Pipeline Investors Are Being Rewarded

I spent the last couple of days visiting clients in central Florida, which is why this blog post is a day later than normal. The gradual return of in-person meetings is a welcome reminder that we’re moving on from Covid. Floridians are happy with how their state handled the virus, often noting that business has been more or less as usual for months’ longer than other parts of the country. Bloomberg even declared Florida and its governor Ron DeSantis “the pandemic winner.” At one hotel in Orlando where masks were not required, a guest wearing a mask entered the elevator and apologized for wearing one once he saw me standing there unmasked (I’ve been vaccinated).

It’s still hard to believe that a year ago New Jersey even forbade a solitary walk in the park or woods. The loss of freedom was breathtaking. It prompted my wife and me to travel south at the earliest possible opportunity (see Having a Better Pandemic in Charleston, SC).

Since then NJ adopted a mixture of guidelines and rules which allowed residents to select which ones to follow. For example, the advice to New Jerseyans to avoid non-essential travel was widely ignored based on the crowds I regularly saw at Newark airport during the winter.

Americans are increasingly done worrying about Covid. Abundant fiscal stimulus on top of the vaccine-enabled economic recovery are driving the market higher.

For most equity sectors other than energy, investors often appear more concerned about missing out on a profitable trade than losing money. By contrast, the pipeline sector has not been overly burdened with FOMO buyers for some time – a feature that investors find attractive. It is one of the very few areas of the market that can still be called cheap.

1Q earnings were good, with many positive surprises and guidance revised upwards. The Texas power cut provided windfall gains for Energy Transfer, Kinder Morgan and Enterprise Products Partners. Every company has something to say about the energy transition.

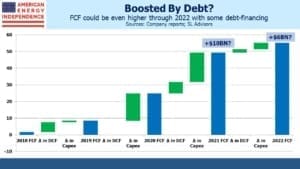

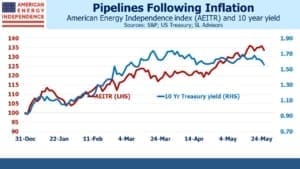

Following earnings we updated our Free Cash Flow (FCF) bridge chart. It’s virtually unchanged from the prior quarter. We expect FCF to continue on its strong growth path. Investors are beginning to embrace this view, which is why the American Energy independence index (AEITR) is up 35% YTD.

FCF is a metric that applies to any equity sector, and it’s becoming the most used measure of results on earnings calls. The Shale Revolution turned out to be an investment bust. Fears of stranded assets due to the energy transition grew in recent years, and the Covid-driven collapse in oil demand a year ago was the third body blow to sentiment. Since then, demand has recovered and growth capex has dropped.

The FCF yield on AEITR is 11% using YE 2021 figures, and we expect it to grow further next year. This puts it at 2X the S&P500. Median Debt:EBITDA is now down to 4X, and we’re finding investors are increasingly drawn to the operating stability, strengthening balance sheets and growing FCF they see. Fund flows (i.e. mutual funds, ETFs and other exchange traded products) are turning positive from our vantage point. Yields of close to 7% are too high for the risk so offer the potential for capital appreciation on top of attractive income.

Energy companies are investing less back into their businesses. This is true for upstream as well as midstream, and is the most important factor driving FCF higher. Improved financial strength will allow some use of debt to finance reduced growth capex while maintaining prudent Debt:EBITDA levels. If a CFO is happy at 4X, a new project that generates, say, $100MM in additional EBITDA can justify being financed with $400MM in debt, maintaining the 4X ratio.

We have modified the FCF bridge chart to reflect this, assuming roughly half of future growth capex will be debt-financed. Each company’s actual financing choices will differ, but the effect is to reduce by 50% the portion of growth capex funded by internally generated cash, which in turn drives FCF even higher.

Comparing the two versions of the FCF bridge chart reveals additional potential FCF upside in this scenario.

It’s an outlook that is resonating with investors who take the time to consider recent progress. My meetings were by definition with a self-selected group of midstream investors, but most found it refreshing to look at a sector that’s rising yet remains cheap.

Inflation is also causing more concern. Pipeline stocks have marched higher along with treasury yields, a link that makes sense given energy’s responsiveness to faster GDP growth and higher oil and gas prices. The possibility of using pipeline investment as a source of income that should benefit from further rises in bond yields and inflation expectations was found intriguing.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!