Energy Demand After Covid-19

Client meetings for many businesses have had to conform to local Covid-19 restrictions. Most of us have found that working remotely is fine, although I suspect it’ll become increasingly problematic in the months ahead. As Zoom calls suddenly became part of daily life, we were all chatting with people with whom we had recently shared an office. Relationships already existed. But we’ll see how it goes when newcomers have to build a rapport over Zoom. Training is also harder. Remote learning is widely believed to have been a bust (see The Results Are In for Remote Learning: It Didn’t Work). Research is finding that students achieved only 70% of the reading gains compared with a typical year, and less than 50% of the Math. This is why it’s critical that schools reopen in-person in September.

Meeting with clients has to take place outside – the photos are from a recent breakfast with two long-time clients and friends, Ron and Jeff Karp from Summit Private Investments. In March all the large investment firms we deal with quickly suspended visits by outsiders. Every contact now carries some risk, and it’ll be interesting to see how much old attitudes are restored once the general population is vaccinated or otherwise immune. It’s likely that the risk of infection disabling an entire department or firm will be a permanent consideration, just as business continuity plans took on added importance following the 2001 attack on the World Trade Center. In finance, we can expect regulators to start looking at how firms protect their employees, as well as their plans if another pandemic occurs.

Nobody misses their daily commute into New York City from the suburbs. Numerous conversations reveal that the 2-3 hours of time previously dedicated to daily travel is highly valued. People will return to the office, but it seems that schedules have permanently changed. Mass transit in the New York area and presumably others is likely to experience a permanent drop in demand, which will pressure finances.

JPMorgan expects to operate with offices only half full, even once restrictions have been lifted. “Hot desks”, available to different users each day will be a used at least temporarily. I understand from a friend that satellite offices are being considered in the suburbs, where enough formerly commuting employees live. Edison, NJ and Stamford, CT are two locations apparently under consideration. Although big corporations will want a more dispersed labor force, they’ll also want their people working in a secure IT environment subject to corporate oversight.

Another friend from Goldman Sachs told me seasoned employees in his department will work from home two days a week, and that such schedules will be fixed — i.e. if Tuesday and Wednesday are your at-home days, you’ll generally be required to stick to that. Interestingly, new hires will be expected in the office five days a week, recognizing that working remotely relies in part on existing professional relationships that have been built through in-person interaction.

I’ve also heard that ground floor office space is becoming more sought after, because workers don’t need to use the elevator. The WSJ noted the other day that some employers, “…can’t figure out how to send people up a 50-story skyscraper.” This is because, “… limiting riders on some elevators would create dangerous crowding in lobbies.”

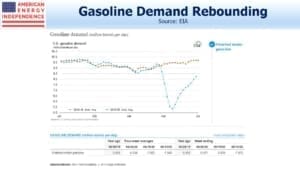

What does all this mean for energy consumption? U.S. gasoline demand has recovered to around 85% of last year’s levels, a surprisingly strong rebound given the recession. The re-imposition of types of lockdown in some southern states hasn’t yet shown up in the figures. But over the longer term, even when masks and social distancing are mostly a memory, some reduction in demand is still likely.

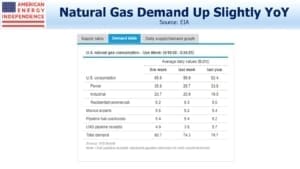

What receives less attention is the continued robust demand for natural gas. The latest weekly figures show total demand slightly ahead of this time last year, at 80.7 Billion Cubic Feet per Day. Across the midstream energy infrastructure industry, we calculate 58% is involved in natural gas with petroleum products only 26%. Although altered work habits are likely to dampen transportation demand, this is a smaller part of midstream than many realize. Earnings reports over the next few weeks will provide an important update on overall energy demand.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

One natural gas derivative not doing so well is the export of LNG, where shiploads have been cancelled (at a cost to the shipper). Part of that may be China.