Insider Sellers Get Suckered

/

Insider trading hasn’t been eliminated, in spite of the SEC’s efforts. In March Terren S Peizer, CEO of Ontrak Inc, was indicted for selling stock in his company when he knew they were losing a key client. He did the trades using Rule 10b5-1 which governs when senior executives can dispose of shares.

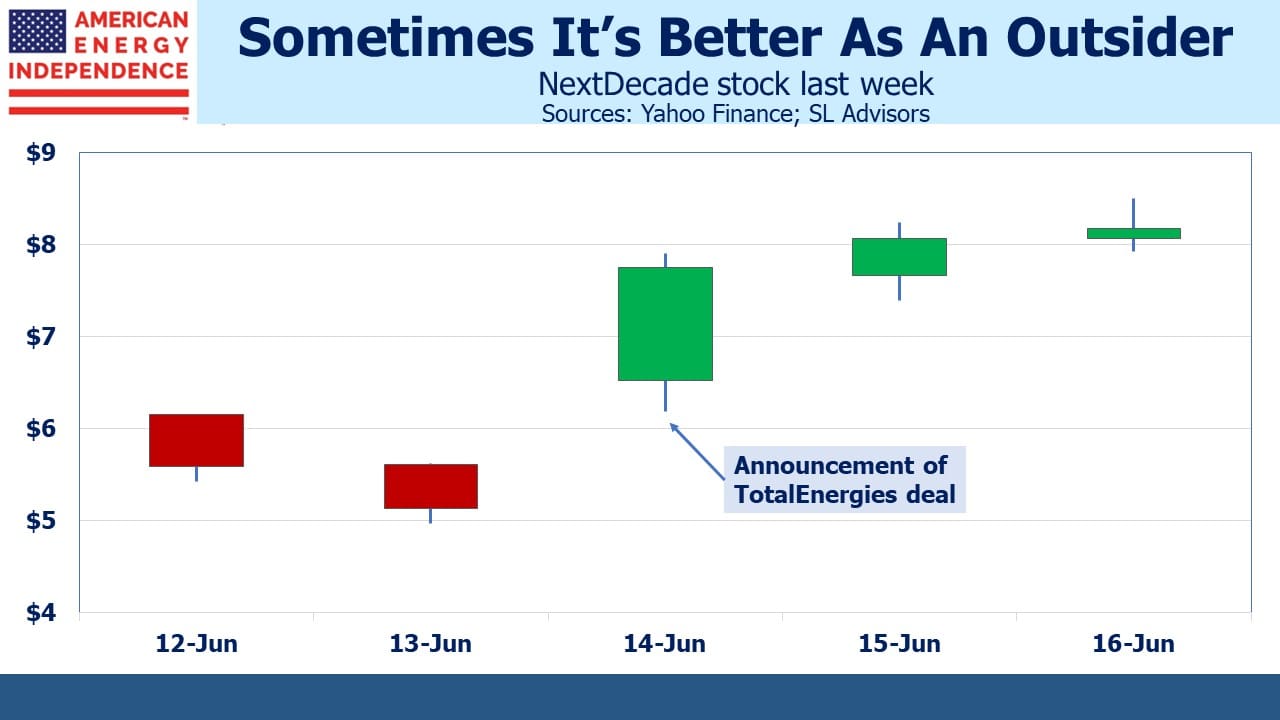

Last week provided circumstantial evidence that insiders were selling NextDecade (NEXT). On Monday and Tuesday NEXT dropped $1, from $6.14 to $5.13, on higher than average volume. There was no news out to justify the drop. The company had most recently reaffirmed its intention to reach Final Investment Decision (FID) on its proposed Rio Grande LNG export facility (see Situations We’re Following). We weren’t aware of any revised ratings from analysts on NEXT. The drop was puzzling.

On Wednesday morning NEXT announced the issuance of the first of three tranches of equity to France’s TotalEnergies, on terms that the company estimates will result in the French energy giant owning 17.5% of NEXT at $4.86 per share.

It seems likely the issuance of NEXT shares at $4.86 was known to some unscrupulous traders. That’s the only plausible explanation for the stock’s precipitous drop in the days prior. Past direct sales of shares by NEXT have similarly been preceded by selling that turned out to be profitable once the announcement was made.

But this time it came with news of a large LNG offtake agreement, also with TotalEnergies. It means capacity for the first three trains is almost completely sold out, making FID highly likely.

This news caught many people by surprise – presumably including the recent aggressive sellers. NEXT stock soared 50% on almost 38 million shares, around 50X its typical volume. There was follow through buying on Thursday, which brought the stock to 62% above its Tuesday afternoon low.

Insider trading is alive and well. NEXT has a problem in maintaining confidentiality around its capital markets activities. Fortunately, this time those seeking free money were relieved of some of theirs.

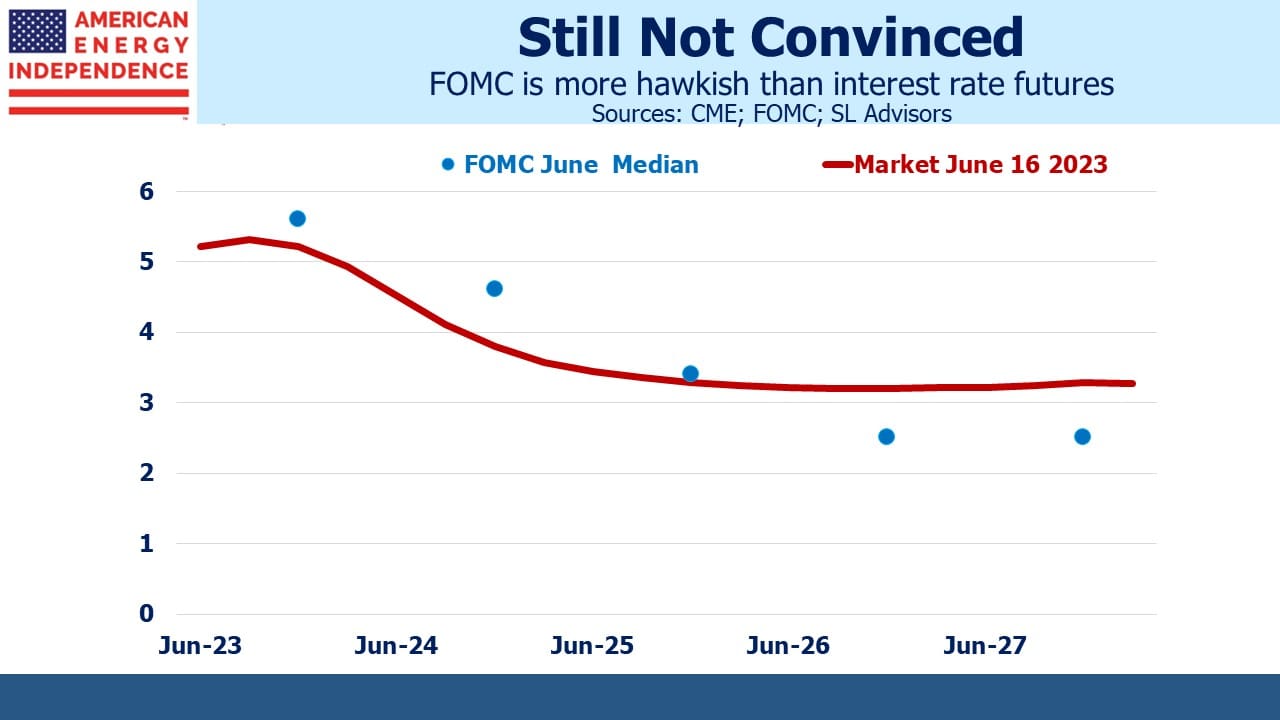

Fed chair Jay Powell maintained the Fed’s posture as more hawkish than the market. He suggested that rates may not come down for a couple of years. Interest rate futures adjusted towards this view but traders are still far from convinced.

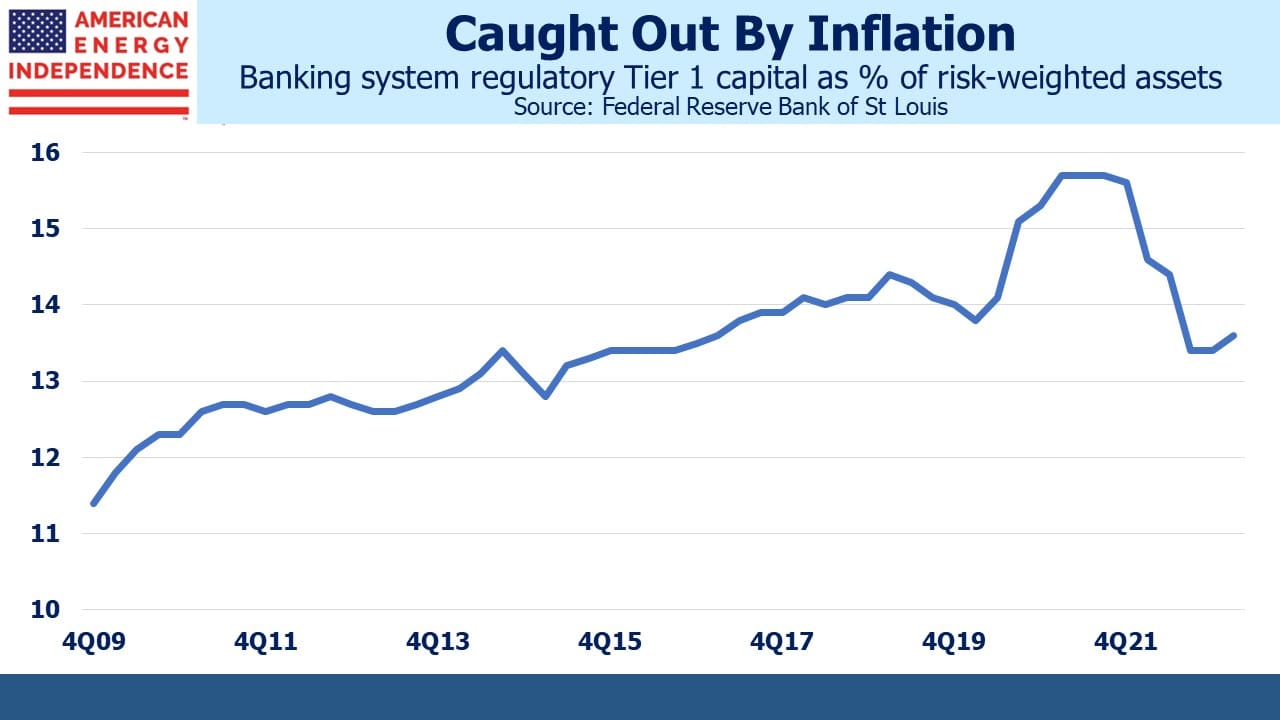

It was bad news for banks, many of which loaded up on low yielding securities and loans during QE and now face competition from 5%+ yielding treasury bills to retain their deposits. Tier One capital has sunk since the Fed began tightening last year, although it recovered slightly last quarter.

Federal Reserve Governor Christopher Waller feels no responsibility for the squeeze on net interest margins. “I do not support altering the stance of monetary policy over worries of ineffectual management at a few banks,” Waller said in a recent interview.

Too many bank CEOs have demonstrated weak risk management. Bailing them out is not the Fed’s job – but as their regulator they should face some tough questions on how monetary policy caught out the industry they are apparently overseeing. If the market is correct in forecasting lower rates next year, it’ll be because the squeeze on net interest margins has impeded credit creation. The 1.5% spread between one year treasury bills and ten year notes renders long term fixed rate exposure unattractive.

The energy transition is providing opportunities for behavior at both ends of the evolutionary spectrum. Sweden’s overly liberal penal code is insufficient to dissuade two morons from defacing a Monet to promote their dystopian vision. Along with their other sad export, Greta, Sweden is developing an unfortunate reputation for producing spoiled, poorly informed young people. If the Swedes can’t discourage such damage to art, perhaps they should send it to another country where it’ll be safe.

More constructive was Williams Companies CEO Alan Armstrong reminding us that increased deployment of intermittent solar and wind will increase the need for natural gas, to provide the reliability that weather-dependent power does not. Williams correctly noted that, “Nobody’s ever going to be comfortable saying: ‘Oh, we’re willing to risk that for five days, we don’t have wind or solar and we’re not going to have a back-up’.”

Our view aligns with Armstrong’s, which is why we believe natural gas and its related infrastructure continue to benefit from increased demand globally. Last week’s sharp move higher in NEXT as their planned LNG export facility moves closer to FID was an example. We expect an announcement from the company by the end of the month, which should include more detail on the mix of financing they intend to pursue. US natural gas is taking another step towards supplying our friends and allies around the world.

We have three funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Many thanks for your positive guidance on NEXT several months ago. Ray