Germany’s Costly Climate Leadership

/

Germany’s energy transition, or “Energiewende” as they call it, is causing casualties. One is the Green Party, which did so badly in recent elections that it may not be represented in Thurungia’s regional legislature. More state elections are scheduled and there are concerns of further loss of support.

The Greens are the main proponents of climate change policies that are hollowing out Germany’s manufacturing base. The combination of an aggressive push into renewables, exiting of nuclear power and catastrophic dependence on Russian gas imports has resulted in the world’s highest energy prices. German retail electricity is US$0.40 per kilowatt hour, more than twice the US average of 16 cents.

German voters have been among the most supportive of policies intended to decarbonize power generation and reduce emissions. But their tolerance to pay more for energy while much of the developing continues to increase coal consumptions and CO2 output is wearing thin.

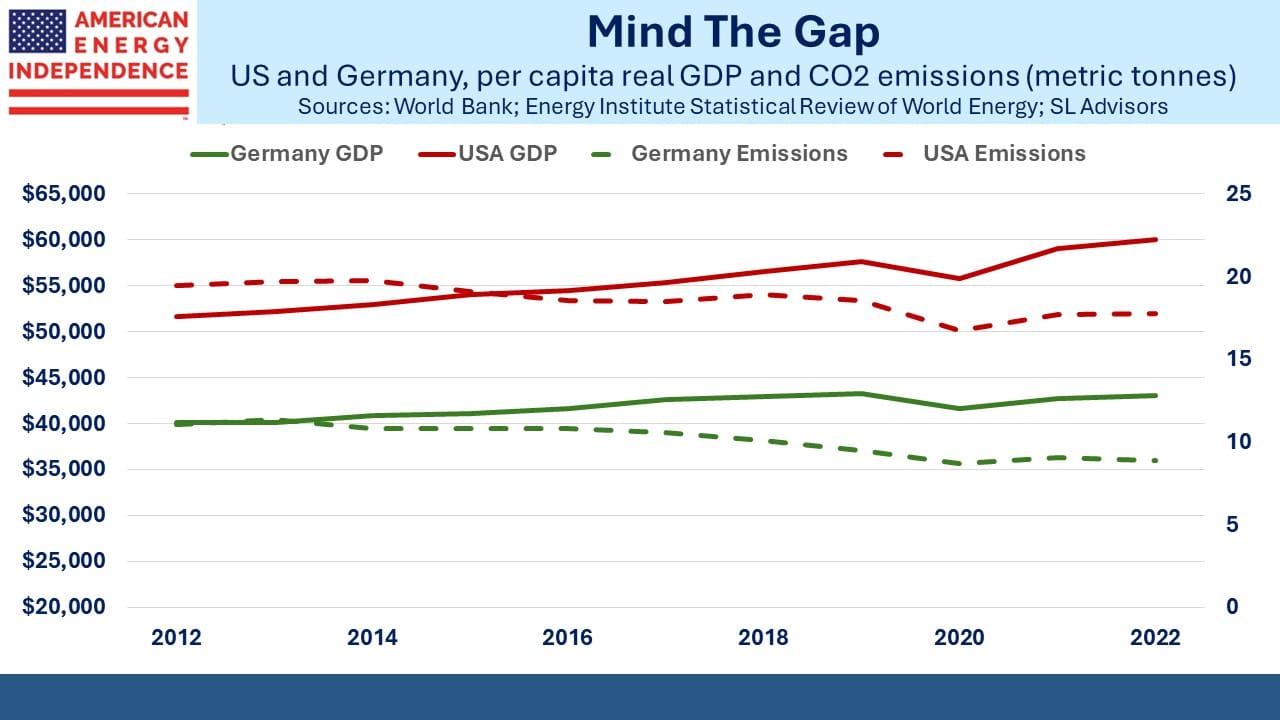

Germany has been more successful than most countries in hewing to the UN’s Zero by Fifty goal, which is to eliminate energy-based CO2 emissions by 2050. Their per capita emissions have dropped by 20% over the past decade, faster than the overall EU at 15%. The average German emits half of her US counterpart.

This success has come at a significant cost, and has enabled developing countries led by China to keep increasing their emissions. Over the past decade since 2012, approximately when the shale revolution began to release cheap American gas and oil, US living standards have pulled farther ahead. German GDP growth has been flat for years, with living standards barely improving. Real GDP per capita in Germany has increased at 0.7% pa over the past decade, less than half the 1.5% pa US rate.

The outsized influence of Germany’s Greens has not been good for Germans. German voters didn’t sign up for climate change policies that would shift jobs elsewhere, to countries with cheaper and more reliable energy. There’s even a proposal in Germany to charge more for electricity on cloudy days.

Germany’s auto industry illustrates the challenges they’re facing. The shift to EVs has been pursued with greater enthusiasm by auto companies than their customers. The offerings aren’t cheap. Audi’s Q8 e-tron priced at €76K has been an expensive flop with software that didn’t work as advertised.

Volkswagen is considering layoffs at its plant in Wolfsburg, the first time in its 87-year history that they’ve had to contemplate closing a factory in their home country.

The problem is that the energy transition is neither cheap nor convenient. It requires paying more for power that is unreliable and planning long drives around EV charging stations. The cost and inconvenience may be worth it to lower emissions on our only planet, but Greens and other environmental extremists have disingenuously presented a different vision. Voters in Germany are waking up to this reality.

When considering the climate policies advocated by progressives it’s important to consider Germany, which has long supported a more rapid energy transition than we have in the US. Few of us would want to trade places with them.

VC investors have often drunk the same Kool-Aid, and the result is a wave of cleantech bankruptcies followed by a more difficult fundraising environment. Last month Moxion, a battery start-up funded by Amazon, failed along with SunPower, owned by France’s Total.

The correct policies include increased US exports of natural gas to displace coal, prioritizing an easier approval process for nuclear and expanding new technologies such as carbon capture. This blog is supportive of sensible ways to reduce emissions, rather than the failing policy prescriptions of the Sierra Club, wretched little Greta and other climate extremists. Natural gas infrastructure has certainly been a better investment than clean energy for years. It’s also been the biggest contributor to reduced CO2 levels in the US, by displacing coal.

To make a small fortune investing in renewables, start with a big one.

In other news, the Energy Information Administration expects North America’s LNG export capacity to more than double by 2028. This includes NextDecade’s (NEXT) Rio Grande facility which will provide 2.3 billion cubic feet per day when Phase One is completed. NEXT’s stock price has remained weak as investors assess what impact the election may have on the project’s completion.

Meanwhile, construction continues, and the company made FERC’s review of the previously issued environmental impact statement easier by withdrawing the carbon capture proposal (see Deciding When To Sell). It’s a measure of the politicization of energy approvals that NEXT concluded that the courts would prefer a simpler proposal that doesn’t capture CO2 emissions.

We have three have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Interesting writing and opinions by SL, as always. I support the belief that energy policies need to be pragmatic, and there are always cost/benefit trade-offs for all policies. The one point I disagree with is ‘carbon capture’ as a new technology to reduce carbon. It sounds like a fools errand and there are better technologies to accomplish this in the pipeline (sorry for the pun).