Bullish News On Gas

/

Last week there were two pieces of news that confirmed the bullish long term outlook for natural gas. On Thursday the WSJ reported on the Behind The Meter (BTM) arrangements that are becoming common (see AI Data Centers, Desperate for Electricity, Are Building Their Own Power Plants). This is faster than connecting with the grid and by allocating the costs directly to the data center avoids fueling the developing political debate about how hyperscalers are driving up household electricity prices.

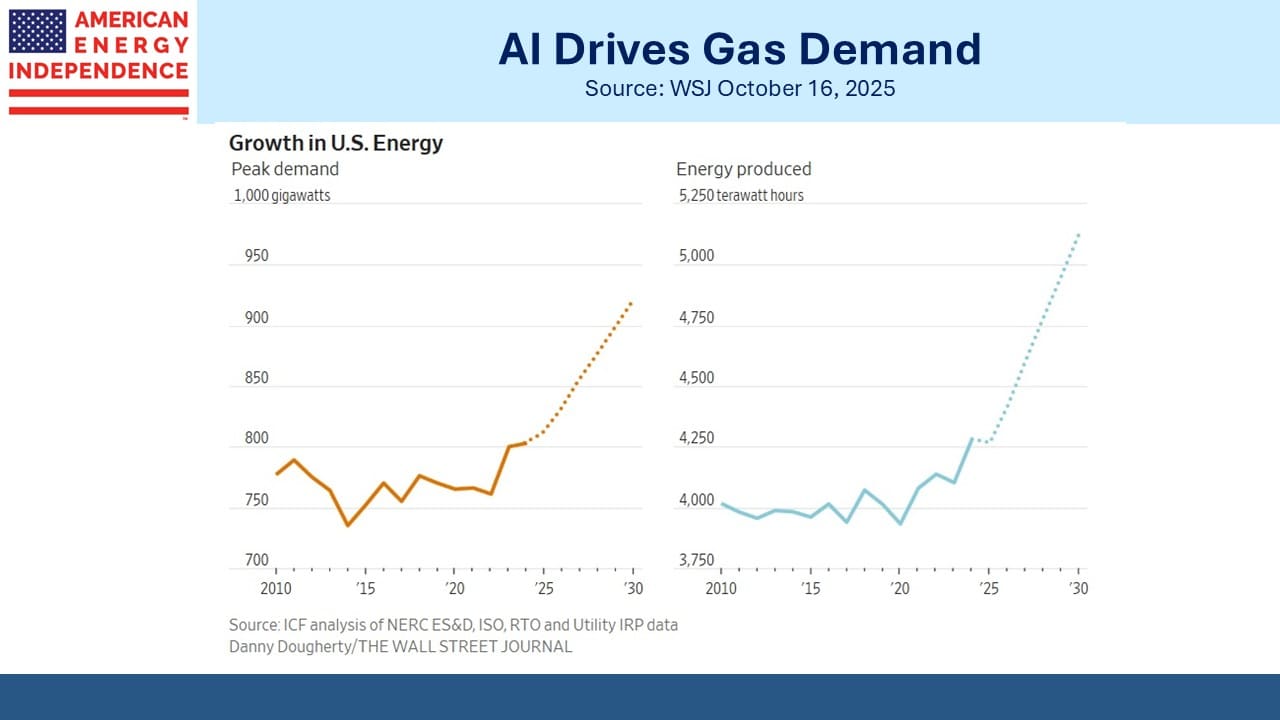

There were some powerful statistics in the report: data centers are expected to represent 12% of US electricity consumption by 2028, up from only 2% in 2020. Texas expects peak load to be 62% higher by 2030. Natural gas will be the energy source of choice because it’s available, reliable and cheap.

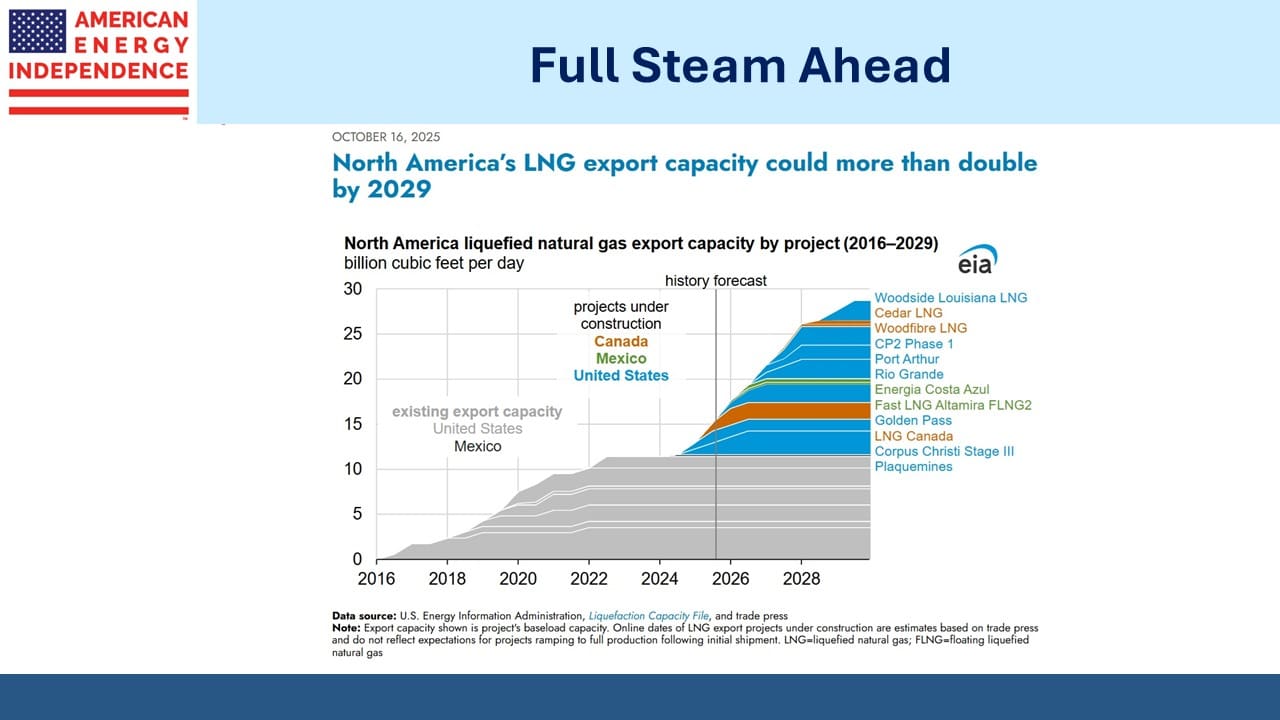

Also on Thursday the Energy Information Administration (EIA) updated their forecast for US Liquefied Natural Gas (LNG) export capacity, noting that it could double within four years.

LNG names have been weak. Venture Global remains under a cloud following their loss in arbitration to BP (see Gassy Isn’t Happy). Witholding expected LNG shipments in 2022 to exploit high spot prices following Russia’s invasion of Ukraine netted a big windfall that’s now at risk to further adverse arbitration decisions (see Nothing Ventured, Nothing Gained). But in our judgment the market has more than priced in that worst case outcome.

NextDecade announced Final Investment Decision and the close of financing on Train 5 of their Rio Grande LNG terminal, notably without issuing any new equity. They expect to start shipping LNG by 2027 although Train 5 will be operational four years later. This will bring their export capacity to 30 Million Tonnes Per Annum (MTPA).

Market leader Cheniere has current capacity of 45 MTPA although this will likely increase by 30 MTPA within five years. Their market cap is $48BN. VG expects to reach 100 MTPA by 2030 and is worth $22BN. NEXT has a market cap of $1.6BN.

Nonetheless, five plus years is a long time to wait for full cashflows from NEXT and the stock, most of which isn’t publicly traded, will likely be subject to periodic swoons in the meantime as has happened twice this year. But we think ultimately the return will be attractive.

I’ve been traveling through the southeast US this week visiting clients, from DC via Richmond, and on to Fort Mill, Columbia and Charleston all in South Carolina. Sector performance has been disappointing, but I’ve enjoyed many interesting conversations with long-time investors, and I can report that this group is comfortable with their midstream investments with some considering adding.

We’ve also been doing a lot of calls with clients, answering questions they may have, and reinforcing that we believe current prices represent an interesting opportunity. One investor told me we communicate more than any other investment manager he knows, which was a nice thing to hear. If you’d like to learn more, feel free to reach out.

We also held a webinar on Thursday – if you missed it, here’s a link to the recording.

I once again joined U-Vest’s Financial’s annual conference, held this year in LPL’s offices in Fort Mill, SC. U-Vest are long-time investors with us and it’s been wonderful to watch their growth over the years as they add new advisors and offices across Florida, Texas, Georgia and South Carolina. Mike Davino, Dustin Johnson and Nick Brinson are building a terrific business.

Progressives have always argued that power generation should rapidly shift to renewables. But solar and wind struggle with intermittency, land use, and grid integration. The current Administration’s hostility to both has added to these challenges, on top of which costs have been rising. Political risk around the quadrennial presidential cycle will temper enthusiasm for renewables for many years to come.

Consequently, we often get questions on nuclear power and whether that can meet some of the new demand for electricity from data centers, reducing the demand for natural gas. We’d invest in nuclear power if it offered visible recurring cashflows comparable to hydrocarbon infrastructure. Today it doesn’t, and the costly delays on the Vogtle plant in Tennessee, which was finally completed last year, are enough to dissuade any full-scale projects for now.

There’s lots of R&D into small modular reactors, but the timeline for these initiatives doesn’t match the urgency of hyperscalers in the AI race. However, supportive executive orders and legislation in areas such as tax credits and streamlined permitting are improving the odds that nuclear power will eventually play a larger role.

The US Army announced last week it is planning to add small nuclear power generation reactors on its bases around the world. The US Navy has for decades operated nuclear-powered aircraft carriers and submarines. But this isn’t a model for the civilian sector because they use weapons-grade plutonium, which no country uses for civilian purposes because of the risk of terrorists. The Army will rely on non-weapons-grade uranium, and it’ll be encouraging if this plan offers lessons that eventually benefit civilian use.

The prospects for reliable US energy look good.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!