Energy Policies Are Moving Right

/

Data center demand for natural gas was the big energy story last year. Wells Fargo referred to “a momentous year for midstream” with this as the biggest driver. It’s been consistently cited by JPMorgan and Morgan Stanley.

Wells Fargo calculated that C-corps outperformed MLPs by 23%. This was a substantial difference and means that the Alerian MLP ETF (AMLP) underperformed the S&P500 in a year when midstream generally beat the market by 20%. This is partly because MLPs are perennially “cheap” since their investor base is limited to wealthy Americans willing to tolerate a K1. US tax-exempt and foreign institutions face onerous tax liability and reporting requirements, so generally avoid MLPs. Retail investors don’t want K1s.

The other reason MLPs lagged is that pure-play natural gas names began converting to c-corps following a ruling from FERC in 2018 that prevented them from including their equity holders’ tax liability in calculating their required return on pipeline tariffs. So today MLPs have limited direct exposure to the biggest story in midstream – data center power demand to be satisfied mainly with natural gas.

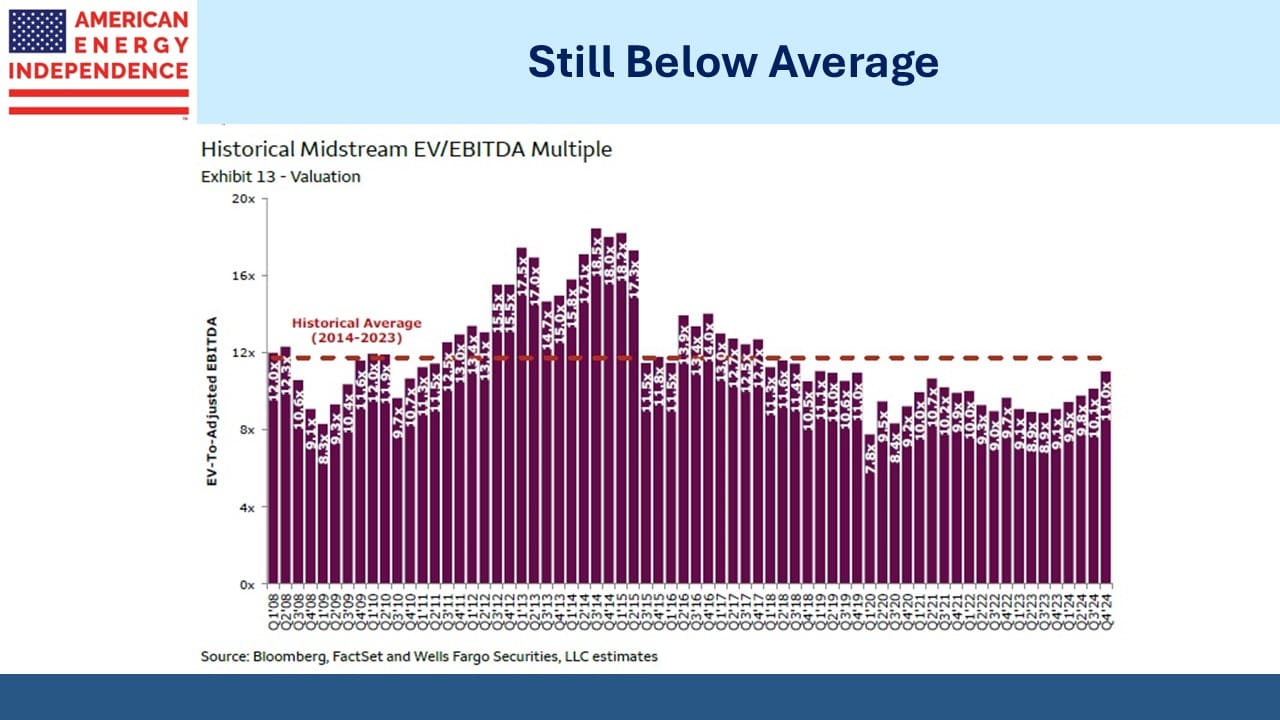

Valuation as defined by Enterprise Value:EBITDA (EV:EBITDA) has risen to 11X, close to the 12X ten year average. However, a move to 12X would be more appreciative than it might appear. Since midstream companies typically finance their assets with around 50% debt, an EV:EBIDTA move from 11X to 12X, roughly a 9% increase in EV, would be double that on the company’s equity since their debt obligations would clearly be unaffected.

2024 was an exceptional year. Nonetheless, the math suggests that a reversion to the mean for valuation, plus a 5% dividend yield, could generate a total return of around 23%. We’re not predicting such. But energy is incoming President Trump’s favorite sector.

Dividend yields are close to the ten year treasury, historically very tight. However, this relationship has lost relevance. Dividend coverage has moved higher in recent years as c-corps have become more prevalent. The old MLP model of paying out 90% of distributable cash flow no longer prevails, with payout ratios of 50-60% common today.

JPMorgan’s Eye on the Market Outlook 2025: The Alchemists was published on January 1. I occasionally interacted with Mike Cembalest, the author and Chairman of Market and Investment Strategy for J.P. Morgan Asset & Wealth Management, 20 years ago when I worked there. I enjoy his writing as much as anything I read. It is deeply researched and full of insights.

In discussing AI, data centers and the growing demand for power from “hyperscalers” (ie Google, Meta, Microsoft, Amazon etc) the report noted: The hyperscalers will probably have to hyperscale back their commitments for green power consumption and rely heavily on natural gas, as they have been.

US natural gas prices have risen 44% so far this year (as of January 6). Winter storm Blair is the reason, not AI. Even so, $3.70 per Million BTUs (MMBTUs) remains far below global prices. Futures on the European TTF benchmark and Asian JKM are both trading in the $14.50-15 range.

US energy remains cheap. Whenever I walk past a store on a hot day with its doors open, using its air conditioning to draw in shoppers, I’m reminded how rare such a sight is elsewhere in the world. Increased US LNG exports over the next few years will benefit our trade partners, reduce coal consumption and modestly lift US prices. It’s a small price to pay.

The pendulum is swinging back from progressive ideas such as uncontrolled immigration and switching to renewables with no cost-benefit analysis. Canada is the latest country to chart a new direction as PM Justin Trudeau concluded when he resigned on Monday. Conservative leader Pierre Poilievre has promised to cancel the country’s much hated carbon tax, which is set to rise to C$170 per metric tonne (US$119) of CO2 equivalent by 2030.

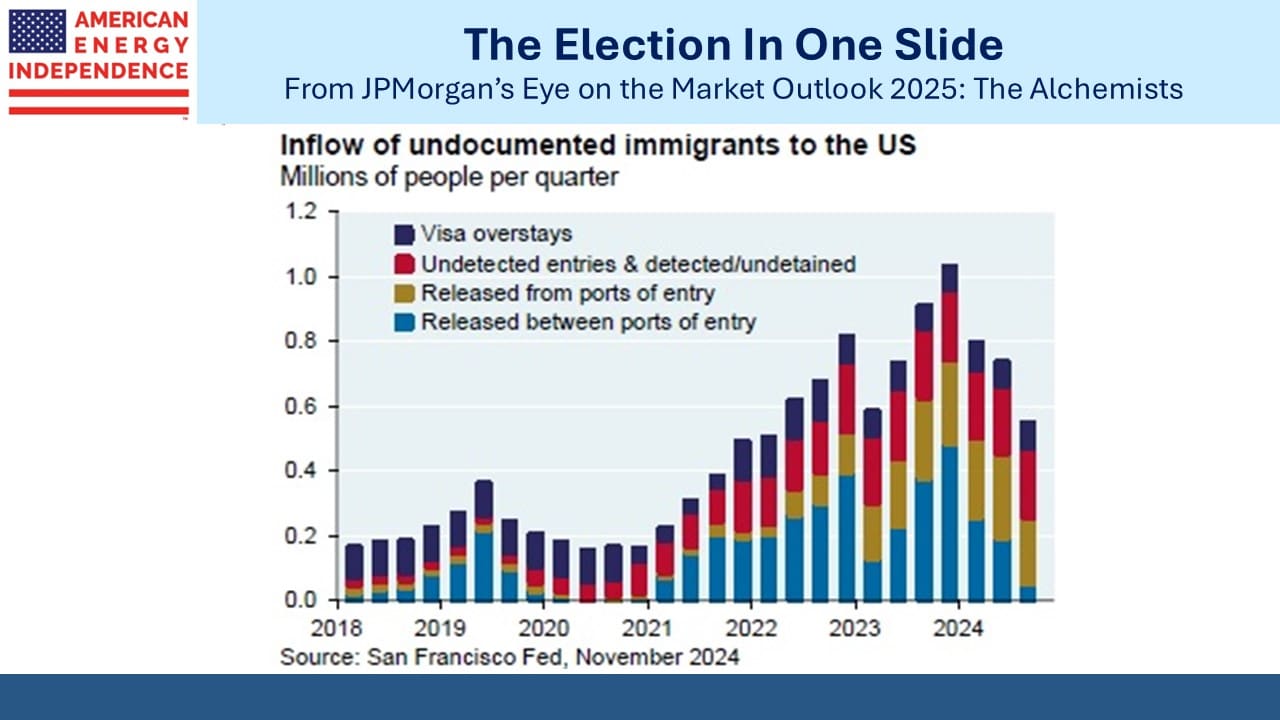

The chart on illegal immigration included in Mike Cembalest’s annual outlook caught my eye more than most, along with this explanation: Biden immigration policies directly led to the largest unchecked, uncontrolled and unmanaged migrant surge on record which will negatively impact major urban fiscal positions for many years.

Cembalest’s writing is apolitical since they have a diverse client base. He’s no ideologue. The sentence above shows how such a view has become solidly mainstream. The general retreat from left wing policies is overdue and represents a positive environment for hydrocarbons. It doesn’t mean we’ll stop working on lowering greenhouse gas emissions, but we are moving into a period of more careful cost-benefit analysis.

This is good for the cleanest hydrocarbon, natural gas.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

The irrationally high tax deferred yields make MLPs a favored investment for me. I profit from the reluctance of others to invest in partnerships.