Trump’s Odds

The positive Presidential Covid test has provided plenty of material for the media. Trump’s known physical disposition is being compared with tables of statistics to assess his likely prognosis. The Financial Times noted that he is in the “vulnerable” population, and gave him 20% odds of requiring hospitalization with a 5% risk of death. Regardless of politics, writing about a living person’s chances of dying strikes me as rather tasteless, although inevitable since it’s the president and the election is a month away.

More interesting than mortality tables was the reaction on PredictIt, a website that allows modest wagers on numerous electoral outcomes. Many believe that betting markets offer more accurate forecasts than opinion polls, presumably because people are more thoughtful when money is tied to their view. PredictIt showed that the odds of Trump dropping out of the race before November 1 had soared from 4% to as high as 17% on high volume, following his positive Covid test.

This seems odd, because it’s hard to conceive of any sickness that would cause Trump to withdraw. And if he really does succumb to the virus, his name will remain on the ballot. The only plausible way he’s withdrawing by November 1 is if he concludes an overwhelming defeat is inevitable, when he might declare the entire election a sham hopelessly distorted by mail-in ballot fraud, paving the way for a challenge of the results. This has nothing to do with Covid, and the reaction of PredictIt shows that even the commitment of modest sums of money doesn’t assure a rational view. The Robin Hood trading platform offers another rich source of financially irrational actors.

The 5% Case Fatality Rate (CFR) referred to by the FT relies on a study from OurWorldInData, which estimated the CFR for different age groups by looking at just four countries (South Korea, Spain, China and Italy). This limited data set took no account of any pre-existing conditions (“comorbidities”). A study in June from the Center for Global Development (“CGD”) took a more precise look, and found that a male aged 70-79, with at least one co-morbidity living in a rich country, had a CFR of 4.35%. Take away any pre-existing condition and the CFR drops by 89%, to 0.48%.

Trump’s pre-existing health conditions, if any, are unknown. He claims to weigh 235lbs, which for his height puts him on the threshold between overweight and obese but well short of severely obese. The 4.35% CFR doesn’t differentiate between one or several co-morbidities.

Trump’s debate performance didn’t show shortness of energy, regardless of whether you found the content appealing or not. There’s little public evidence that he’s chronically sick.

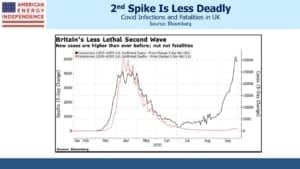

Moreover, the CDG study is from June. CFRs keep improving – although infections are rising again in many countries, fatalities are not. More testing, better treatment and a less fatal strain of the virus are among the possible explanations. It’s likely the CDG study would produce lower figures if the data was updated. And Trump will be receiving the best care available.

On Friday, stocks and crude oil both fell on the news. Pipeline stocks surprised by moving higher, perhaps showing that attractive valuations are finally overwhelming negative sentiment.

The absence of any formal training in virology has not prevented us from offering a data-based view on Covid. So for Trump, the odds are high that he’ll emerge from self-quarantine reporting a mild case easily handled, confirming his assertion that widespread popular fear of the virus is unwarranted.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!