Dividends on Pipeline Stocks Remain High

Markets finished the strongest quarter sine 1987 yesterday, led by the energy sector. The American Energy Independence Index, which comprises North America’s biggest pipeline stocks, is still down 29% for the year. Some investors are weary of years of underperformance against the broader market, combined with high volatility.

The volatility is largely a function of the investor base. In March, Closed End Funds (CEFs) that were forced to cut leverage at the lows added to the indiscriminate selling (see The Virus Infecting MLPs). Fund managers such as Kayne Anderson and Tortoise were to blame for not having the good sense to reduce risk earlier. The good news is that the consequent destruction of capital has rendered these CEFs less able to repeat, because they’re now a lot smaller.

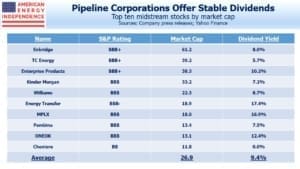

Back in March, investors had many concerns about dividend sustainability. The top ten companies, which represent over half the sector’s $490BN market cap, all maintained payouts (Cheniere doesn’t pay a dividend). A recurring question we get from investors is, what’s the catalyst that will get stock prices higher? Putting aside higher crude oil, which usually coincides with improving sentiment, we believe the continued high dividend yields will draw in more buyers.

In Pipeline Cash Flows Will Still Double This Year, we explained how falling spending on new projects is driving cash flows higher. Covid-19 has produced few positives, but one of them is an acknowledgment by the energy industry that investing in new production and its supporting infrastructure needs to be cut. It may not be what executives want, but investors can find plenty to like about reduced spending.

In the next few weeks companies will report earnings and updated guidance. We don’t expect any of the biggest pipeline companies to cut dividends. Oneok (OKE) is probably the most at risk, but since they recently completed a secondary offering of common equity it would seem odd timing for them to cut.

These top ten companies have an average market cap of $27BN and an average yield of 9.4%, including Cheniere. Every three months pipeline stocks pay in dividends more than two years’ worth of interest on ten year treasury notes. Energy has been too volatile, but the improving free cash flow picture that is supporting dividends contrasts positively with others. We don’t know of another sector that is going to double its free cash flow this year.

Conversations with investors continue to reveal widespread caution about the overall market. The news on Covid-19 is rarely positive, and many find it difficult to maintain a constructive outlook against this backdrop. But Factset is still forecasting 2021 S&P500 earnings to be flat to 2019, fully recouping the Covid-19 drop in just one year. This, combined with low bond yields, continues to drive long term investors into stocks (see The Stock Market’s Heartless Optimism and Stocks Look Past The Recession and Growing Debt).

The dividend yield on the top ten pipeline stocks is a staggering five times that of the S&P500. As investors become increasingly comfortable that these are sustainable, yields will be driven down by new buying. Earnings reports in the coming weeks will provide an important opportunity for companies to provide confirmation.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

One restraint inhibiting further buying is the election uncertainty. If Biden wins and the Democrats control Congress that can be a frightening prospect to investors (it is to me). On the other hand, they can only ban fracking on federal, not private, lands, and if new pipelines have difficulty in becoming approved that is a positive for existing pipelines.

Then there are Biden tax proposals. Eliminate the stepped up basis, raise capital gains and other taxes and I’m guessing eliminate return of capital distributions just because.