Gas Exporters Keep Growing

/

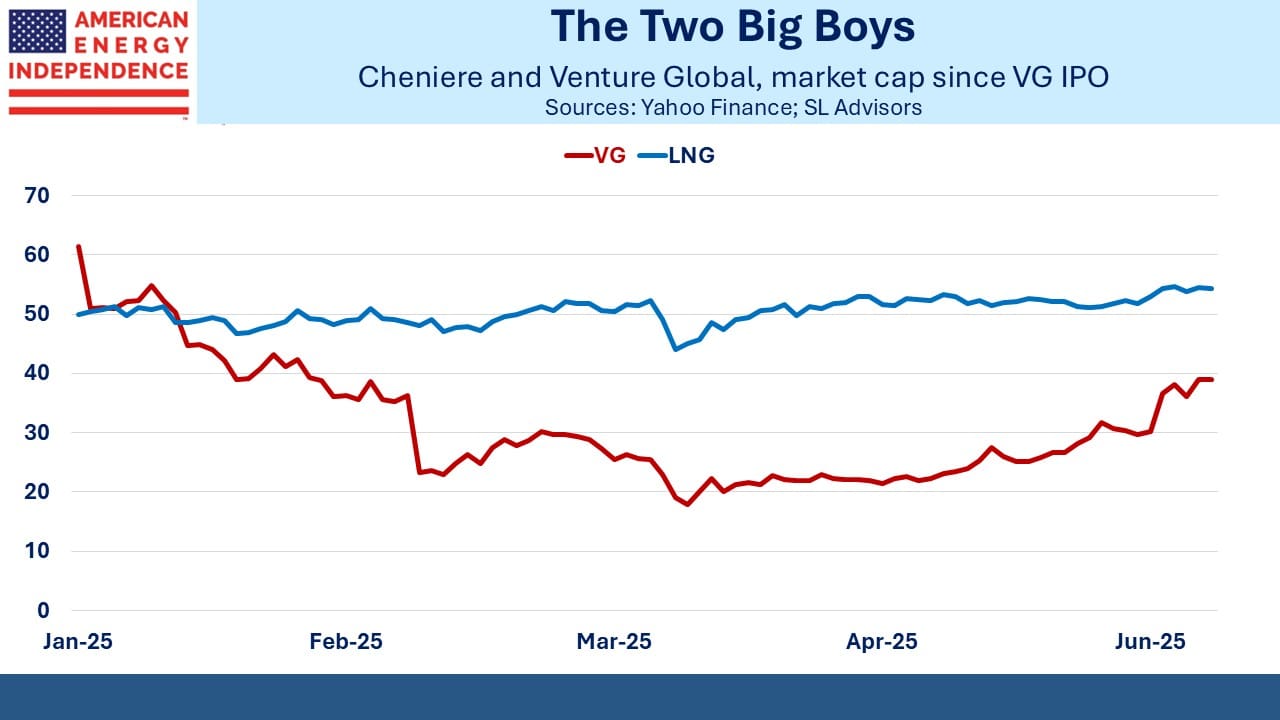

Venture Global (VG) continued its post-IPO recovery last week. Back in January price talk was above $50 which would have valued the company at double market leader Cheniere. Pushback from institutional investors reduced the IPO price to $25, but it quickly sank below this (see Nothing Ventured, Nothing Gained).

VG has earned a reputation for fast construction of LNG terminals using a modular approach. They’ve also been willing to antagonize big customers. When European LNG prices spiked in 2022 following Russia’s invasion of Ukraine, VG held off making contracted deliveries so they could take advantage of the suddenly high prices themselves. S&P Global estimates this netted them windfall profits of $3.5BN, which their contracted buyers including Shell and BP believe should have been theirs.

VG was contracted to start LNG deliveries once Calcasieu Pass LNG was “commissioned” (fully operational). The parties have different interpretations of what this means, and the dispute has gone to arbitration. The downside case for VG is they have to pay $3.5BN. Future LNG buyers are likely to negotiate quite carefully with them. TotalEnergies has said they don’t want to do business with them.

VG is looking like another Energy Transfer – a combative approach to business combined with great execution.

Regular readers know we like exposure to America’s growing LNG story, but we initially avoided VG because we thought it was overpriced. We later took a small position.

Last week FERC gave final approval to VG’s third export facility, CP2 LNG. The company announced that construction would begin immediately. VG and Cheniere are competing to be the biggest US exporter. As each company makes a new announcement, they leapfrog the other.

Once completed, CP2’s 28 Million Tons per Annum (MTPA) will take VG’s total capacity to 66.5 MTPA. The company expects it to begin operations in 2027. Whether contracted buyers actually take delivery will depend on the strength of their contracts and whether geopolitical events have created a lucrative spot market.

Cheniere’s current capacity is 46 MTPA with another 8 MTPA under construction. CEO Jack Fusco has said the company plans to double its capacity by expanding their existing facilities at Sabine Pass and Corpus Christi on the Texas gulf coast.

Between the two companies, they plan to have capacity of almost 19 Billion Cubic feet per Day (BCF/D)

US natural gas production averaged 113 BCF/D last year, with LNG exports taking 12 BCF/D. Cheniere was around half of that. The US Energy Information Administration (EIA) expects 14.2 BCF/D of exports this year. At last year’s rate European buyers will account for three quarters of this.

The US is the world’s biggest LNG exporter and looks likely to stay that way.

Given the increasing demand from export terminals as well as data centers, US natural gas prices are likely to move higher over the next couple of years.

The power needs of data centers are about to become a political issue. PJM Interconnection, which operates the country’s largest grid across a swathe of the eastern US extending from Illinois, expects costs to rise by $9.4BN. This has been blamed on new data centers by PJM’s watchdog. Much of this is attributed to Virginia and Maryland, where data centers proliferate.

Brian George, who leads global energy market development and policy at Google, conceded that, “We are now imposing a significant cost on the system.”

New Jersey’s Democrat governor Phil Murphy has announced a $430 million initiative to subsidize bills for poorer households. Your blogger lives in New Jersey, doesn’t like Phil Murphy and doesn’t expect to receive a reduced electricity bill. However, the increased demand for natural gas is welcome.

Tier 4 data centers have an expected uptime of 99.995%, which equates to about 26 minutes of downtime annually. According to Morgan Stanley, Bill Schweber, an electronics engineer, wrote for EE Times that AI data centers require 99.99999% uptime, which equates to being down only 3 seconds a year.

Renewables are entirely inadequate in this regard. The hyperscalers building data centers are quickly compromising their green energy goals. Because combined cycle natural gas turbines have a backlog of as much as five years, smaller single cycle turbines are being snapped up. These are less efficient, but there’s a scramble for electricity.

Congressional support for solar and wind is crumbling as the 1BBB makes its way through the Senate. Some Republican legislators from states benefitting from tax credits in the Inflation Reduction Act (IRA) have been pushing back against plans to cut or eliminate them. But a Politico Energy podcast reported last week that Senator James Lankford (R-OK) from a windy state thinks they need more reliable energy such as natural gas to provide baseload power and meet the needs of data centers.

Gas demand continues to grow.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!