Russia Boosts Inflation

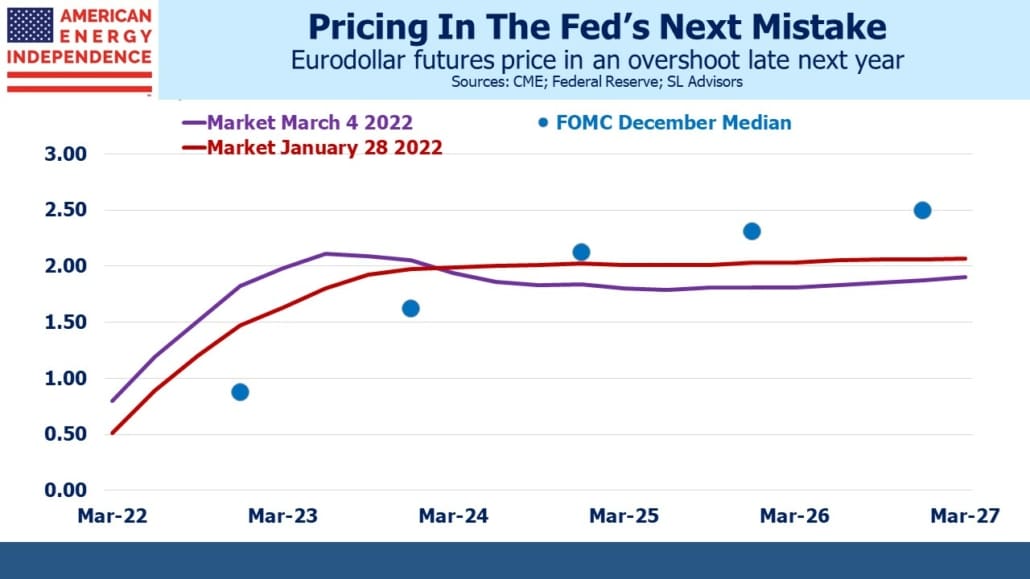

Had Jay Powell and the FOMC prudently begun reducing the economy’s degree of monetary support a year ago when the Covid vaccine was already being administered, they’d have more flexibility to manage the economy’s current challenges. From a 2% neutral rate and with the balance sheet shrinking, they’d be able to pivot towards easing or further tightening depending on circumstances. Because of that policy error they’re now having to get back to neutral during high economic uncertainty.

Hence eurodollar futures are anticipating a follow-up error to last year’s which is excessive tightening by the end of next year which then has to reverse in 2024, an election year. Some FOMC members must regret having followed such a reactive strategy.

The good news for the Fed in Friday’s payroll report was a small increase in the participation rate and flat earnings growth – although changes in the composition of the workforce make month-to-month comparisons difficult.

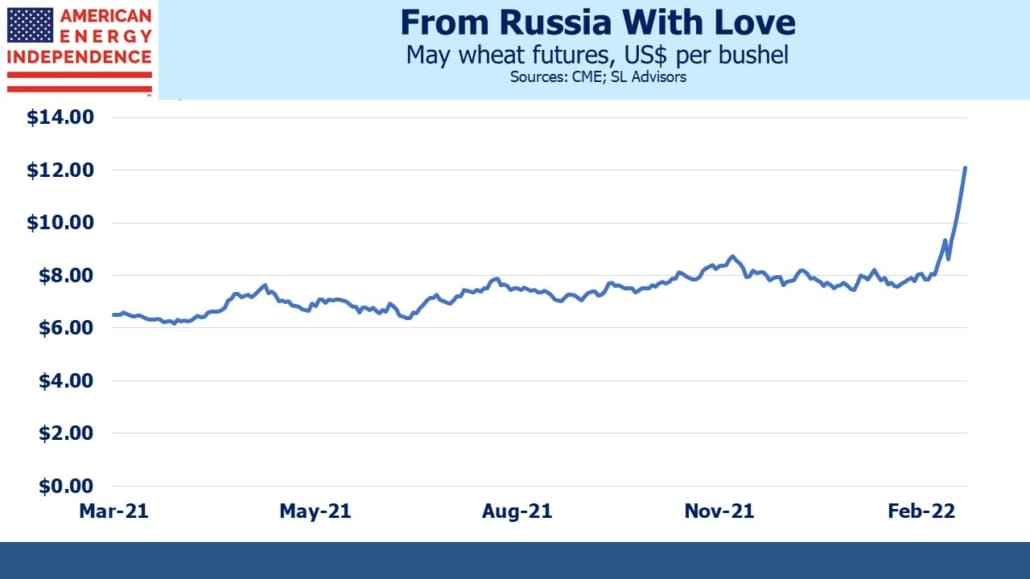

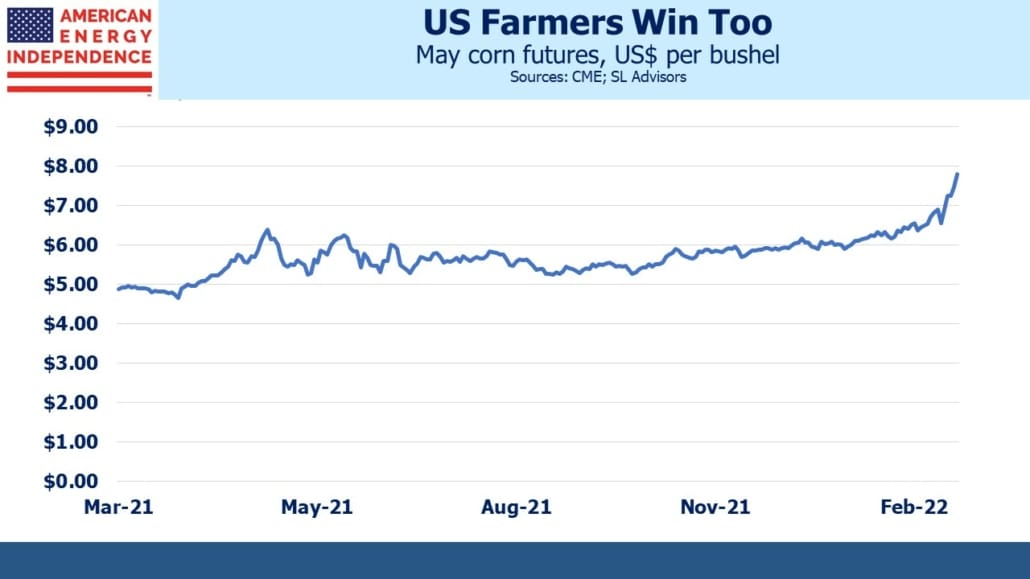

Higher energy prices will constrain growth in the months ahead, while also boosting inflation. Food prices are also likely to rise. Russia is almost 20% of gobal wheat exports, and Ukraine 10%. Fertilizer prices will probably also rise.

Inflation ex-food and energy won’t look as bad, although some of this will pass through via higher transportation costs. The Fed will want to control the inflation that’s caused by excess demand while looking beyond the transitory effects of supply constraints now exacerbated by Russia’s invasion.

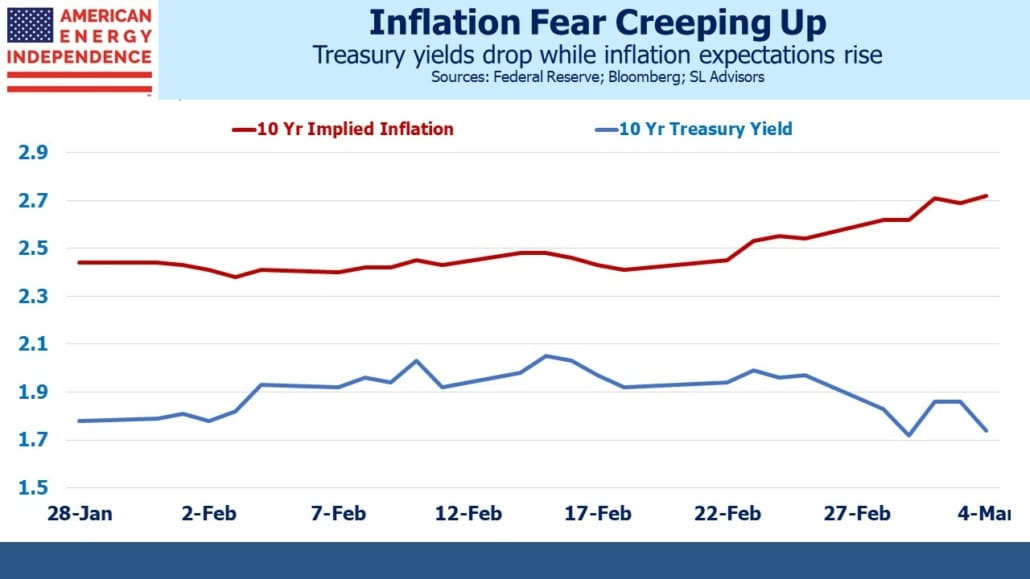

The futures market reflects some risk that the FOMC will fail to judge correctly. Ten year inflation expectations derived from the treasury market edged up 0.25% over the past month. Since higher energy and commodity prices will constrain growth while boosting prices, the Fed will likely have to tolerate higher inflation for longer than they would like. With the FOMC biased towards maximizing employment at the possible risk of higher inflation, signs of economic weakness ought to moderate their path to normalization of policy.

Financial markets are pricing for slower growth with higher inflation, what became known in the 1970s as “stagflation”. Fortunately, persistently negative real yields are softening the blow by allowing nominal rates to stay lower than they would otherwise be. Next time you run into the trustee of a public pension fund, thank them for unthinkingly financing America’s growing indebtedness for no real return.

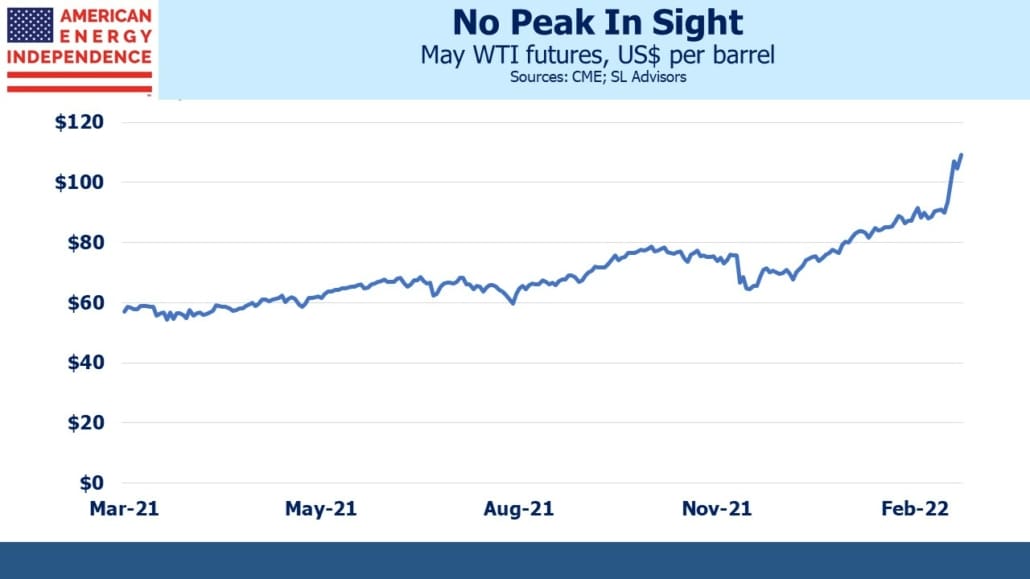

On crude oil, the Administration’s anti-fossil fuel posture is translating into higher prices. White House press secretary Jen Psaki responded to a reporter that oil companies should increase production. Meanwhile, members of the Federal Energy Regulatory Commission (FERC) were justifying their recent decision to consider climate change when approving new natural gas pipelines. Senator Joe Manchin (D-W.Va) accused FERC of, “setting in motion a process that will serve to further shut down the infrastructure we desperately need as a country and further politicize energy development in our country.”

Chevron’s CEO Mike Wirth has called for “long-term commitments to support investment in America’s domestic oil industry.” Administration policy has been to dissuade domestic oil and gas production, a strategy that has been a disaster for US consumers. Energy executives understandably see little point in major capital commitments given the Federal government’s stance. It represents a collision between proponents of an overly rapid energy transition and energy security.

Russia is already having trouble finding buyers for its oil, with Shell reporting a transaction on Friday at a $28.50 discount to the Brent benchmark. JPMorgan estimates that 70% of Russian crude exports are struggling to find buyers. Political support is growing for banning US imports of Russian oil, a move the White House probably regards as a trap since it would quickly be followed by calls to support increased US production.

The Administration is unlikely to shift their energy policy before the mid-terms, which means US consumers shouldn’t expect much relief from high prices.

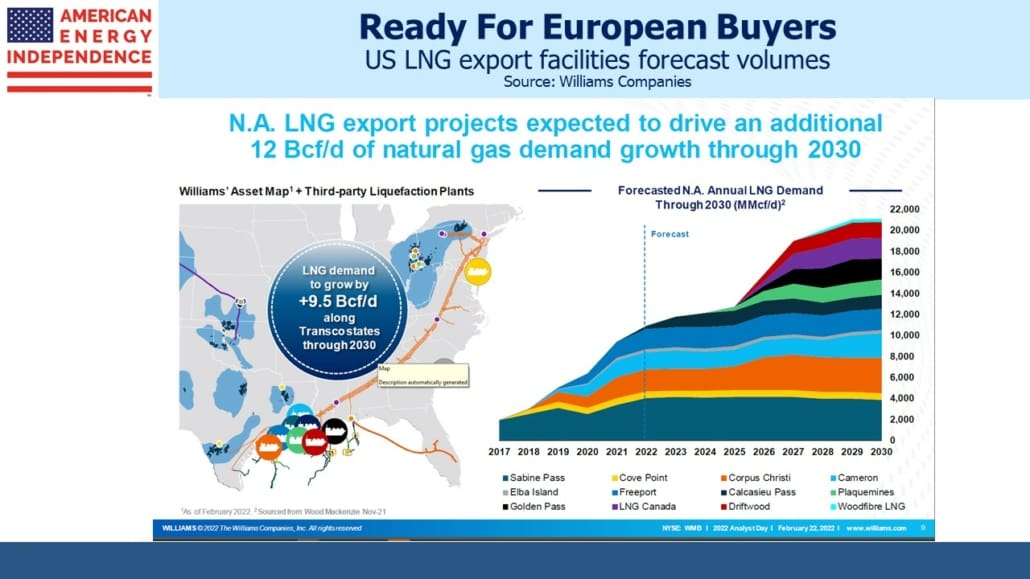

The outlook for US midstream energy infrastructure is unambiguously good. Large new pipeline projects are almost impossible to complete, so free cash flow continues to grow because spending on new projects remains a third of its 2018 level. And no matter how the conflict in Ukraine plays out Europe will be less reliant on Russia for its energy supplies.

Liquified Natural Gas (LNG) export facilities take years to build. Williams Companies anticipates strong export-led demand for natural gas through their pipeline network.

Amidst considerable uncertainty, prolonged inflation well above the Fed’s target and robust demand for US natural gas both seem likely.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.