Natural Gas To Remain Top Energy Source For Decades

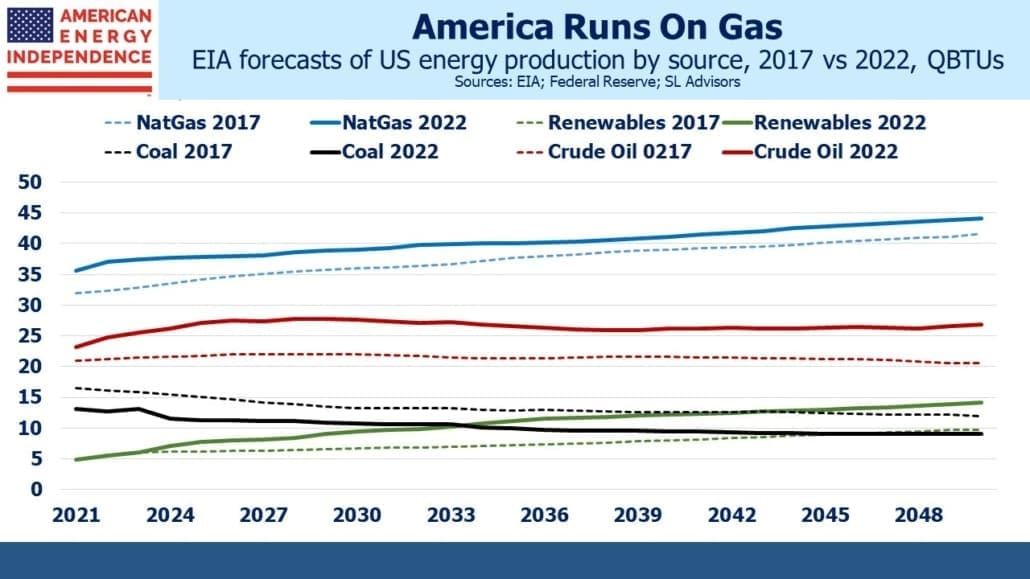

Last week the US Energy Information Administration (EIA) published their 2022 Annual Energy Outlook. Solar and wind output are expected to grow at 4% pa, reaching 12% of our total energy production by 2050, triple their share today. This is an impressive growth rate, although less than the media coverage of renewables would suggest. It’s higher than in the EIA’s 2017 annual outlook, which looked for solar and wind to have a 9% market share by 2050.

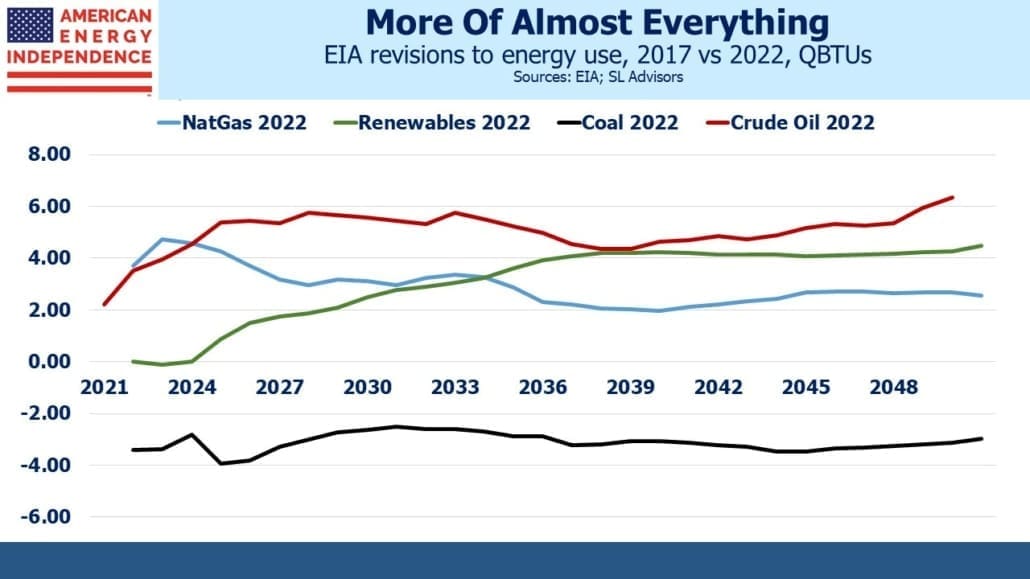

In other revisions, the EIA has also boosted its forecast of natural gas production, which is now expected to grow by 8 Quadrillion BTUs (QBTUs). This puts 2050 production at the equivalent of 121 Billion Cubic Feet per day (BCF/D) versus a forecast of 89 BCF/D for 2022.

Many will be surprised to learn that the energy equivalent increase in natural gas production through 2050 is close to the increase from solar and wind (9 QBTUs). This reflects cheap natural gas, the slow pace of energy transitions and continued growth in domestic energy consumption, which is expected to increase by 7 QBTUs, from 99 to 106. In effect solar and wind will do a little more than cover increased demand.

Another surprise will be the revisions to crude oil production. Over the past five years, the EIA has boosted its 2050 forecast of US oil production by the equivalent of almost 3 million barrels per day. This is more than revisions to solar/wind, or natural gas. Coal is the one area where they’ve lowered expected production.

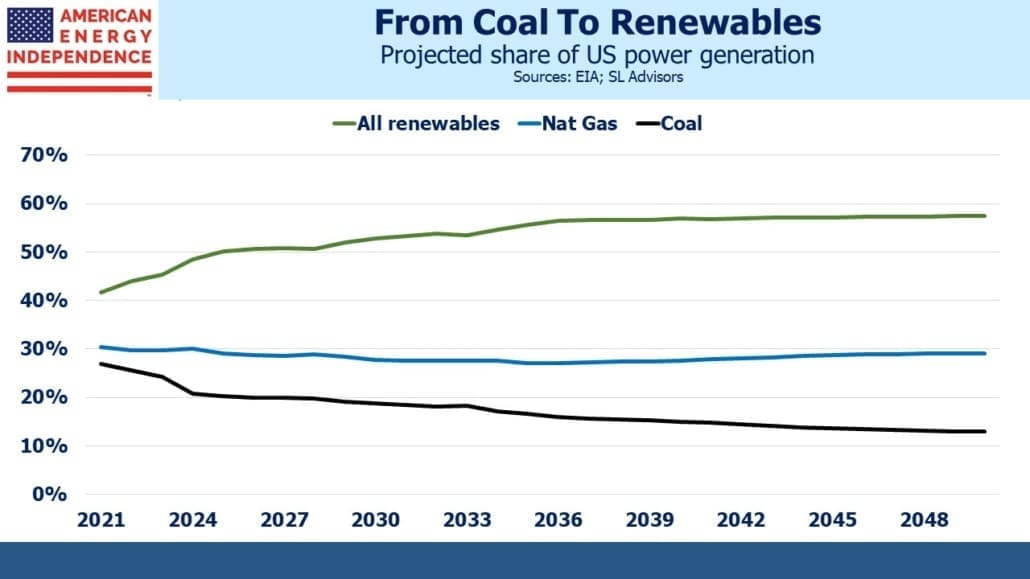

There are other surprising trends. The non-fossil fuel share of electricity production is expected to increase relatively slowly through 2050, from 42% to 58%. This adds back hydropower and nuclear, both sectors unlikely to grow much. The best locations for hydropower were identified and used long ago, while nuclear plants face debilitating opposition. There are signs climate extremists in Europe are becoming more amenable to nuclear, a welcome sign of pragmatism versus the purist view that requires running everything with solar and windmills.

The natural gas share of power generation is not expected to change much – from 30% to 29%. Coal will absorb most of the losses, representing the most realistic path to reducing emissions. By contrast, Germany recently brought forward the deadline by which they plan to reach 100% renewable power, from 2040 to 2035. The US is on track to reach 56% by then after which little change is forecast.

Russia’s invasion of Ukraine has suddenly made Europeans more aware of energy security. Renewable power is almost always domestic, so increasing this makes sense on top of buying more LNG from other countries including the US. But so far Germany’s headlong rush towards windpower hasn’t been something to emulate. We’re fortunate that the US isn’t moving at the same speed. It would only serve to accommodate China’s persistently increasing emissions. Russia isn’t helping much either.

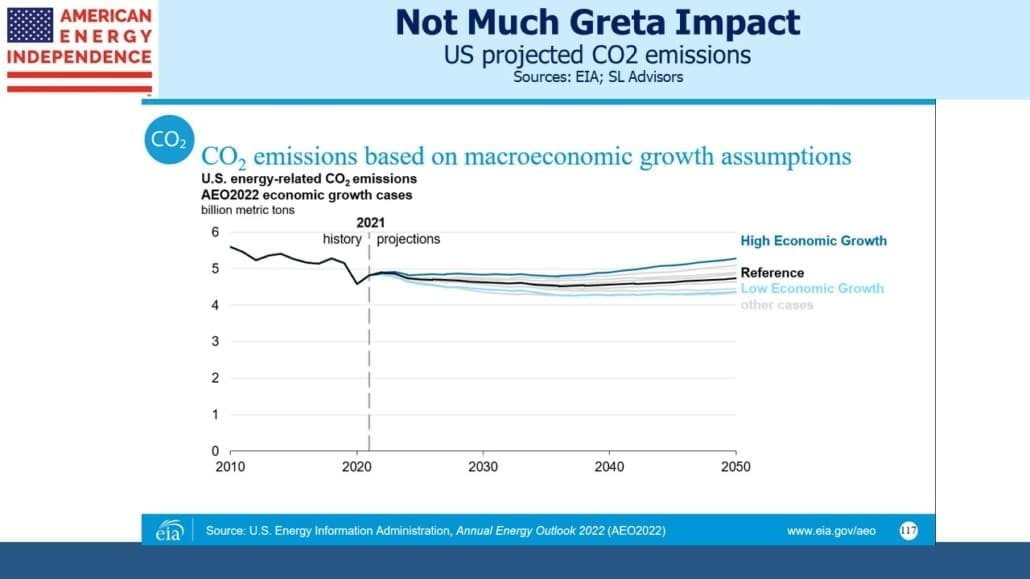

The EIA’s outlook on emissions shows generally steady state for the next three decades – a slight dip through 2035 followed by a modest increase. High oil prices and slower growth might cause a bigger reduction – a combination we are likely to experience based on recent events. But until voters accept higher-priced energy as necessary to reduce emissions, we’re unlikely to see much change.

Neither political party has offered appealing solutions – Progressives implausibly want the whole world to run on solar and windmills. Conservatives see little appetite among voters to pay more to reduce emissions. US states play a big role, which has led to more modest steps reflecting popular ambivalence on the issue.

That contrasts with the Administration’s stated goal of cutting CO2 emissions in half by 2030, although they haven’t yet provided any details on how they plan to do that. The infrastructure bill that recently passed included $8BN in funding to establish four hydrogen hubs, which would enable greater use of the clean-burning fuel by the power and industrial sectors. Hydrogen is 2-3X the price of US natural gas, but the right economic incentives would boost its role. The EIA projects almost no hydrogen use even by 2050. Europe is farther ahead because natural gas prices before the Ukraine war made it competitive.

The EIA annual outlook reminds that US natural gas output has a bright future, likely to grow for decades. It’s why we invest in the sector – the economics are more attractive than renewables, helped by the widely-held erroneous belief that fossil fuels are going away. Over the past five years the EIA has revised fossil fuel production up by more than renewables. Europe’s sudden realization that they need to import more LNG isn’t factored into the EIA’s report, prepared as it was before Russia’s invasion.

Investors are starting to recalibrate their expectations, like the EIA.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

What are your thoughts on FERC’s updated Pipeline Certificate Policy Statement (PL18-1-000) and how it may or may not affect the future growth of natural gas and the pipeline industry ?