Energy Does More Than Move People

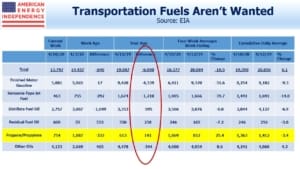

As the world’s economy has stopped moving, demand for transportation fuel has collapsed. The latest weekly report from the U.S. Energy Information Administration (EIA) presents the statistical reality in our country. Gasoline supplies are down 46% from a year ago. Kerosene (jet fuel) is down 72%. Nobody has anywhere to go.

Interestingly, propane supplies are up. Natural gas liquids are part of the hydrocarbon value chain. At one end is methane, the simplest molecule. This is the natural gas that produces electricity, heats homes and runs through your gas stove. It’s known in the industry as “dry gas”. Natural gas liquids (NGLs) are successively more complex molecules of carbon and hydrogen; these include ethane (can be burned but is mostly used as a feedstock for plastics); propane (heating and cooking where methane supply isn’t available), butane and others. The hundreds of blends of crude oil sit at the more complex end.

In today’s energy market, the farther you are from transportation fuel, the better.

Natural gas demand has held up. Power demand has risen compared to a year ago. Residential/Commercial is up because people are spending more time at home. And we’re exporting more. There is almost no evidence of coronavirus in this part of the energy market.

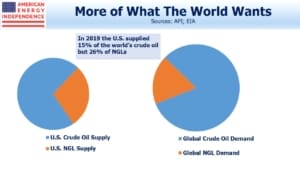

NGLs don’t receive much attention, but there are two reasons investors in midstream energy infrastructure sector care: (1) NGLs require processing when extracted to separate them into their useful products, creating multiple opportunities to “touch” each molecule and charge a fee, and (2) the U.S. produces around 26% of world consumption, far bigger than our share for natural gas or crude oil. NGL exports continue to make new records.

Many Indians cook and heat their homes with Liquid Petroleum Gas (LPG), a combination of propane and butane. Methane requires too much pressure to go in the ubiquitous gas bottles seen all over the world, so LPG meets the needs of consumers without a natural gas hook up. The U.S. exported over 100 thousand barrels per day of NGLs to India in 2019.

Last week Bloomberg ran a story highlighting rising LPG prices (see One Fuel Is Thriving During the World’s Biggest Lockdown). In Asia, LPG is often produced as a byproduct of refining crude oil, and lower gasoline demand means refineries are cutting output. LPG demand in India is up, whereas demand for transportation fuels is down 20% or more. James Mann of the Texas Pipeline Association warned that cutting oil production would have the unintended consequence of also reducing NGLs and gas, potentially leaving some customers short of needed product.

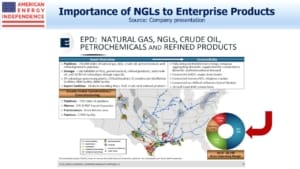

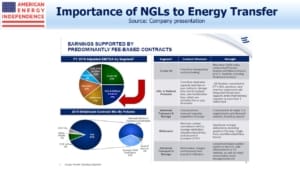

Some big U.S. midstream energy infrastructure companies generate a significant portion of their profits from NGLs. Last Tuesday the Texas Railroad Commission held hearings on a request to curb Texan oil production (called “pro-rationing”). Enterprise Products Partners CEO Jim Teague was invited to give his view. He was against pro-rationing, and went on to note that their LPG export facilities were in high demand.

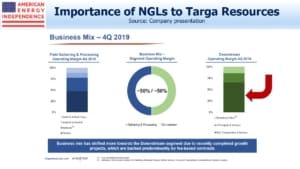

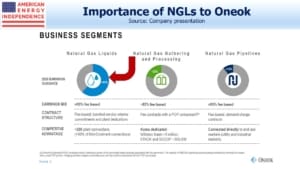

The following slides show the importance of NGLs to some of North America’s biggest pipeline companies.

We are invested in all of the companies mentioned above.