Germany’s Costly Climate Leadership

Germany’s energy transition, or “Energiewende” as they call it, is causing casualties. One is the Green Party, which did so badly in recent elections that it may not be represented in Thurungia’s regional legislature. More state elections are scheduled and there are concerns of further loss of support.

The Greens are the main proponents of climate change policies that are hollowing out Germany’s manufacturing base. The combination of an aggressive push into renewables, exiting of nuclear power and catastrophic dependence on Russian gas imports has resulted in the world’s highest energy prices. German retail electricity is US$0.40 per kilowatt hour, more than twice the US average of 16 cents.

German voters have been among the most supportive of policies intended to decarbonize power generation and reduce emissions. But their tolerance to pay more for energy while much of the developing continues to increase coal consumptions and CO2 output is wearing thin.

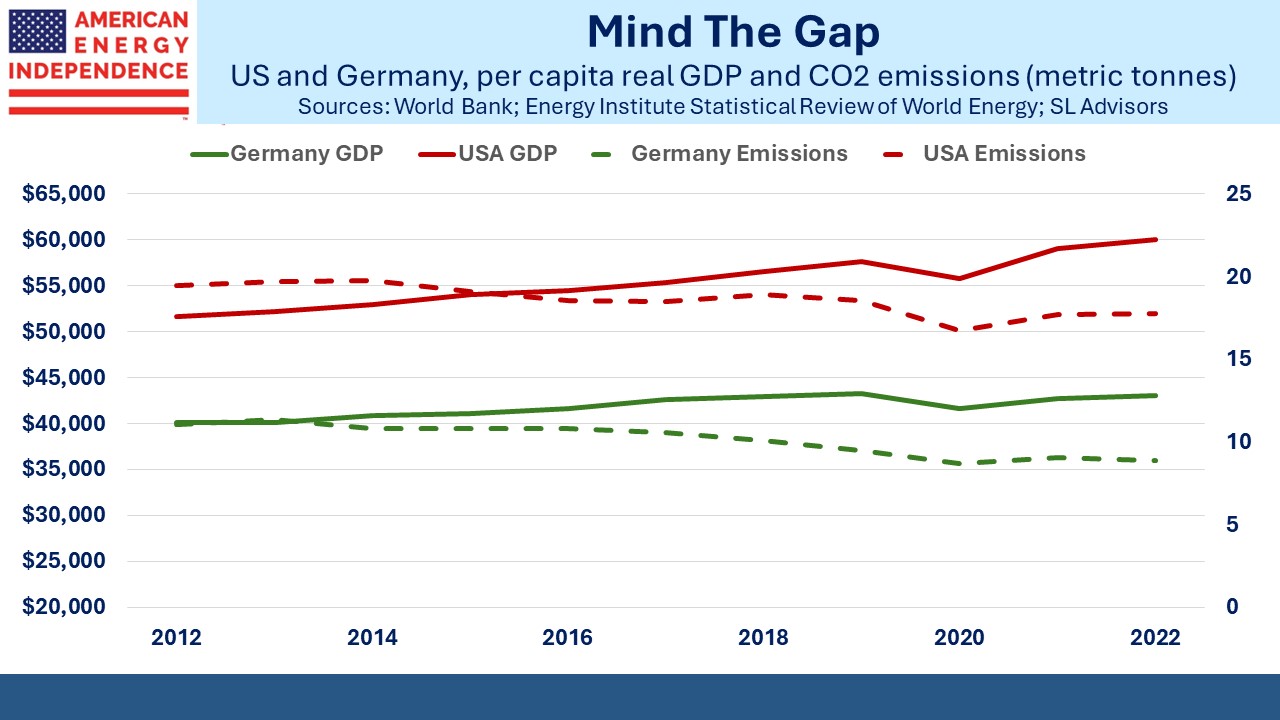

Germany has been more successful than most countries in hewing to the UN’s Zero by Fifty goal, which is to eliminate energy-based CO2 emissions by 2050. Their per capita emissions have dropped by 20% over the past decade, faster than the overall EU at 15%. The average German emits half of her US counterpart.

This success has come at a significant cost, and has enabled developing countries led by China to keep increasing their emissions. Over the past decade since 2012, approximately when the shale revolution began to release cheap American gas and oil, US living standards have pulled farther ahead. German GDP growth has been flat for years, with living standards barely improving. Real GDP per capita in Germany has increased at 0.7% pa over the past decade, less than half the 1.5% pa US rate.

The outsized influence of Germany’s Greens has not been good for Germans. German voters didn’t sign up for climate change policies that would shift jobs elsewhere, to countries with cheaper and more reliable energy. There’s even a proposal in Germany to charge more for electricity on cloudy days.

Germany’s auto industry illustrates the challenges they’re facing. The shift to EVs has been pursued with greater enthusiasm by auto companies than their customers. The offerings aren’t cheap. Audi’s Q8 e-tron priced at €76K has been an expensive flop with software that didn’t work as advertised.

Volkswagen is considering layoffs at its plant in Wolfsburg, the first time in its 87-year history that they’ve had to contemplate closing a factory in their home country.

The problem is that the energy transition is neither cheap nor convenient. It requires paying more for power that is unreliable and planning long drives around EV charging stations. The cost and inconvenience may be worth it to lower emissions on our only planet, but Greens and other environmental extremists have disingenuously presented a different vision. Voters in Germany are waking up to this reality.

When considering the climate policies advocated by progressives it’s important to consider Germany, which has long supported a more rapid energy transition than we have in the US. Few of us would want to trade places with them.

VC investors have often drunk the same Kool-Aid, and the result is a wave of cleantech bankruptcies followed by a more difficult fundraising environment. Last month Moxion, a battery start-up funded by Amazon, failed along with SunPower, owned by France’s Total.

The correct policies include increased US exports of natural gas to displace coal, prioritizing an easier approval process for nuclear and expanding new technologies such as carbon capture. This blog is supportive of sensible ways to reduce emissions, rather than the failing policy prescriptions of the Sierra Club, wretched little Greta and other climate extremists. Natural gas infrastructure has certainly been a better investment than clean energy for years. It’s also been the biggest contributor to reduced CO2 levels in the US, by displacing coal.

To make a small fortune investing in renewables, start with a big one.

In other news, the Energy Information Administration expects North America’s LNG export capacity to more than double by 2028. This includes NextDecade’s (NEXT) Rio Grande facility which will provide 2.3 billion cubic feet per day when Phase One is completed. NEXT’s stock price has remained weak as investors assess what impact the election may have on the project’s completion.

Meanwhile, construction continues, and the company made FERC’s review of the previously issued environmental impact statement easier by withdrawing the carbon capture proposal (see Deciding When To Sell). It’s a measure of the politicization of energy approvals that NEXT concluded that the courts would prefer a simpler proposal that doesn’t capture CO2 emissions.

We have three have funds that seek to profit from this environment: