Climate Change: Prevention or Mitigation?

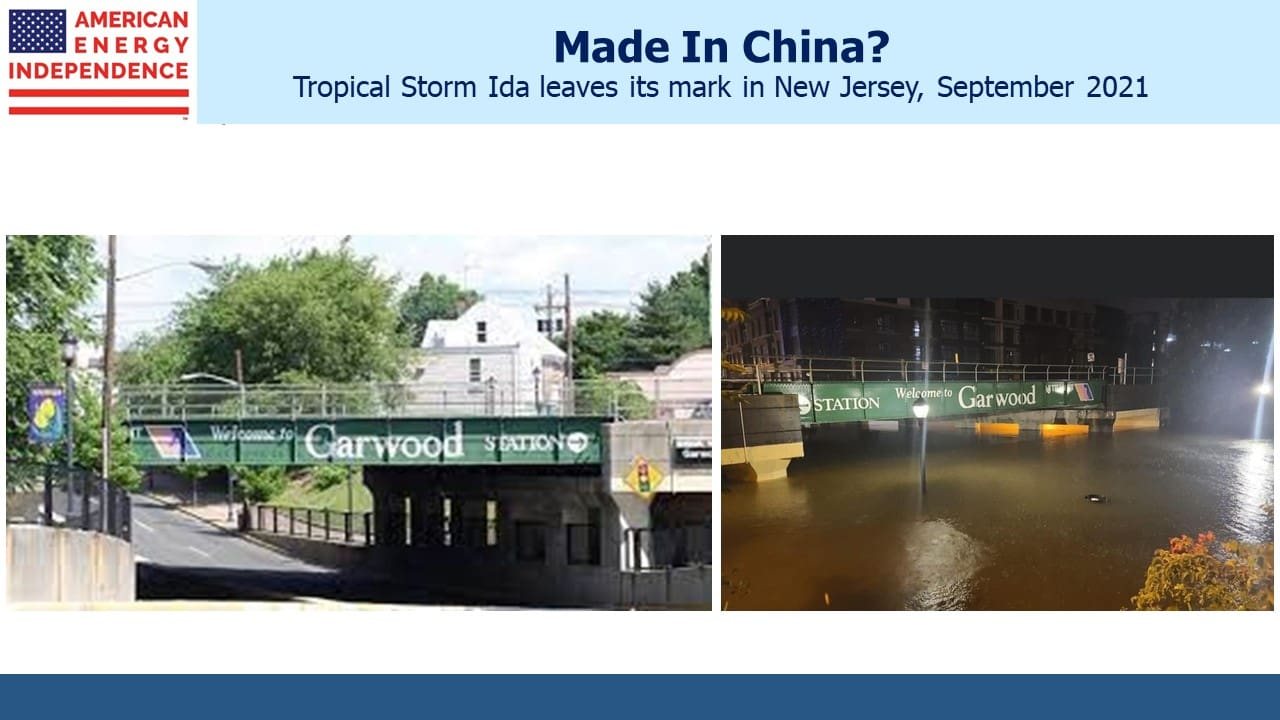

Last week the northeast US suffered 52 deaths as Hurricane Ida (by then a tropical storm) dumped up to ten inches of rain in just a few hours. Cranford, NJ on the Rahway River is prone to flooding. It’s a couple of miles from Westfield, GHQ for SL Advisors, and it seems like every decade or so hundreds of basements are flooded in those homes close to the river. Garwood is another small neighboring town and source of the striking photos below.

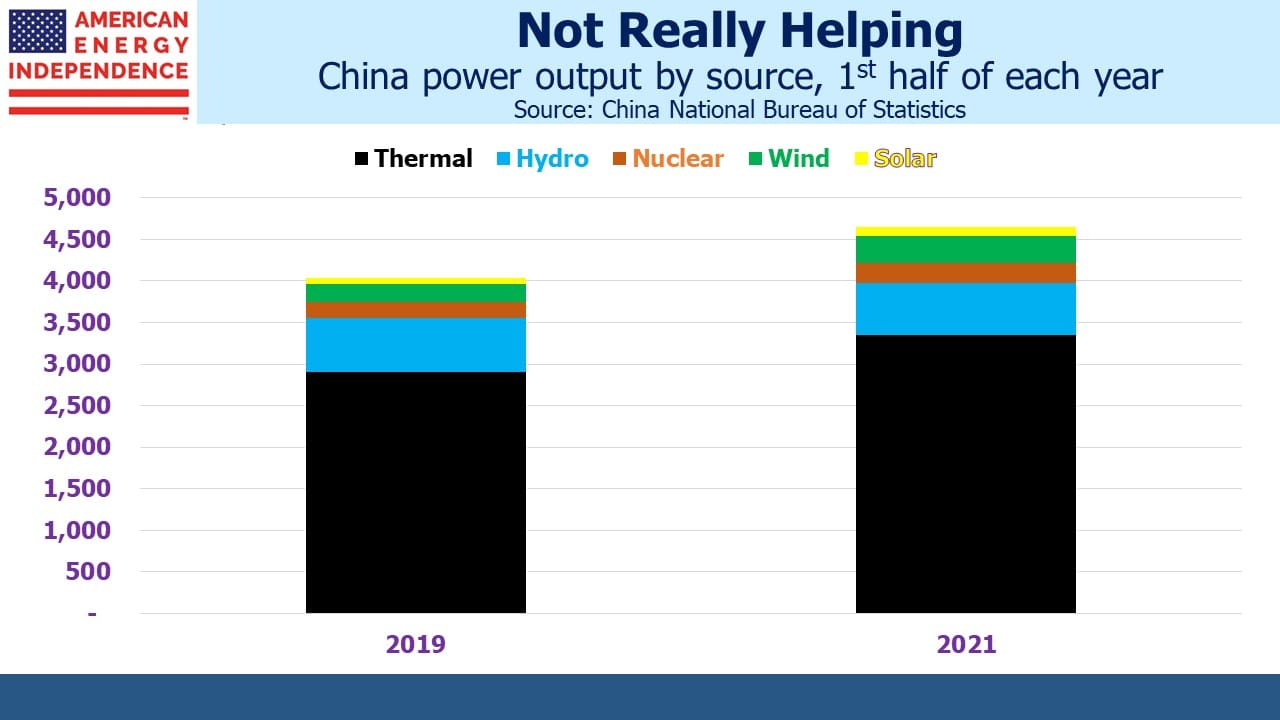

Seemingly unrelated to the heartbreaking losses caused by Ida, journalist John Kemp noted China’s continued reliance on coal for power generation, which has experienced a Compound Annual Growth Rate (CAGR) of 5% over the past two years. Since Covid caused a drop last year, this highlights the strong underlying trend. Coal futures on the Zhengzhou Commodity Exchange recently traded at $150 per tonne, compared with $85 a year ago. The market is signaling more demand for coal.

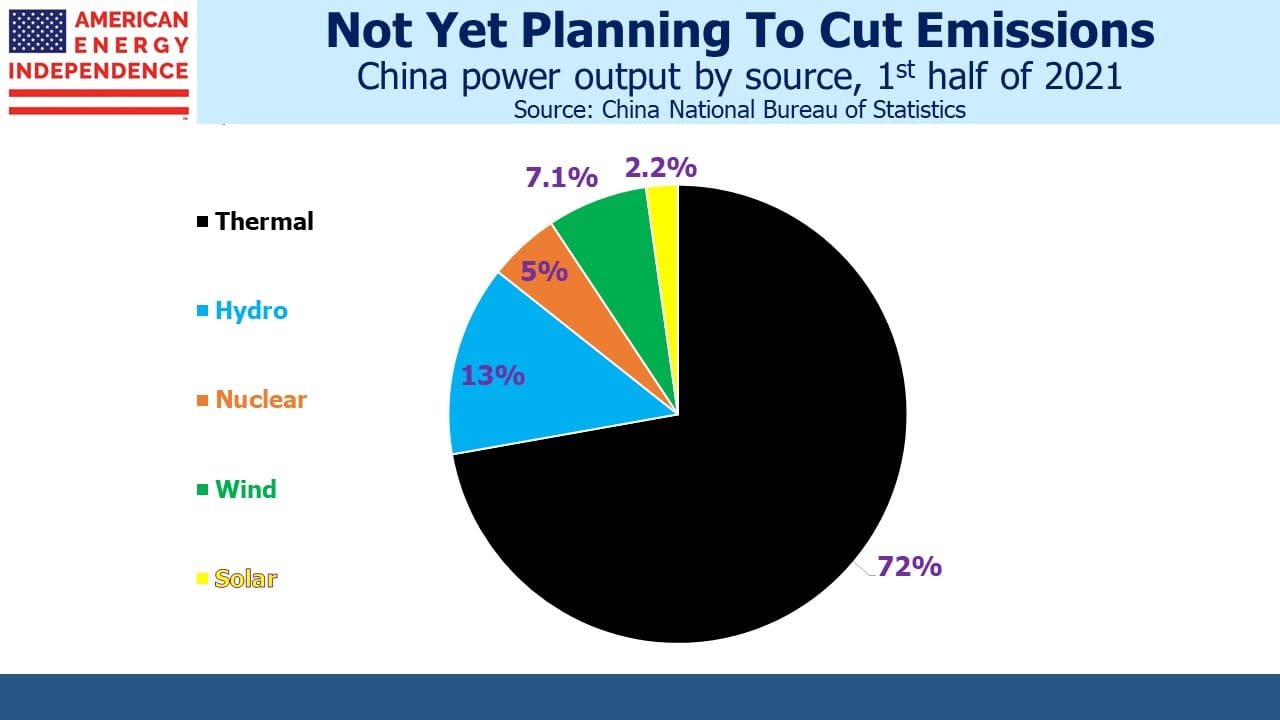

Apologists for China herald the 25% CAGR for wind power over this time, and 24% for solar. Hydro output dropped slightly. Don’t be fooled. Thermal power, which is mostly coal since China burns half the world’s output, still provides 72% of China’s electricity as was the case two years ago. Thermal power also met 72% of the increase in demand, hence its static share of the total.

This is why China generates 28% of global CO2 emissions. It plans to continue increasing at least through 2030 before reversing course on an improbable path to zero by 2060 (see Is China Worried About Global Warming?).

Here’s why China’s power output is linked to flooded towns in New Jersey. Ads for solar panels are everywhere, because of generous state and Federal subsidies. As a result, New Jersey electricity customers have so far paid $3BN in higher fees to help pay for solar installations. Future tax breaks for solar are expected to add $800 million annually to utility customers’ bills, rising to $1.4BN by 2030.

Hurricane Ida may or may not be a consequence of climate change. The media interprets every weather fluctuation as caused by global warming. The UN’s report earlier this summer warned of more extreme weather events but attributing any single event to the one degree Celsius increase since the 1850s is impossible.

Nonetheless, if you’re pumping water from your Cranford basement, as you do every decade or so, proliferating subsidized solar panels aren’t much use. Living in a solidly blue state, you’re probably convinced that global warming will cause even more frequent flooding. Having long ago rejected the wholly sensible idea of moving to higher ground, you might like those solar panel subsidies redirected towards improved infrastructure to stop the Rahway River from bursting its banks. Users of the New York City subway would favor mitigation of the sudden indoor waterfalls we saw on news reports and social media.

The widely reported efforts by rich countries to blanket the landscape with solar panels and windmills aren’t having any noticeable impact on global CO2 emissions. Implementation carries local costs while any benefits are shared globally. Californians can feel good about their efforts to shut down natural gas plants, even though it results in more expensive and less reliable electricity. They still get forest fires. New Yorkers may support constraints on new natural gas connections. The subway still had to shut down because of flooding.

We may already be experiencing the climate changing effects of a warmer planet. If so, at some point there’s a valid choice between prevention and adaptation. None of us can control the planet’s CO2 levels. But every community can fortify itself again extreme weather events. The quest to lower emissions is a global social undertaking that relies on widespread participation. It requires community spirit on a worldwide scale. The free-rider problem is likely fatal to success. China is only the most visible emerging economy exploiting this – the world’s biggest producer of solar panels, which it sells to dozens of countries, is also the #1 consumer of coal and generates over a quarter of global CO2 emissions.

The energy transition has lots of momentum. Shifting from coal to natural gas remains the world’s most assured path to reduced emissions. Nonetheless, China’s increase in wind and solar only met 25% of the additional demand for power since 2019. The desire of rich countries to lower emissions remains in conflict with emerging economies’ intention to raise living standards by using more energy.

This misalignment of interests means that eventually a sea wall will be more useful than a windmill. That time is coming.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Great Article Thanks

I’m reading “Unsettled” by Steven Koonin, which should be read by anyone who comments about climate issues. For one thing, Hurricane Ida was a weather event, not a climate event. It takes an analysis of at least a decade of weather events to consider them a climate matter and then another decade of weather events with which to compare it before one can rationally describe any alleged change in climate. And generally there are no or very minor changes..

By 2040, it’s possible that the Earth’s citizens will have collectively spent many trillions of dollars “to combat climate change” without attaining any real, measurable results. If so, that will have to be the single worst return on investment the world has ever seen.

Very interesting read, thankyou. I still think we have time to stop it.