Inflation Concerns Remain

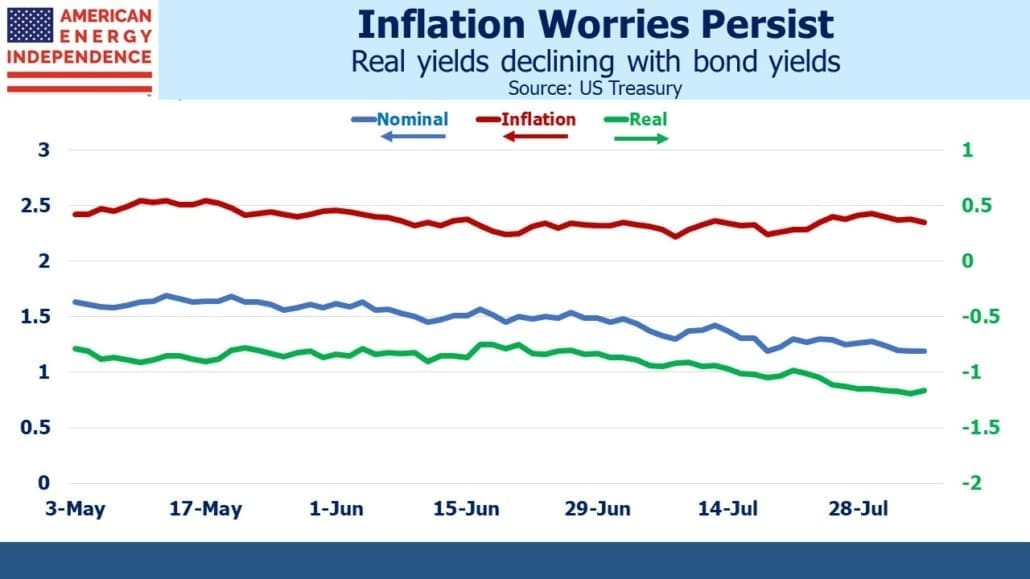

The fall in treasury yields can be misinterpreted as implying that inflation expectations are moderating. Although ten-year treasury yields have dropped 0.40% over the past three months, almost all of that has been through lower TIPs yields. Inflation expectations (nominal yields minus TIPs) have hardly budged.

Given the Fed’s outsized role in the bond market, it’s hard to discern market expectations absent their activity. They’re buying 54% of all net supply this year, and as we noted a couple of weeks ago (see Behind The Fed’s Benign Inflation Outlook) they bought 85% of net new supply in July. Over the next couple of months, reduced maturities and increased issuance combined with the Fed’s regular $80BN in monthly purchases will draw on increased purchases by others to balance the market.

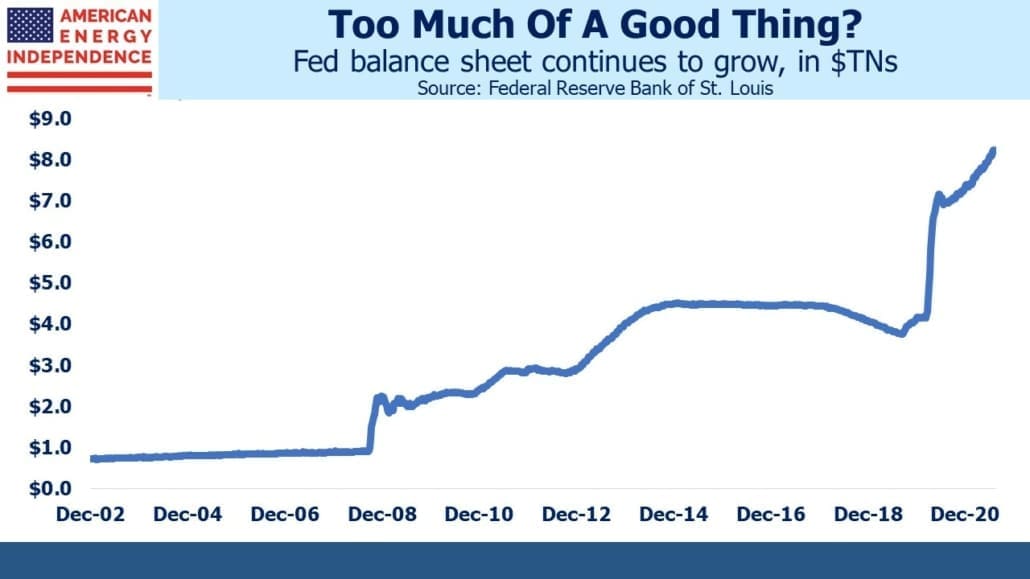

Friday’s payroll report kept us on the interminable path towards tapering and an eventual cessation of Fed debt monetization. Former NY Fed president Bill Dudley was interviewed on Bloomberg and noted that restoring the Fed’s $8TN balance sheet to more normal levels will take many years.

Prior to 2008, quantitative easing via Fed buying of bonds was an unknown tool. Former Fed chair Ben Bernanke unlocked it to good effect, but the Fed’s balance sheet continued to grow for several years after the 2008-09 financial crisis. It took almost a decade for assets to start rolling off meaningfully. Covid hit within a year, and the Fed’s assets soon doubled.

It is a partial monetization of our debt, no matter how Fed chair Powell may describe it otherwise. Society’s tolerance for this is one more proof that inflation has few opponents nowadays. Monetary policy aims, “to achieve inflation moderately above 2 percent for some time” according to the FOMC’s most recent statement, and the bond buying will continue until, “substantial further progress has been made toward its maximum employment and price stability goals.”

While the Fed aims to boost inflation, fiscal policy is striving for the same. The $1TN infrastructure plan working its way through Congress will add $256BN to the deficit according to the non-partisan Congressional Budget Office, even though negotiators claimed that it would be revenue neutral.

Expect very little outcry over this, since low bond yields reflect the inconsequential cost. With fiscal hawks long gone, excessive deficit spending will continue until it causes inflation. The stock market’s brief pullback in mid-July was arrested in part because of the “Biden put” — a severe drop in economic activity would draw another multi-$TN fiscal stimulus.

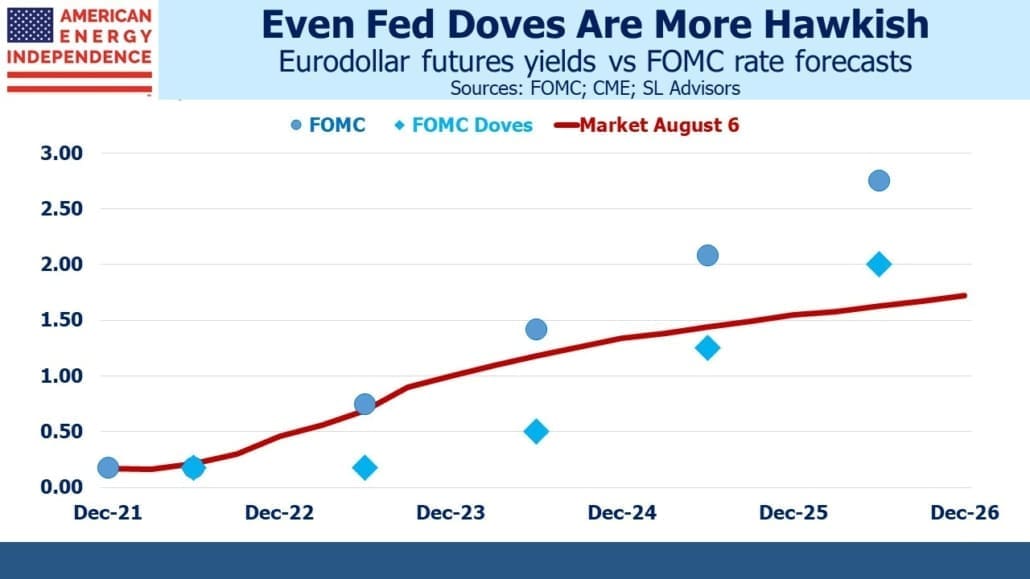

Although bond yields have remained near their recent lows, eurodollar futures yields rose during the week as the odds of a tightening in short term rates by the end of next year increased.

The yield curve nonetheless remains too flat. Median FOMC projections of short-term rates as well as the most dovish forecasts both suggest a sharper rate of increase from 2023 on. The FOMC’s forecasting record is abjectly poor. But this Fed is unashamedly dovish, so FOMC forecasts that are more aggressive than the market continue to look like an opportunity to bet with the FOMC by positioning for a steeper yield curve in eurodollars 2023-25, or that the 0.55% spread between two and five year treasuries is too narrow.

In other news, the Economist magazine recently ran a piece called A 3°C world has no safe place. It presented a sober contrast between the (mostly unmet) pledges of countries to reduce CO2 emissions and the scientific modeling that predicts the consequences. Rich countries committed $100BN per year to help developing countries adapt, although even this sum has not been delivered. Even though such promised transfer payments get virtually no coverage in US media, political leaders in countries like South Africa can be found on TV telling viewers that much larger sums are needed to pay for the energy transition.

As we noted in a recent podcast (Episode 79: The Bill For The Energy Transition), South Africa believes $750BN per year is needed from OECD to emerging economies, which would work out to $250BN from the US if apportioned among rich countries based on relative GDP. This is almost 4X what we spend on Medicare and Health, or over 40% of our defense budget. It’s as well that such discussion doesn’t make it to the US, because it would at a minimum cast a pall over the Adminstration’s excited talk about green growth opportunities.

One of the most striking features of the Economist article was how slowly the climate changes. Models, which have a checkered past of making climate predictions although presumably are better today than ever, forecast dire consequences by 2100. None of the people likely to be impacted by this can read the article, while the people who must make sacrifices in the meantime to reduce emissions will have mostly died by then.

It’s why developing countries like China and India are more concerned about increased energy use to raise living standards now, and don’t share the concern of OECD countries about global warming.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!