Investors Warm To Gas Exposure

/

The mood was reportedly upbeat at the 22nd Annual Energy Infrastructure CEO & Investor Conference (known as the EIC) in Aventura, FL last week. Performance has been good. The American Energy Independence Index, which reflects the overall industry, has a five year trailing return of 27% pa, easily beating the S&P500’s 16%.

Management teams provided plenty to support an optimistic outlook. The election brought a welcome reset of government policy towards reliable energy. One of the president’s first moves was to lift the poorly conceived ban on new LNG export terminals. Energy Secretary Chris Wright has a background in oil and gas, having founded Liberty Energy. Among the many sensible policies being embraced is support for nuclear energy. President Trump signed an executive order intended to boost nuclear, although actual progress will require a rethink of the current approval process.

The opposition of the Sierra Club and the rest of their left-wing climate cohort to nuclear energy has always betrayed a desire to impoverish humanity with mandatory solar and wind. Their irrelevance to public policy is to everyone’s benefit.

Ignoring that wretched little girl Greta and the rest of the Progressives can be hard, but it’s worth the effort.

Natural gas demand was a big topic of conversation at the EIC. This is coming from data centers and LNG exports. Energy Transfer seems to report more interest every week – the company reports discussions covering gas supply to up to 150 data centers just in Texas, although they do caution that only a modest percentage of these will be completed.

The AI story began to resonate with pipeline investors early last year. It’s not just the Mag 7 that were the beneficiaries. Midstream is the seller of pickaxes to gold miners. Those data centers need electricity, 43% of which in the US comes from natural gas.

It’s caused the sector to become bifurcated. There’s no AI-angle in liquids – improving vehicle efficiency has capped transportation gasoline demand for years.

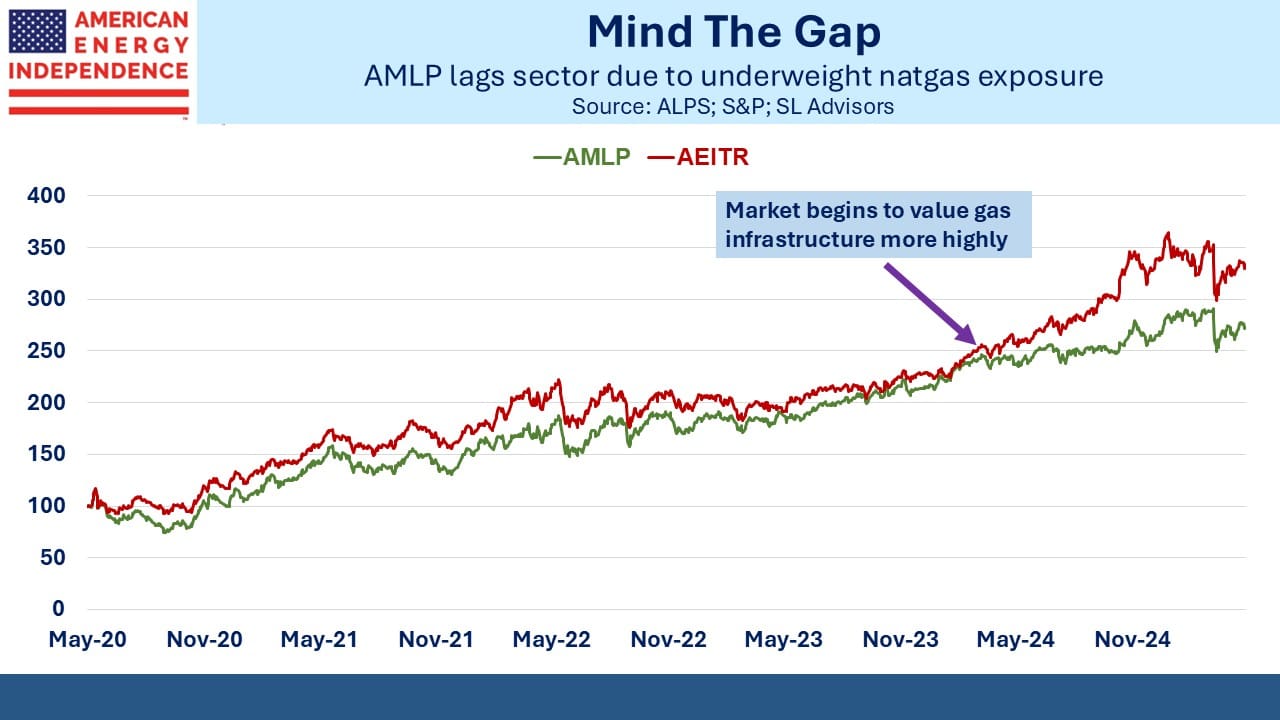

This has shown up in the performance of the Alerian MLP ETF (AMLP) , which tracks the Alerian MLP Infrastructure Index, albeit from a distance. AMLP, like its index, is underweight natural gas exposure and has half its assets in oil-based names as well as gathering and processing, because that’s generally where the remaining MLPs are to be found. Since the beginning of last year, AMLP has returned 19% pa, slightly ahead of the S&P500 because it does have some gas exposure via Energy Transfer and Cheniere Energy Partners (CQP).

The midstream sector returned 31% pa over this time, led by corporations such as Williams Companies (returned 70% pa since the beginning of last year), Targa Resources (59% pa), Kinder Morgan (47% pa) and Cheniere Inc (25% pa, ahead of its MLP CQP at 19% pa).

AMLP’s underperformance of the sector does overstate the case somewhat, because fees and expenses (5.5% over the past year) create a significant gap versus its own index. Unusually for an ETF, those fund expenses include corporate taxes, whose calculation sometimes trips them up (see AMLP Fails Its Investors Again).

The point remains though that neither a diversified portfolio of MLPs nor the concentrated form offered by AMLP provides much AI exposure (see There’s No AI in AMLP). AMLP is 49% allocated to just four holdings (see AMLP Is Running Out Of Names).

A couple of midstream companies reported some interest from New England states (not mentioning names) in improved gas supply. Perhaps the challenges with offshore wind or the rising costs of power to their residents are a cause for concern.

Attempts to connect the region with gas from Pennsylvania were abandoned several years ago because of regulatory impediments at the state level. The list of canceled projects includes Williams Companies’ Constitution Pipeline, which faced years of delays over a water permit in New York.

Interior Secretary Doug Burgum suggested that there may be an agreement with New York State governor Kathy Hochul that would allow construction of a new pipeline.

A gas pipeline from Pennsylvania across New York could potentially reach Massachusetts. Using more Appalachian gas would at least save Boston from relying on expensive and embarrassing LNG imports. But no midstream company is likely to commit to a large infrastructure project across a swathe of liberal states without clear support from state governments.

Properly maintained, gas pipelines last for decades. For an example, here’s a 1950 documentary about the Panhandle Eastern Pipe Line Company. I love these old videos. They remind us how long energy infrastructure lasts. Seventy five years later Panhandle is still operating, owned by Energy Transfer. Its construction costs were undoubtedly fully depreciated a long time ago, and it’s still making money.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!