Strengthening Your Portfolio With Pipelines

/

When conflict occurs that might disrupt global oil supplies, portfolios that include an allocation to midstream energy infrastructure usually enjoy some modest protection. Crude traded up 14% on Thursday night as the Israeli attack unfolded. Some opportunistic hedging by producers trimmed those gains during the day. Energy stocks as usual responded positively.

The effect on midstream is more subtle. The sector is less responsive to commodity prices than in the past. It may enjoy a brief lift as positive energy sentiment spills over, but management teams don’t generally obsess too much about oil. This time may be different, because weak crude prices have constrained US oil production with some even forecasting it may drop next year. Friday’s higher prices benefitted Oneok and Plains All American, which might see more robust volumes through their systems if higher prices persist.

Crude weakness this year has also curbed inflation expectations. The partial reversal explains Friday’s weakness in bonds. According to Wells Fargo, around half the midstream sector’s EBITDA is tied to contracts that allow price hikes linked to the PPI. In 2022 this was a significant benefit since midstream companies were able to raise prices in line with inflation. This supported the sector’s 22% return that year, a sharp contrast with the S&P500’s -18% return as the Fed tightened rates.

On Friday, midstream outperformed the S&P500 by 1.5%. But the diversification benefits of midstream last for more than a couple of days. Most investors have significant technology exposure, since it’s now almost a third of the S&P500. Several articles have been written about the evolution of the market’s leading index towards a basket of growth stocks.

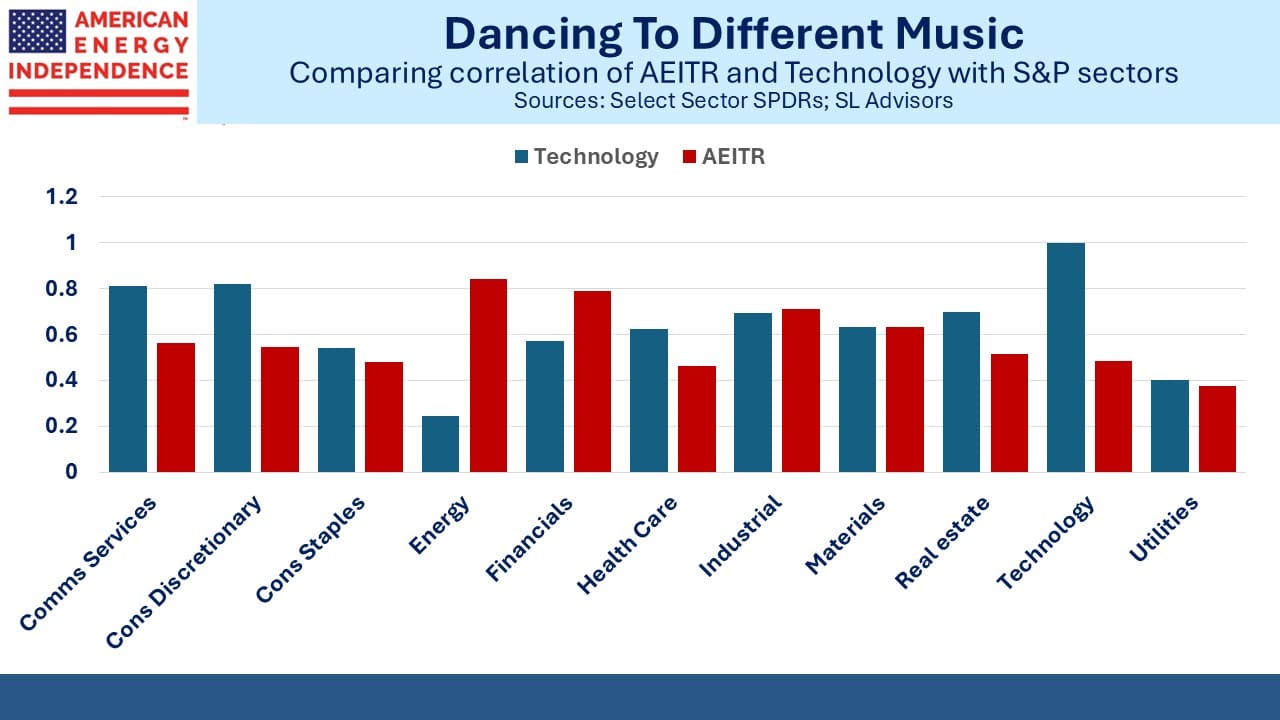

Midstream energy infrastructure, defined here as the The American Energy Independence Index (AEITR), is less correlated with most S&P500 sectors than is the Technology sector. The two sectors where this is significantly not the case are the energy sector itself and financials. It has only half the correlation to the S&P500 as Technology, unsurprisingly given the shifting composition of the index. But for Communication Services, Consumer Discretionary and Healthcare the AEITR is also less correlated to these sectors than is the Technology sector.

It also doesn’t hurt that when markets are considering whether Israel will strike Iran’s energy infrastructure, the AEITR is all in North America well out of harm’s way. The Strait of Hormuz is widely recognized as a chokepoint for Middle East oil exports. Less attention is paid to the vulnerability of trade in Liquefied Natural Gas (LNG), 20% of which passes through the same stretch of water from Qatar and the UAE.

Last year Qatar exported 80 million metric tons of LNG, making them the third biggest exporter behind the US and Australia, with 19% of global trade. 70% of Qatar’s exports go to Europe and 20% to Asia. We were surprised that so far neither of the regional LNG benchmarks have responded much to the same concerns that have boosted oil prices, even though buyers have limited alternatives.

US LNG exports don’t face the risk of a Middle East war disrupting supplies. We think that the reliability of the US as a supplier could become more highly valued as buyers contemplate worst case scenarios for the product.

We still see attractive opportunities among LNG stocks.

Venture Global received a boost last week when they withdrew their application to build the Delta LNG terminal, because they believe they can achieve an equivalent capacity increase by expanding their Plaquemines facility. VG has earned the respect of many for their relatively fast project execution.

NextDecade announced that they have reached agreement with Bechtel Energy to build Trains 4 and 5 of their Rio Grande LNG terminal. We think it’s possible that NEXT will make a Final Investment Decision (FID) to go ahead with this second stage before the end of the year.

Israel halted production at its Leviathan natural gas field, operated by Chevron, due to security concerns. Within hours Egypt, which depends on gas imports, began shutting factories.

Russia’s invasion of Ukraine made energy security a higher priority. The war in the Middle East will likely add to that. We continue to think that US LNG exports will be highly valued by America’s friends and allies around the world.

For many investors, midstream appeals because of the stable dividends well covered by cashflow and declining leverage. Few consider the diversification benefits of an allocation or the sector’s resilience to disrupted energy supplies. The events of recent days have highlighted these additional positive features.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!