Fewer MLPs And American Exceptionalism

The diminishing number of MLPs has started to draw attention from sell-side analysts. Morgan Stanley’s Robert Kad wrote in his Midstream Weekly that consolidation was likely to, “impact active manager mandates that have been dedicated to the sector.” The shrinking pool of MLPs and its impact on MLP-dedicated funds has been a developing problem for years. The changed business model during the height of the shale revolution favored growth over distribution stability. The subsequent downturn saw cuts in payouts that soured the traditional investor base of wealthy individuals (see The Disappearing MLP Buyer from March 2020).

Many MLPs responded by rolling up into their c-corp GP parent, sometimes with adverse tax consequences for their holders. This began in 2015 (see Kinder Shows The MLP Model is Changing). The Oneok combination with Magellan Midstream is similarly imposing an unwelcome tax bill on long-time unitholders of the latter.

Robert Kad goes on to suggest that MLP-dedicated funds may adopt broader mandates, perhaps to broad infrastructure or the energy transition, although attractive opportunities in wind and solar are rare in our opinion. Windpower mandates are being renegotiated because the suppliers are losing money (see Why Aren’t Renewables Stocks Soaring?).

Kad notes that diversifying away from MLPs will create selling pressure. Keeping MLP exposure below 25% avoids the tax liability faced by MLP funds such as the Alerian MLP ETF (AMLP). It’s a binary rule – 26% exposure to MLPs still renders the entire fund liable for corporate taxes.

As we’ve noted before, investors in MLP-dedicated funds should worry about whether and how their funds modify their portfolios (see Why MLP Fund Investors Should Care When They Change from October 2020).

Slowly switching into c-corps would impose triple taxation on those holdings because the fund would remain taxable until MLPs fell below 25%. A gradual switch could lessen the market impact at the expense of additional taxes. There’s an advantage to being a first mover, so the managers of the Invesco Steelpath family of MLP-dedicated funds and AMLP are probably watching each other warily, wondering what the other will do.

AMLP updates its unrealized tax liability every day. As of August 21 it was $357MM. AMLP is once more a taxpayer, so its NAV will only appreciate by around 79% of its index (1 minus the corporate tax rate). It’s a terribly inefficient structure. Earlier this year Vettafi, publisher of AMLP’s benchmark, sought stakeholder input on potential changes to the index.

The pressure for change is growing. Investors in MLP-dedicated funds, many of whom have tax-deductible losses, have little upside in staying invested during the process.

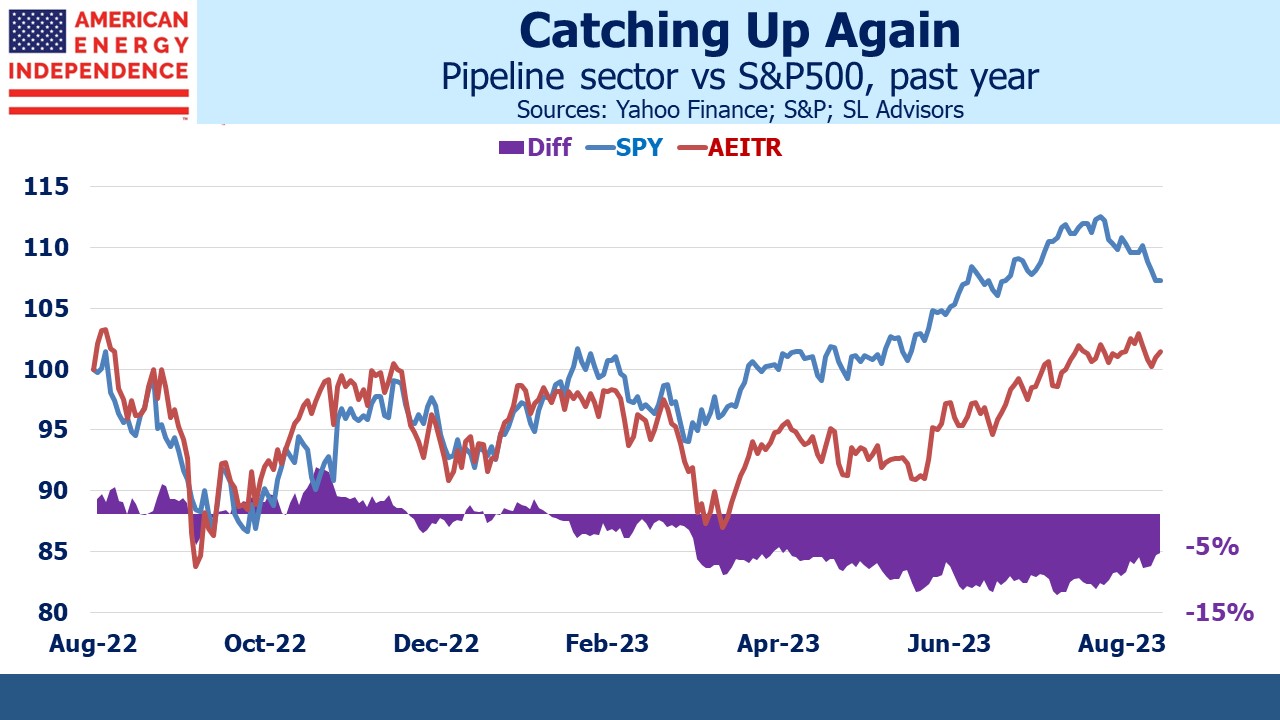

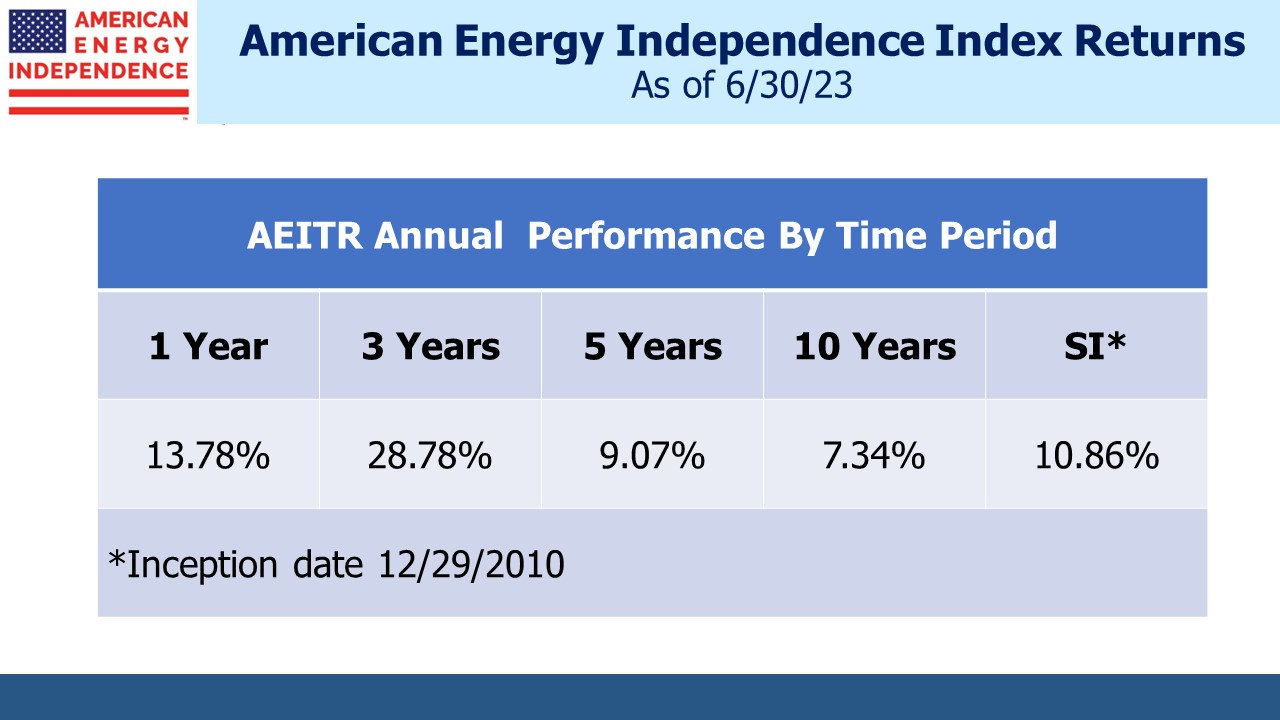

Midstream energy infrastructure has been quietly outperforming the market recently. So far in August the American Energy Independence Index (AEITR) is ahead by 3.5%. The extreme low of Covid in March 2020 provides a flattering point of comparison. But even over the past three years the AEITR is ahead by 15% pa.

Strong performance in 2021-22 inevitably ran out of steam, and this year a small number of stocks with an AI angle have made diversification look pedestrian. But every trend ends, and the release of 2Q earnings has coincided with energy infrastructure gaining momentum.

It helps that earnings were generally good. Results +/- 5% of consensus were the norm, apart from Cheniere which seems to reliably “beat, raise and repeat” to quote JPMorgan’s Jeremy Tonet. The broader pattern has been in evidence for several quarters. The positives are well known to investors – reduced growth capex is supporting growing free cash flow which is leading to improved dividend coverage (1.7X in 2022) and falling leverage (<3.5X Debt:EBITDA by YE 2023).

This is supporting dividend increases and stock buybacks.

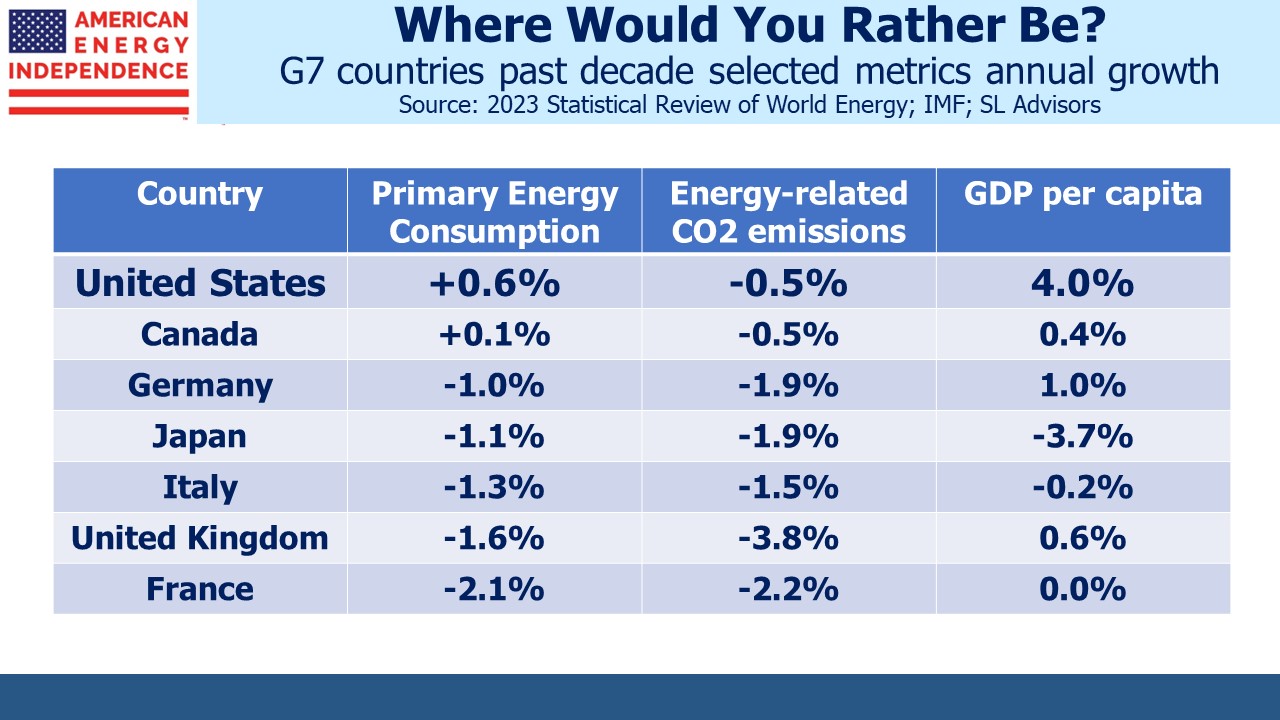

The energy transition and climate change put two competing visions at conflict; rich world countries want lower emissions, while developing countries want higher living standards, which require using more energy.

G7 countries have generally reduced energy consumption over the past decade, and their citizens’ living standards have stayed flat. The US is a notable exception in that energy consumption has grown, aided by the shale revolution and its corresponding increase in domestic supply. Nonetheless our emissions have fallen, mainly because the mix has shifted from coal to natural gas. Renewables have also contributed modestly to this.

By contrast with the rest of the G7, Americans have enjoyed rising living standards during this time (see Celebrating The 4th of July). The reasons are complex and not solely due to our energy policies. But a decade reflects the policy choices each country has made. I’m not sure why the combination of energy consumption, emissions reduction and per capita GDP growth achieved by any of the other six members of the G7 would be preferable to what we’ve achieved in America. No US president should ever feel the need to apologize for American exceptionalism. The world could use more of what we have here.

We have three funds that seek to profit from this environment: