Is China Worried About Global Warming?

The UN’s Intergovernmental Panel on Climate Change (IPCC) released their latest report on Monday, in preparation for COP26, the November meeting of heads of government in Glasgow to discuss how we should respond.

The report says humans have warmed the planet by 1° C since pre-industrial times, the agreed-upon benchmark. A further 0.5°C is likely on current trends within the next two decades. The New York Times, rarely short of hyperbole, misleadingly wrote, “Even if nations started sharply cutting emissions today, total global warming is likely to rise around 1.5 degrees Celsius within the next two decades, a hotter future that is now essentially locked in.” This sounds like an additional 1.5° over the next 20 years, unless you’ve read the IPCC Summary for Policymakers.

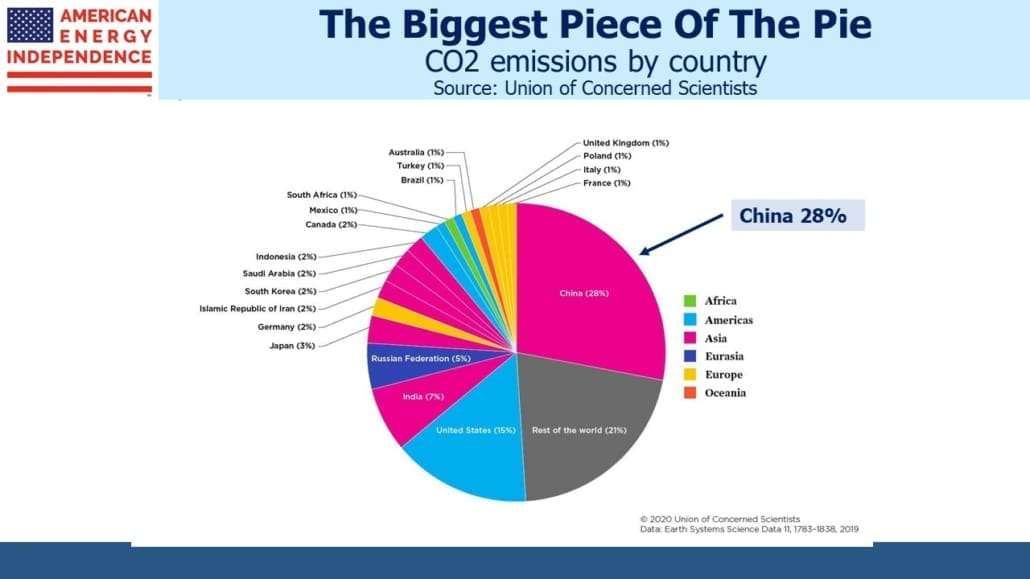

Putting aside biased news coverage, the most important question is what does China think? The IPCC’s summary presents a sober case that the world needs to begin dramatically cutting CO2 emissions from fossil fuel use with a view to reaching carbon neutrality by 2050. Only then can we be assured that the remaining capacity of the atmosphere to absorb additional CO2 will not be exhausted, with irreversible consequences.

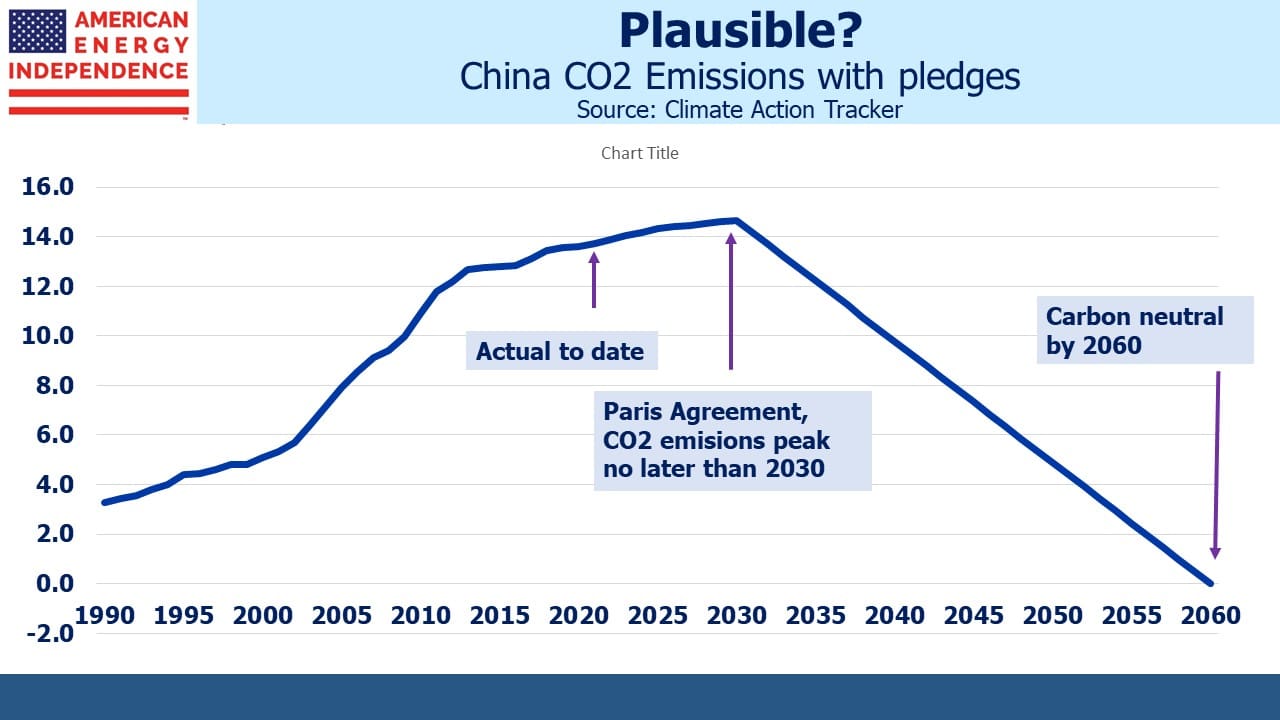

As with most things, actions count for more than words. Even though we’re supposed to cut emissions now, China plans to keep increasing them until 2030. At that point, an improbable pledge to be carbon neutral within three decades is supposed to usher in a sharp decline. While China could perhaps do this, there’s good reason to doubt they will.

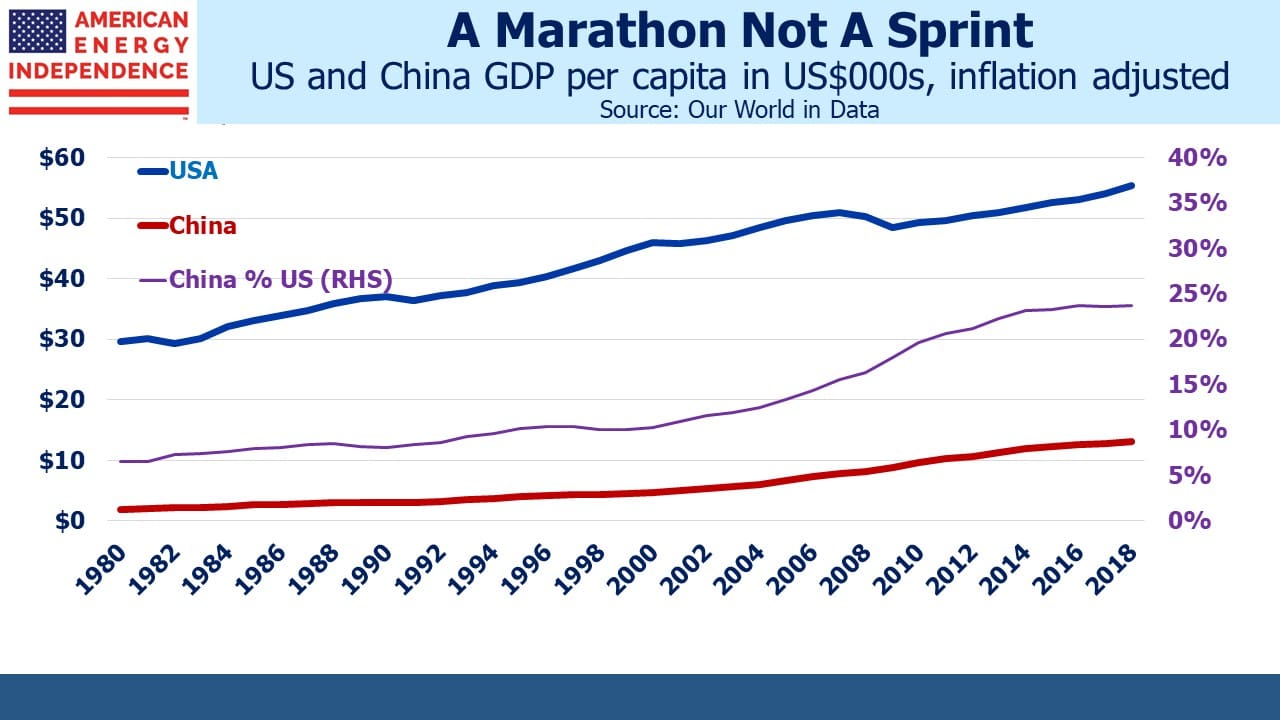

How must Chinese policymakers regard their choices? Real per capita GDP has grown at 5% pa since 1980, three times the US rate. It wouldn’t have happened without higher energy use. Yet even now, China is at less than 24% of the US level. The looming energy transition is hugely expensive and negative for growth.

Improving living standards beats climate in China. They likely deem the increased incidence of heatwaves and extreme weather as inconsequential. Although much of the western media appears almost suicidal over the planet’s future, everyday life for the typical Chinese citizen (or US for that matter) isn’t visibly impacted by the 1°C warming we have engineered so far.

While the science of human-caused warming is generally beyond question, predicting the consequences is far harder. The UN has an unfortunate track record of offering dire predictions that miss, although the science is presumably now better than ever. Chinese citizens, if they think about it, may even conclude that the current climate isn’t necessarily the best we could have.

Like many people, I spend far more time and money coping with excessive cold rather than heat. I head to Florida as soon as the daytime high in New Jersey drops below a golf-impeding 50°F. Cold weather is miserable. If human-induced Global Cooling threatened, I’d find that far more distressing — it might get me to join the Sierra Club. But a slightly warmer planet, like a slightly warmer day, doesn’t sound so bad. The Chinese probably feel the same way.

Despite the absence of any meaningful weather impact, as a matter of risk management, it seems sensible to take the science seriously. As an investor, it’s important to assess the likely outcomes.

Emerging economies are where energy use, emissions and living standards are growing fastest. Regardless of its pronouncements, China shows every sign of valuing continued growth of living standards over reduced energy use to lower CO2 emissions. Non-OECD countries emit around two thirds of global CO2, and this is growing at eight times the pace of rich countries. China and India count for 35% of the total. Although both countries regularly highlight renewable energy, they’re using more of everything, including coal. Their energy needs continue to rise.

Moreover, emerging economies want money from rich countries to finance green energy investments. $100BN per year was pledged but not delivered last year. Some are asking for far more (listen to our recent podcast, Episode 79: The Bill For The Energy Transition to hear South Africa’s Environment Minister telling citizens substantial foreign aid is needed). This receives no attention in the US media but certainly does in supplicant countries. The Biden Adminstration recognizes that US political support for the energy transition doesn’t mean voters are willing to pay for it.

High crude oil prices are a necessary step in inducing drivers to switch to electrric vehicles, but the White House continues to urge increased production from OPEC. National Security Advisor Jake Sullivan called for, “Americans to have access to affordable and reliable energy, including at the pump.” It remains the case that there are votes in appearing to push for the energy transition but fewer in executing, which is why Democrats continue to be good for the sector.

The inevitable conclusion is that climate change is occurring too slowly and with too limited impact to cause the dramatic behavioral changes called for by the IPCC. Western countries are moving aggressively to confront it, but the most likely outcome is that we’ll be stuck with the negative consequences of ever more solar panels and windmills without seeing any discernible impact on global CO2 emissions. Even though the IPCC report warns that populations in poorer countries are most vulnerable to heatwaves and rising sea levels, their energy consumption shows they deem increasing living standards to be more important.

We’re going to adapt to a modestly warmer planet, while at the same time pursuing policies that reduce CO2 emissions. Coal to natural gas switching remains a big global opportunity, and US LNG export growth remains a bright spot for the domestic energy business. But the conflicting goals of raising living standards versus lowering emissions will continue to dominate the outcome.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Great comments.

” They likely deem the increased incidence of heatwaves and extreme weather as inconsequential.”

In the real world, if one were to look at data and not confine one’s look to only very recent history to suit the narrative, extreme weather and heatwaves have not increased.

In terms of better science on climate, again, it doesn’t appear that much has been accomplished over the past few years. This is not surprising since our climate system is incredibly complex. It will take a very long time to make progress. The system is so complex that the models, if run backwards, cannot match up with historical climate records. Normally, any model that had that characteristic would be thrown out – but not here. Model projections don’t match up with history but they do match up with the desires of policymakers. You can predict where we are headed…