Sending More Carbon Back Underground

Last year’s Inflation Reduction Act (IRA) raised the tax credit for CO2 that’s permanently buried underground. Some CO2 is used in Enhanced Oil Recovery (EOR) to help push crude out of mature, low pressure wells. It can then be pumped back into the well for permanent storage. This is Carbon Capture, Use and Sequestration (CCUS). The IRA tax credit for CCUS via EOR is $60 per metric tonne. There are still some sources of naturally occurring CO2 that are tapped for EOR, a counterintuitive process that IRA tax credits will likely cause to be phased out.

Burying CO2 without using it to produce fossil fuels is more in keeping with the spirit of climate change, and so Carbon Capture and Sequestration (CCS) draws larger credits than CCUS. The biggest credit goes to CCS that extracts CO2 out of the ambient air, called Direct Air Capture (DAC). CO2 exists at about 412 parts per million and is fairly evenly distributed. DAC is expensive, but the IRA’s $180 per tonne credit is enough to justify private sector investment. Extraction facilities can be placed wherever is convenient – such as above a geological formation that used to hold hydrocarbons.

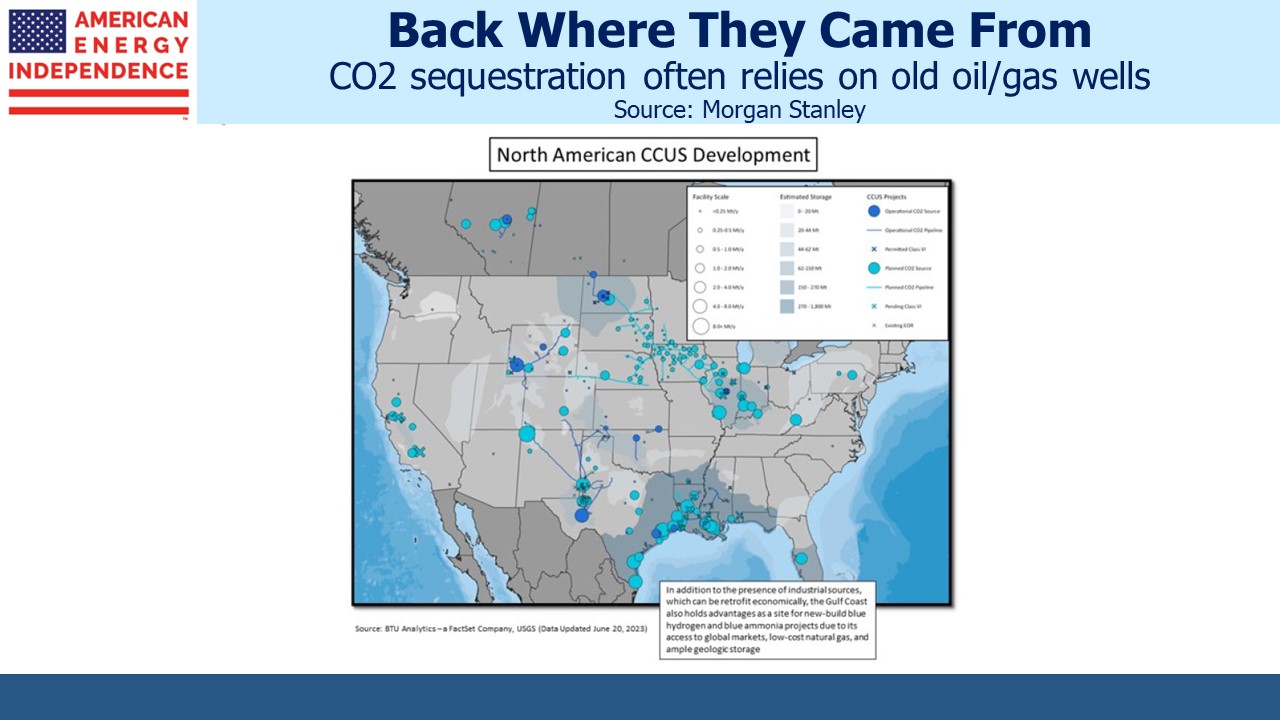

There’s a beautiful symmetry here, in that carbon atoms are first extracted as hydrocarbon molecules. For example, natural gas (methane) is CH4. Their combustion causes the carbon atom to break from its hydrogen atoms and recombine with oxygen, forming the CO2 atoms whose increasing presence is a main driver of concern about global warming. Some of the best places to permanently store CO2 molecules are where CH4 molecules and other hydrocarbons were originally found deep underground.

The map is unfortunately a little grainy, but nonetheless makes clear that CCUS projects are either linked to old oil/gas wells by CO2 pipelines or sit directly above them.

Energy infrastructure investors should care about this for two reasons. One is that carbon capture offers a new revenue source, since the pipelines and other hardware required are owned and will be built by existing midstream businesses. Enlink is especially well positioned, since they have a significant presence in Louisiana moving natural gas to the state’s petrochemical industry. Providing transport for the CO2 byproduct back to the geological formations that sourced the hydrocarbons is a good fit.

The second reason is that increased use of carbon capture enhances the benefits of traditional, reliable energy versus solar and wind. In all of human history we’ve never transitioned to a form of energy that is less reliable and takes up far more space than what we’re already using. Solar panels and windmills are a regressive step in many ways.

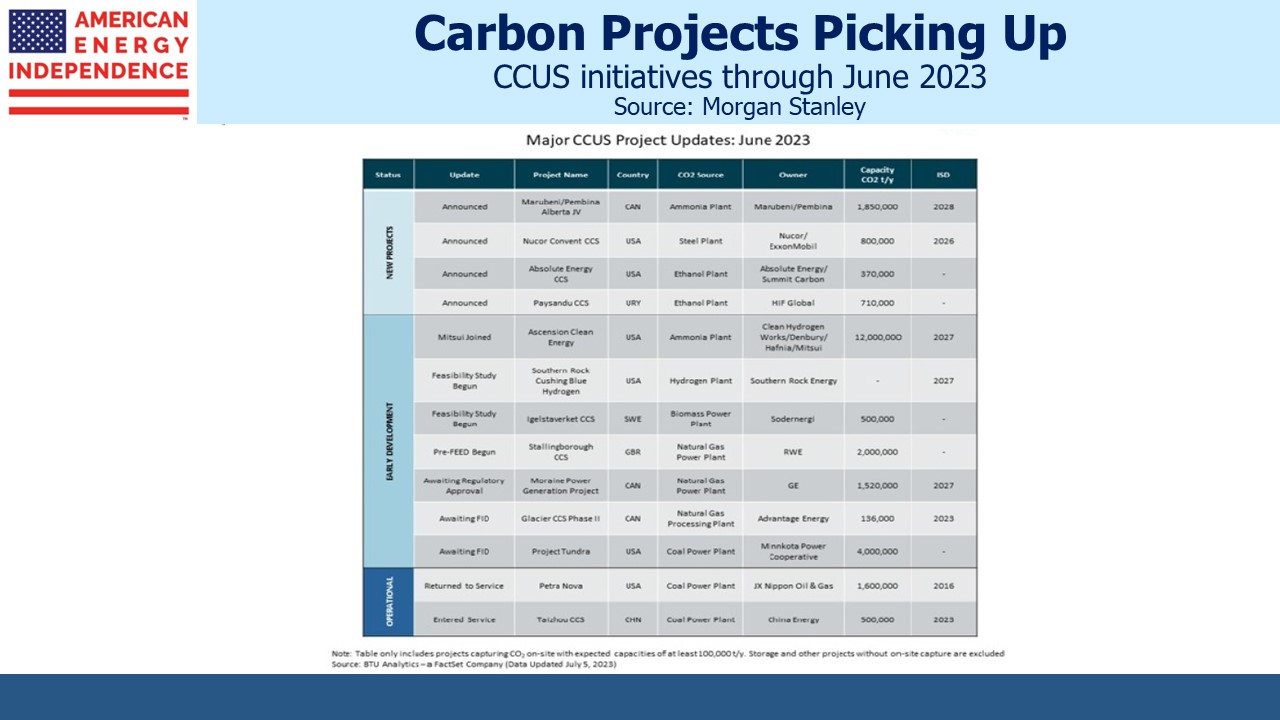

Cheap natural gas and IRA tax credits are a potent combination that is drawing industries to the US. OCI, a Dutch fertilizer company, is building a $1BN ammonia plant in Texas that will capture 95% of the emissions generated by its process. Ammonia is widely used to produce fertilizer, one of Vaclav Smil’s four pillars of civilization (along with steel, cement and plastic).

The “blue” ammonia OCI will produce costs $119 per metric tonne more than conventionally produced ammonia. But they estimate that the IRA tax credits will be worth $145 per tonne. It’s a perfect example of why European businesses are being drawn to America.

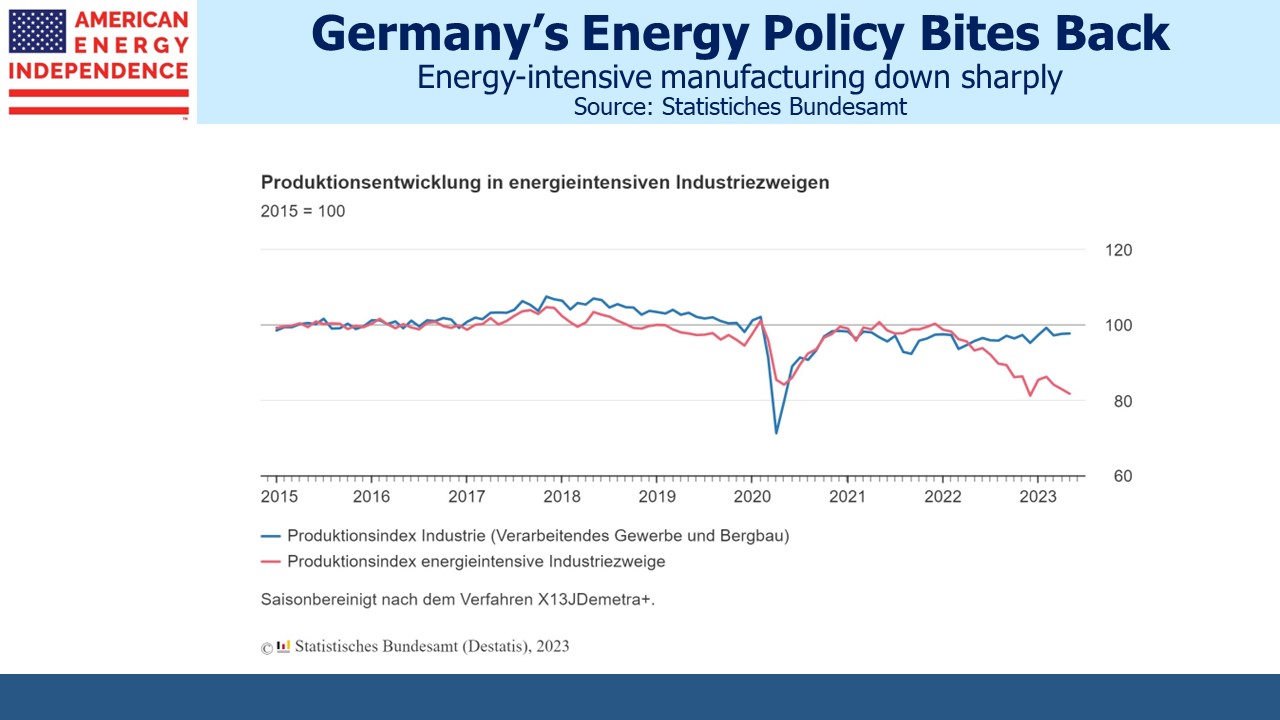

German politicians have drawn comfort from the drop in industrial energy use following Russia’s invasion of Ukraine. Some credited conservation measures by energy-intensive manufacturers, but the data shows that a drop in output is the real explanation. America’s energy policies unlocked cheap oil and gas. European companies such as OCI are investing here because of that. German energy policies led to enormous investment in windpower and neglected natural gas because they thought Russia would maintain supply until it was no longer needed. They have the world’s most expensive electricity as a result, with any reduction in CO2 emissions swamped by China’s consumption of half the world’s coal. German energy policies are a catastrophe.

Berkshire Hathaway continues to lean into the wind by increasing its traditional energy investments. Most recently Buffett invested $3.3BN for 50% of the Cove Point LNG plant, adding to the 25% already owned via Berkshire Hathaway Energy. He obviously sees a bright future for exports of US natural gas.

Lastly, the Mountain Valley Pipeline (MVP) saga took another turn with the US Court of Appeals for the Fourth Circuit’s decision to halt construction in response to a lawsuit filed by the Wilderness Society. The suit concerns a 3.5 mile construction corridor through the Jefferson National Forest. Even an act of Congress specifically approving MVP has been insufficient to break through the legal obstacles. Infrastructure permitting in the US is a mess.

We have three funds that seek to profit from this environment: