Can An ETF Go Negative?

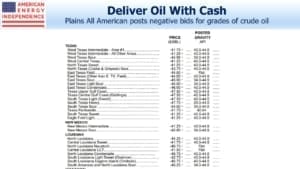

Monday was the day crude oil futures traded as low as negative $41 per barrel. As with the 1987 stock market crash, Monday’s participants will recall that date for the rest of their lives, the way I do October 19, 1987. Shortage of oil storage is the problem – nobody is going anywhere, so we’re not using much gasoline or jet fuel. Some have commented, only half-jokingly, that being paid $40 to take a barrel of oil would draw in a lot of buyers with the ability to temporarily repurpose other forms of storage.

But oil is a nasty product to handle. It is highly toxic, and leaks noxious gases such as hydrogen sulfide. If the air that you’re breathing contains as little as 0.1%, it kills you within seconds. This is why Texans aren’t filling up their swimming pools with the stuff.

The May futures contract traded 231 thousand times on Monday. One contract is equivalent to 1,000 barrels of oil. It traded from $17.85 to minus $40.32, a range of $58.17 which must be a record. A trader careless enough to be long 1,000 contracts who suffered a $10 adverse price move before dumping his position would lose $10 million. Given the volume and daily range, yesterday’s losses will be big enough to draw their own press coverage.

The United States Oil Fund, LP (USO) is an ETF that gives investors exposure to crude prices. Watching it has been the financial equivalent of a train wreck lately. Retail investors piled in last week, adding $1.6 billion of inflows. “Crude can’t stay this low” is sufficient analysis for many. Crude pricing is unlikely to correct before such adherents are wiped out.

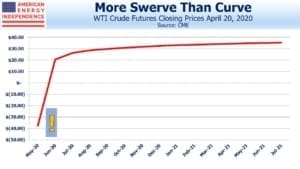

Many have concluded crude prices are wrong, but few have questioned USO’s raison d’etre. This is an ETF that buys futures contracts. Crude is in contango, meaning prices in the future are higher than today. Some interpret this as a forecast that the market must rebound, but forward prices are a poor predictor of what actual prices will be. What is clear is that the buyer of, say, July futures confronts the inevitable “rolldown” as today approaches July and actual supply/demand for crude increasingly determines the price. The rolldown is the price difference incurred as the holder of the July contract “rolls” into August by selling July and buying August at a higher price.

The bullish crude view has to constantly paddle upstream against the rolldown current. USO apparently rolled May futures into June last Friday, on terms that looked more like paddling up through spring rapids. Wiser and poorer for the experience, on Sunday they announced an improvement in their strategy. Henceforth, 20% of their futures positions will be invested in later-dated contracts, thus avoiding having to roll them all at once.

What is the point of an ETF that buys and holds futures contracts? Why don’t retail investors wishing to speculate on crude oil simply buy the futures themselves? Or an oil royalty trust? USO is a dumb way to bet on crude prices. A year ago, the July 2020 WTI futures contract was trading at $60 and yesterday was at $23, down 62%. Over that time USO has dropped from $13 to $3, down 77%. Its structure makes it hard to figure out how much it should move for a given change in crude prices. If crude can go negative, as the May futures did on Monday, can USO? Could USO go bankrupt?

Why do people bother with it? As well as being of dubious value to investors, few probably realize that they get stuck with a K-1 instead of a 1099, as USO is a partnership.

People buy USO because it’s easy to buy an ETF in a brokerage account, but more complicated to trade futures. Often it requires a separate agreement.

The reason is that the SEC regulates equities, including ETFs, while the CFTC regulates futures. USO and crude oil futures are both financial instruments – they ought to have a single regulator. The Senate Banking Committee oversees the SEC. The Senate Agriculture Committee oversees the CFTC, reflecting the original importance of agricultural futures. Brokers make valuable campaign contributions to the senators who oversee their regulator. The Finance/Real Estate/Insurance sector is the biggest source of such funding to the Senate Agriculture committee. No senator wants to give that up.

Merging the two regulatory agencies has often been suggested in the past, but is widely acknowledged to be a political non-starter. Even the passion for reform that followed the 2009 financial crisis was insufficient to overcome the economics.

USO is a result of our fractured regulatory structure, which is caused by the need for senators to raise money. USO buyers made a bad market call, but multiple overseers of financial instruments led to a poorer vehicle, which ultimately cost them even more. Yesterday USO was trading at a 27% premium to its NAV, indicating continued strong demand for this flawed ETF. It’s an instance of regulatory failure, caused by campaign contributions outweighing a more intelligent regulatory framework.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

This is a clear as day explanation of what most people won’t ever get. I trade both etfs and futures and you better know the difference. I believe that yes, an ETF based on futures can go negative. A “real” stock or equity limits your loss to what’s invested. In theory, an equity is really an option (a call) on the future earnings of a company; it can go to zero but not negative. That’s what “limited liabilty”–the basis for all corporate structures since the 17th century is all about. The other structure I don’t like are ETN’s that give exposure to commodity and other markets. They have blown up in the past, in the oil market look at UWTI, now listed in the “pink” sheets as UWTIF.

In terms of storage, EPD changed one of its Mt. Belvieu storage facilities from storing NGLs to storing gasoline and jet fuel.

Learned something today, thanks.

Many thanks for the analysis- so in conclusion can an ETF go negative or not?