Sending More Carbon Back Underground

/

Last year’s Inflation Reduction Act (IRA) raised the tax credit for CO2 that’s permanently buried underground. Some CO2 is used in Enhanced Oil Recovery (EOR) to help push crude out of mature, low pressure wells. It can then be pumped back into the well for permanent storage. This is Carbon Capture, Use and Sequestration (CCUS). The IRA tax credit for CCUS via EOR is $60 per metric tonne. There are still some sources of naturally occurring CO2 that are tapped for EOR, a counterintuitive process that IRA tax credits will likely cause to be phased out.

Burying CO2 without using it to produce fossil fuels is more in keeping with the spirit of climate change, and so Carbon Capture and Sequestration (CCS) draws larger credits than CCUS. The biggest credit goes to CCS that extracts CO2 out of the ambient air, called Direct Air Capture (DAC). CO2 exists at about 412 parts per million and is fairly evenly distributed. DAC is expensive, but the IRA’s $180 per tonne credit is enough to justify private sector investment. Extraction facilities can be placed wherever is convenient – such as above a geological formation that used to hold hydrocarbons.

There’s a beautiful symmetry here, in that carbon atoms are first extracted as hydrocarbon molecules. For example, natural gas (methane) is CH4. Their combustion causes the carbon atom to break from its hydrogen atoms and recombine with oxygen, forming the CO2 atoms whose increasing presence is a main driver of concern about global warming. Some of the best places to permanently store CO2 molecules are where CH4 molecules and other hydrocarbons were originally found deep underground.

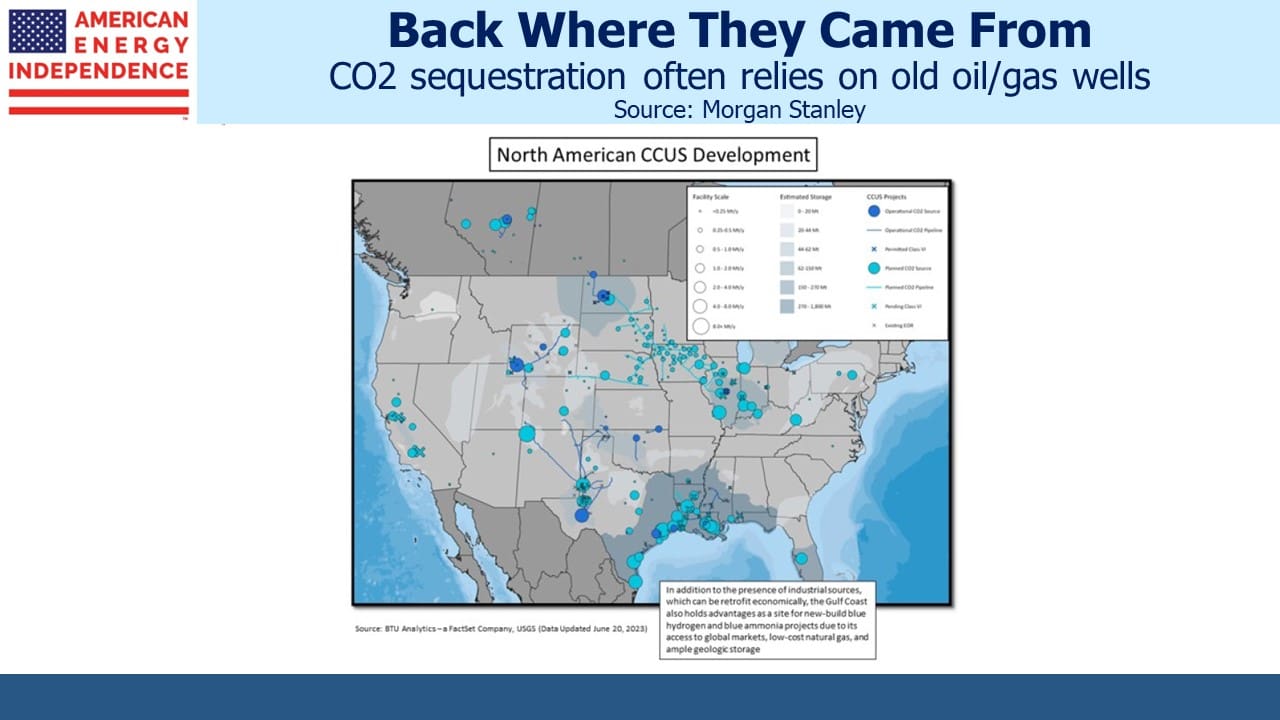

The map is unfortunately a little grainy, but nonetheless makes clear that CCUS projects are either linked to old oil/gas wells by CO2 pipelines or sit directly above them.

Energy infrastructure investors should care about this for two reasons. One is that carbon capture offers a new revenue source, since the pipelines and other hardware required are owned and will be built by existing midstream businesses. Enlink is especially well positioned, since they have a significant presence in Louisiana moving natural gas to the state’s petrochemical industry. Providing transport for the CO2 byproduct back to the geological formations that sourced the hydrocarbons is a good fit.

The second reason is that increased use of carbon capture enhances the benefits of traditional, reliable energy versus solar and wind. In all of human history we’ve never transitioned to a form of energy that is less reliable and takes up far more space than what we’re already using. Solar panels and windmills are a regressive step in many ways.

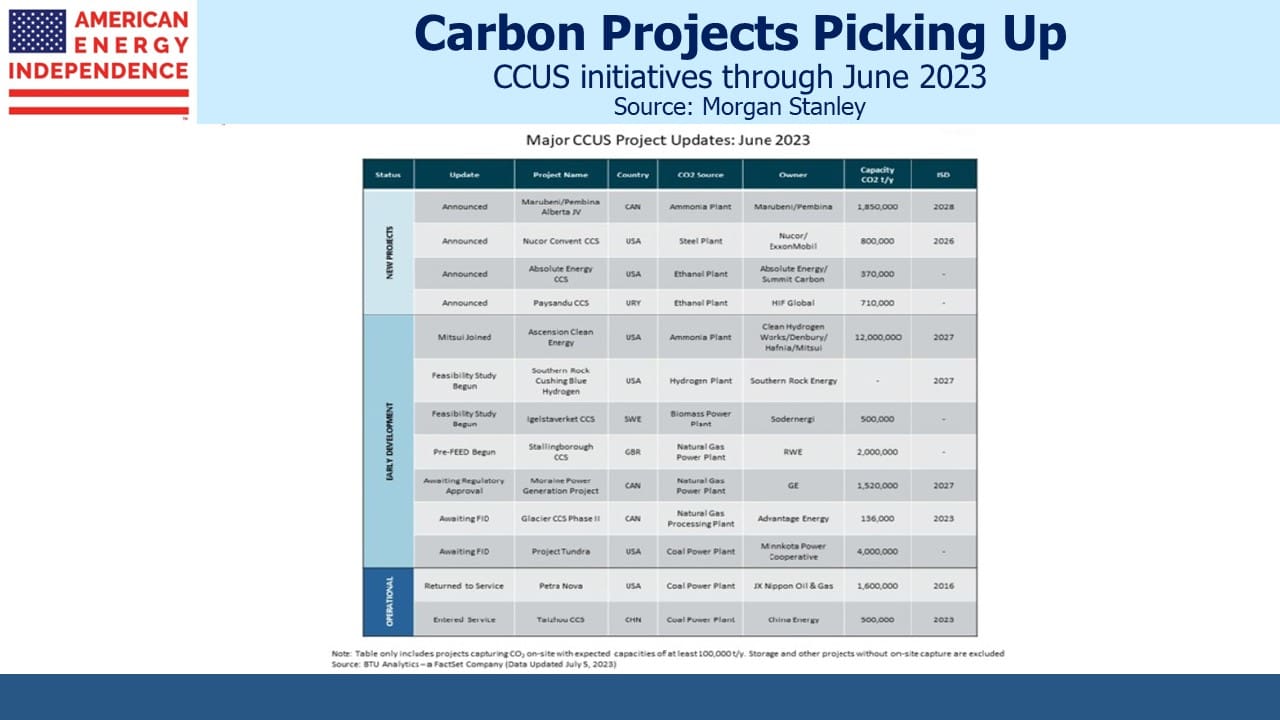

Cheap natural gas and IRA tax credits are a potent combination that is drawing industries to the US. OCI, a Dutch fertilizer company, is building a $1BN ammonia plant in Texas that will capture 95% of the emissions generated by its process. Ammonia is widely used to produce fertilizer, one of Vaclav Smil’s four pillars of civilization (along with steel, cement and plastic).

The “blue” ammonia OCI will produce costs $119 per metric tonne more than conventionally produced ammonia. But they estimate that the IRA tax credits will be worth $145 per tonne. It’s a perfect example of why European businesses are being drawn to America.

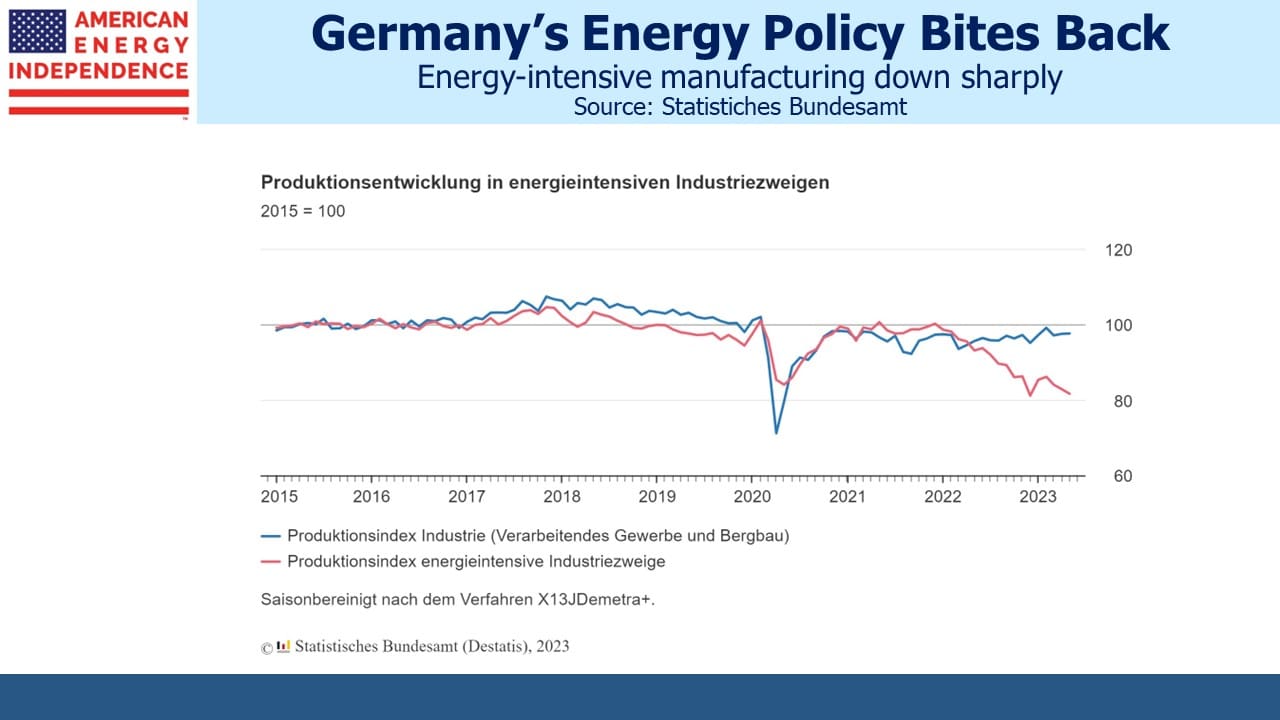

German politicians have drawn comfort from the drop in industrial energy use following Russia’s invasion of Ukraine. Some credited conservation measures by energy-intensive manufacturers, but the data shows that a drop in output is the real explanation. America’s energy policies unlocked cheap oil and gas. European companies such as OCI are investing here because of that. German energy policies led to enormous investment in windpower and neglected natural gas because they thought Russia would maintain supply until it was no longer needed. They have the world’s most expensive electricity as a result, with any reduction in CO2 emissions swamped by China’s consumption of half the world’s coal. German energy policies are a catastrophe.

Berkshire Hathaway continues to lean into the wind by increasing its traditional energy investments. Most recently Buffett invested $3.3BN for 50% of the Cove Point LNG plant, adding to the 25% already owned via Berkshire Hathaway Energy. He obviously sees a bright future for exports of US natural gas.

Lastly, the Mountain Valley Pipeline (MVP) saga took another turn with the US Court of Appeals for the Fourth Circuit’s decision to halt construction in response to a lawsuit filed by the Wilderness Society. The suit concerns a 3.5 mile construction corridor through the Jefferson National Forest. Even an act of Congress specifically approving MVP has been insufficient to break through the legal obstacles. Infrastructure permitting in the US is a mess.

We have three funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!