Is Biden Bullish For Pipelines?

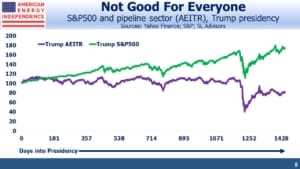

The Trump presidency was unequivocally good for investors. The S&P500 returned 14.9% p.a. during his four-year term. There will be strong opinions on either side, and we’ll leave that debate for others. But it’s fair to say that this beat the expectations held by many when he was elected.

Energy executives cheered the loudest when Trump won in 2016. This is an industry where Republican views dominate. Few energy investors were expecting such a miserable subsequent four years. Even before Covid decimated crude oil demand, the American Energy Independence Index (AEITR) had returned 3% p.a., versus 16% for the S&P50 through 2019. On the day voters elected Biden, the numbers for Trump’s term were –4.9% and +14.9% respectively.

Trump’s policies were energy-friendly – he eased regulations, pulled out of the Paris climate agreement and promoted American “energy dominance”. The problem was energy executives. They over-invested, over-produced and, in the case of some pipeline companies, overbuilt. The lesson for energy investors is that when management teams get what they want, look out!

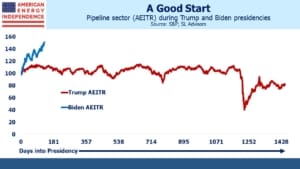

It’s still early to assess the Biden impact on pipelines, but the signs are encouraging. Democrats are naturally anti-fossil fuels, but the ones in power recognize that keeping the lights on is important to staying in office. The energy transition is a long one. We’re not yet fully reliant on intermittent solar and windmills and should hope we never are. Democrat policies are oriented towards constraining the supply of what they dislike, not demand.

This is turning out to be investor-friendly. Every energy company has a few ESG slides in their presentation. They all discuss the energy transition. Some are even investing in solar and wind, although wouldn’t unless the IRR on such investments was supplemented by the benefits of a greener image. On their recent earnings call, Energy Transfer (ET) co-CEO Mackie McCrea revealed that, “… we’re struggling with wind quite honestly, it’s hard for us to figure out how to make that work. And we’re not going to do anything that doesn’t make good economic sense for unitholders.” He then added, “I don’t know if we’ll ever get involved as far as investing in a solar project because the returns are …so much less than what we can achieve with other opportunities we have.”

Financial discipline is acting as a constraint against boldly leaping into renewables. At the same time, traditional pipeline projects on a large scale are becoming too risky to contemplate. When Biden canceled the Keystone XL, he reversed a prior executive order approving it and gave scant attention to our ally Canada’s need to find export routes for its crude. TC Energy (TRP) had already brought in the province of Alberta as a partner in case a Democrat president canceled the project. Alberta’s CS1.5BN investment is likely to be lost.

Kinder Morgan (KMI) similarly offloaded the Trans Mountain Pipeline project to the Canadian federal government in 2018 when they tired of navigating Alberta and British Columbia’s conflicting views on its completion (see Canada’s Failing Energy Strategy). Enbridge’s Line 3 Replacement is also at risk from U.S. government opposition, although most expect it to be completed.

Pipeline construction risk has become almost unquantifiable, because Democrat leaders are willing to over-turn previous approvals. Court challenges from environmental extremists can add substantial delays. Renewables projects advance PR objectives, but low IRRs limit their scope. The result is pipeline companies’ assessment of new investments reflect economic and political realites. Democrats have achieved something that long eluded investors, which is to limit growth capex. Smaller projects are still being done. The Energy Information Administration (EIA) yesterday noted new gas pipelines with 4.4 billion cubic feet per day of capacity entered service between November and January.

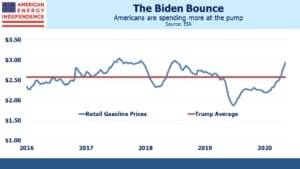

Reduced capex among upstream companies is constraining oil and gas supply, which is contributing to rising prices. Although pipeline companies have limited direct economic exposure to commodity prices, they reflect sentiment and overall economic activity. High energy prices are good for energy investors.

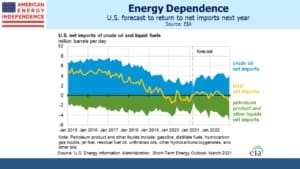

Gasoline prices are well above the $2.57 per gallon average of the Trump presidency and are on the verge of exceeding the range of his four-year term. Since the Administration felt compelled to provide a $1.9TN fiscal boost to the economy, it’s likely that gasoline prices are headed higher. The EIA expects domestic oil production to recover slowly, and for the U.S. to revert to being a net importer of crude next year.

The pandemic dominated energy prices last year and has permanently impacted production. Maybe U.S. output would be on the same modest growth path if Trump had won re-election.

Nonetheless, Democrat policies are oriented towards less spending and higher energy prices, both very pro-investor policies. With the emphasis on impacting supply not demand (i.e. no carbon tax), these trends are likely to continue. They’re consistent with efforts to combat climate change. They’re also good for the energy sector. The Biden administration has become an unwitting friend of pipeline investors.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

We have three funds that seek to profit from this environment: