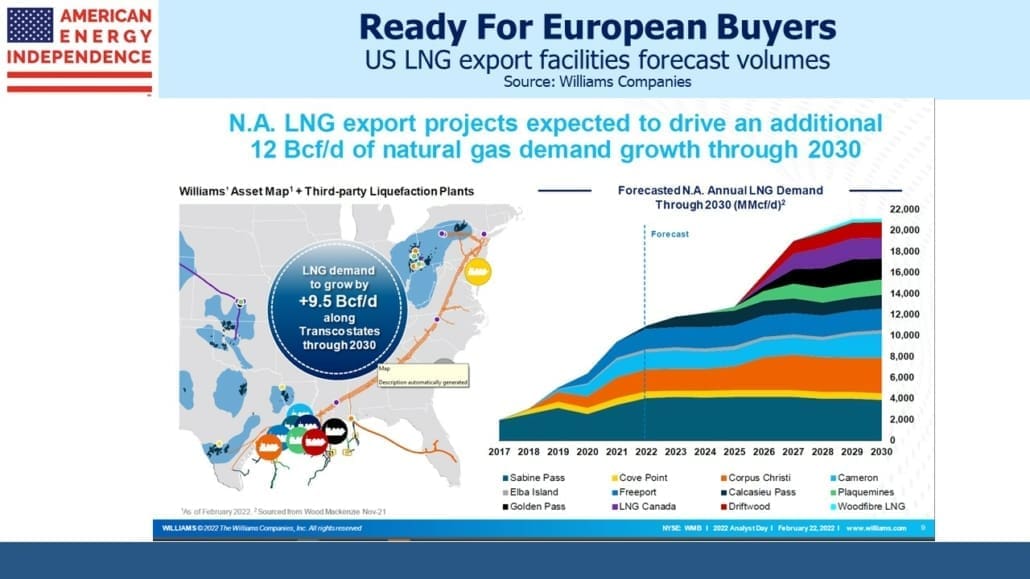

Liquified Natural Gas (LNG) export facilities take years to build. Williams Companies anticipates strong export-led demand for natural gas through their pipeline network.

Amidst considerable uncertainty, prolonged inflation well above the Fed’s target and robust demand for US natural gas both seem likely.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

My belief is that whether it was conscious or not, Powell’s reluctance to reduce QE and increase rates was due to a desire for re-appointment.

The Administration’s failure to change its energy policy before the mid-terms will only increase the Democrat losses in those elections. But nobody ever accused the Administration of either foresight or intelligence.