Fed Still Hoping For Lower Inflation

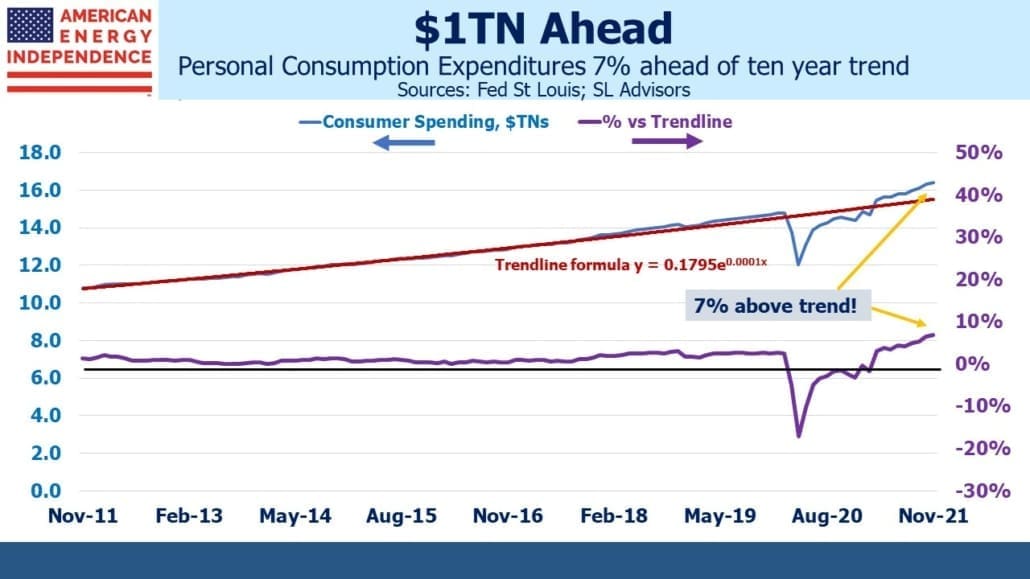

In Fed chair Jay Powell’s testimony yesterday during his renomination hearing before the Senate Banking Committee, he stuck to his familiar narrative of blaming inflation primarily on supply bottlenecks. We think excessive fiscal and monetary stimulus are more important reasons. One of the more persuasive charts is of Personal Consumption Expenditures (PCE). The Fed likes to use the PCE deflator to measure inflation, because unlike CPI its weights adjust to incorporate substitution (i.e., apples for pears if relative prices move).

Consumer spending is running well ahead of its ten year trendline – currently 7% above, equal to an extra $1TN. It’s 10% above it’s pre-Covid level. This would seem to be a more plausible explanation for inflation than supply bottlenecks. Fiscal and monetary policy are the cause. It still beggars belief that the Fed continues to buy bonds and maintain near-zero interest rates, providing ongoing stimulus that the economy no longer needs.

Senator Pat Toomey (R-PA), the ranking Republican on the Committee, asked if it was realistic to expect the Fed to succeed in curbing inflation without bringing short term rates at least up to the level of inflation itself. Prior to entering politics, Toomey traded derivatives at Merrill Lynch and in the 1980s he and I once ate dinner together in New York with several other markets people. He understands finance better than most politicians, and this was a good question.

Powell responded that they expect supply bottlenecks to ease, but that the Fed was ready to do more if required. Their slothful normalization of policy reflects a degree of hope that supply constraints will recede, and inflation fall, without them having to do much.

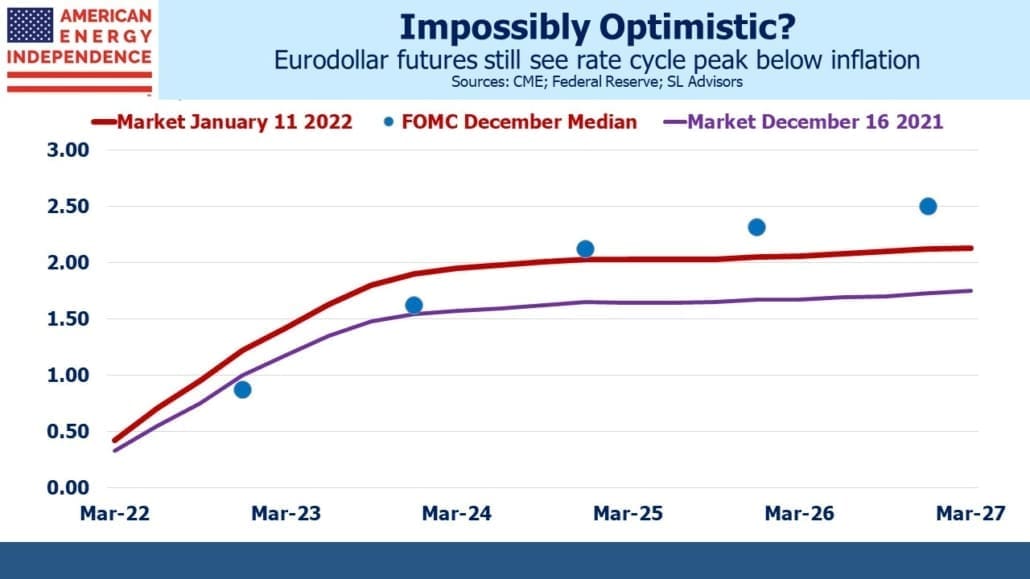

Toomey’s question was salient, because the FOMC’s projections are for the Fed Funds rate to reach 2.5% in about five years’ time, presumably long after inflation has been vanquished. The eurodollar futures market is even more optimistic, priced for short term rates to stall out at around 2% within three years. Both are consistent with the supply constraints explanation for inflation. If it turns out that the $1TN in extra spending power available to consumers is more important, a change in expectations will be warranted.

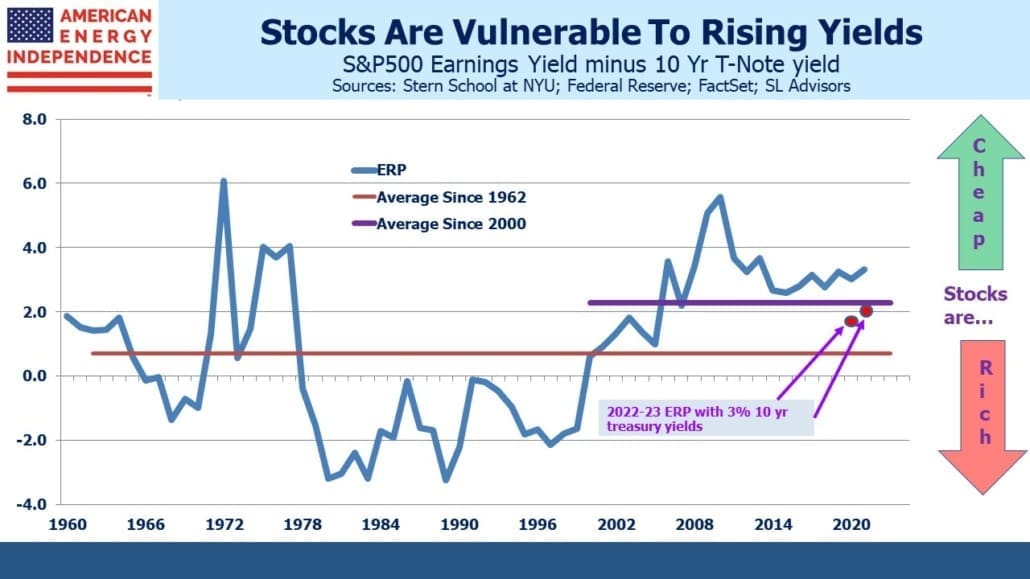

Bond yields have provided support for stocks for many years. Low long term yields continue to defy logic. Former Fed vice chair Alan Blinder was on CNBC yesterday morning, and like many observers he remains puzzled by this. Return-insensitive investors with substantial assets indiscriminately buying sovereign debt is our best guess. While it’s foolhardy to assume bond yields will rise significantly, it’s a risk worth pondering as the Fed finally starts normalizing policy.

Attention recently has focused on the Fed’s $8.8TN balance sheet. In response to a question, Powell said, “We will reduce the balance sheet sooner and faster than last time.” FOMC minutes from December fueled concern about how this might take place. The minutes noted that the balance sheet, “… was much larger, both in dollar terms and relative to nominal gross domestic product (GDP), than it was at the end of the third largescale asset purchase program in late 2014.”

If the Fed sits on its hands, $1.1TN in US treasuries will mature within the next year. More intriguing is whether the Fed concludes long term yields need to rise in order to slow inflation. They have $3.9TN with maturities longer than ten years, $2.6TN of which is Mortgage-Backed Securities (MBS). Total 2021 MBS issuance was $4.2TN, so the Fed is a big player here. Their balance sheet was growing at a $1.4TN annual rate until the recent taper announcement. If they ever decide to shrink it at the same pace, the Fed would have to start auctioning off some of its holdings.

For equity investors it’s worth considering what a 3% yield on the ten year treasury might mean. The Equity Risk Premium (ERP) would no longer show stocks to be cheap, at least compared with valuations over the past decade.

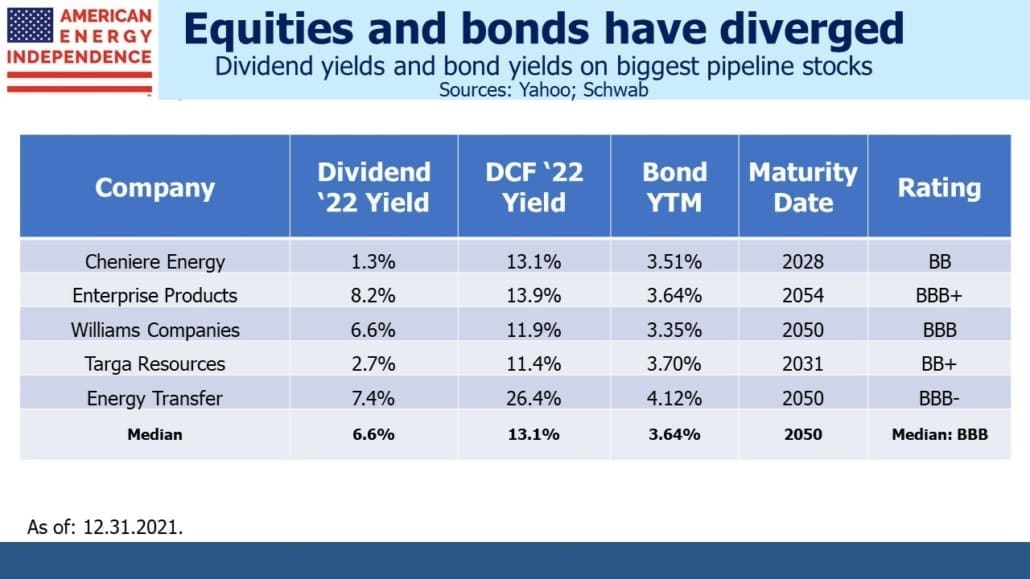

Energy continues to perform well, and yet pipeline stocks remain mispriced relative to their bonds. Several investment grade issuers offer dividend and free cash flow yields substantially higher than their long term bonds. A buyer of debt maturing in three decades by definition holds a constructive view on the equity.

Midstream infrastructure bond yields reflect equanimity if not optimism over the long term prospects for the issuers. By contrast, equity valuations continue to suggest concern about the security of payouts, overlooking the increasing prevalence of dividend hikes and stock buybacks. The apparent disconnect between equity and debt pricing remains a puzzle.

Stocks are vulnerable to a sharp jump in bond yields. However, pipeline stocks offer much better valuations as well as protection against inflation if it persists at a higher level than many expect.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!