Earnings and Pending Legislation Good For Pipelines

/

The theme to pipeline earnings for 2Q22 is one of positive surprises. It reminds me of Don Layton, former vice chair at JPMorgan and more recently CEO of Freddie Mac, when I told him I’d hired a new derivatives trader with a perfect Math SAT. Don, not easily impressed, responded by recounting a class he attended at MIT where the professor asked anyone who had not achieved an 800 Math SAT to stand up. Only a handful did.

Midstream CEOs could similarly remain seated while delivering earnings reports that mostly exceeded Wall Street expectations. Anticipating this, JPMorgan had recently been raising their forecasts, and “beats” were nonetheless common.

Start with Cheniere, who beat Wall Street analysts by a wide margin, as they did in the prior quarter too. EBITDA came in at $2.529BN versus consensus at $1.9BN. The company is now guiding to full year EBITDA of $9.8BN-$10.3BN, fully $4BN above their original ‘22 forecast made last year. They also spent $540MM on buybacks, retiring 4.1 million shares. These purchases fell late in the quarter. Their 10Q revealed that their share count dropped by a further 0.6 million shares during July, so the buybacks have continued. Cheniere’s prospects, already strong, received a further boost when Russia invaded Ukraine. Global trade in Liquefied Natural Gas (LNG) is on a strong growth path. They now expect to generate $20BN in excess free cash through 2024.

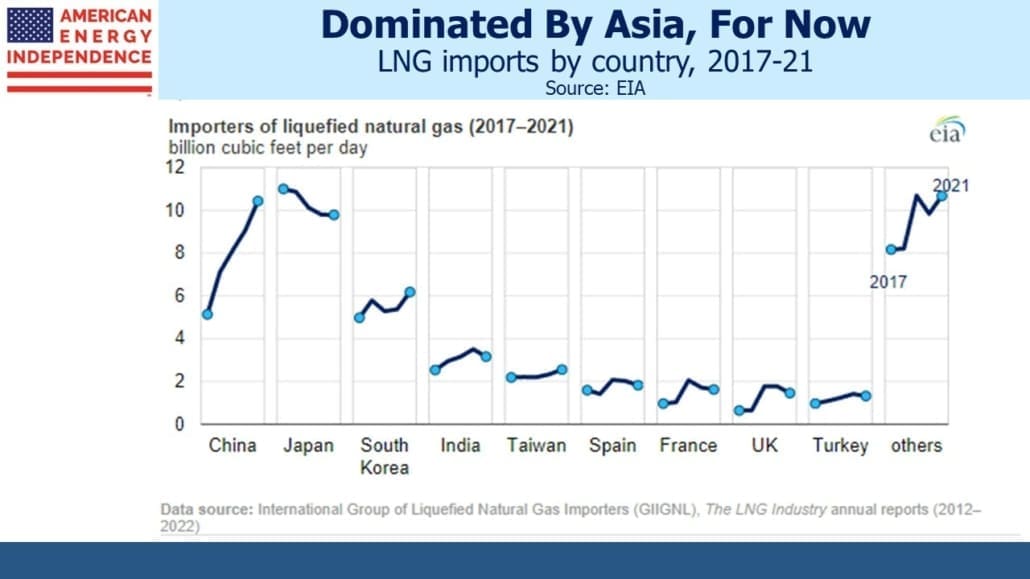

Asia has historically dominated global trade in LNG, with China recently displacing Japan as the biggest buyer. Along with South Korea, India and Taiwan five Asian buyers were over 60% of global LNG volume last year. In the future we shall see European buyers figure more prominently.

This is already creating competition between the two regions. Germany and other European countries regard their desperate need for natural gas imports as a temporary diversion on their energy transition to an economy dominated by renewables. Consequently, they sometimes balk at signing the twenty year contracts that LNG exporters require to justify the enormous capital investment required. Asian buyers are more pragmatic, which has led to them signing a series of agreements with US shippers.

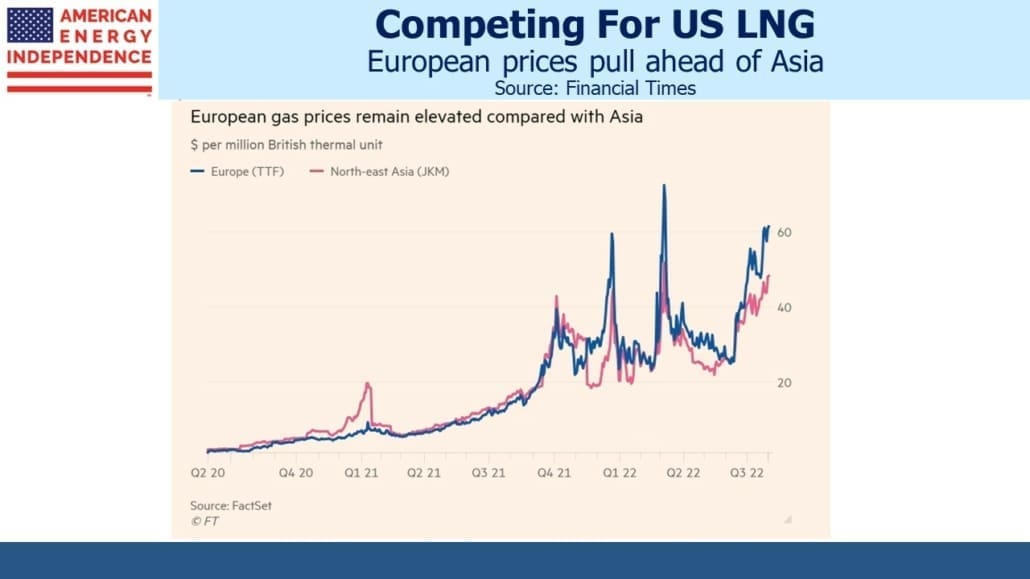

This tension is visible in the LNG market, where a spread is opening up between the European TTF benchmark and the Asian JKM. Ensuring adequate supplies before the northern hemisphere winter is driving global competition. We think this increased demand will endure, which will result in more commitments to buy US LNG and therefore more projects achieving a Final Investment Decision (FID) to go forward.

Energy Transfer, probably the individual stock most widely held by financial advisors who own our funds, raised 2022 EBITDA guidance from $12BN to $12.7BN (midpoint). They expect their Lake Charles LNG facility to reach FID later this year.

Williams Companies (WMB) increased their 2022 EBITDA guidance for the second time this year, now $6.25BN vs $5.8BN originally (midpoint). They expect to end the year with Debt:EBITDA of 3.6X. CEO Alan Armstrong noted that their $1.70 dividend (yield 5.3%) is covered 2.29X.

Enterprise Products Partners (EPD) beat sell-side expectations by almost 7%. The stock yields 7.3%, reflecting the MLP yield premium the market imposes to handle K1s.

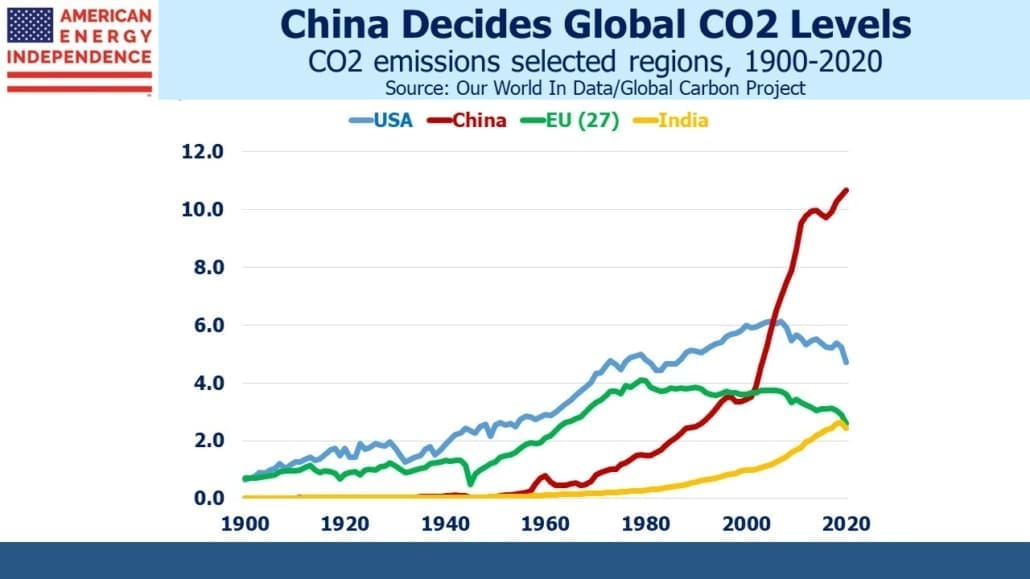

The Inflation Reduction Act of 2022 now looks likely to pass. Private equity managers once again retained their indefensible carried interest tax treatment, the price Senator Kyrsten Sinema oddly insisted on to secure her vote. Independent analysis is confirming that it should reduce US CO2 emissions by 40% below 2005 levels by 2030, a significant accomplishment but so far China remains uninspired to follow our lead.

Part of the expected reduction in US emissions in the proposed legislation will rely on 45Q tax credits as high as $85 per tonne for Carbon Capture and Sequestration (CCS). Several companies commented that this was a positive development.

EPD’s Randy Fowler said, “…we believe the proposed changes to the 45Q credits could be a game changer for post combustion emitting customers.” ET’s co-CEO Mackie McCrea said, “…the new credits in this new bill would provide for a significantly higher rates of return with that tax credit going from up to the $85.”

WMB’s Chad Zamarin head of strategic corporate development said, “the 45Q credits would be very supportive of our CCUS project in the Haynesville.”

The pipeline sector was strong in July, coming close to recouping the losses of June. Recession concerns appear to be waning. Based on Friday’s unemployment report, the economy continues to expand at a rapid pace, with the unemployment rate falling to 3.5%. The Fed’s refusal to sell the mortgage backed securities they acquired during Quantitative Easing is making it difficult to slow the economy. Ten year treasury yields of 2.8% are stimulative. Bond yields are more important to capital investment and real estate than short term rates. A 3.5% neutral Fed Funds rate, the FOMC’s initial target, is unlikely to push treasury yields up much. Absent a shift to more rapid balance sheet contraction by the Fed, the economy looks robust.

With strength in pipeline sector earnings and improving growth prospects for natural gas, it’s hard to think of a more attractive sector for the long term investor.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Here is a quote from the lead editorial on page A14 of this weekend’s WSJ: “Ms. Sinema ……moderated the damage of the 15% minimum tax on book earnings by allowing for accelerated depreciation of business investment.” That is more significant to me and to you than her support of the carried interest.