Insider Sellers Get Suckered

Insider trading hasn’t been eliminated, in spite of the SEC’s efforts. In March Terren S Peizer, CEO of Ontrak Inc, was indicted for selling stock in his company when he knew they were losing a key client. He did the trades using Rule 10b5-1 which governs when senior executives can dispose of shares.

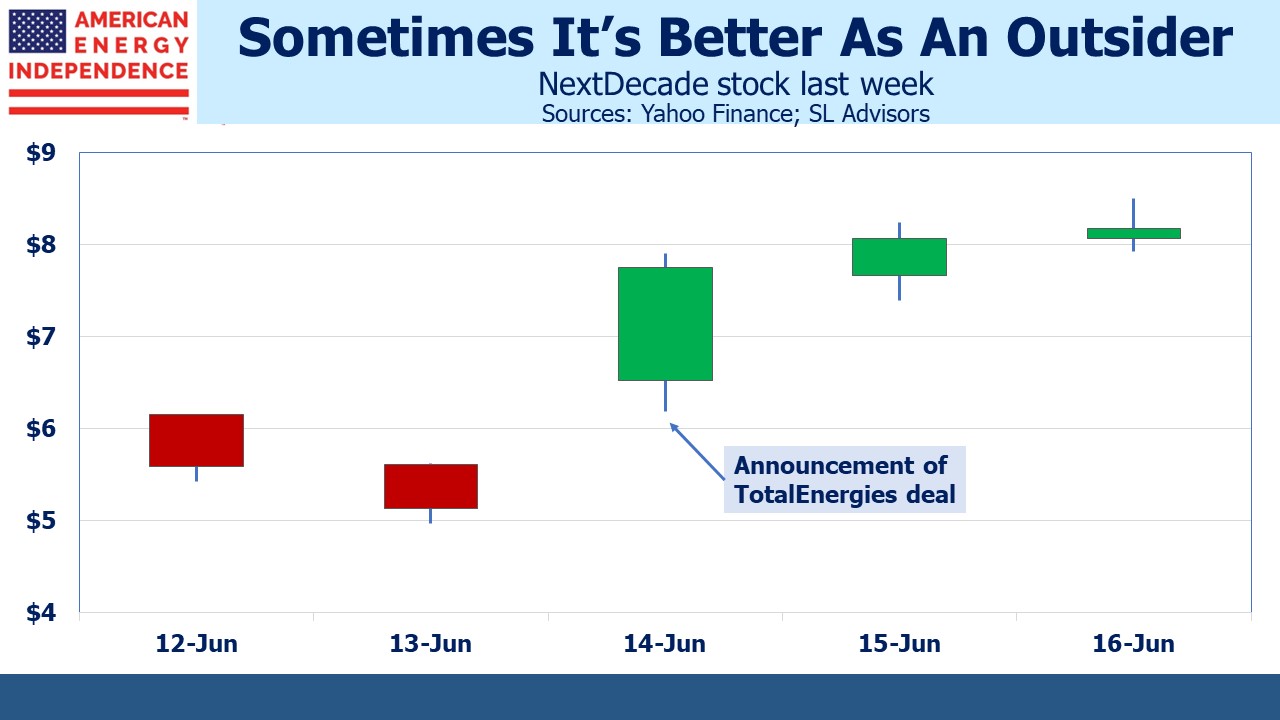

Last week provided circumstantial evidence that insiders were selling NextDecade (NEXT). On Monday and Tuesday NEXT dropped $1, from $6.14 to $5.13, on higher than average volume. There was no news out to justify the drop. The company had most recently reaffirmed its intention to reach Final Investment Decision (FID) on its proposed Rio Grande LNG export facility (see Situations We’re Following). We weren’t aware of any revised ratings from analysts on NEXT. The drop was puzzling.

On Wednesday morning NEXT announced the issuance of the first of three tranches of equity to France’s TotalEnergies, on terms that the company estimates will result in the French energy giant owning 17.5% of NEXT at $4.86 per share.

It seems likely the issuance of NEXT shares at $4.86 was known to some unscrupulous traders. That’s the only plausible explanation for the stock’s precipitous drop in the days prior. Past direct sales of shares by NEXT have similarly been preceded by selling that turned out to be profitable once the announcement was made.

But this time it came with news of a large LNG offtake agreement, also with TotalEnergies. It means capacity for the first three trains is almost completely sold out, making FID highly likely.

This news caught many people by surprise – presumably including the recent aggressive sellers. NEXT stock soared 50% on almost 38 million shares, around 50X its typical volume. There was follow through buying on Thursday, which brought the stock to 62% above its Tuesday afternoon low.

Insider trading is alive and well. NEXT has a problem in maintaining confidentiality around its capital markets activities. Fortunately, this time those seeking free money were relieved of some of theirs.

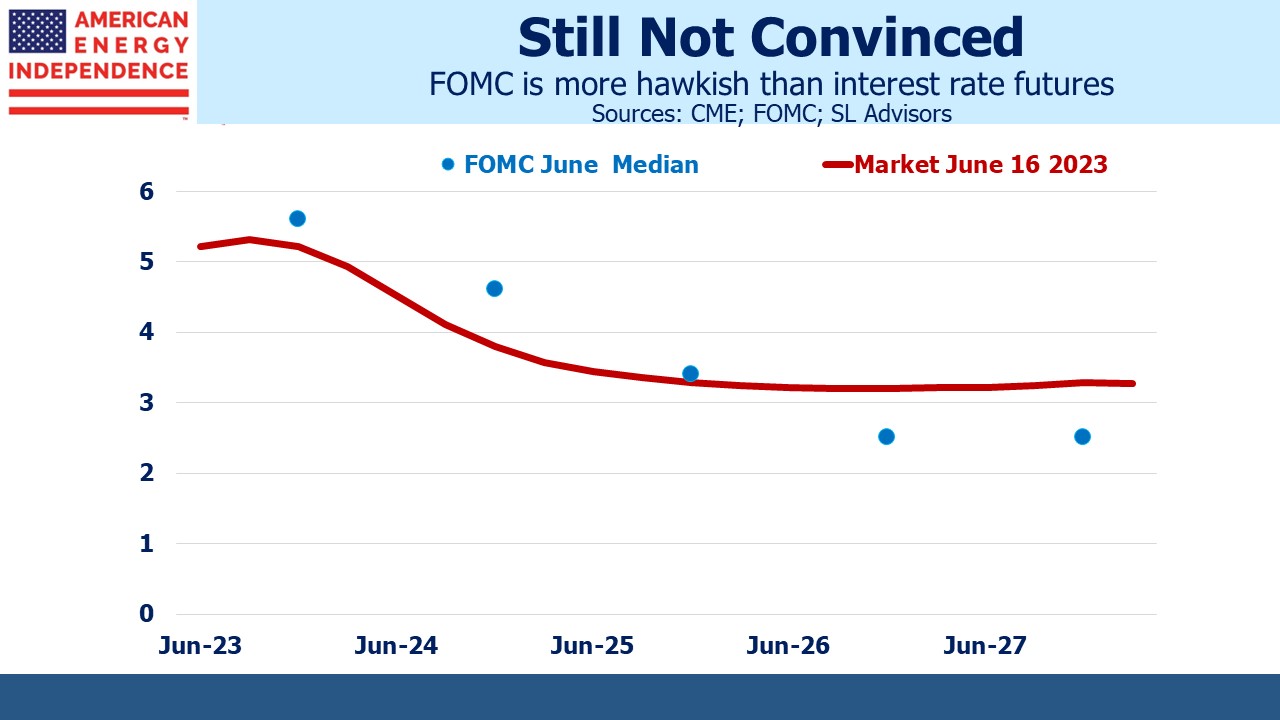

Fed chair Jay Powell maintained the Fed’s posture as more hawkish than the market. He suggested that rates may not come down for a couple of years. Interest rate futures adjusted towards this view but traders are still far from convinced.

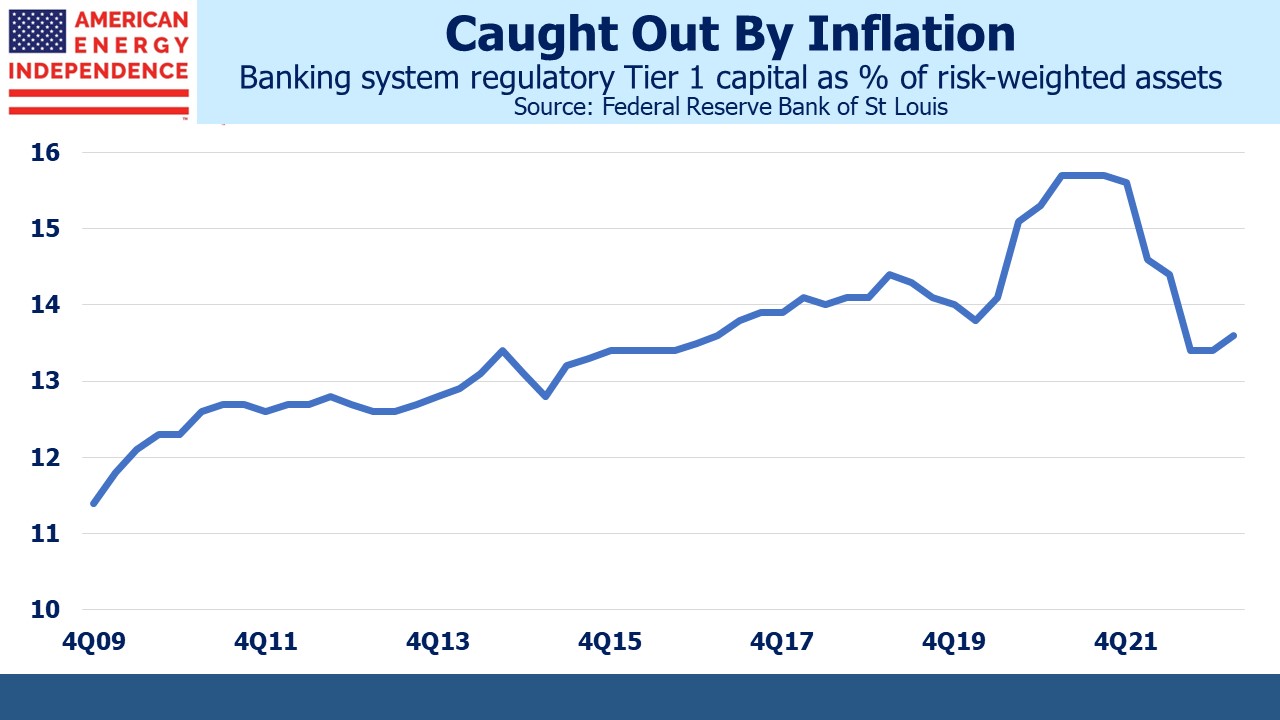

It was bad news for banks, many of which loaded up on low yielding securities and loans during QE and now face competition from 5%+ yielding treasury bills to retain their deposits. Tier One capital has sunk since the Fed began tightening last year, although it recovered slightly last quarter.

Federal Reserve Governor Christopher Waller feels no responsibility for the squeeze on net interest margins. “I do not support altering the stance of monetary policy over worries of ineffectual management at a few banks,” Waller said in a recent interview.

Too many bank CEOs have demonstrated weak risk management. Bailing them out is not the Fed’s job – but as their regulator they should face some tough questions on how monetary policy caught out the industry they are apparently overseeing. If the market is correct in forecasting lower rates next year, it’ll be because the squeeze on net interest margins has impeded credit creation. The 1.5% spread between one year treasury bills and ten year notes renders long term fixed rate exposure unattractive.

The energy transition is providing opportunities for behavior at both ends of the evolutionary spectrum. Sweden’s overly liberal penal code is insufficient to dissuade two morons from defacing a Monet to promote their dystopian vision. Along with their other sad export, Greta, Sweden is developing an unfortunate reputation for producing spoiled, poorly informed young people. If the Swedes can’t discourage such damage to art, perhaps they should send it to another country where it’ll be safe.

More constructive was Williams Companies CEO Alan Armstrong reminding us that increased deployment of intermittent solar and wind will increase the need for natural gas, to provide the reliability that weather-dependent power does not. Williams correctly noted that, “Nobody’s ever going to be comfortable saying: ‘Oh, we’re willing to risk that for five days, we don’t have wind or solar and we’re not going to have a back-up’.”

Our view aligns with Armstrong’s, which is why we believe natural gas and its related infrastructure continue to benefit from increased demand globally. Last week’s sharp move higher in NEXT as their planned LNG export facility moves closer to FID was an example. We expect an announcement from the company by the end of the month, which should include more detail on the mix of financing they intend to pursue. US natural gas is taking another step towards supplying our friends and allies around the world.

We have three funds that seek to profit from this environment: