Fewer MLPs And American Exceptionalism

/

The diminishing number of MLPs has started to draw attention from sell-side analysts. Morgan Stanley’s Robert Kad wrote in his Midstream Weekly that consolidation was likely to, “impact active manager mandates that have been dedicated to the sector.” The shrinking pool of MLPs and its impact on MLP-dedicated funds has been a developing problem for years. The changed business model during the height of the shale revolution favored growth over distribution stability. The subsequent downturn saw cuts in payouts that soured the traditional investor base of wealthy individuals (see The Disappearing MLP Buyer from March 2020).

Many MLPs responded by rolling up into their c-corp GP parent, sometimes with adverse tax consequences for their holders. This began in 2015 (see Kinder Shows The MLP Model is Changing). The Oneok combination with Magellan Midstream is similarly imposing an unwelcome tax bill on long-time unitholders of the latter.

Robert Kad goes on to suggest that MLP-dedicated funds may adopt broader mandates, perhaps to broad infrastructure or the energy transition, although attractive opportunities in wind and solar are rare in our opinion. Windpower mandates are being renegotiated because the suppliers are losing money (see Why Aren’t Renewables Stocks Soaring?).

Kad notes that diversifying away from MLPs will create selling pressure. Keeping MLP exposure below 25% avoids the tax liability faced by MLP funds such as the Alerian MLP ETF (AMLP). It’s a binary rule – 26% exposure to MLPs still renders the entire fund liable for corporate taxes.

As we’ve noted before, investors in MLP-dedicated funds should worry about whether and how their funds modify their portfolios (see Why MLP Fund Investors Should Care When They Change from October 2020).

Slowly switching into c-corps would impose triple taxation on those holdings because the fund would remain taxable until MLPs fell below 25%. A gradual switch could lessen the market impact at the expense of additional taxes. There’s an advantage to being a first mover, so the managers of the Invesco Steelpath family of MLP-dedicated funds and AMLP are probably watching each other warily, wondering what the other will do.

AMLP updates its unrealized tax liability every day. As of August 21 it was $357MM. AMLP is once more a taxpayer, so its NAV will only appreciate by around 79% of its index (1 minus the corporate tax rate). It’s a terribly inefficient structure. Earlier this year Vettafi, publisher of AMLP’s benchmark, sought stakeholder input on potential changes to the index.

The pressure for change is growing. Investors in MLP-dedicated funds, many of whom have tax-deductible losses, have little upside in staying invested during the process.

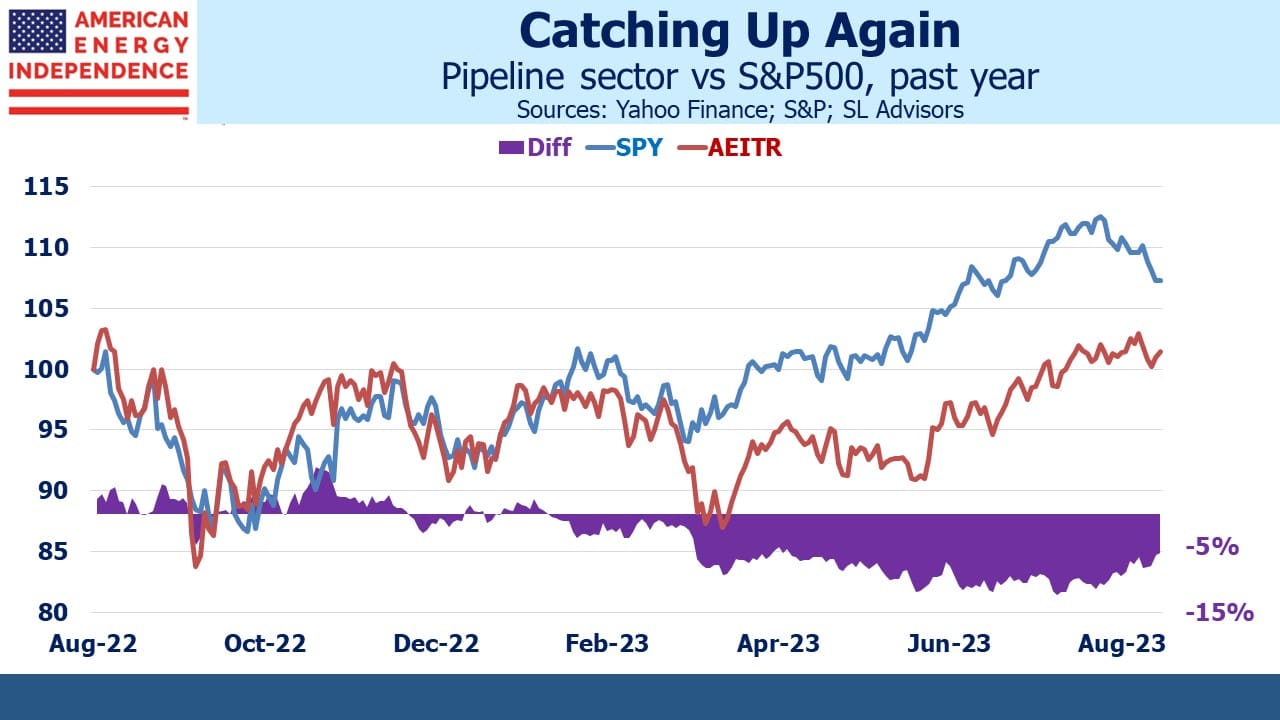

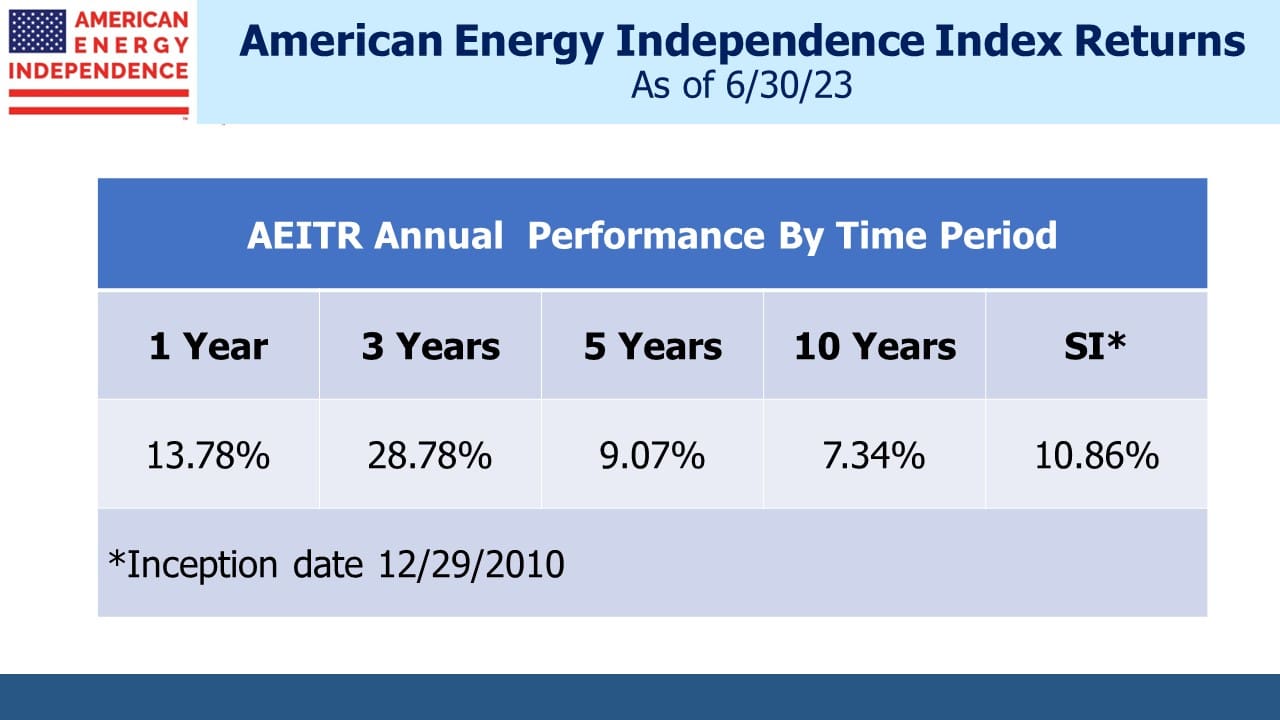

Midstream energy infrastructure has been quietly outperforming the market recently. So far in August the American Energy Independence Index (AEITR) is ahead by 3.5%. The extreme low of Covid in March 2020 provides a flattering point of comparison. But even over the past three years the AEITR is ahead by 15% pa.

Strong performance in 2021-22 inevitably ran out of steam, and this year a small number of stocks with an AI angle have made diversification look pedestrian. But every trend ends, and the release of 2Q earnings has coincided with energy infrastructure gaining momentum.

It helps that earnings were generally good. Results +/- 5% of consensus were the norm, apart from Cheniere which seems to reliably “beat, raise and repeat” to quote JPMorgan’s Jeremy Tonet. The broader pattern has been in evidence for several quarters. The positives are well known to investors – reduced growth capex is supporting growing free cash flow which is leading to improved dividend coverage (1.7X in 2022) and falling leverage (<3.5X Debt:EBITDA by YE 2023).

This is supporting dividend increases and stock buybacks.

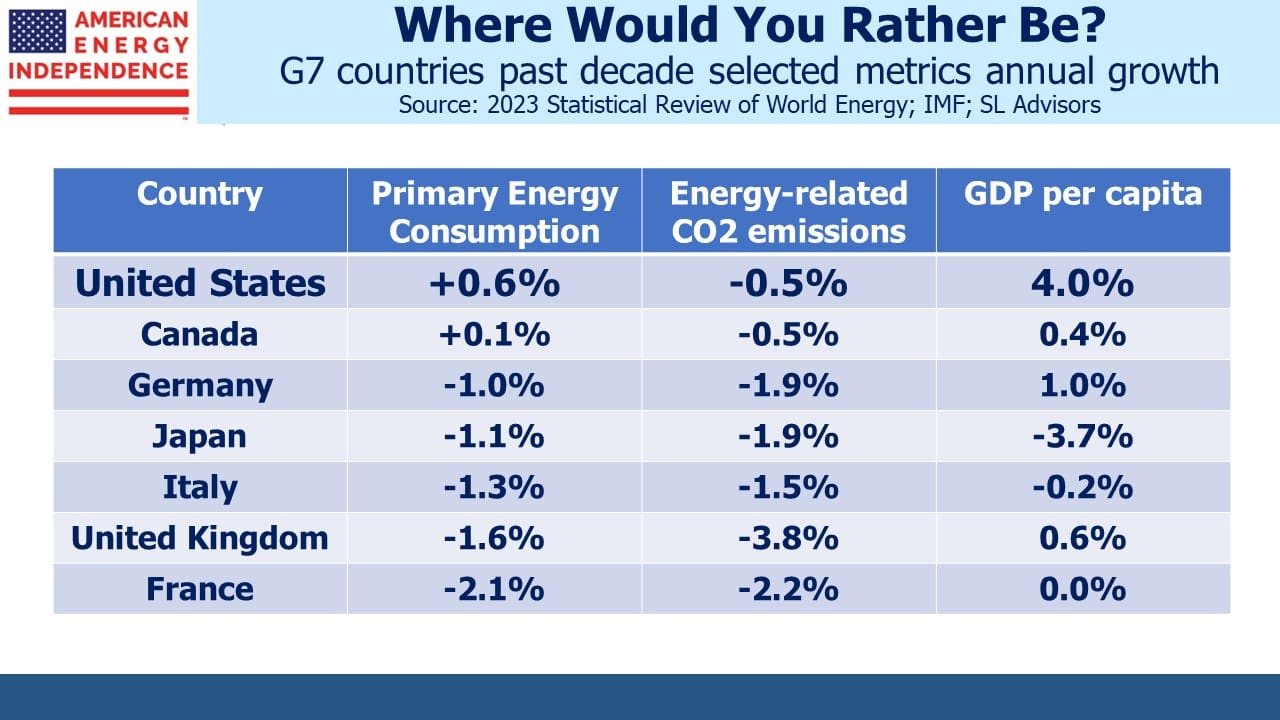

The energy transition and climate change put two competing visions at conflict; rich world countries want lower emissions, while developing countries want higher living standards, which require using more energy.

G7 countries have generally reduced energy consumption over the past decade, and their citizens’ living standards have stayed flat. The US is a notable exception in that energy consumption has grown, aided by the shale revolution and its corresponding increase in domestic supply. Nonetheless our emissions have fallen, mainly because the mix has shifted from coal to natural gas. Renewables have also contributed modestly to this.

By contrast with the rest of the G7, Americans have enjoyed rising living standards during this time (see Celebrating The 4th of July). The reasons are complex and not solely due to our energy policies. But a decade reflects the policy choices each country has made. I’m not sure why the combination of energy consumption, emissions reduction and per capita GDP growth achieved by any of the other six members of the G7 would be preferable to what we’ve achieved in America. No US president should ever feel the need to apologize for American exceptionalism. The world could use more of what we have here.

We have three funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!