Energy As A Hedge Against Geopolitical Risk

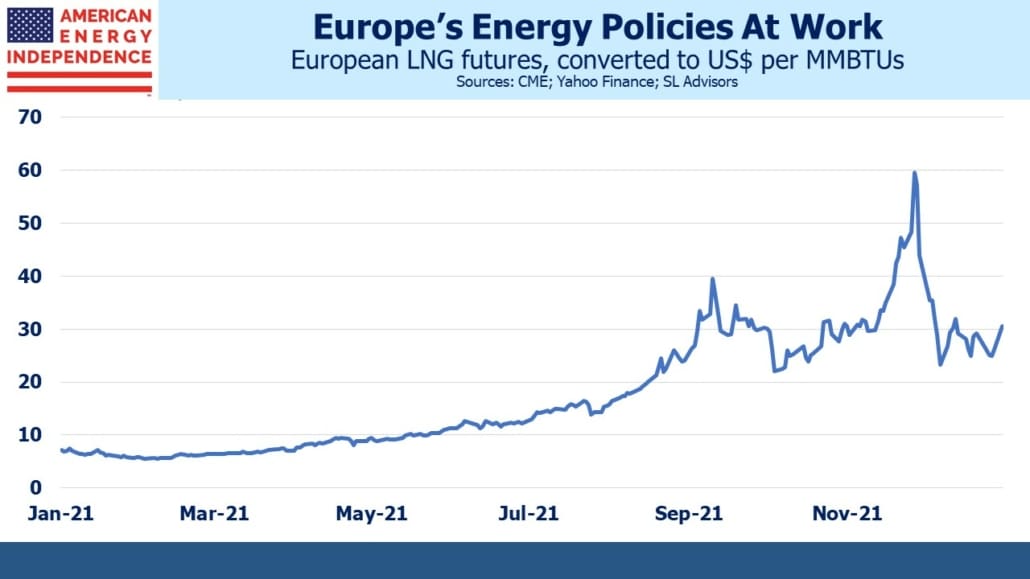

It’s a measure of the increased importance of natural gas to the world economy that geopolitical tensions now move its price the way crude oil has responded for decades. Russian troops massing on the border with Ukraine have shed an uncomfortable light on Europe’s vulnerable natural gas supply. Climate extremists are partly to blame because they’ve assumed windmills can solve every energy problem.

Germany’s government is still dead set against nuclear power, and is lobbying the EU to omit it from the revised list of clean energies. But relying on Russia for so much of Germany’s natural gas has constrained their ability to respond to Russian aggression elsewhere in Europe. US energy policy, whatever its faults, is more enlightened than Europe’s.

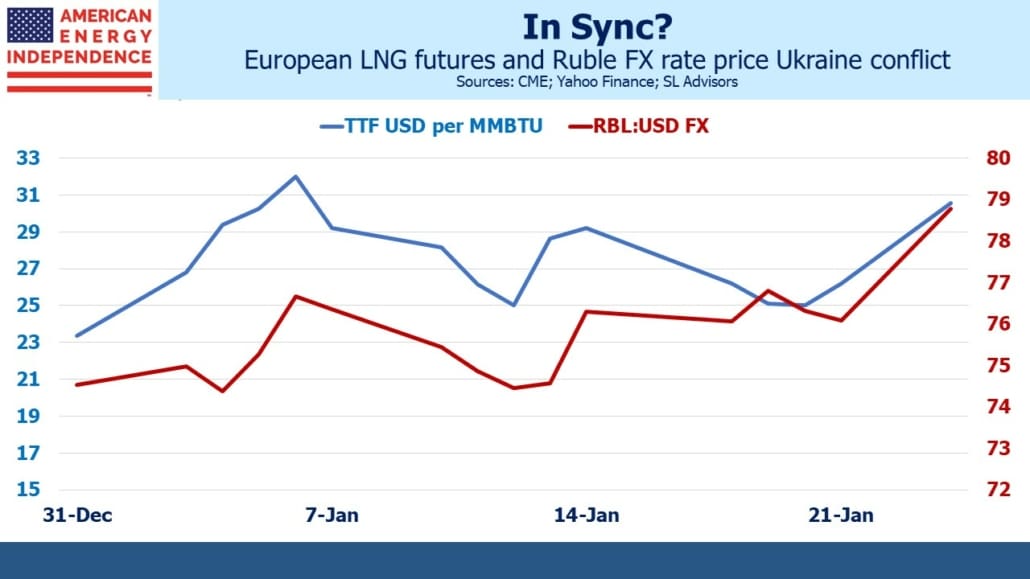

In recent weeks, the Ruble’s moves against the US Dollar have been calibrated to the fluctuating odds of a Russian military incursion into Ukraine with its consequent damage via sanctions to the Russan economy. The deployment of NATO assets to member countries in the region represents another step in escalation that has drawn the market’s attention.

But Russia isn’t uniquely vulnerable – European natural gas futures have begun moving with the Ruble too, reflecting the possibility of supply disruptions if Russia chooses to respond to sanctions by using its own economic leverage.

Geopolitical risk often comes with fears of supply disruption to crude oil, but this might be the first time in history that natural gas prices have been sensitive to the possibility of armed conflict. It’s rarely easy to predict such events, but investments in the energy sector can be a source of some comfort when uncertainty is driving the market lower. The strong recent performance of pipelines versus the S&P500 may be a coincidence – the shift from growth to value has been more important – but holding US energy infrastructure assets does bring the comfort of knowing America retains more control of its destiny than any other country. Domestic natural gas pipelines and LNG export terminals are invulnerable to foreign conflict and potentially able to opportunistically benefit from supply disruptions elsewhere.

Eastern Europe is the current focus, but it’s not the only potential hotspot. On the weekend, the United Arab Emirates intercepted a ballistic missile fired over Abu Dhabi, probably by rebels in Yemen where a proxy war between Saudi Arabia and Iran continues to smolder.

China has been adopting a more bellicose posture towards Taiwan, whose independence from the mainland it has never recognized.

North Korea periodically tests new missiles, sometimes flying them over Japanese territory.

None of these other flashpoints are related – and yet, the risk is that if one heats up it raises the tension elsewhere. This is because all of them to some degree draw the oversight and potential engagement of the US. If American military attention and resources are focused in one area, bad actors in another may perceive an opportunity to act when the superpower is briefly looking away.

It’s this strategic challenge that underlies US military planning to be prepared to fight two major wars simultaneously – most likely one in Europe and another in Asia. The thinking is that conflict in one makes an adversary more likely to take provocative action in the other theatre.

Russia’s troops massed on Ukraine’s border are likely to move within weeks – either as invaders or back within their own country. Winter with its ice-hardened roads and fields offers a preferable environment for tanks and heavy equipment than the spring thaw when the terrain is muddy.

Usually, the bad outcomes you fear in investing don’t happen, but it’s as well to be prepared. It scarcely seems in Russia’s interests to draw the apparently ruinous sanctions the US has planned. So the most likely outcome must surely be a diplomatic exit.

But it’s worth considering that Russian tanks rolling into Kyiv isn’t the limit of how bad things could get. Other points of conflict will then be at increased risk of heating up.

This is where energy investments offer a form of geopolitical tail risk insurance. Most of the time, such coverage provides little or no payoff, but occasionally can look prescient. If you consider a list of all the products and services offered by the companies in the S&P500, domestic energy and the physical infrastructure required to process, transport and store it looks more vital and in our national interest relative to much else that generates EPS.

Hopefully, this crisis will pass, but it is a reminder that planning for the unexpected is an essential element of risk management.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.