More Thoughts On Oneok and Magellan

/

Wall Street analysts are predisposed to be supportive of management’s M&A activities. The sycophantic posturing that precedes an earnings call question with, “Nice quarter, guys” lives in the hope of investment banking business. Hence the response of sell-side analysts to Oneok’s (OKE) proposed acquisition of Magellan Midstream (MMP) is one of mild surprise at this unlikely combination that stops short of overt criticism.

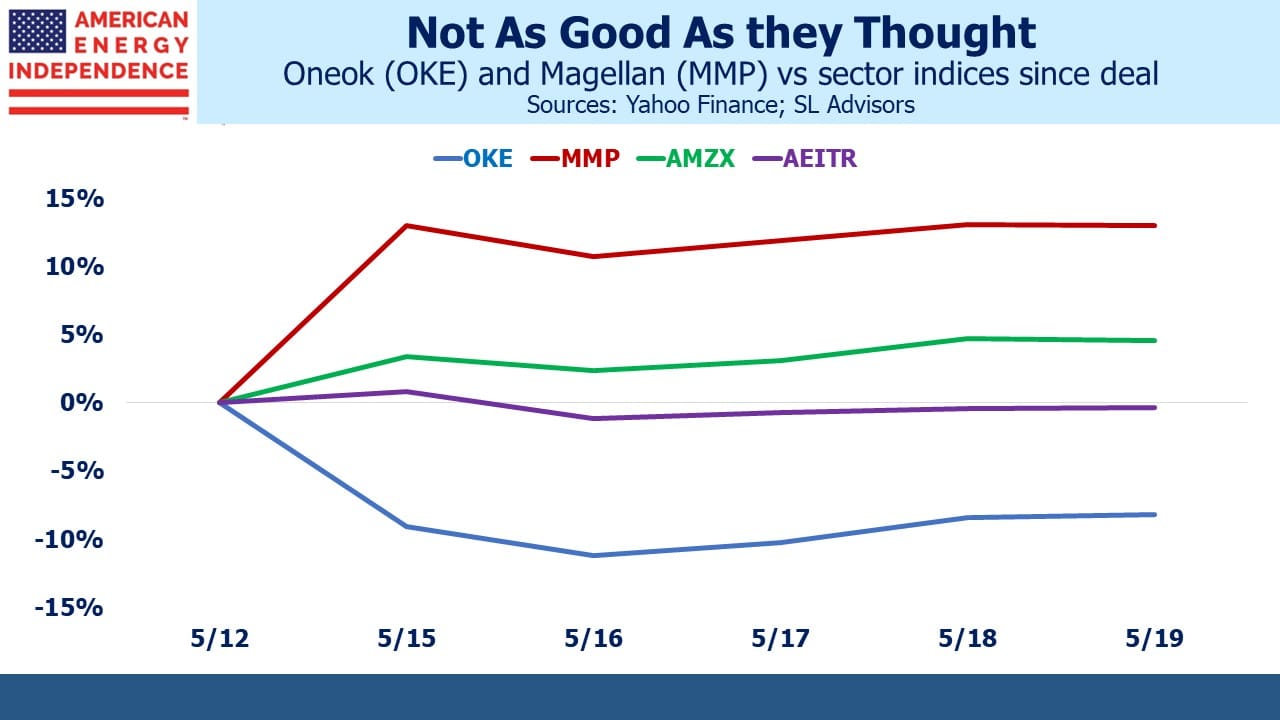

The numbers offer a less enthusiastic reception. OKE is –8% since the deal was announced, in spite of the $1.5BN tax shield and $200-400MM of annual synergies. MMP is up 13%, but this is well short of the 22% premium that heralded the deal because of OKE’s underperformance. In addition, MMP investors are facing the recapture of deferred taxes on prior distributions. This will be more for long term holders, which runs counter to the point of MLPs which is to allow long term management of tax deferrals by investors.

It’s hard to see anyone other than a recent MMP investor being untroubled by the recapture. The cohort of long term MMP holders may be too small for their votes to disrupt the deal. MMP has presumably analyzed this closely. But financial advisors who hold MMP in client accounts will not relish explaining any unexpected tax bill to clients.

An investor who owned OKE and MMP in proportion to their relative market caps is down 2.2%. By contrast, the Alerian MLP Index (AMZX) has gained 4.8% since the deal, partly due to MMP’s jump but also because traders have anticipated a rebalancing from MMP once it disappears into the shrinking group of remaining MLPs. In other words, the investors who have done best out of this deal are the ones not involved in it.

If the transaction ultimately closes, enthusiasm will be muted. The proposed OKE acquisition of MMP is a solution to a problem nobody has.

Turning to the regional bank crisis — a few weeks ago I shared my experience as treasurer of our Naples co-op in trying to earn a fair interest rate on our cash (see Some Banks Are Having To Pay More). We recently switched banks and left the 3% deposit rate that we had only achieved through persistent complaints. Banks operate on the assumption that you don’t know where treasury bills or Fed Funds are.

Our new bank relationship began at 0.25%. The initial response when I requested a competitive rate was that I should point out a competitor’s rate and they would then consider the matter. I responded that 0.25% was so off-market that it was unworthy of such effort and that they were insulting my intelligence. Days passed with no response, and finally they improved to 2%. This is from a bank whose market cap has shed two thirds in the past eighteen months.

So we’re going to open a brokerage account and buy treasury bills which yield 5%. It creates some additional administrative work, but such offensive behavior demands it. This is how one regional bank will lose a $500K deposit. Banks behave as if we’re stupid, or lazy. Their prior experience may justify such a stance, but it hardly seems like a stable business model to hold your customers in such low regard.

The question regional bank investors must answer is whether large numbers of depositors will react like us. Banking services need to be paid for. Banks rely on paying a discounted rate on deposits. The last time Fed funds traded above 2.5% was in 2008 before the Great Financial Crisis (GFC). Since then, deposit rates near zero haven’t represented much of an opportunity cost for customers.

Now they do, and in the intervening fifteen years moving money and gaining access to information have only become easier. Banks don’t seem willing to create linked brokerage accounts that can own treasury bills, and information about deposit rates for business clients is kept intentionally opaque. They don’t make it easy.

Nonetheless, foregoing a couple of per cent on $250K might strike many depositors as a steep price to pay for banking services.

If competitive pressure forces deposit rates higher, net interest margins will be squeezed. The argument against marking to market bank holdings of securities rests on the notion that deposits are sticky and when rates are rising the value of that stickiness (ie the discount to treasury bill yields) increases. But this is based on past behavior. How depositors reacted to rising rates prior to the GFC may not be a useful guide today. Deposits can leave, at times quickly. Regional bank investors will find out in the months ahead how responsive savers are to more competitive rates from the US Treasury.

We have three funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

In addition to the capital gains taxation due to adjusted basis in MMP units having been reduced by tax deferred distributions, MMP unitholders will have significant ordinary income taxed resulting from depreciation recapture even after the release of suspended passive activity losses.

I had a similar discussion with my bank prior to the recent bank mess. I told them that I have been building a bond ladder since September and that calling my checking account a money market checking account while paying .01% interest was ridiculous. At the time Vanguard was paying 4.2% in their MM account. They shrugged their shoulders. I built my ladder and roll over 6 month treasuries. Opportunity costs are real. Options are easy. Money will move. Pain will be felt. Banks will fail.

I really like your posts and videos. Thanks for taking the time to create them. Jim

Hi Simon, thanks for your blog I find it very interesting. What do you think happens to money market account values if there is a US Government technical default related to the current “negotiations” between the Biden administration and Congress? Is there a possible permanent dip in the traditional $1/share value that’s typical in those accounts? I’ve been considering moving money back into a bank account until the drama has subsided. Thanks