Pipelines Offer Protection From European Conflict And The Fed

Friday afternoon’s warning from the White House that a Russian invasion of Ukraine could come at any time did at least distract attention from Thursday’s CPI. Energy stocks rose while the S&P500 fell – a welcome negative correlation.

Bonds also recouped their losses from the prior day. Over several decades the bond market’s sensitivity to rising energy prices has evolved. In 1990 when Iraq invaded Kuwait, threatening to cut supply of oil to the west, bond yields rose sharply. The memories of 1970s inflation caused by OPEC raising prices was still fresh.

At other times, rising crude has been regarded as a tax hike, since it does represent a wealth transfer from oil consumers to producers. The Shale Revolution altered US sensitivity to oil prices by increasing the portion of the economy that benefits when they’re high. Your blogger has to restrain his glee when friends complain about the price at the gas pump or how much they’re spending on heating oil. During the Covid-induced collapse in the energy sector in early 2020, cheap gasoline provided scant solace for depressed portfolios. We look forward to crude oil continuing its march higher.

Friday saw higher prices for bonds, crude and pipelines, as the rest of the market feared European conflict will hurt growth and sought refuge in energy.

The midstream sector’s strong performance does highlight its resilience to geopolitical risk. Enbridge, North America’s biggest pipeline company, reported earnings on Friday. Enbridge has no assets outside North America, a welcome protection from any global disruption.

Pipeline pricing is often tightly regulated, to prevent gouging of customers. A substantial portion of the industry sets tariffs based on the PPI. Last month the Federal Energy Regulatory Commission (FERC) set the pricing index for the next five years as PPI-0.21%.

Inflation as measured by the PPI Final Demand Goods, the index used by FERC, was 13.6% last year.

This built-in protection against inflation used to receive more attention. Prior to 2014, before the Shale Revolution had led to some dubious capital allocation decisions, MLPs (since that’s mostly where pipelines were housed back then) attracted investors because of their stable yields that came with built-in price escalators.

The tumult of the last few years has not altered this feature, even though it is rarely on the list of reasons investors cite when making an allocation. But over the next several quarters, expect to see increased mention about Cost of service (CoS) adjustments to pipeline tariffs.

Enbridge, to cite one example, says that 80% of its EBITDA comes from CoS contracts. In August we noted that Wells Fargo estimated a 3% lift to sector EBITDA from PPI escalators (see Pipelines Still Linked With Inflation). This was based on a 2021 PPI estimate of 5.5%, less than half the actual result.

What is becoming clear is that when the FOMC reinterpreted their dual mandate of maximum employment with stable prices in 2019, they made a subtle but important shift in favor of full employment at the risk of elevated inflation. Although it seems surreal given last week’s CPI release, three years ago they were concerned at the tendency of inflation to come in below their 2% target, and the constraint this placed on monetary policy to be stimulative without resorting to negative nominal rates.

Within six months Covid stopped the economy dead in its tracks, and Congress unleashed enormous fiscal stimulus through early 2021. The Fed’s prolonged monetary stimulus, synchronized with $TNs of debt-financed spending, reflected their new bias towards employment and willingness to risk inflation.

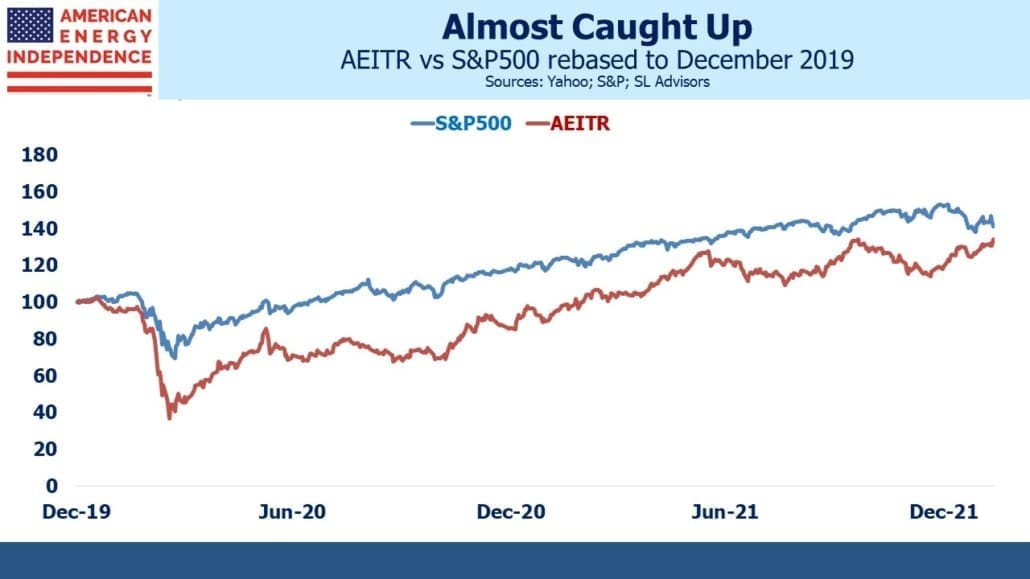

Following a near-death experience in the early months of Covid, the pipeline sector has been steadily closing the performance gap with the S&P500. On Friday the broad-based American Energy Independence Index (AEITR) recorded another good day, beating the S&P500 by 4.7%. It’s within easy reach of being ahead of the S&P500 from the end of 2019, wiping out the entire Covid-related period of underperformance.

Demand for inflation protection remains strong. Treasury Inflation Protected securities (TIPs) are an example – real yields (i.e. after inflation) are still negative. Big investors are starting to adjust their long term inflation expectations. For example, Blackrock expects inflation to average 3% over the next three years, and five year TIPs are priced for 2.8%. As Americans come to accept that the days of 2% inflation are behind us, it’ll be increasingly difficult for the Fed to bring it back down.

The demand for real assets such a midstream energy infrastructure is driven in part by investors who want protection against the Fed’s new tolerance for a little faster inflation. 3% over the long run is a safer bet than 2%.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

I think there is plausibility to the notion that the windfarm assets Enbridge has off the coast of Europe are liabilities rather than assets. But if they are assets then it is not true that Enbridge only has assets in North America.