The Fed, Thinking Fast Or Slow

Interest rate markets became a lot more interesting this year. Uncertainty around inflation and the Fed’s likely response are creating undulations in the yield curve whose precise forecasts are sometimes a trading opportunity.

For example, late last year the spread between the December ‘21 and December ‘22 eurodollar futures contracts was around 5bps. Since the Fed typically moves its policy rate in 25bp increments, this projected a one in five probability of one tightening in 2022. This turned out to be too low. A rebounding economy combined with profligate fiscal stimulus has led to upward revisions to growth and inflation this year.

The FOMC’s Summary of Economic Projections (SEP) showed that FOMC members had brought forward their estimated timing of higher rates. By early June the spread was at 20, showing an 80% of a 2022 year-end tightening. Six months ago, taking the one in five odds by buying the spread (long December ‘21 and short December ‘22) was a good bet.

A week ago, following the June FOMC meeting, St. Louis Fed president James Bullard revealed that he is forecasting a 2022 tightening. He is one of seven (out of 18) FOMC members with that view, two of whom expect two tightenings. So we know where Bullard’s blue dot sits. Our eurodollar spread moved further, and now sits around 34 where it is priced for at least one tightening by the end of next year and around a 40% chance of a second.

Imagine sitting down with FOMC members while they tell you whether eurodollar futures are correctly priced or not. Were James Bullard to visit SL Advisors’ GHQ and enter into such a conversation, he would likely endorse the market’s pricing. Getting here was the Bullard trade. He favors a faster pace of tightening than some other FOMC members.

The slow, or dovish camp is led by Fed chair Jay Powell. 11 of the 18 FOMC members expect no tightening next year. If Powell accepts this invitation to visit SL Advisors and discuss eurodollar futures, he would say that the market is wrong. He goes to great lengths to downplay the significance of the blue dots in the SEP.

Powell regularly reminds us that the unemployment rate in February 2020 just before Covid was 3.5%, so today’s 5.8% suggests we remain far from full employment. We’re still over 7 million jobs short of where we were, and Powell wants to give those people every opportunity to return to the labor force. He expects inflation to moderate from its temporarily high level and sees little likelihood of the Fed having to hike rates next year. The market is currently skeptical of this view.

The Bullard view is currently in the ascendancy. He favors a faster path to higher rates, which by moving earlier in the economic cycle suggests less need for tightening later on. Eurodollar futures more closely reflect this outcome. Fed chair Powell may be among the majority of FOMC members, but financial markets disagree. What always makes such contrasts especially fascinating is that futures prices are telling the FOMC they disagree with their forecast. It would be bold of a bond manager to tell the Fed chair’s he’s dead wrong, but the market’s collective estimate is doing just that.

By 2023 most FOMC members expect higher rates, but there are still five who forecast no hike and two looking for just one. Powell is likely in one of these two groups – it therefore must be galling to have watched the December 2023 eurodollar futures yield climb almost 30bps from where it was prior to their meeting. At 1.15% it’s pricing in 3-4 tightenings, whereas Powell is likely expecting only one. He must think December ‘23 futures are cheap.

Powell might be right, and certainly has more influence over the outcome than most others. His term as Fed chair ends in February, but if he’s not reappointed an equally dovish replacement is likely. The bond market is no longer as powerful as when Clinton’s campaign manager Jim Carville said he’d like to be reincarnated, “…as the bond market. You can intimidate everybody.”

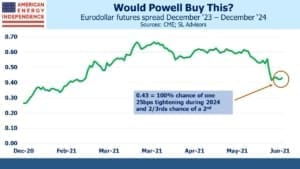

What this means is that while we’ve had the Bullard trade, the Powell trade is possible. This is where markets price in a more delayed tightening, meaning more later on. Looking farther out on the curve, the spread between the December ‘23 and December ‘24 eurodollar futures in forecasting less than two tightenings in 2024. The FOMC has a longer term, equilibrium rate of 2.5%, although eurodollar futures don’t forecast we’ll reach this level within even five years.

Markets expect the Fed to start tightening by 2023. It seems implausible that, once in motion, the Fed will move less than at least once per year. The Dec ‘23/Dec ‘24 spread has narrowed almost 25bps from its widest levels, mostly because the Dec ‘23 has moved farther from the FOMC. The Powell trade would be to buy this contract and sell Dec ‘24, betting on delayed tightening but ultimately two or more annually. At 43, it’s not yet a compelling opportunity but is worth watching in case it narrows a little more.

Eurodollar futures currently offer a rich source of information, and the occasional trading opportunity, by comparing market forecasts with those of the FOMC.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Simon with the probability of higher rates, higher taxes, tax code changes to MLPs, and intense pressure from climate change activist, why is the pipeline space an attractive space for investors ?