Pipelines Are Cheap; Stocks Are Not

Market strategists often point out that valuations aren’t a good timing tool, but it’s still worth staying on top of whether the market is cheap or not. Stocks were having a good year leading into the election, and the Republican sweep took the market another leg higher. Residents of Naples, FL, our winter home, are politically right of center with a demeanor that is unfailingly cheerful, for good reason because it’s a beautiful place.

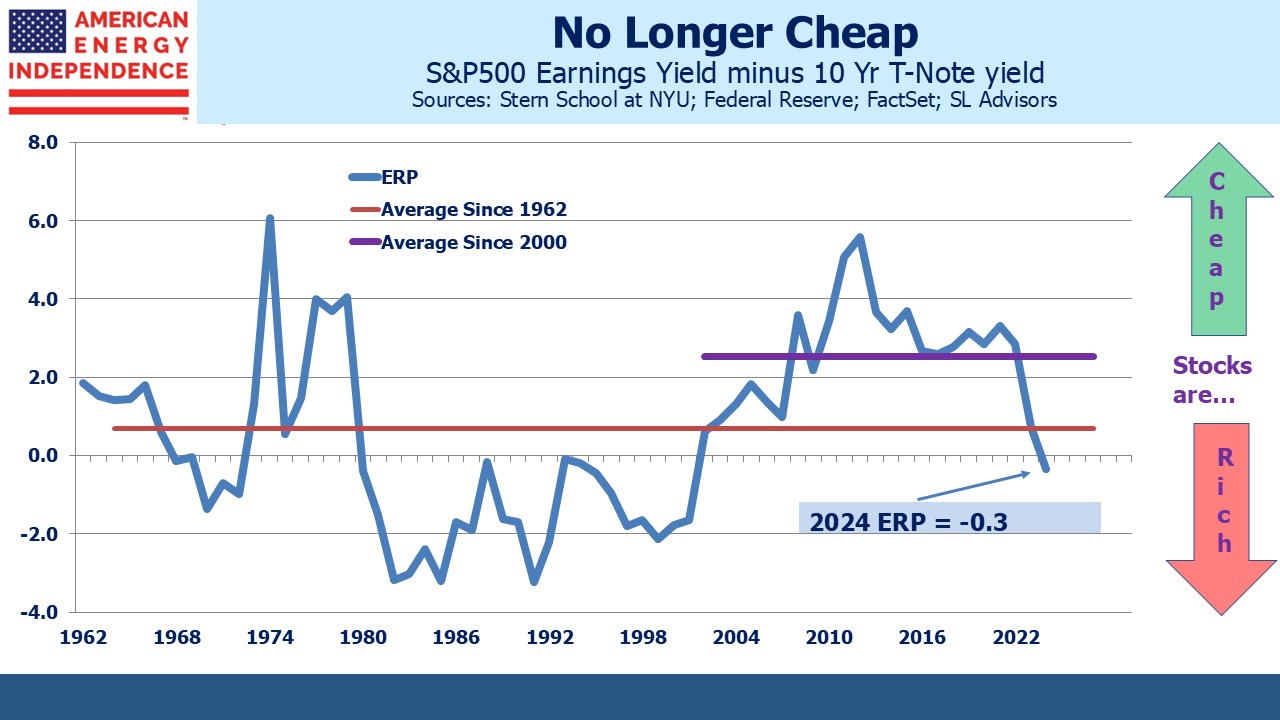

So, my friends at the golf club are nowadays exhibiting even more good cheer than normal, with happiness from the election and with their portfolios easily offsetting the clean-up cost of two recent hurricanes. My hope is that their sunny disposition continues indefinitely because they’re so much fun to be around. But I’m also watching the Equity Risk Premium (ERP).

With both the S&P500 and bond yields rising at the same time, valuation was never going to be compelling. What’s striking is that the ERP (defined here as the yield spread between S&P500 earnings and the ten-year treasury) is the least attractive in at least twenty years. This blog has noted that stocks aren’t that cheap to bonds for at least the past year, which is why we don’t employ a market-timing overlay across any of our portfolios.

The Cyclically Adjusted Price Earnings (CAPE) model popularized by Robert Shiller also shows stocks to be expensive. This has been true for several years, demonstrating the weakness in valuation as a timing tool. Nonetheless, CAPE has a good record in predicting future ten year returns from stocks, as shown in this article from 2020. Since then the market’s continued strong returns have discredited the analysis somewhat, but a tool with a robust history going back 80 years or so is still worth considering.

Markets can remain expensive for a long time. Factset is forecasting earnings growth of 15% next year which would be the best since 2021 when profits rebounded from the pandemic. The current optimism is well founded. But it’s hard to make a case for declining bond yields given the outlook for the deficit, tariffs and deported illegal immigrants.

By contrast, midstream energy infrastructure remains cheap, and to this blogger offers a good chance of continuing to outperform the broader market as it has done for the past five years. A recent Bloomberg article noted that labor productivity in oil and gas extraction has improved faster than any other sector over the past decade. Continued innovation in shale has led to increasing output per well and fewer rigs employed while production continues to reach new highs.

Finally, some notes from my partner Henry Hoffman who attended the TD Energy Conference in New York last week:

The conference featured an insightful discussion between John Miller of Washington Research Group and Dustin Meyer, who oversees Policy and Regulatory Affairs at the American Petroleum Institute.

A key point of discussion was the impact of energy policy on recent elections. Meyer noted that while the primary concerns were immigration and inflation, he attributed part of the inflation issues to the Biden Administration’s climate initiatives. He criticized the increased regulatory burdens and climate mandates, highlighting their contribution to rising costs and inefficiencies.

Meyer expressed concern that industry professionals are unclear about compliance expectations under the current EPA, describing the administration’s approach as disjointed with extensive, yet unclear, directives. He also touched on the Inflation Reduction Act, labeling it as a partisan effort that indiscriminately funnels funds into various clean energy projects without a clear strategy. Meyer mentioned a division within the Republican Party over whether to repeal the act or retain elements that are gaining GOP support, such as the tax credit for carbon capture, known as 45Q.

On the topic of U.S. LNG, a representative from Cheniere’s Investor Relations conveyed optimism about the growth prospects for U.S. LNG. He underscored Cheniere’s significant role, accounting for half of the U.S.’s LNG 15bcf/d of exports, equivalent to two LNG tankers daily from their facilities alone. He highlighted Cheniere’s consumption of 7-8% of all U.S. natural gas and affirmed the company’s capability to continue expansion at their target of 7x EBITDA build multiple. He anticipated that the halts on issuing non-FTA licenses by the DOE would be quickly reversed under a new Trump administration.

In a separate session, NextDecade’s CFO, Brent Wahl, shared optimism about U.S. LNG export growth. Specific to RGLNG, he expects no hurdles from FERC for a SEIS by next year and hopeful for a reversal of the DCCCA’s 3-judge panel’s vacatur sooner. Wahl also noted strong support from stakeholders for continuing with Train 4 once permitting challenges are addressed.

We have two have funds that seek to profit from this environment: