Liquefied Natural Gas Shows Up In More Places

/

To the twin certainties of death and taxes, the energy investor might add increased US exports of Liquefied Natural Gas (LNG). The outcome of Russia’s invasion of Ukraine is far from certain, but it’s hard to envisage Europe ever relying on Nord Stream 2 for natural gas. Moreover, once the flows from Nord Stream 1 stop – and at 20% of capacity they almost have – any future volumes of natural gas from Russia will not represent a critical part of Europe’s overall supply.

It’s rare for the flaws in a widely accepted public policy to be so cruelly exposed. Brexit always looked like a shot in the foot, an impulsive response to excessive immigration dressed up as a jingoistic rejection of an EU that constrained Britain’s true potential. Now UK GDP growth is 19th out of the G20, ahead of only Russia. Scotland will likely vote for independence next year, seeking their true potential unshackled from London. The reunion of the island of Ireland also looks increasingly likely within a decade or so.

Brexit will eventually undo the 1707 Act of Union that joined England with Scotland, and the Acts of 1800 that added the entire island of Ireland to Great Britain. Northern Ireland, born in 1921 out of persistent unrest and confirmed in the 1998 Good Friday agreement, rejected Brexit which means they picked Ireland inside the EU rather than England outside of it. Britain’s English rural majority imposed its Brexit will on diminutive nation-appendages as well as urban London. Once the others have left, fka Great Britain’s GDP will be closer to Canada than Germany. Like people, countries make mistakes too.

Similarly, Germany’s national security rested unsteadily on an unwavering belief that engagement with Russia through trade would ultimately lead to shared values if not a huge eastern liberal democracy. Angela Merkel, only the last in a succession of German leaders not burdened with self-doubt on the matter, faces a retirement of speeches in staunch defense – or few public speaking engagements at all.

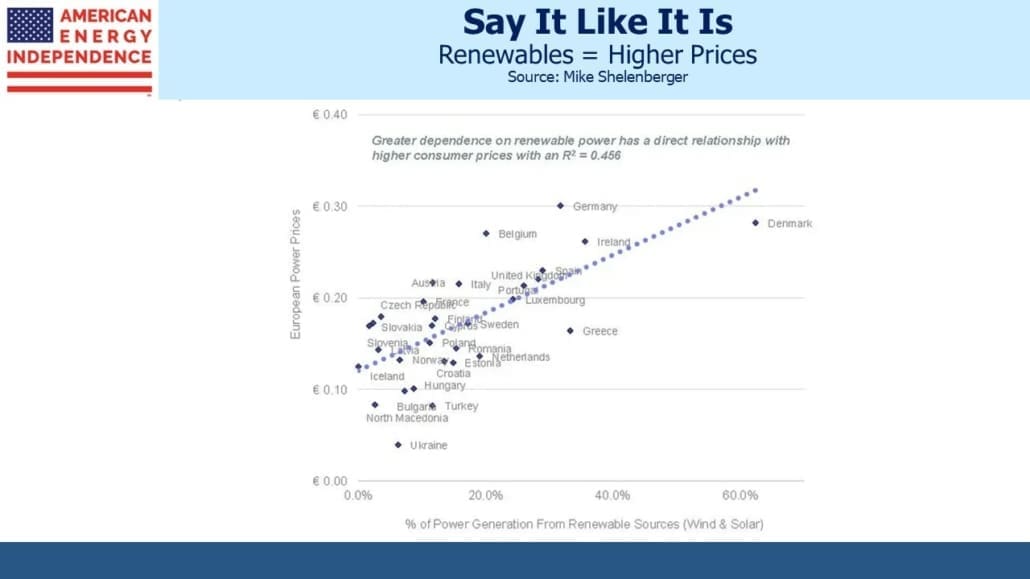

US energy investors are the beneficiaries of Europe’s geopolitical mis-steps on energy security. Because EU policymakers also believed the world’s poorer countries would soon insist on growth via renewable energy or none at all, they pursued intermittent power to inspire others. The consequences of these twin policy failures include year-ahead power prices in France up 10X. Renewables penetration is correlated with European electricity prices. Leaders in developing countries, most obviously China, fear popular unrest at slow growth more than shame at failing to emulate hubristic Germany.

US natural gas is the opportunity to express this geopolitical analysis as an investment view.

Cheniere Energy is the obvious beneficiary. They export half of our LNG and have the lowest maintenance capex as a % of EBITDA of any midstream infrastructure company. They’re well positioned to fulfill Asian contracts that often run to two decades while growing free cash flow.

To this observer, LNG prevails over ESG nowadays in pipeline company presentations, reflecting a triumph of substance over style. To wit, in Williams Companies’ 2Q22 investor presentation, LNG appears 15 times and ESG two. One might call this a Seriousness:Frivolity ratio, or S/F, of 15:2. Kinder Morgan’s 2Q22 earnings press release S/F was 8:0. Enbridge had an S/F of 46:10 in their 2Q22 earnings presentation.

For Williams Companies, this preponderance of substance translates into nine projects to transport natural gas to LNG export facilities, with estimated in service dates all within five years. They see 1H22 LNG plus Mexican pipeline exports up over 10% year-on-year. They expect LNG exports along their Transco natural gas pipeline corridor to double by 2035.

Kinder Morgan claims to move half of US natural gas destined for export as LNG. Their growth projects include supplying Venture Global’s Plaquemines LNG facility, which just received its final investment decision in May.

Enbridge expects to almost triple its LNG exports by 2040. It’s not just in the US that it’s growing. Enbridge will supply natural gas to Woodfibre LNG, currently under development near Vancouver.

For those who find normal energy sector volatility tame, NextDecade is closing in on a final investment decision on their Rio Grande LNG export project in Brownsville, TX. They regularly issue press releases announcing new “sale and purchase agreements”, most recently with Exxon Mobil. This had an S:F ratio of 27:2, even though NextDecade’s ESG credentials are solid because they plan to capture the CO2 emitted as they convert methane into LNG.

If you possess unshakeable conviction that the abrogation of Germany’s policy of energy engagement with Russia is irreversible, NextDecade offers a pureplay bet on the consequences.

Energy as a share of the S&P500 has doubled from its 2020 low but remains well below the long-term average.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

“Seriousness:Frivolity ratio.” Brilliant.