Energy Policies Are Moving Right

Data center demand for natural gas was the big energy story last year. Wells Fargo referred to “a momentous year for midstream” with this as the biggest driver. It’s been consistently cited by JPMorgan and Morgan Stanley.

Wells Fargo calculated that C-corps outperformed MLPs by 23%. This was a substantial difference and means that the Alerian MLP ETF (AMLP) underperformed the S&P500 in a year when midstream generally beat the market by 20%. This is partly because MLPs are perennially “cheap” since their investor base is limited to wealthy Americans willing to tolerate a K1. US tax-exempt and foreign institutions face onerous tax liability and reporting requirements, so generally avoid MLPs. Retail investors don’t want K1s.

The other reason MLPs lagged is that pure-play natural gas names began converting to c-corps following a ruling from FERC in 2018 that prevented them from including their equity holders’ tax liability in calculating their required return on pipeline tariffs. So today MLPs have limited direct exposure to the biggest story in midstream – data center power demand to be satisfied mainly with natural gas.

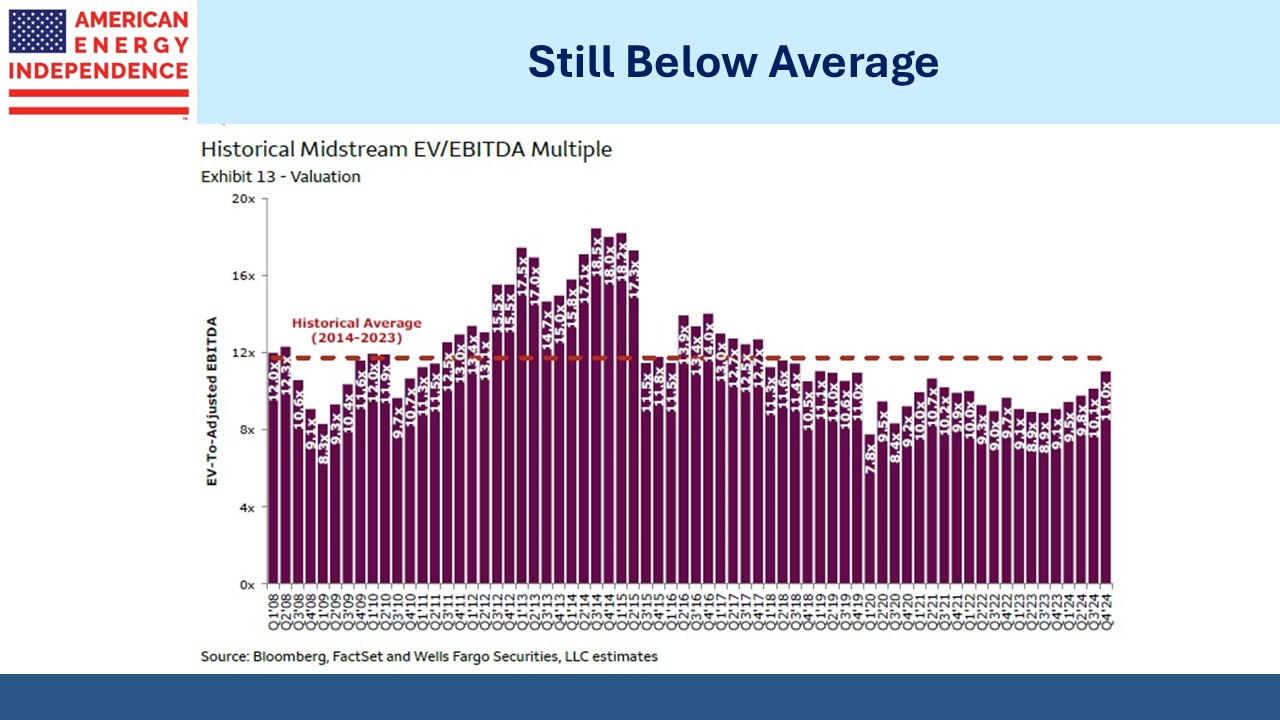

Valuation as defined by Enterprise Value:EBITDA (EV:EBITDA) has risen to 11X, close to the 12X ten year average. However, a move to 12X would be more appreciative than it might appear. Since midstream companies typically finance their assets with around 50% debt, an EV:EBIDTA move from 11X to 12X, roughly a 9% increase in EV, would be double that on the company’s equity since their debt obligations would clearly be unaffected.

2024 was an exceptional year. Nonetheless, the math suggests that a reversion to the mean for valuation, plus a 5% dividend yield, could generate a total return of around 23%. We’re not predicting such. But energy is incoming President Trump’s favorite sector.

Dividend yields are close to the ten year treasury, historically very tight. However, this relationship has lost relevance. Dividend coverage has moved higher in recent years as c-corps have become more prevalent. The old MLP model of paying out 90% of distributable cash flow no longer prevails, with payout ratios of 50-60% common today.

JPMorgan’s Eye on the Market Outlook 2025: The Alchemists was published on January 1. I occasionally interacted with Mike Cembalest, the author and Chairman of Market and Investment Strategy for J.P. Morgan Asset & Wealth Management, 20 years ago when I worked there. I enjoy his writing as much as anything I read. It is deeply researched and full of insights.

In discussing AI, data centers and the growing demand for power from “hyperscalers” (ie Google, Meta, Microsoft, Amazon etc) the report noted: The hyperscalers will probably have to hyperscale back their commitments for green power consumption and rely heavily on natural gas, as they have been.

US natural gas prices have risen 44% so far this year (as of January 6). Winter storm Blair is the reason, not AI. Even so, $3.70 per Million BTUs (MMBTUs) remains far below global prices. Futures on the European TTF benchmark and Asian JKM are both trading in the $14.50-15 range.

US energy remains cheap. Whenever I walk past a store on a hot day with its doors open, using its air conditioning to draw in shoppers, I’m reminded how rare such a sight is elsewhere in the world. Increased US LNG exports over the next few years will benefit our trade partners, reduce coal consumption and modestly lift US prices. It’s a small price to pay.

The pendulum is swinging back from progressive ideas such as uncontrolled immigration and switching to renewables with no cost-benefit analysis. Canada is the latest country to chart a new direction as PM Justin Trudeau concluded when he resigned on Monday. Conservative leader Pierre Poilievre has promised to cancel the country’s much hated carbon tax, which is set to rise to C$170 per metric tonne (US$119) of CO2 equivalent by 2030.

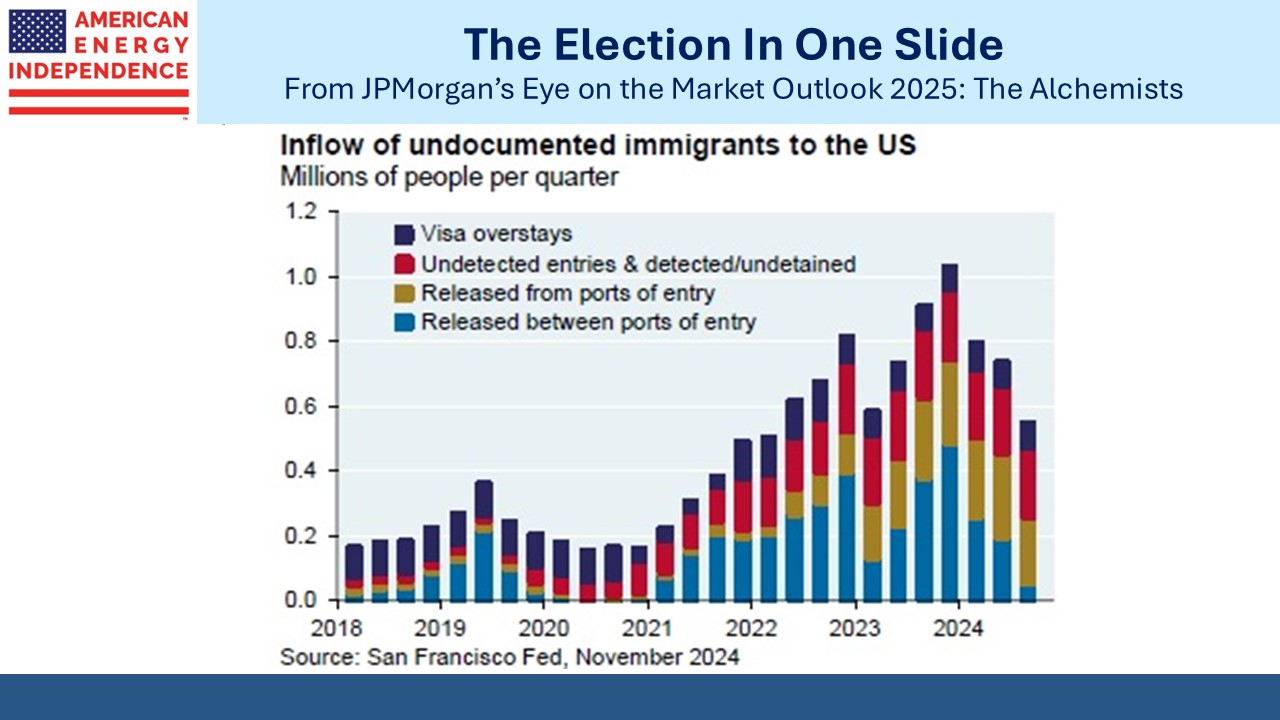

The chart on illegal immigration included in Mike Cembalest’s annual outlook caught my eye more than most, along with this explanation: Biden immigration policies directly led to the largest unchecked, uncontrolled and unmanaged migrant surge on record which will negatively impact major urban fiscal positions for many years.

Cembalest’s writing is apolitical since they have a diverse client base. He’s no ideologue. The sentence above shows how such a view has become solidly mainstream. The general retreat from left wing policies is overdue and represents a positive environment for hydrocarbons. It doesn’t mean we’ll stop working on lowering greenhouse gas emissions, but we are moving into a period of more careful cost-benefit analysis.

This is good for the cleanest hydrocarbon, natural gas.

We have two have funds that seek to profit from this environment: