Energy As A Hedge Against Geopolitical Risk

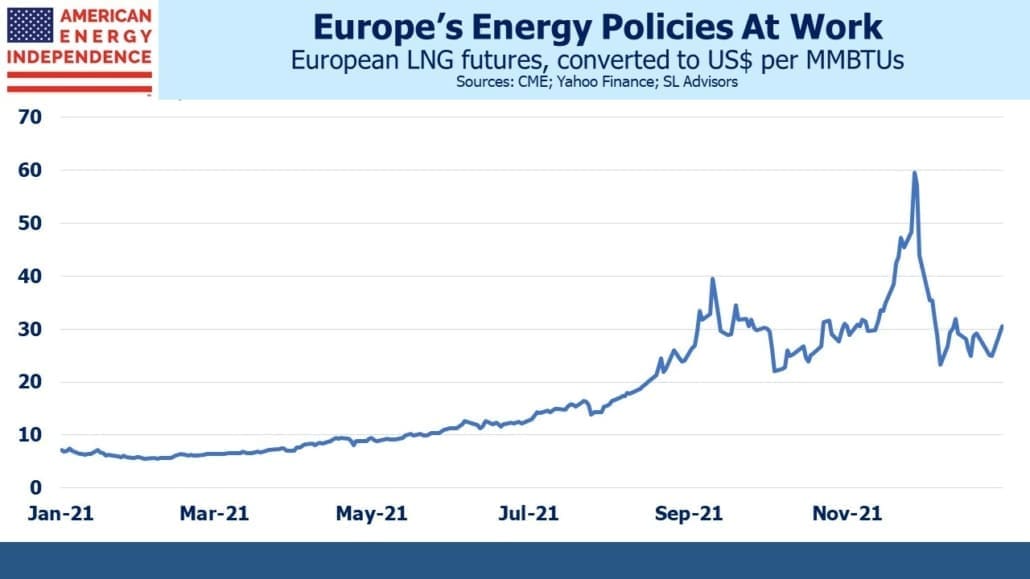

It’s a measure of the increased importance of natural gas to the world economy that geopolitical tensions now move its price the way crude oil has responded for decades. Russian troops massing on the border with Ukraine have shed an uncomfortable light on Europe’s vulnerable natural gas supply. Climate extremists are partly to blame because they’ve assumed windmills can solve every energy problem.

Germany’s government is still dead set against nuclear power, and is lobbying the EU to omit it from the revised list of clean energies. But relying on Russia for so much of Germany’s natural gas has constrained their ability to respond to Russian aggression elsewhere in Europe. US energy policy, whatever its faults, is more enlightened than Europe’s.

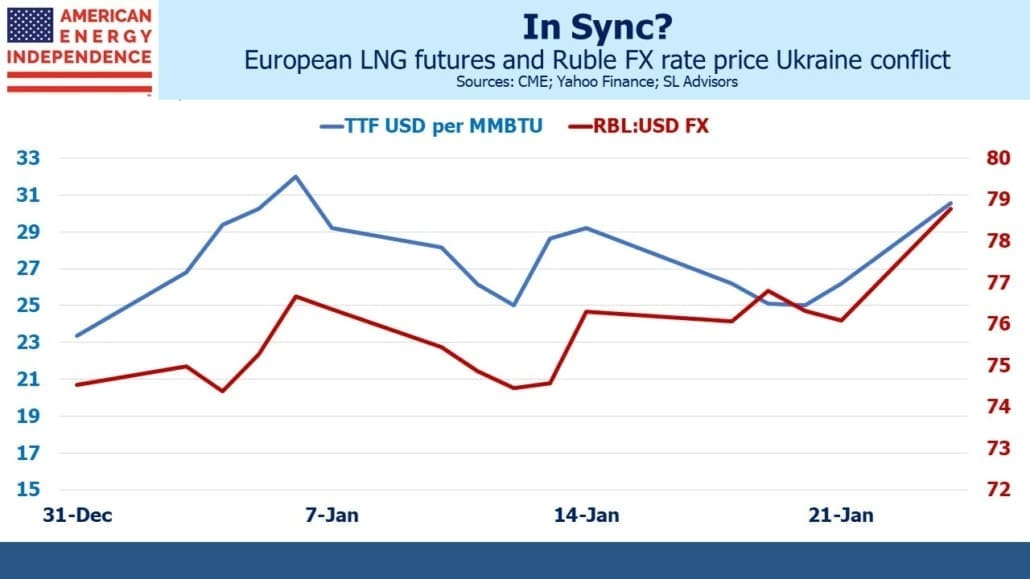

In recent weeks, the Ruble’s moves against the US Dollar have been calibrated to the fluctuating odds of a Russian military incursion into Ukraine with its consequent damage via sanctions to the Russan economy. The deployment of NATO assets to member countries in the region represents another step in escalation that has drawn the market’s attention.

But Russia isn’t uniquely vulnerable – European natural gas futures have begun moving with the Ruble too, reflecting the possibility of supply disruptions if Russia chooses to respond to sanctions by using its own economic leverage.

Geopolitical risk often comes with fears of supply disruption to crude oil, but this might be the first time in history that natural gas prices have been sensitive to the possibility of armed conflict. It’s rarely easy to predict such events, but investments in the energy sector can be a source of some comfort when uncertainty is driving the market lower. The strong recent performance of pipelines versus the S&P500 may be a coincidence – the shift from growth to value has been more important – but holding US energy infrastructure assets does bring the comfort of knowing America retains more control of its destiny than any other country. Domestic natural gas pipelines and LNG export terminals are invulnerable to foreign conflict and potentially able to opportunistically benefit from supply disruptions elsewhere.

Eastern Europe is the current focus, but it’s not the only potential hotspot. On the weekend, the United Arab Emirates intercepted a ballistic missile fired over Abu Dhabi, probably by rebels in Yemen where a proxy war between Saudi Arabia and Iran continues to smolder.

China has been adopting a more bellicose posture towards Taiwan, whose independence from the mainland it has never recognized.

North Korea periodically tests new missiles, sometimes flying them over Japanese territory.

None of these other flashpoints are related – and yet, the risk is that if one heats up it raises the tension elsewhere. This is because all of them to some degree draw the oversight and potential engagement of the US. If American military attention and resources are focused in one area, bad actors in another may perceive an opportunity to act when the superpower is briefly looking away.

It’s this strategic challenge that underlies US military planning to be prepared to fight two major wars simultaneously – most likely one in Europe and another in Asia. The thinking is that conflict in one makes an adversary more likely to take provocative action in the other theatre.

Russia’s troops massed on Ukraine’s border are likely to move within weeks – either as invaders or back within their own country. Winter with its ice-hardened roads and fields offers a preferable environment for tanks and heavy equipment than the spring thaw when the terrain is muddy.

Usually, the bad outcomes you fear in investing don’t happen, but it’s as well to be prepared. It scarcely seems in Russia’s interests to draw the apparently ruinous sanctions the US has planned. So the most likely outcome must surely be a diplomatic exit.

But it’s worth considering that Russian tanks rolling into Kyiv isn’t the limit of how bad things could get. Other points of conflict will then be at increased risk of heating up.

This is where energy investments offer a form of geopolitical tail risk insurance. Most of the time, such coverage provides little or no payoff, but occasionally can look prescient. If you consider a list of all the products and services offered by the companies in the S&P500, domestic energy and the physical infrastructure required to process, transport and store it looks more vital and in our national interest relative to much else that generates EPS.

Hopefully, this crisis will pass, but it is a reminder that planning for the unexpected is an essential element of risk management.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!