More Energy Discussions In The Palmetto State

Covid introduced us to first-time meetings over Zoom. Last week I had the pleasure of meeting Jack Jeffords and Adam Bloomberg, from Mount Pleasant, SC, in person after having first met them both via a video call several months ago. Recognizing a familiar face along with the person’s voice reinforced how helpful it is to chat on a screen when traveling to a meeting isn’t practical. Like it or not, zoom is now an adjective (although we prefer Microsoft Teams).

Over a convivial lunch reflecting southern hospitality, we chatted about the long term outlook for natural gas, the main focus of our energy investing nowadays. Conveniently, the US Energy Information Administration’s (EIA) International Energy Outlook 2021 (IEO2021) was released the following day. Long term projections such as these are why we’re confident that US pipelines will be in use for decades to come.

As an aside, we learned that port congestion is also an issue at Savannah, with some two dozen ships waiting offshore. Truckers and port warehouse workers are reported to be in short supply.

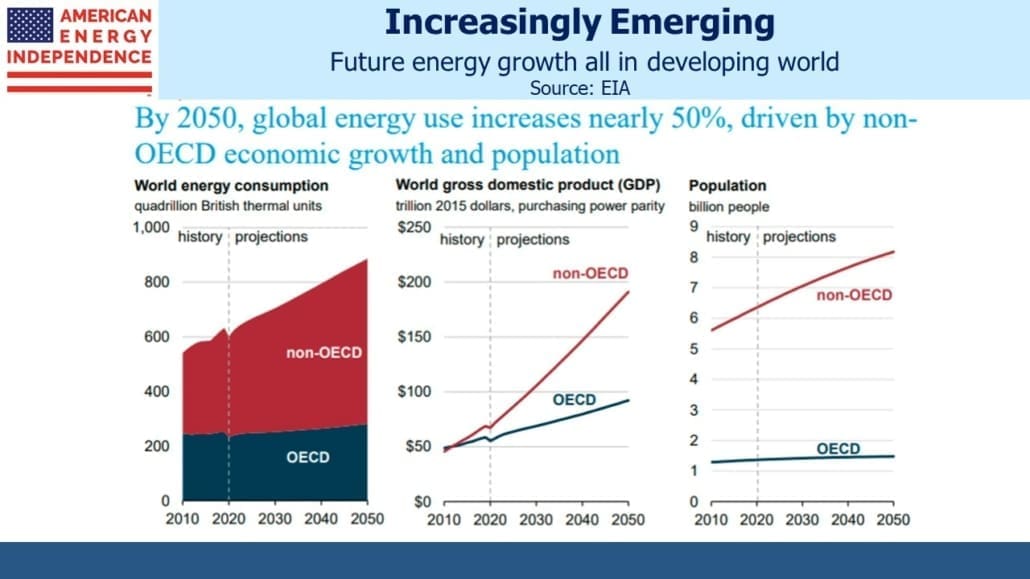

The energy transition brings together two opposing forces – the desire of developed countries (i.e. OECD) to lower emissions, and the intention of emerging countries to raise living standards, which requires increasing their energy use.

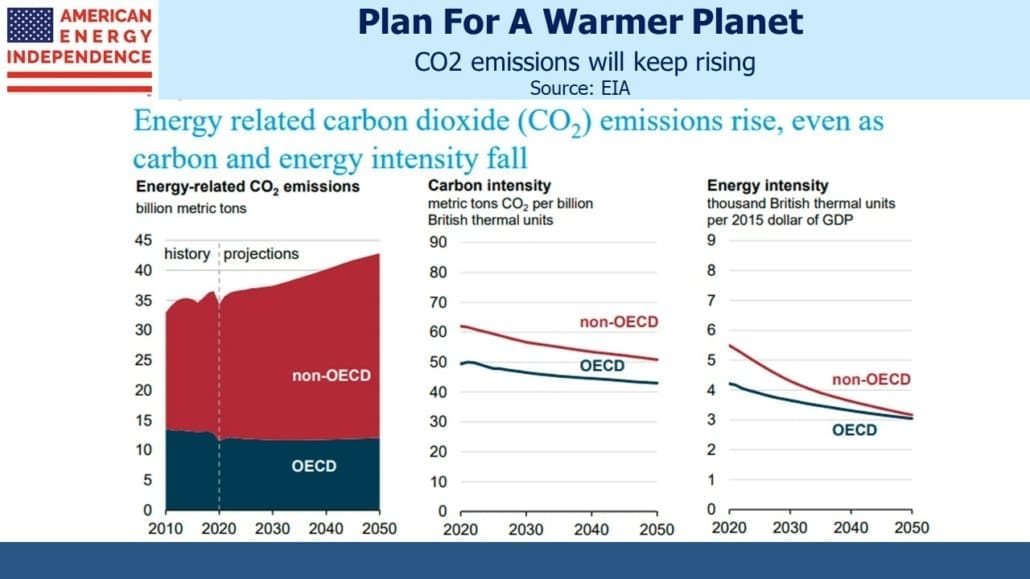

The trajectory of global population and GDP growth means the latter of these conflicting forces will dominate. Even if the US and the rest of the OECD countries cut CO2 emissions in half over the next three decades, the world would still be emitting more CO2 than it does today. The inevitable reality of population growth dictates that emerging economies will drive energy demand for the foreseeable future.

The upcoming COP26 global climate change conference is well timed as it coincides with a developing global energy crisis (ex-USA). This is largely the result of years of policy aimed at dissuading investment in new production of oil and gas, which has directly led to today’s high prices. Europe’s demonstrated vulnerability to supply shortages should inject some overdue humility and realism into the COP26 deliberations (see Europe Follows California Into Renewables Oblivion). They don’t need any more of Greta’s grandstanding.

China has ordered its coal mines to increase output — not good optics for a country that already burns half the world’s coal heading into COP26. India is experiencing blackouts as some of its power stations run out of coal. Energy security supersedes climate change for these countries.

The result is that, for all the relentlessly positive media coverage about increases in solar and wind, renewables will fail to satisfy the growth in world energy demand. Therefore, we’ll be using more of everything – sadly including coal.

Even in the power sector, which most easily lends itself to increased solar and wind, these two intermittent energy sources will fail to cause a contraction in fossil fuels – in part because increased use of weather-dependent power will necessitate more dispatchable (i.e. there when you need it) sources to compensate for cloudy, windless days.

Perhaps most surprising is the strong outlook for “petroleum and other liquids.” It’s set to grow at 1% p.a. over the next three decades, with growth in every region even including Europe which is farthest ahead on decarbonization. In spite of increasing uptake in electric vehicles, far more conventional automobiles will be bought as living standards rise in emerging economies.

The last chart illustrates the challenge facing policymakers. India’s electricity output is expected to increase five-fold over the next three decades. Enormous increases in solar and wind will still fall short of meeting this growth. This, along with the continued need for conventional power sources to compensate for renewables’ intermittency, explain why India’s coal consumption isn’t likely to fall. Canada’s electricity transmission is on track for zero emissions, but India’s power output is likely to be 10X Canada’s by 2050.

The EIA outlook is based on current policies and technology, which they call their “Reference Case.” The contrast it presents with where most of the world says it wants to go is so jarring that one has to expect some policy changes to come out of the COP26. Nonetheless, it highlights the enormous difficulty the world will have in achieving the IPCC emission goal, which is to reach zero by 2050. The IEO2021 forecasts CO2 emissions going from 34 to 42 Gigatons over that period. We may do better, but zero seems implausible. Given our dependence on energy supplies that work, technologies such as carbon capture will likely become a more important solution, which augurs well for today’s investments in natural gas.

We have three funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

thanks for your informative and clear minded blogs

(also thanks for pushing back on covid restriction nonsense)