Picking The Top Pipeline

/

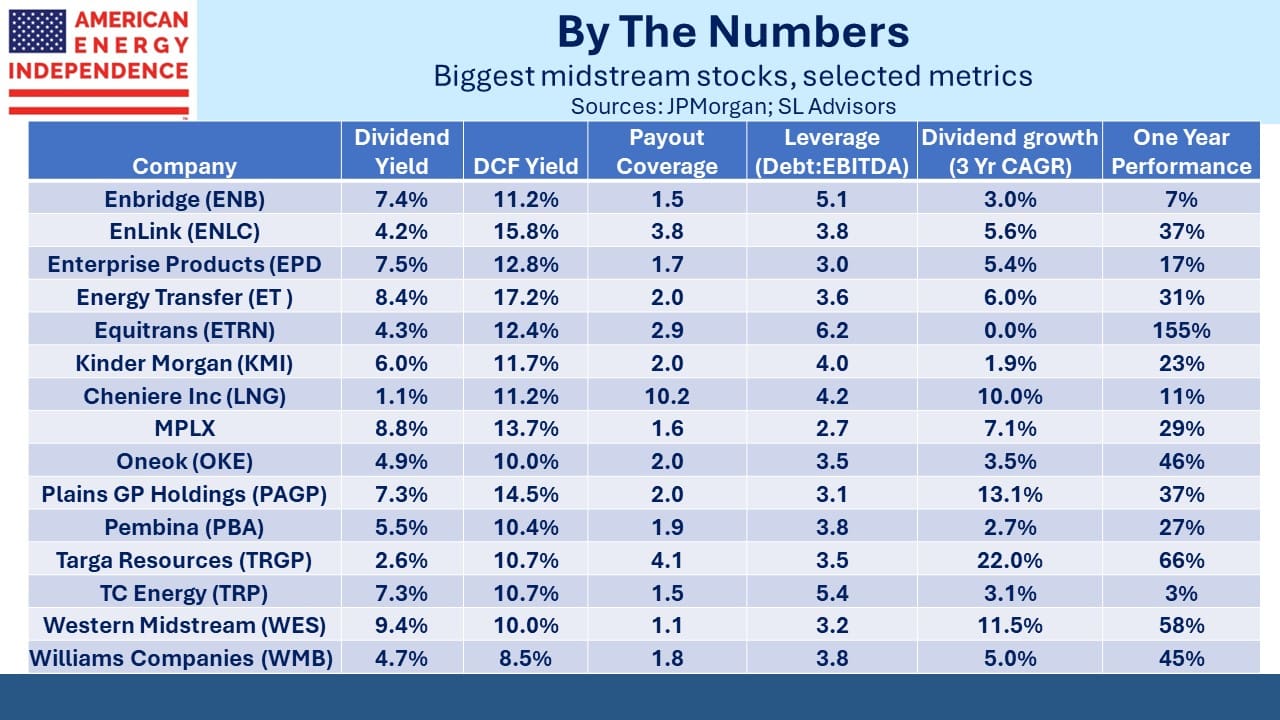

Which is the best pipeline company? It depends on what you’re measuring. Income-seeking investors might focus on Distributable Cash Flow (DCF) yield or distribution (dividend) yield. Dividend coverage is usually important. Lowest leverage would provide comfort to those concerned about downside. Momentum investors will look at dividend growth – and few will ignore price performance. So how do they rate?

We’ll focus on the biggest companies and MLPs, all part of the American Energy Independence index (AEITR). If DCF yield is what you’re after, Energy Transfer (ET) is top at 17.2%. For years this stock labored under the “Kelcy discount” as potential buyers were wary of past management actions that weren’t fiduciary best practice (see A Look Back At Energy Transfer).

However, this company knows how to execute. Last year’s acquisition of Crestwood has been absorbed with more synergy benefits than forecast. Many advisors we talk to own ET, and their reputation has evolved away from most likely to self-deal to great operator with an “in-your-face” posture to competitors and regulators.

One investor said he’d heard that some analysts are downgrading ET, but JPMorgan and Wells Fargo both reaffirmed Overweight ratings following earnings earlier in the month.

The highest dividend yield is Western Midstream Partners (WES) at 9.4%. Their DCF yield is only 10%, giving them a scant 1.1X coverage. It’s many years ago now but low distribution coverage ratios used to be typical when MLPs were the dominant corporate form in midstream energy infrastructure. They were routinely doing secondary offerings to buy “drop-down” assets from their controlling general partner.

The shrinking pool of MLP-oriented money forced a more conventional single entity c-corp structure on most of the industry. Giving up the partnership structure meant accepting the double taxation common to most equity securities (ie first on corporate profits then on dividends paid to owners).

Depreciation charges help lower taxable income in many cases.

The best payout coverage is a whopping 10.2X at Cheniere. Their DCF yield of 11.2% is close to the median. They paid their first dividend in November 2021. It’s grown by a third since then but still only represents a derisory 1.1%. One of the features we like about Cheniere is that once an LNG terminal is built its ongoing maintenance capex is low. As a % of EBITDA Cheniere has the lowest ratio in the industry.

Pipelines have been reducing leverage in what’s become a virtuous cycle. Falling capex, caused in part by opposition from climate extremists, has boosted free cash flow. This has allowed some debt paydown as well as driving EBITDA higher. MPLX currently has the lowest Debt/EBITDA of 2.7X.

The two big Canadians, Enbridge (ENB) and TC Energy (TRP), have both been bucking this trend (5.1X and 5.4X respectively) with big capex programs and (in ENB’s case) acquisitions. This has caused their stocks to lag the market, although both are continuing to raise dividends and reduce leverage.

Growth, as measured by three-year CAGR in payout, is distorted by companies that have significantly increased their payout ratio. Hence Targa Resources (TRGP) is top with a 22% CAGR having raised their annual payout from $2 per share in 2023 to an estimated $3.63 (re JPMorgan). More representative growth rates from companies that were always paying a reasonable dividend are Williams Companies (5%), ET (6%) and MPLX (7.1%).

When it comes to trailing one year performance, Equitrans is the clear winner with a +155% return. Resolution of Mountain Valley Pipeline (MVP) thanks to its inclusion in a debt ceiling bill makes Senator Joe Manchin (WVa) their MVP.

In 2022 NextEra, a JV partner in MVP, was so pessimistic about the prospects of completion that they wrote down their interest to zero (see Why Pipeline Construction Is Hard). The repeated delays and cost overruns show why making the permit process more predictable is so important to all kinds of energy infrastructure, especially renewables. If courts can rescind authorizations years after the fact, building big projects will carry an additional layer of risk.

Other strong performers over the past year include TRGP (+66%), WES (+58%) and Oneok (+46%). I received a hefty tax bill due to their acquisition of Magellan Midstream (MMP) last year, which we and others opposed (see Still Uncovinced By Oneok Magellan Combo).

Since New Jersey doesn’t recognize tax loss carryforwards, the gain on MMP which I’d held for close to two decades was fully taxed on my state return while my federal return allowed some older losses to offset.

The NJ tax code is the most effective tool for encouraging those with means to flee the state. Fortunately, the OKE-MMP combination has performed better than expected.

Whichever metric you prefer in selecting stocks, midstream energy infrastructure has names that measure up well. It’s why the sector continues to outperform.

We have three have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!