Discussing Energy Markets In The Palmetto State

In June of last year my wife and I fled the draconian lockdown imposed on New Jersey for the south (see Having a Better Pandemic in Charleston, SC). Whereas back then our autocratic governor had even forbidden a solitary walk in the park, Charleston SC felt like a world apart. We were left awestruck at the sight of diners enjoying an evening out. The welcome freedom was somewhat marred by BLM protests, that being the big news story of the moment. Boarded up storefronts did not present Charleston at its best, and we vowed to return at a more auspicious time.

That moment arrived 16 months later, and we enjoyed a wonderful dinner with long-time friend of the firm Jim Agostini and his delightful wife Lindsay. We found Charleston fully open. In keeping with southern manners, masks were politely requested if non-vaccinated, as opposed to demanded. Few were evident, even among the employees of restaurants and stores sporting such a sign. We all agreed we’re fed up with being required to wear a mask “for your protection” when it’s really to protect the unvaccinated who demonstrate little fear of covid. Most are moving on.

Client meetings are coming back, as financial services’ finds a new balance between the convenience of remote working and the benefits of in-person interaction. Our business went fully and permanently remote a year ago. Face to face client meetings are becoming more frequent, but not yet back to where a full day of meetings on a road trip is possible

I was interested to learn that Lindsay Agostini is a member of Conservatives for Clean Energy (CCE). In fact, Lindsay was recently named a Conservative Clean Energy Champion. CCE promotes innovation along with continued use of nuclear energy and greater adoption of electric vehicles – more pragmatic than the liberal climate extremists who have helped cause Europe’s current energy crisis.

We’ll hear more from Lindsay in the near future.

Meanwhile, the energy sector continues to strengthen, in almost willful defiance of most observers. Many have wrongly concluded that the energy transition makes the sector uninvestable, whereas the policies advocated by climate extremists are behind Europe’s energy crunch. Pushing for reduced capex is achieving the free cash flow growth investors have long yearned for but were unable to engineer themselves.

European natural gas prices continue to reach levels unfathomable in the US. Britain is the new poster child for a mis-managed energy transition, joining Germany and California as examples to avoid. British natural gas prices hit £3 per therm on Monday, the equivalent of $41 per MCF (versus around $6 in the US). The WSJ wrote How Not To Do An Energy Transition to offer some belated advice. Aramco noted that the natural gas crisis had driven oil demand up by 500K barrels per day, more than OPEC’s recently announced production increase.

Recent developments are highlighting the poor planning behind many countries’ headlong rush to renewables. It shows the problems of building policy on soundbites, instead of designing good policies that generate their own slogan. Lessons will be learned, including that the energy transition is far from costless. This should lead to a more thoughtful approach that acknowledges the vital role natural gas will continue to play in providing reliable power for decades to come. The wake-up call for policymakers is good news for energy investors. Electricity can’t be intermittent, and the UK government is paying a steep price for over-reliance on windpower without adequate back-up.

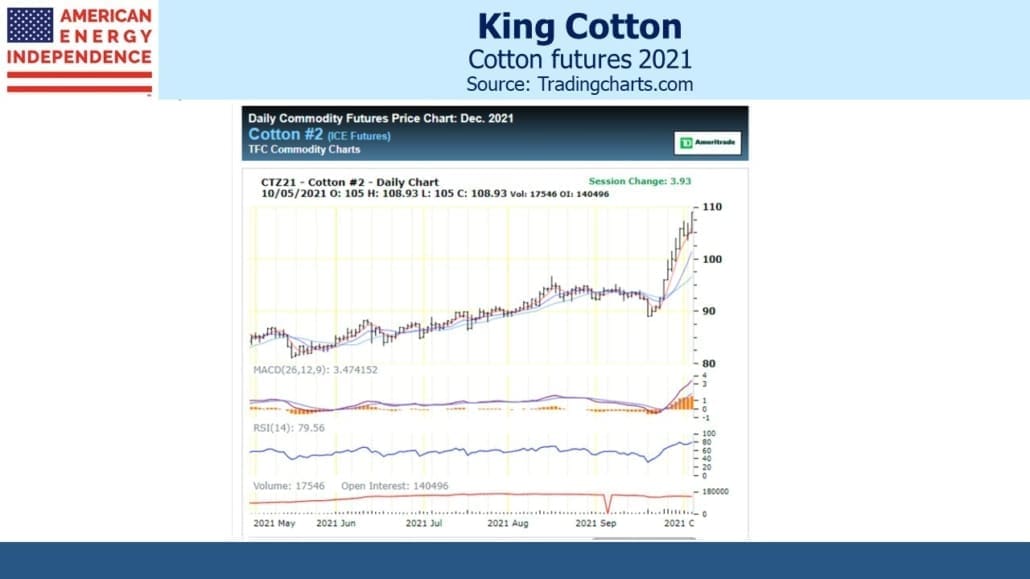

Natural gas is far from the only commodity in a bull market. The Bloomberg Commodity Index tracks 23 energy, metals and crop futures contracts. Even cotton, hardly a target of climate extremists, has rallied sharply in recent weeks.

The inflationary implications of the energy transition were harder for the Fed to forecast than the impact of fiscal uber-stimulus and debt monetization. Rising energy prices offer a graceful exit from the Fed’s transitionary narrative around current inflation, should they choose it. The eurodollar futures curve is priced for a 0.70% increase in short term rates between December 2023 and 2025, a pace of slightly over one tightening per year. Although it’s widened from 0.55% over the past couple of weeks, it still represents an asymmetric bet, since even today’s dovish FOMC is more hawkish than the market. If inflation fails to return to its 2% FOMC target, the risk is for much more tightening in a couple of years than is reflected in current pricing.

We have three funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!