Navigating the Collapsing Oil Market

To the list of previously inconceivable events, add Texas oil drillers asking for their regulator to impose production curbs. Pioneer Natural Resources (PXD) and Parsley Energy (PE) filed a request with the Texas Railroad Commission (RRC) to hold a hearing on the state’s oil and gas production. It’s over 40 years since they last considered such a move.

The U.S. energy industry has been hit with a 1-2-3 punch – coronavirus demand destruction; collapse of OPEC+ limits on output; Saudi Arabia’s launching a price war while increasing exports.

Senator Ted Cruz (R-TX) described a call between nine U.S. senators and the Saudi ambassador complaining about “economic warfare”. The Saudis blame Russia. “The Saudis are hoping to drive out of business American producers, and in particular shale producers, largely in the Permian Basin in Texas and in North Dakota,” Cruz told CNBC. “That behavior is wrong, and I think it is taking advantage of a country that is a friend.”

The petition to the RRC from PXD and PE included recent presentations from two energy consulting firms that paint a dire picture.

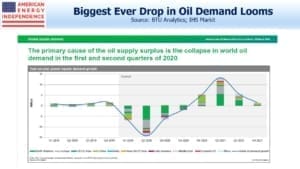

IHS Markit is forecasting a drop in global demand for crude oil of 14.2 Million Barrels per Day (MMB/D), and a 7.2 MMB/D drop for the year. This is far more than the drop during the 2008 financial crisis. The combination of collapsing demand and rising supply is filling up available global storage capacity, which is estimated at 1.3-1.6 billion barrels, assuming the excess oil can be moved there. The 1H20 forecast crude surplus of 1.8 billion barrels will use this all up.

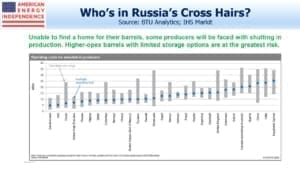

Producers around the globe are already shutting in production, which can cause permanent damage to a reservoir depending on its structure. Shale oil production is easily curtailed through sharp decline rates by simply reducing the number of new wells drilled and completed. Once producing, a shale well’s operating costs are very low. Lifting costs (meaning the cost to produce after the well has been drilled) are just $3-5 per barrel. So this type of production is unlikely to be shut-in. New wells drilled will drop sharply, causing U.S. shale output to fall mostly through curtailed drilling of new wells and the normal fast decline rates for existing wells. The breakdown of OPEC+ has made many other producing regions in the world unprofitable. Even Russia may need to start shutting-in production as spot prices drop below $15 a barrel.

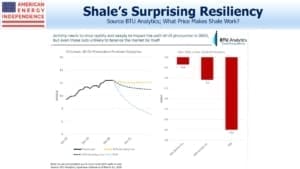

The decision to drill new US shale wells to offset production declines will face a different analysis. Producers will look towards the forward curve which is currently $11 higher one year out than spot prices, to lock in hedges for wells they expect to exceed their breakeven return threshold. This slide from BTU Analytics shows that a drop in drilling activity of around 50% (which they estimate would occur with WTI prices in the mid $30s) would stabilize US production around 11 MMB/D.

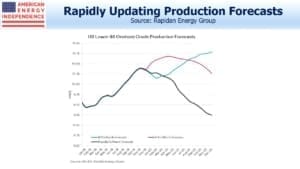

Rapidan Energy Group’s forecast is for U.S. oil production to fall by 1.25 MMB/D. The two other forecasts on the chart, from the U.S. Energy Information Administration (EIA) and the International Energy Agency (IEA), were produced only a couple of weeks earlier, showing how rapidly situations are changing. Rapidan is forecasting an even bigger drop in 2Q20 global demand, of 16.4 MMB/D, but with a faster recovery so their 7.1 MMB/D full year demand drop is close to BTU Analytics.

Current prices are ruinous for all producers. President Trump recently said he’d be discussing oil prices with Russia. He told NPR, “”We don’t want to have a dead industry that’s wiped out. It’s bad for them, bad for everybody. This is a fight between Saudi Arabia and Russia having to do with how many barrels to let out. And they both went crazy; they both went crazy.”

The U.S. has limited leverage over Russia. We could curb imports of foreign oil, although that would cause problems for domestic refineries which generally aren’t equipped to handle the light grades produced by shale drillers. The U.S. military’s ongoing defense of Saudi oil infrastructure is gaining attention, and seems absurd when that country’s policies are so damaging to our domestic energy sector. A single presidential tweet on the topic wouldn’t hurt.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

You got your tweet :). And it did not hurt.