Pipelines Are ESG

ESG is in the eye of the beholder. There are multiple lists of stocks that score well on Environmental, Social and Governance metrics. My favorite is Lockheed Martin (LMT), a perennial member of the Dow Jones Sustainability Index. If building weapons to blow up people and property can be done in a sustainable way, then ESG is a generous mistress (see Pipeline Buybacks and ESG Flexibility).

There are currently 138 ESG ETFs traded on U.S. markets, with almost $90BN in AUM. The most important thing about ESG investing is that it’s growing faster than the market. A cynic might regard the rush by CEOs to demonstrate ESG-ness as driven by asset flows rather than altruism. ESG-driven investors can note with satisfaction the market-beating performance of such funds. The largest ESG ETF is the iShares ESG Aware MSCI USA ETF (ESGU), with $15BN in AUM.

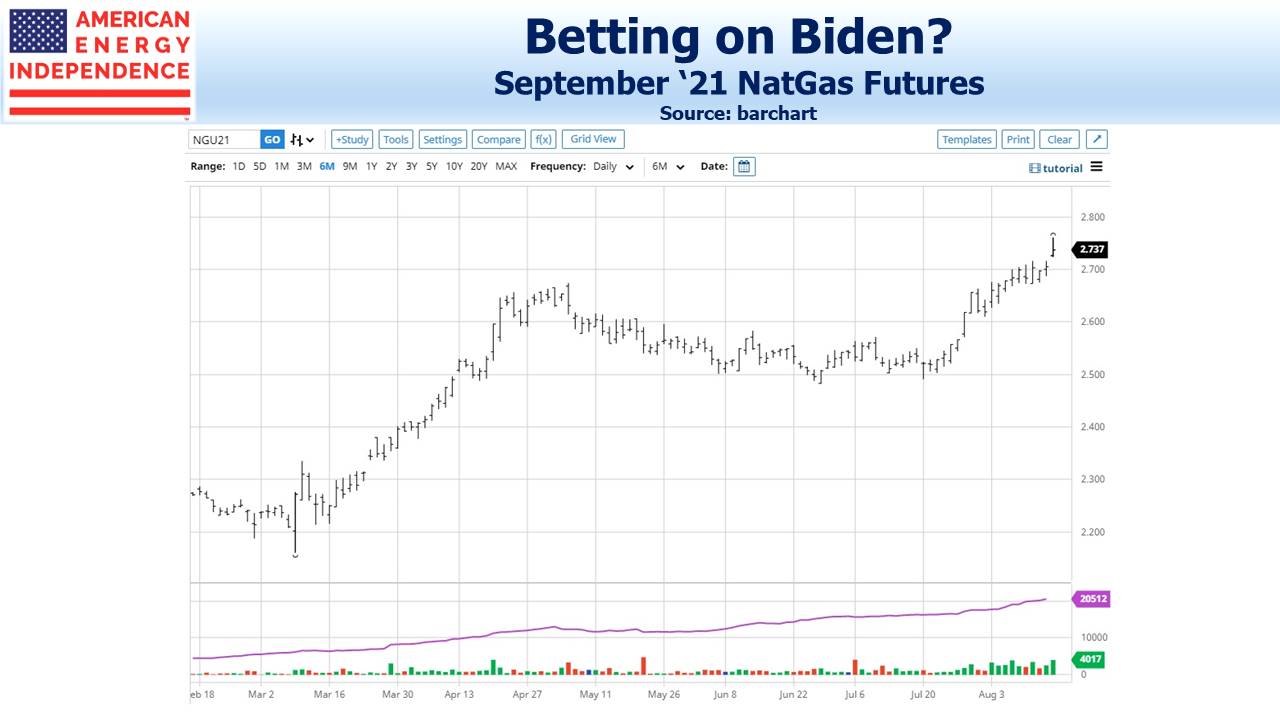

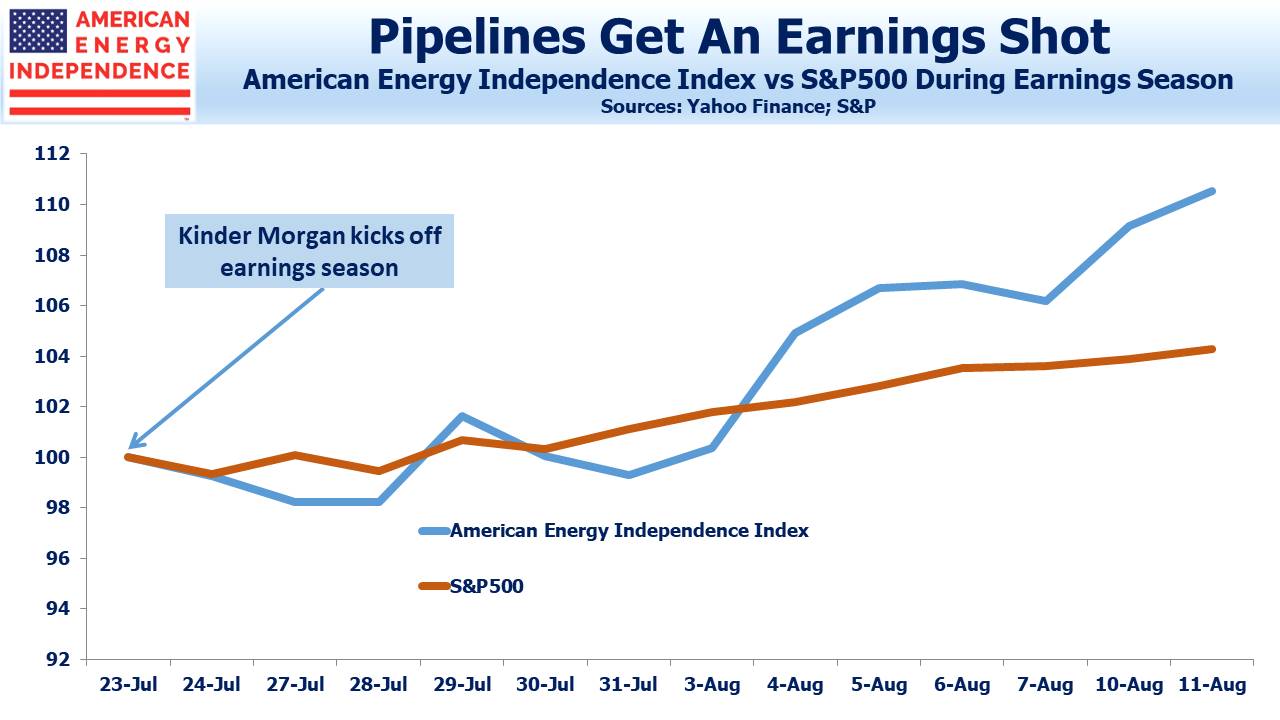

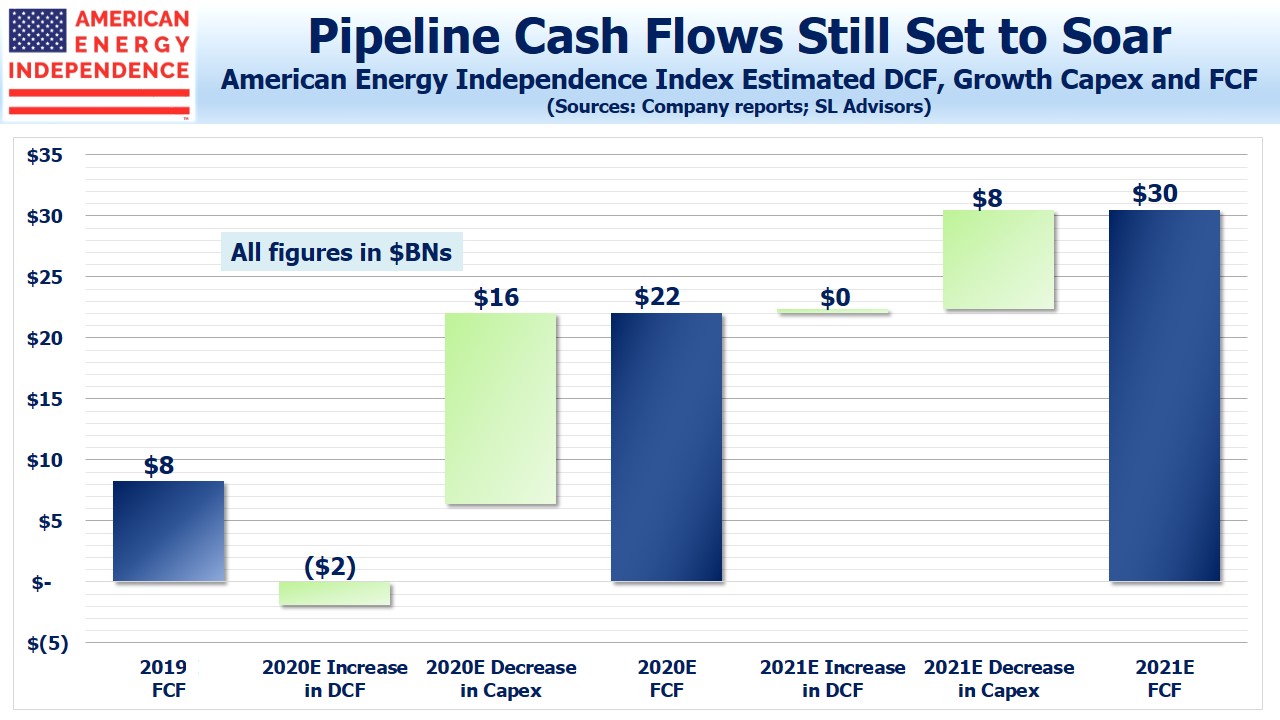

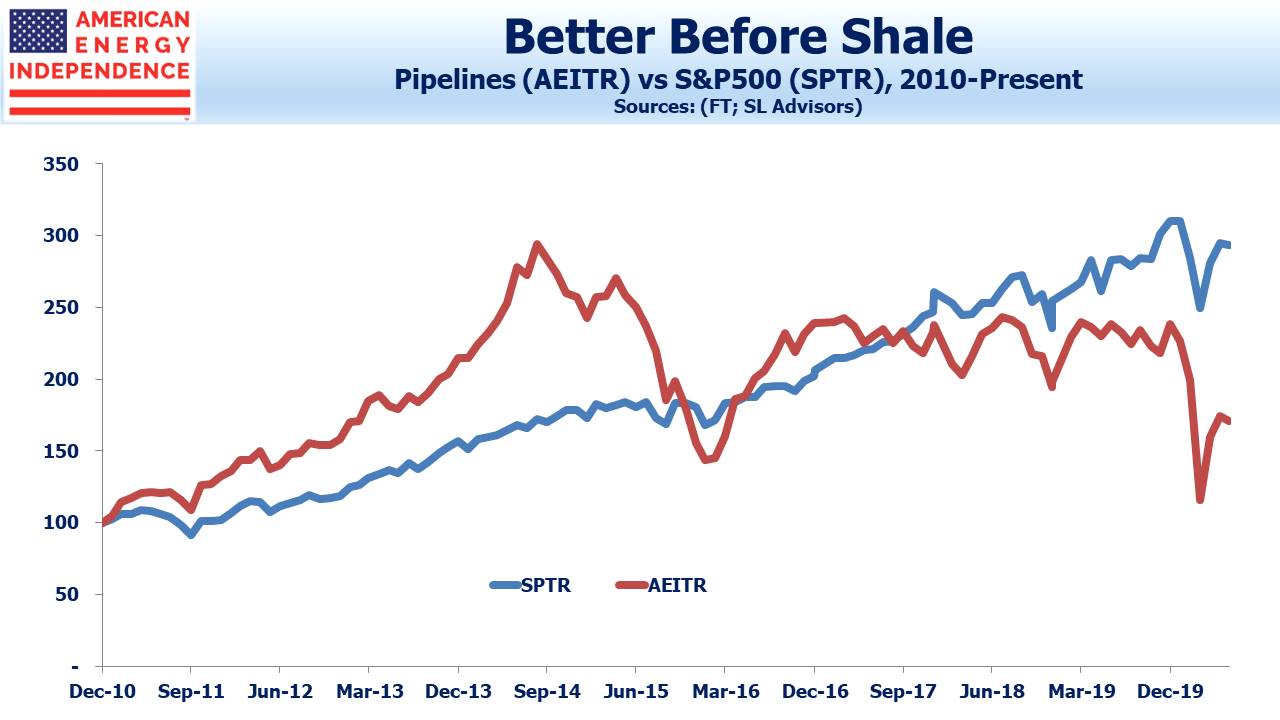

The pipeline sector offers 7% yields, growing free cash flow and strong recent performance. It has been out of favor more often than not in recent years, but Joe Biden’s arrival at the White House has ushered in rising energy prices with less growth spending (see Is Biden Bullish For Pipelines?). Investors are warming to policies that encourage parsimonious funding of new projects, something that eluded them during Donald Trump’s presidency.

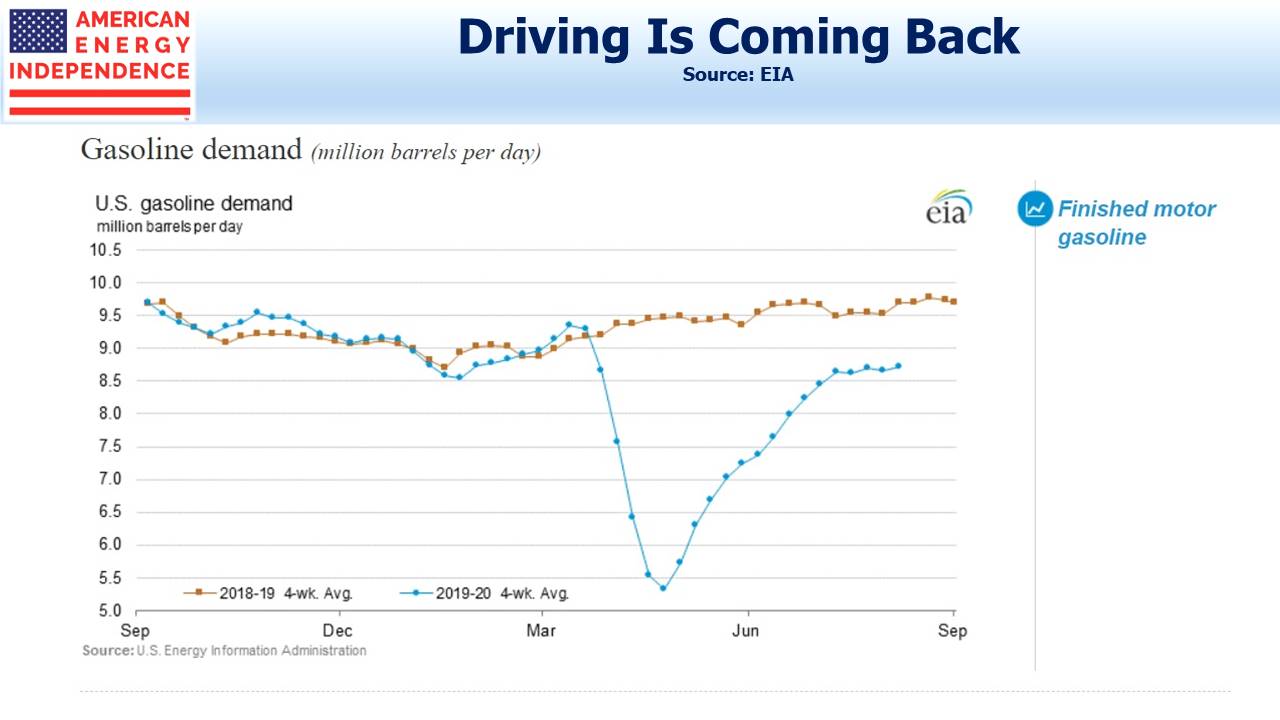

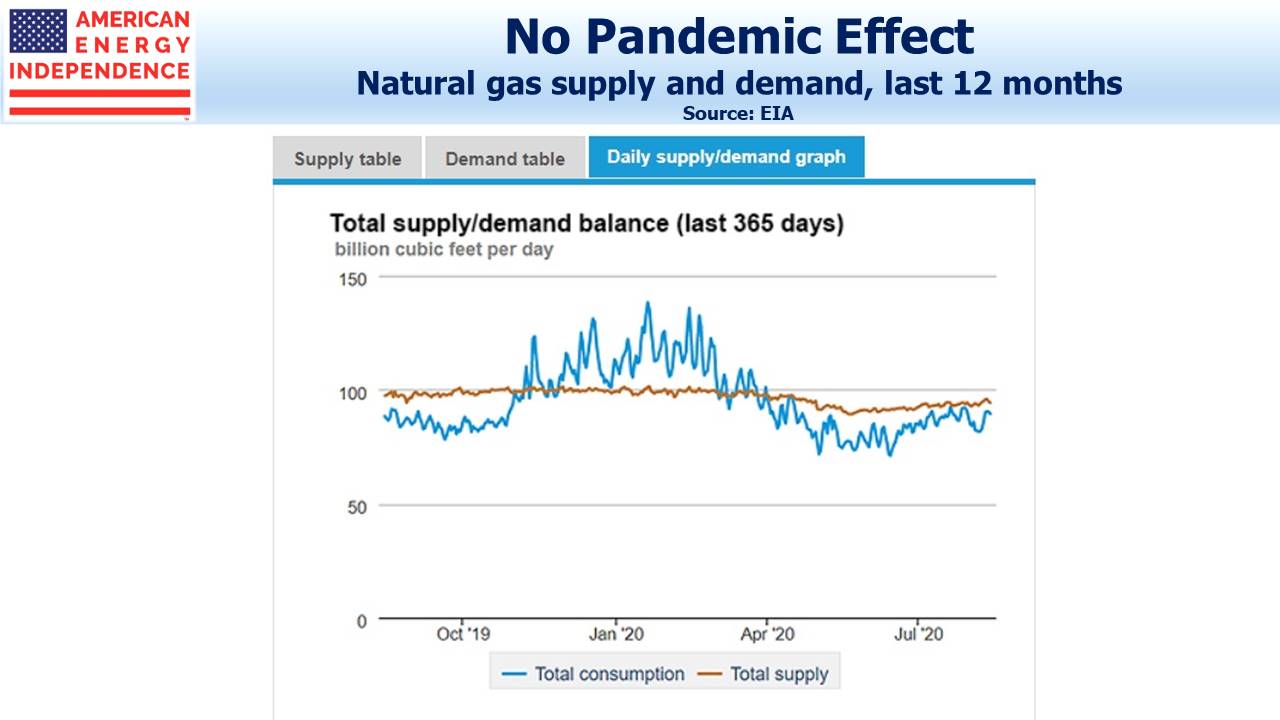

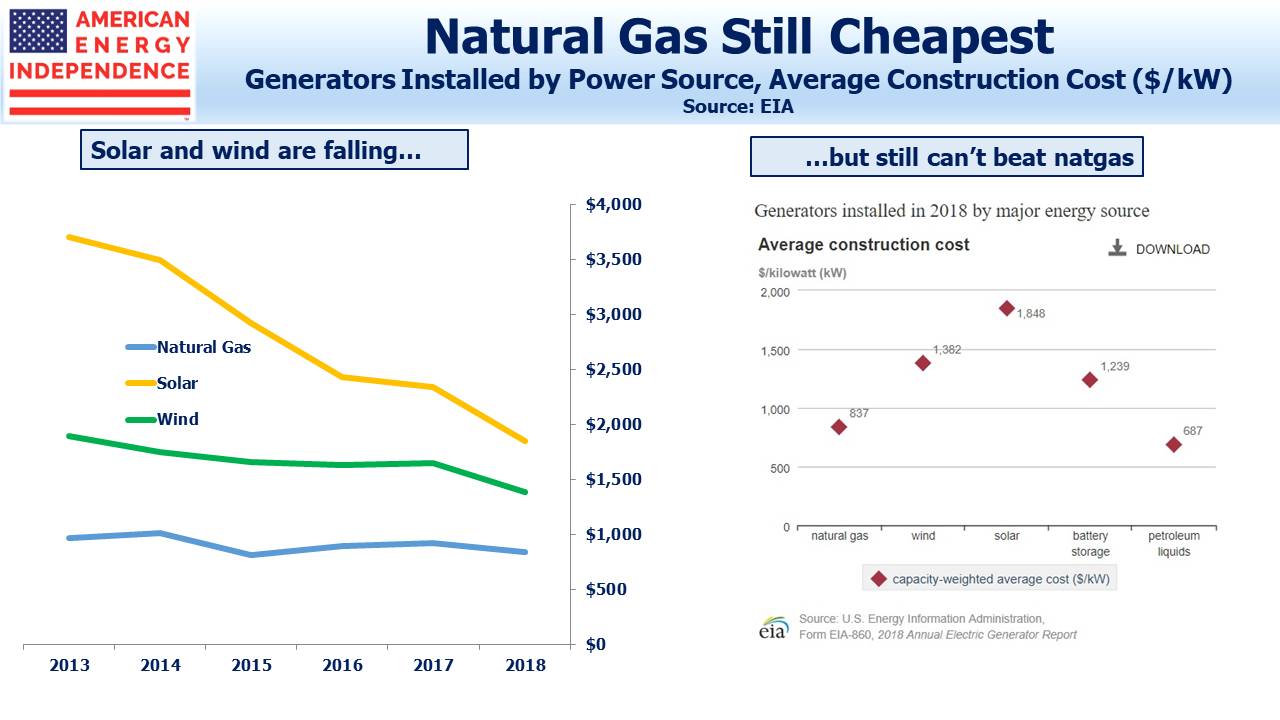

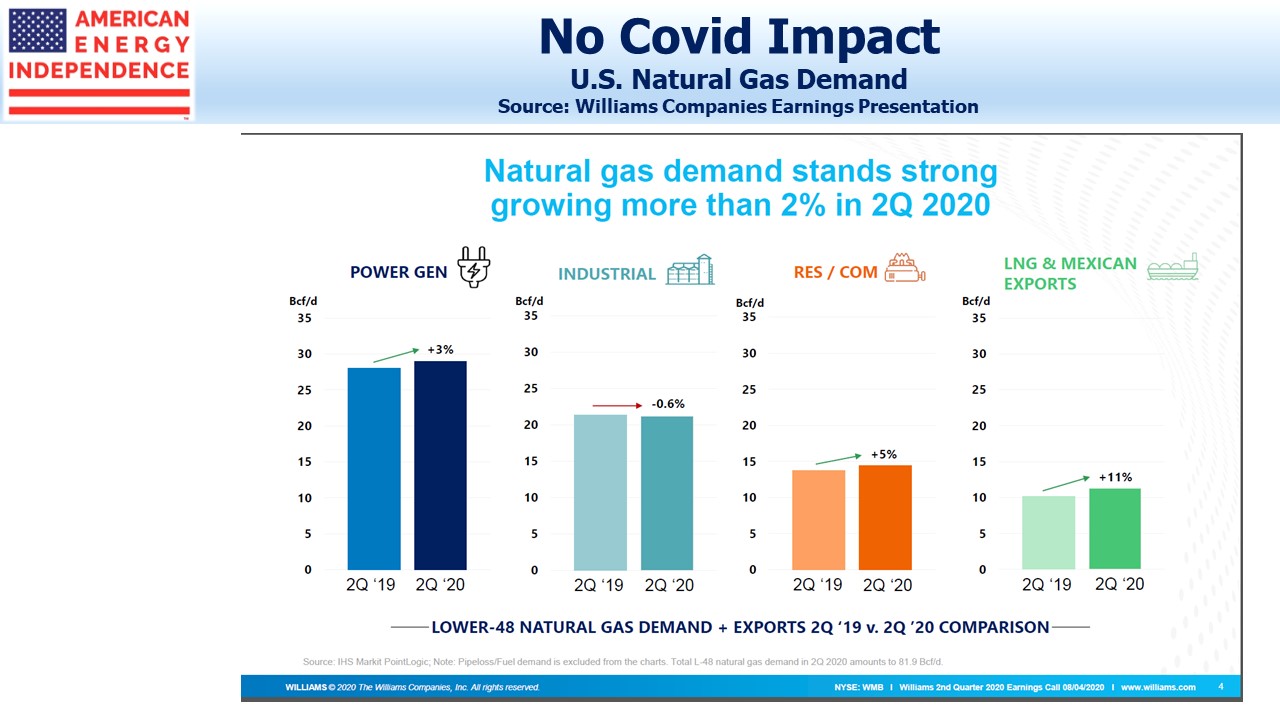

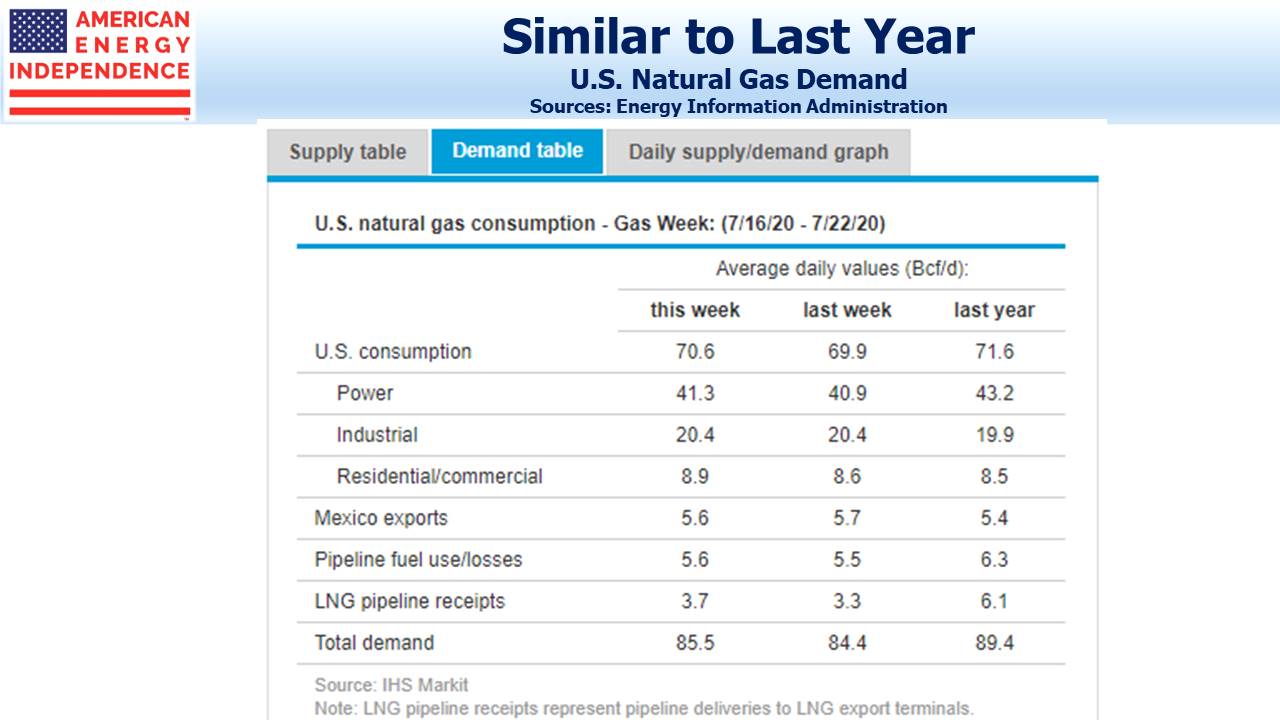

Some may avoid pipelines because of historic volatility, although operating performance last year was scarcely affected by Covid. The energy transition deters others, although a pragmatic desire not to wreck the economy means natural gas retains its bright future as part of the solution to reducing emissions. A third cohort thinks fossil fuel companies are bad, even though it’s how the world has reached today’s living standards. There’s a belief that the energy sector has much to apologize for.

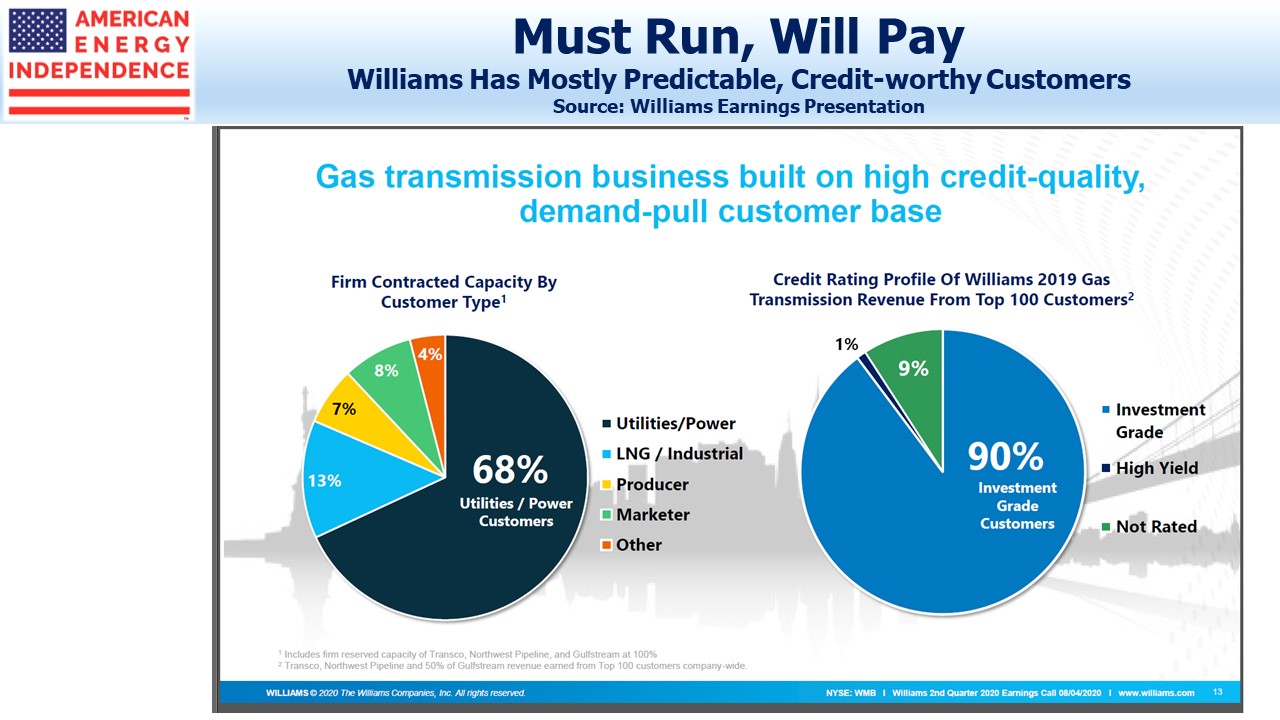

It may surprise this last group to learn that ESGU has a 2.5% weighting to energy, virtually indistinguishable from the S&P500’s 2.6%. ESGU holds Kinder Morgan (KMI), Cheniere (LNG), Oneok (OKE), Targa Resources (TRGP) and Williams Companies (WMB), all components of the American Energy Independence Index. Relative to the S&P500 it has modest overweights in Chevron (CVX) and Exxon Mobil (XOM). It also overweights Nextera Energy (NEE), one of the largest producers of electricity from natural gas.

ESGU has some interesting underweights, including Alphabet (GOOG) and Microsoft (MSFT) both companies with plenty to say about their ESG credentials. Clearly ESG-ness isn’t a binary issue, or Facebook’s dual share class would knock them out on the Governance scale. Instead, it trims them to 1.81% in ESGU versus 2.06% in the S&P500. Berkshire Hathaway (BRK) is ESGU’s biggest underweight, at 0.84% versus 1.47%. Those omitted from ESGU are an eclectic bunch, including Tyson Foods (TSN) and Boston Scientific (BSX). The complete absence of airlines in ESGU fueled some of its outperformance. Covid crushed the sector rather than any ESG shortcomings.

These differences are trivial, which means ESGU looks a lot like the S&P500 and tracks it closely. For the past couple of years, their daily returns are 0.99 correlated, and ESGU has outperformed by 2.1% p.a. It’s unlikely that ESG-run companies offer better long-term performance than the market. More likely is that investors just want to own them a little more, which is boosting their stock returns.

Index providers continue to compete to be the market standard for ESG-ness. Current standards vary. Since probably every member of the S&P500 has ESG slides in its investor presentation, it’s hard to avoid virtue-claiming companies.

If ESG doesn’t impact operating results, then eventually ESG funds will underperform the market because buyers will have overpaid. But for now, metrics from the past two years tempt the virtue-signaling investor – good odds of roughly tracking the market, some chance to beat it and the claim to morally higher ground than one’s peers.

The substantial overlap between ESGU and the S&P500 simplifies the choice facing an ESG-motivated investor. ESGU’s portfolio signifies approval of almost the entire S&P500. There’s no discernible difference in virtue between an investor in ESGU or the S&P500 itself. What ESGU does offer is a small bet on continued flows into ESG funds.

ESGU’s energy holdings represent an endorsement. An investor hesitating to take advantage of the high yields and growing free cash flow of pipelines because of a misplaced concern that her liberal friends may frown can point to ESGU for absolution.

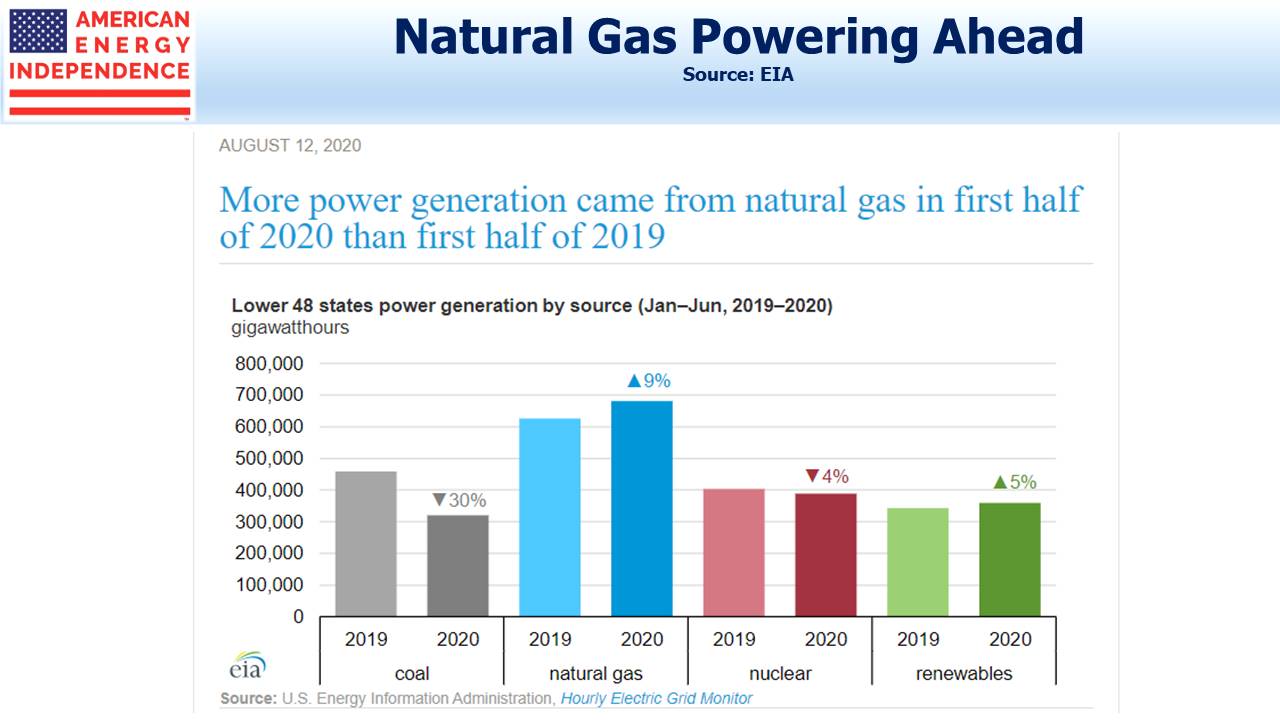

Energy, and pipeline companies specifically, sit at market weight or better in many of the biggest ESG funds. They should – coal to natural gas switching in the U.S. has done more than renewables to lower emissions over the past decade. U.S. exports of liquified natural gas offer other countries the opportunity to emulate our success. Pipelines are ESG.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.