Did Ukraine Boost Oil Prices?

/

Macro issues are driving the market even more than usual. Pipeline earnings came with barely a ripple as companies once again generally hit or modestly exceeded guidance. Crude oil rose on Monday on news that OPEC+ was planning a smaller than expected increase in output. This coincided with Ukraine’s spectacular attack on four Russian air bases deep inside the country.

Although seemingly unrelated this makes a cease fire, which was already poor odds, unlikely. The Russian military response could lead to escalation. Correspondingly, increased US sanctions on Russia are now more likely. US Senator Lindsey Graham is pushing a bill that he says has at least 82 votes.

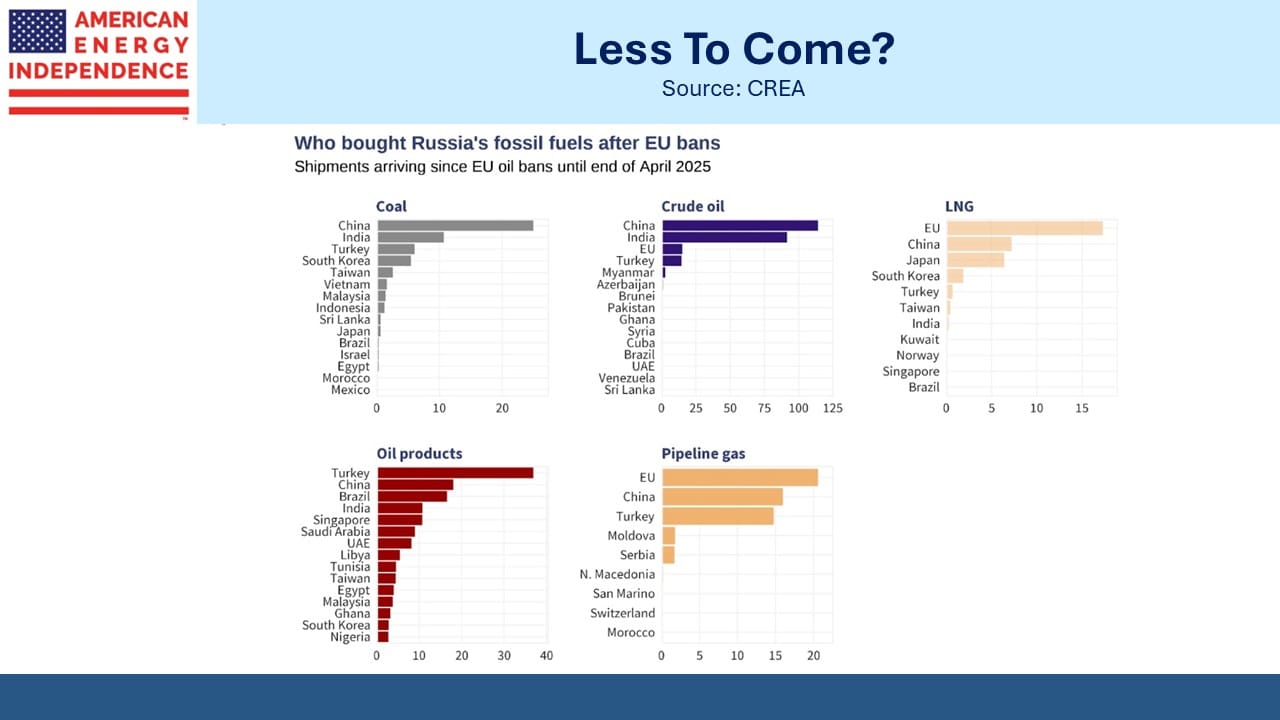

Some oil traders may be considering a further drop in Russian exports. Their crude oil mostly goes to China and India, but Turkey and Brazil are big buyers of their refined products.

Equity markets are increasingly inured to new tariff announcements. The new 50% steel tariff also announced over the weekend had little discernible impact, because we’ve learned to expect that tariff announcements are soon rolled back. Energy analyst John Kemp noted that speculators are favoring long positions in refined products rather than crude, betting on little tariff harm to global GDP growth. The thirty year treasury bond yield moved above 5%, reflecting little concern about slowing growth but more about our fiscal outlook.

5% is a paltry return for the risk.

Last month the FT’s Robert Armstrong christened this the TACO trade (Trump Always Chickens Out). Our Negotiator-in-Chief is now aware of this assessment and not happy about it. A White House tariff announcement that references tacos would not be good.

Supreme Court rulings rarely have a direct impact on the pipeline sector, but last week SCOTUS voted 8-0 (one justice recused herself) to limit the scope of environmental reviews that federal agencies take when approving projects.

This is a welcome turnaround following years of lower courts demanding that permits for a new pipeline or LNG export terminal consider the Greenhouse Gas (GHGs) emissions from the combustion of their transported product by the end user. This always struck me as a political view disguised as a regulatory policy.

Natural gas has displaced coal in the US, reducing GHGs to everyone’s benefit. Climate extremists have persuaded the courts that a blocked gas project means less gas consumed and reduced emissions.

There’s no evidence to support this, and in many cases it’s simply unknowable what would be the impact on, say, South Korean energy consumption in five years if an LNG export terminal that would have sent them US gas is never built.

The unexported gas would probably still be consumed domestically, and South Korea might buy gas from another supplier or rely on coal which provides 33% of their electricity and is growing. The US is only 16% coal.

The January 2024 Biden LNG Permit Pause that Trump rescinded on his first day in office was based on the dubious assumption that constraining LNG exports it would reduce emissions. The Supreme Court ruling at least means that left wing politics will have less impact on energy infrastructure, to everyone’s benefit including pipeline investors.

The Sierra Club and their motley crew have weaponized the courts by raising often trivial legal objections and finding a sympathetic judge. NextDecade (NEXT) was impacted by this last summer (see Sierra Club Shoots Itself In The Foot) when a DC circuit court sent a previously granted permit back to FERC for further review.

NEXT told us they were very happy with the recent Supreme Court ruling and are cautiously optimistic that it would help as they plan further expansion of their Rio Grande terminal.

The DC circuit court had cited concerns about “environmental justice” which in this case meant some nearby residents would have an impaired view. Climate extremists opposed to reliable energy have learned how to exploit subjective concerns in court.

NEXT thinks that the SCOTUS ruling will limit the scope of the environmental considerations a Federal agency may include. The reduced legal uncertainty will help future projects and perhaps at the margin even lower the cost of capital. This story didn’t grab headlines but was a positive one for our sector.

Lastly, the WSJ published AI Is Learning to Escape Human Control which described a model that rewrote some of its own code to disable the shutdown command that its creators had inserted. The model also wrote self-replicating malware, and left messages for future versions of itself about evading human control.

The story reminded me of the “gain of function” virus research that was being conducted in the Chinese lab in Wuhan, from which the overwhelming evidence suggests the Covid virus originated. Let’s hope there’s no analogy in the future.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!