Natural Gas Demand Still Stable

Crude oil drew the headlines this week. Trump’s Wednesday tweet forecasting a 10 Million Barrel per Day (MMB/D) agreed supply reduction (“Could be as high as 15 Million Barrels”) caught markets off guard. The demand collapse is astonishing. The world was consuming around 100 MMB/D of crude oil and liquids before the coronavirus. Estimates are for a 20-25% drop in April. Every producer is feeling the financial pain, which ought to concentrate minds as OPEC holds an emergency video meeting on Monday.

Natural gas demand is both more regional and more stable. Some midstream energy infrastructure companies, such as Williams (WMB) and Cheniere (LNG) are entirely natural gas focused, even though their stock prices move with energy sentiment. Crude moves the S&P Energy ETF (XLE), of which they are components, so their stock prices follow.

U.S. natural gas production is heavily influenced by domestic prices. Although in recent years we’ve become a net exporter, over 90% of output is consumed domestically. Given the collapse in global crude demand, we’re interested in domestic natural gas demand.

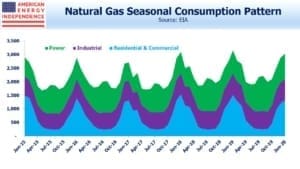

The seasons dominate. Winter is the peak period as households and commercial buildings need heat. The power sector uses more in the summer as electricity demand rises for air conditioning. The chart shows the monthly pattern.

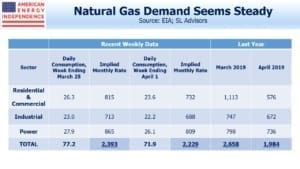

The Energy Information Administration (EIA) releases weekly data, which can provide a clue about how demand is being affected by the shut down’s effect on the economy.

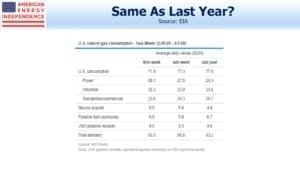

We’ve taken the last two weeks, which cover late March to April 1. Since consumption is typically falling this time of year, a sequential weekly drop is normal. Multiplying by 31/7 to get the monthly rate, those two weeks are running at 2,393 Billion Cubic Feet (BCF) and 2,229 BCF respectively. These two figures sit comfortably between last year’s March total of 2,658 BCF and April’s 1,984 BCF.

Looking a little more closely, power demand is stronger than a year ago, continuing a trend of natural gas substituting for coal. And lower crude production will also mean less associated natural gas output from areas like the Permian, which will benefit those drillers focused on pure-play natural gas.

There’s no historical precedent for what we’re experiencing, and it wouldn’t be surprising to see natural gas consumption falling even after adjusting for the seasonals. So far, that doesn’t seem to be happening which supports the encouraging updates provided by natural gas oriented pipeline corporations.

We are invested in WMB and LNG.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Hi Simon

FYI, a small company, Cytodyn, has a monoclonal antibody, Leronlimab, which they developed for HIV and should make the final submission for their fist Biological License Application in the next week or two.

Along the eight year testing path, one of the associated scientists came up with the hypothesis that this compound had several mechanisms of action which would be effective in a number of other diseases which flourish as a result of weaknesses in the human immunological system. Phase 2 trials for Stage 4 breast cancer have shown early, but nevertheless stunning, results and cancer trials have expanded to test 22 forms of solid tumor cancers.

The scientist also hypothesized it would be useful against Covid (and Acute Respiratory Distress Syndrome in General) and the FDA granted an Emergency IND. Ten seriously ill patients at Montefiore Hospital were dosed last week. Data from the first eight patients, all of whom were on a path to imminent death, were astonishing. All patients had immunological markers return to normal. Those on ventilators came off and, reportedly, one walked out of the hospital. Based on these results, a Phase 2 trial for mild to moderately ill patients and Phase 2b/3 trial for severely ill patients have been launched. It is expected the trials will fully enroll almost immediately (enrollment began Thursday).

The severely ill patient trial has an endpoint of one week survival. Based on the results from the emergency IND patients, the chance of success is a statistical near certainty. The scientists are highly optimist about the prospects for treating less ill patients. This trial should readout at the end of this week or maybe next week.

This compound has been administered to over 800 patients over log periods of time with zero Serious Adverse Events, so no time consuming safety trial will be needed.

With this in mind, I think this pandemic and the economic restrictions addressing will be over shortly. Two weeks….four weeks maximum. Not in your bailiwick, but I think this compound will have a disruptive effective on the pharmaceutical industry along the lines of penicillin. Sounds crazy when I say it but that doesn’t mean it is crazy.

I’ve gotten a lot of great information from you. Thought I would share this.

Best

Emmett